Bitget Gold Token Futures Trading Guide

1. What are gold tokens?

Gold tokens are blockchain-issued cryptocurrencies pegged to physical gold. Each token corresponds to a fixed weight of physical gold (such as 1 gram or 1 ounce), securely stored in professional vaults and strictly supervised by the issuer. Their price tracks the international gold market in real time, enabling investors to benefit from gold ownership and potential returns, without physically holding it.

2. Why trade gold tokens?

Gold tokens combine the stability of gold with the flexibility of crypto, offering several advantages:

● Stable value and inflation hedge: Pegged to physical gold prices, they provide a reliable hedge against inflation, unlike volatile standalone cryptocurrencies.

● Global trading efficiency: Buy and sell on exchanges anytime without physical delivery—instant settlement and enhanced liquidity.

● Fractional ownership: Supports small denominations (such as 0.01 ounces), making it accessible to small investors and suitable for DeFi applications such as lending and yield farming.

● Transparency and security: Blockchain records are immutable, reducing fraud risks and enabling easier audits.

● Low cost and easy access: No storage fees and low entry fees, ideal for all types of investors.

3. Popular gold tokens on Bitget

Two leading gold tokens are available on Bitget for perpetual futures:

PAXG (Pax Gold) is issued by Paxos Trust Company and regulated by New York financial authorities. Each PAXG token is backed by one ounce of London Good Delivery gold bar, stored in LBMA-certified vaults. Key features:

○ Low cost: Minimum trade size of 0.001 PAXG, no storage fees.

○ Security and compliance: Monthly audits, redeemable for physical gold or USD.

○ Instant settlement: Unlike traditional gold's T+2 settlement, PAXG settles instantly. Utility: View gold bar details on Ethereum; supports trading on crypto exchanges and in DeFi.

XAUT (Tether Gold) is issued by Tether. Each token equals one ounce of gold held in Swiss vaults. Key features:

○ Low cost: Minimum trade size of 0.01 XAUT, no storage fees.

○ Convenience: Easy to buy, sell, and transfer—no logistics needed.

○ High transparency: Regular reserve audits and on-chain proof.

○ Versatile: Integrate Tether ecosystem for DeFi. Utility: Acquire gold ownership upon purchase, and redeem for physical gold or equivalent fiat currency.

4. How to trade gold token futures on Bitget

Bitget is the world's leading crypto exchange and supports USDT-M perpetual futures trading for PAXG and XAUT. You can amplify your returns with leverage up to 50x, go short for hedging, and trade with flexible strategies. Here's how to get started:

1. Sign up and verify account: Sign up on the Bitget website or app instantly. Complete identity verification to unlock futures trading features and higher limits.

2. Deposit funds: Deposit funds into your spot wallet using bank transfer, credit card, or cryptocurrency (such as USDT). Bitget offers multiple funding methods with low fees and fast processing.

