Can Intel Stock Keep Soaring? What You Need to Know About the 2025 Turnaround and What’s Next

Will Intel stock continue its impressive rally, or is the best already behind us? After a bruising 2024, few could have predicted just how strongly Intel would bounce back this year. The iconic chipmaker not only returned to profitability in Q3 2025, but also attracted high-profile backing from the U.S. government, Nvidia, and SoftBank—fueling a 90% stock surge that’s caught Wall Street’s attention.

Whether you’re already invested in Intel stock, keeping it on your watchlist, or simply curious about the drivers behind this dramatic comeback, this guide covers all the must-know details. We’ll break down Intel’s Q3 results, explore what’s fueling the rebound, unpack the latest business moves, and give you a realistic Q4 outlook—so you can decide if Intel stock deserves a place in your portfolio.

Track Intel Stock Market Performance: Understanding the Recovery

Intel’s share price underwent a sharp recovery in 2025, reversing the deep decline seen the previous year. As of late October 2025, Intel stock has posted a remarkable 90% year-to-date gain—much of which occurred over the past two months following major strategic developments, including investments from the US government, SoftBank, and a high-profile partnership and stake by Nvidia.

This stands in stark contrast to 2024, when Intel shares fell approximately 60% amid leadership uncertainty, operational challenges, and waning confidence in its manufacturing segment. The appointment of new CEO Lip-Bu Tan in March 2025 signaled a new era, and since then, Intel has embarked on aggressive restructuring and cost control while also sharpening its technological focus, particularly around artificial intelligence (AI).

What’s Fueling Intel Stock? Key Drivers Explained for Investors

1. Return to Profitability

Intel stock surged after Intel posted Q3 2025 net income of $4.1 billion versus a $16.6 billion loss one year prior. Achieving positive earnings after six consecutive loss-making quarters was a critical turning point for Intel stock holders and sent a strong signal to the entire market.

2. Cost Reductions and Organizational Overhaul

Intel slashed its employee count by 13% quarter-over-quarter, reducing its total workforce to 88,400 by the end of Q3 2025, including a 29% YoY drop across the whole company and subsidiaries. This reduction, alongside strict cost management, helped boost cash flow and operating margins, which has been viewed favorably by Intel stock investors.

3. PC and Data Center Segment Trends

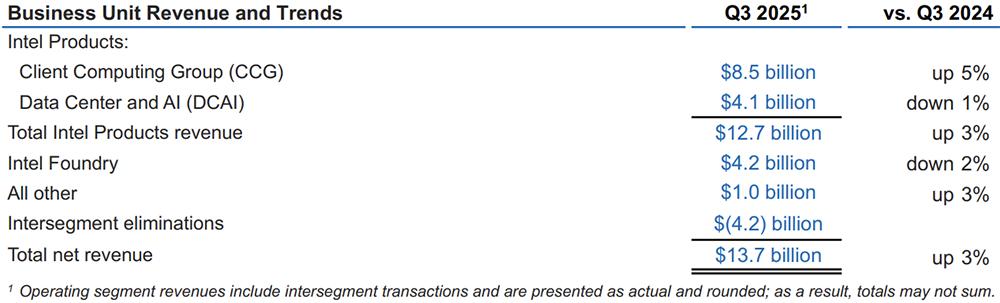

Intel’s client computing revenue hit $8.5 billion—rising 5% YoY—on the back of a PC demand rebound and accelerated enterprise upgrades of Windows systems. While data center and AI revenue slipped 1% YoY to $4.1 billion, sequential improvements are projected. Intel stock sentiment has also benefited from signs of improvement in Intel’s foundry business, which saw its quarterly loss shrink from $5.8 billion (2024) to $2.3 billion.

4. Strategic Capital Injections

-

U.S. government: Acquired a 9.9% Intel stock stake for $8.9 billion.

-

Nvidia: Announced $5 billion investment, acquiring a 4% Intel stock holding, plus joint development of future CPU-GPU products for AI/data center/consumer use.

