Netflix Stock Splits and Q3 Earnings: A Comprehensive Guide for Investors

Netflix stock (NASDAQ: NFLX) has long been a standout in the streaming entertainment sector, and a strong presence in the equities market. As Netflix stock has soared well above $1,000 per share in recent years, it has continued to attract a diverse investor base and is frequently featured in S&P 500 performance discussions. Given recent developments and Netflix's history of stock splits, a thorough understanding of the company's financial standing, including the impact of a Netflix stock split on share price and accessibility, is crucial for making informed investment decisions.

Source: Google Finance

Netflix Stock Split Plan

On Thursday, Netflix announced a 10-for-1 Netflix stock split, aiming to make Netflix stock shares more accessible to both retail investors and employees. Investors holding Netflix stock on record as of November 10 will receive nine additional shares for each share already owned, with the distribution set for November 14. Trading of Netflix stock at the adjusted post-split price will begin on Monday, November 17.

The goal of the Netflix stock split is to lower the price per individual share, which makes Netflix stock more attainable for a wider group of investors and increases overall liquidity. Despite the technical nature of stock splits, which do not impact the company’s fundamentals or the total value of an investor’s holdings, a Netflix stock split can influence market sentiment and trading volumes. This move places Netflix among a select group of S&P 500 stocks with historically high per-share prices that have pursued splits to draw more participants to their equity.

Netflix Stock Price Reaction After the Split Announcement

Historically, both investors and analysts react positively to a Netflix stock split announcement. This recent 10-for-1 Netflix stock split was no exception: after the announcement, Netflix stock surged over 2% in after-hours trading. On the day, Netflix stock closed at $1,089, marking a 42% increase year-to-date. The Netflix stock split is expected to boost liquidity and psychological comfort for individual investors, even though modern platforms now offer fractional shares.

Netflix Stock Splits: History and Impact

Netflix has completed two Netflix stock splits prior to this latest announcement, helping to shape the journey of Netflix stock in the equity markets:

1. 2004: 2-for-1 Netflix Stock Split

The first Netflix stock split took place in February 2004. Investors saw their Netflix stock holdings double, as each share was divided into two. This move was aimed at expanding Netflix stock’s reach among investors and improving liquidity. The market responded enthusiastically, as more investors found Netflix stock accessible.

2. 2015: 7-for-1 Netflix Stock Split

Netflix stock underwent a dramatic 7-for-1 split in July 2015. This step was in response to Netflix stock's rapid ascent in value, and once again, the action increased trading interest and ownership diversity. The split fueled further enthusiasm, highlighting Netflix’s transition into a global streaming giant.

Price Reaction Each Time

In both 2004 and 2015, the Netflix stock split saw a mild to notable uptick in Netflix stock prices right after each announcement. While a split does not impact the intrinsic value of Netflix stock, the increased liquidity and perceived affordability often create positive momentum. Notably, some stock market icons, like Warren Buffett with Berkshire Hathaway, avoid splitting their shares; however, the Netflix stock split tradition clearly resonates with both retail and institutional investors.