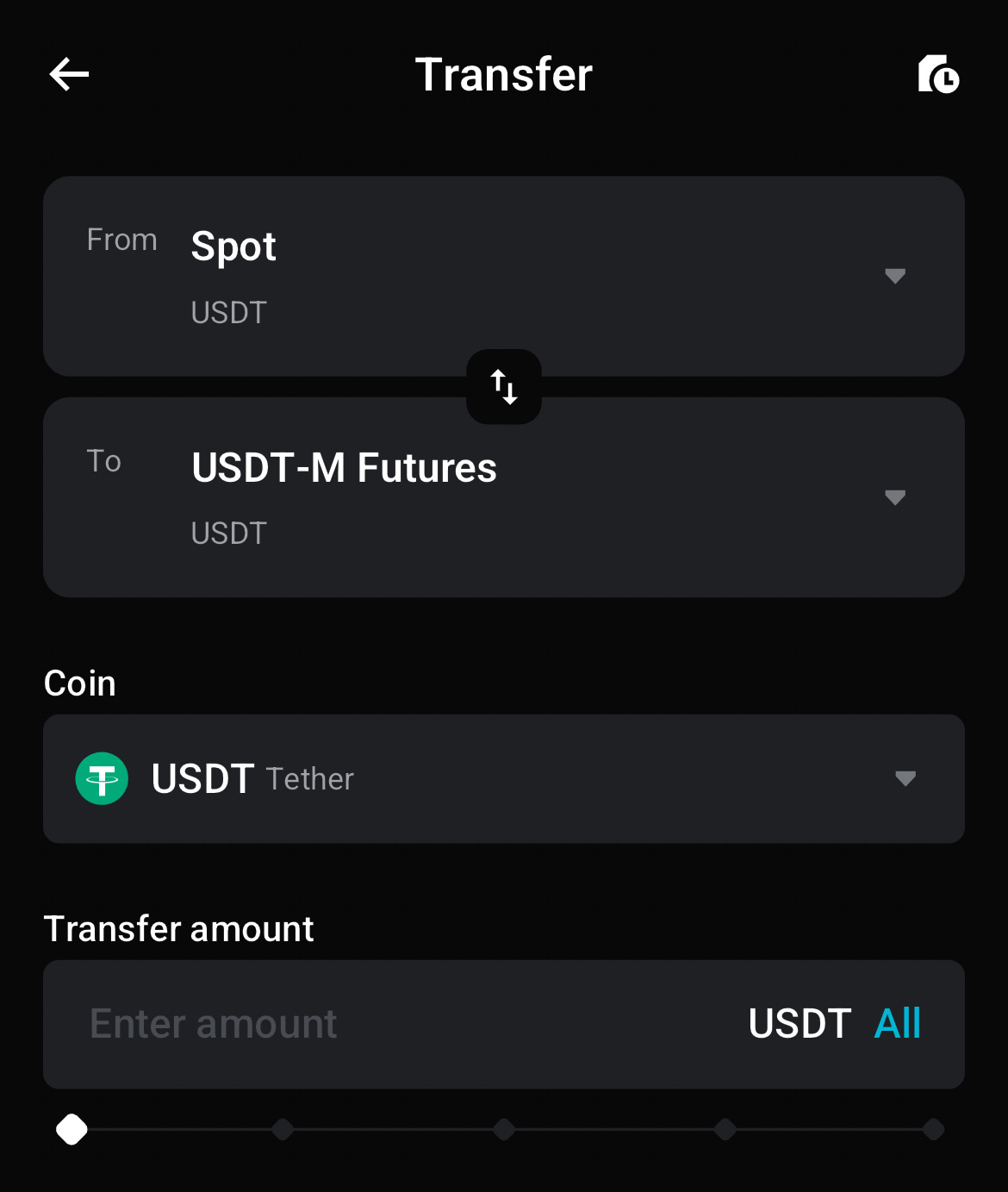

3. Transfer to futures account: Transfer funds from your spot account to your futures account. Use USDT as margin to ensure you have sufficient funds.