-

SoftBank: Started a $2 billion Intel stock purchase.

-

Other funding included $5.7B in accelerated U.S. government financing, $4.3B from Altera asset sales, and $900M from Mobileye share sales.

These actions have fortified Intel’s balance sheet, with $30.9 billion in cash and short-term investments at the end of Q3.

Intel Stock and Q3 Earnings: Must-Know Highlights and Strategic Moves

-

Total revenue: $13.7 billion (+3% YoY)

-

Non-GAAP gross margin: 40%

-

Operating cash flow: $2.5 billion

-

PC/broad client business: Continued demand strength thanks to global device refreshes.

-

Arizona Fab 52: Now in full operation, supporting advanced 18A process node which is on schedule.

-

Altera spin-off: Removed from consolidated financials after September 12, increasing future external foundry revenues.

-

Manufacturing focus: Intel continues to invest in developing its 14A and 18A process nodes, with recent external customer feedback on 14A “very encouraging,” according to management.

AI acceleration remains a core part of Intel’s transformation:

-

Annual releases of inference-optimized GPUs such as the new Crescent Island silicon

-

Clearwater Forest, based on 18A, showcased as next-gen server product

-

Foundry group continues to work on winning external customers after historic in-house orientation

CEO Lip-Bu Tan’s strategic vision:

The new CEO quickly became the central figure in Intel’s “rebirth.” Not only did he execute sweeping layoffs and cost optimization, but also prioritized product focus and AI partnerships. He cited AI as the company’s “biggest opportunity,” particularly in everyday inference workloads.

What’s Next? Intel Stock Q4 Forecast and Key Milestones

For those following intel stock, Q4 2025 will be crucial in validating whether this turnaround is sustainable.

-

Revenue guidance: $12.8B–$13.8B, matching most Wall Street estimates.

-

Client computing: Management expects mild sequential decline due to capacity being allocated to higher-value server shipments.

-

Data center and AI: Anticipated “strong” growth in response to rising demand for AI inference and new CPU launches.

-

Foundry services: Expected quarter-on-quarter increases as external sales (boosted by the Altera spin-off) start to flow.

-

Capital expenditure: Approximately $18B for 2025, rising to $27B in 2026 for continued capacity and node upgrades.

Intel stock investors should particularly watch:

-

AI commercialization progress amid fierce Nvidia competition

-

Ongoing external foundry customer wins for advanced process nodes (especially 14A)

-

Balance sheet and debt management as capital spending ramps up

Actionable Intel Stock Price Forecast: Analyst Expectations

Analyst forecasts for Intel shares reflect a broad range given execution risks, macroeconomic factors, and uncertainties in AI adoption and foundry competitiveness:

-

Bullish scenario (LongForecast): Price target as high as $90 by end-2026 if Intel wins significant new foundry customers, successfully ramps 14A/18A nodes, and AI demand accelerates.

-

Base/Consensus: Most Wall Street expectations center around $38–$45 over the next 12 months, assuming steady, but not explosive, momentum.

-

Bearish scenario (WalletInvestor and CoinCodex): Citing slow external foundry ramp and continued losses in the group, downside targets in the $19–$32 range are possible if cost overruns and AI execution falter.

Conclusion

Intel’s 2025 resurgence serves as a compelling case of corporate transformation. The shift from record losses to profitability, reinforced by substantial investments and an AI-centric product roadmap, has reinvigorated market confidence and powered a near-doubling of Intel’s share price. Nonetheless, substantial competitive risks remain—particularly in the execution of its foundry plans and in rapidly closing the AI hardware gap with leaders like Nvidia.

Intel’s outlook for Q4 is broadly stable, with the greatest upside hinging on successful new customer acquisition for its advanced nodes and the rapid commercialization of its AI silicon portfolio. Long-term investors and market watchers should monitor progress around the 14A and 18A nodes, continued strategic partnerships, and Intel's ability to balance cost control with innovation as the global semiconductor race intensifies.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock market is high-risk, high-volatility—always conduct your own research before making investment decisions.