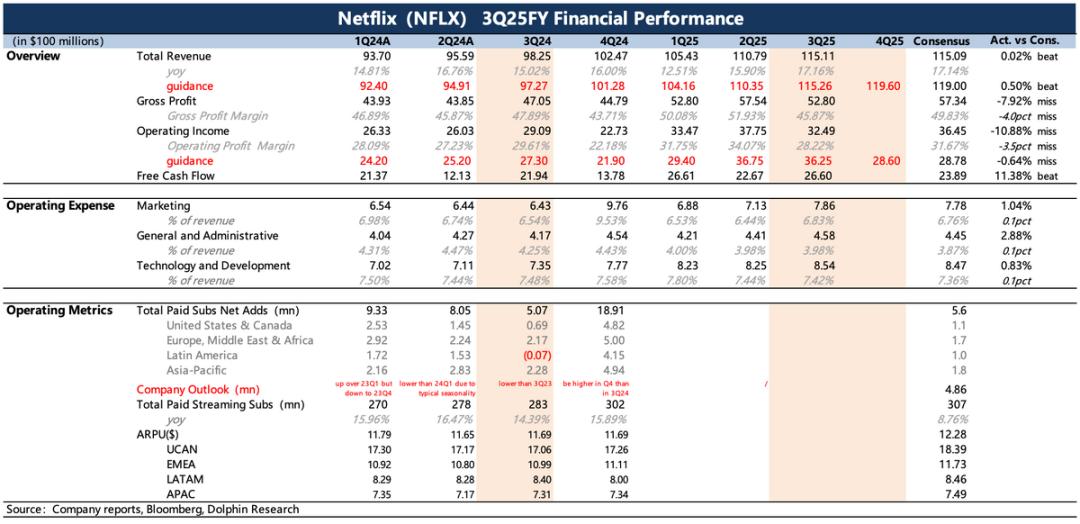

Netflix Q3 2025 Earnings: Comprehensive Analysis

Realities Beneath the Headlines

Netflix recently reported its Q3 2025 earnings on October 21. While the initial response to Netflix stock was negative, closer examination shows that the so-called "miss" on profit was due to a non-recurring $619 million cost related to a Brazilian service tax. Excluding this one-off, Netflix stock’s core business performance actually surpassed expectations.

-

Operating profit: Reached $3.87 billion (up 33% year-over-year) with an operating margin of 33.6%—higher than consensus when adjusting for the tax charge.

-

Revenue: Grew 17% year-over-year, driven mainly by price hikes and the expansion of the ad-supported Netflix stock subscription tier.

-

Subscriber growth: Net subscriber additions, while positive at an estimated 4 million, fell below the long-term average of past years. Key content, such as "KPop Demon Hunters," "Squid Game" Season 3, and "Wednesday" Season 2, generated significant buzz but did not fully meet lofty member growth expectations.

Revenue Drivers and Global Trends

Revenue growth for Netflix stock continues to rely primarily on subscription price increases and growing ad-tier adoption. However, the global average revenue per user (ARPPU) was impacted by a larger mix of lower-priced international memberships and the removal of the affordable, ad-free “Base” plan. Netflix’s management remains confident, projecting annual ad revenue of $1.5 billion and integrating new tools like Amazon DSP to assist further expansion.

Investment, Buybacks, and Cash Flow

Netflix stock shareholders benefited from $1.9 billion in Q3 share repurchases (1.5 million shares at $1,250 average price). The company invested $4.6 billion in fresh content, continuing to lead in original programming. Notably, content spending pace has slowed compared to previous years, signaling smart management amid competitive and macroeconomic headwinds. Free cash flow, at $2.66 billion for the quarter, easily exceeded projections and led to upward-revised annual guidance for 2025.

Assessing Netflix Stock’s Value and Growth Potential

Despite impressive numbers, Netflix stock is trading at a robust forward P/E ratio of 35x. This high valuation assumes Netflix stock will maintain its double-digit revenue growth and follow through on its margin improvement targets as advertising and new ventures expand. Some investors worry future growth may not entirely support current Netflix stock valuations, especially with macro uncertainties and higher costs on the horizon; others see untapped upside from Netflix stock’s expansion into sports, gaming, and more.

Importantly, recent short-term earnings do not yet fully capture these long-term potential drivers for Netflix stock. With ongoing investment in the ad-supported model and premium intellectual property, and content hitting global audiences, Netflix stock remains positioned for continued relevance and growth.

Conclusion

For both new investors and long-term holders, Netflix stock remains one of the most compelling stories in tech and media. The new 10-for-1 Netflix stock split demonstrates the company’s commitment to making ownership of Netflix stock more accessible and liquid. While a split itself doesn’t change fundamentals, it can energize trading and broaden the investor base, keeping Netflix stock at the center of attention.

Recent earnings highlight the need to look past headline numbers. Underlying resilience, careful cash management, and smart capital allocation support the ongoing strength of Netflix stock. As the business evolves and the effects of Netflix stock split announcements play out, investors are wise to factor both short-term metrics and long-term vision into their Netflix stock strategy.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.