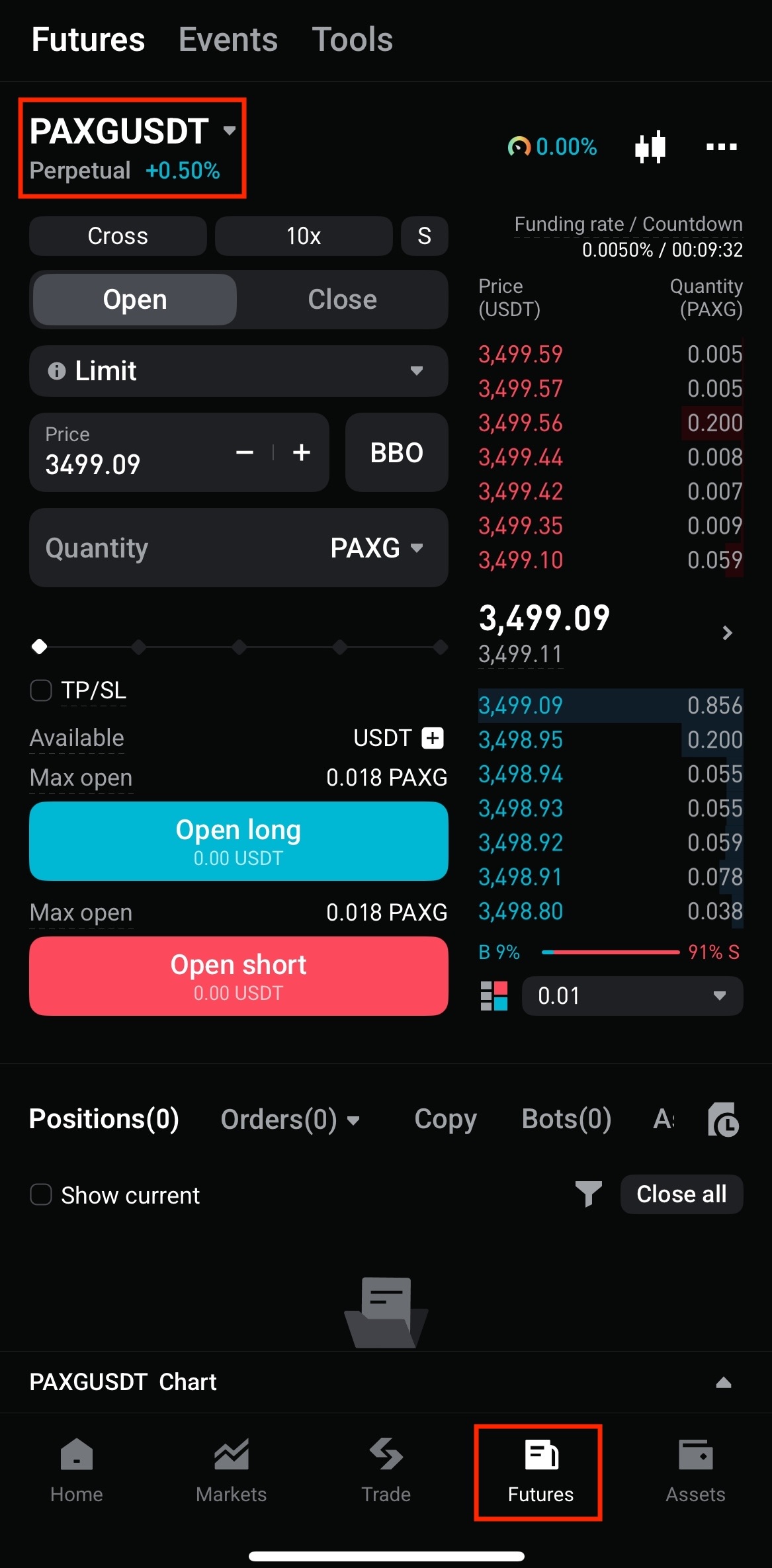

4. Select your trading pair: Go to the Futures section and search for PAXGUSDT or XAUTUSDT perpetual futures.

○ Select mode: Cross margin or isolated margin.

○ Adjust leverage: Choose from 1x to 50x based on your risk tolerance. Example: Go long (buy) if you expect gold to rise, or short (sell) if you expect it to fall.

5. Place an order: Select order type: Market order (instant execution) or Limit order (set your own price).

○ Enter order size, set take-profit/stop-loss levels (such as stop-loss at 5% to limit risk).

○ Confirm and execute.

6. Monitor and close positions: View positions, PnL, and market data in real-time via the app or website. Adjust stop-loss or close positions manually if necessary.

5. Risk warning

Gold token trading is relatively stable but not risk-free. Please trade rationally.

● Issuer risk: Dependence on the issuing company (such as Paxos or Tether). Problems with the issuer may affect redemption.

● Market volatility: Gold prices are influenced by economic and geopolitical factors. Leveraged futures can lead to rapid liquidation.

● Regulatory changes: Changes in crypto regulations may affect liquidity.

By trading gold tokens on Bitget, you can capture gold's market opportunities. Sign up today and start your digital gold journey. If you need help, contact Bitget support.

- Which Bitget Futures Bot Should You Use?2025-10-16 | 5m

- Recall (RECALL): Trust and Discovery Layer for AI Agents2025-10-15 | 5m