XRP Price Outlook: Could the Token Drop to $1.5 as ETF Decision Nears?

With pivotal decisions on U.S. spot XRP exchange-traded fund (ETF) applications approaching, all eyes are on Ripple’s native asset, XRP. Investors are closely tracking upcoming developments, including the potential impact of Ripple’s new digital asset treasury (DAT), to gauge where the XRP price could be headed next. This article provides an up-to-date, data-driven guide to XRP’s price performance, the latest ETF news, Ripple’s strategic moves, and how these factors could influence XRP’s trajectory—possibly down to $1.5 or setting the stage for future rallies.

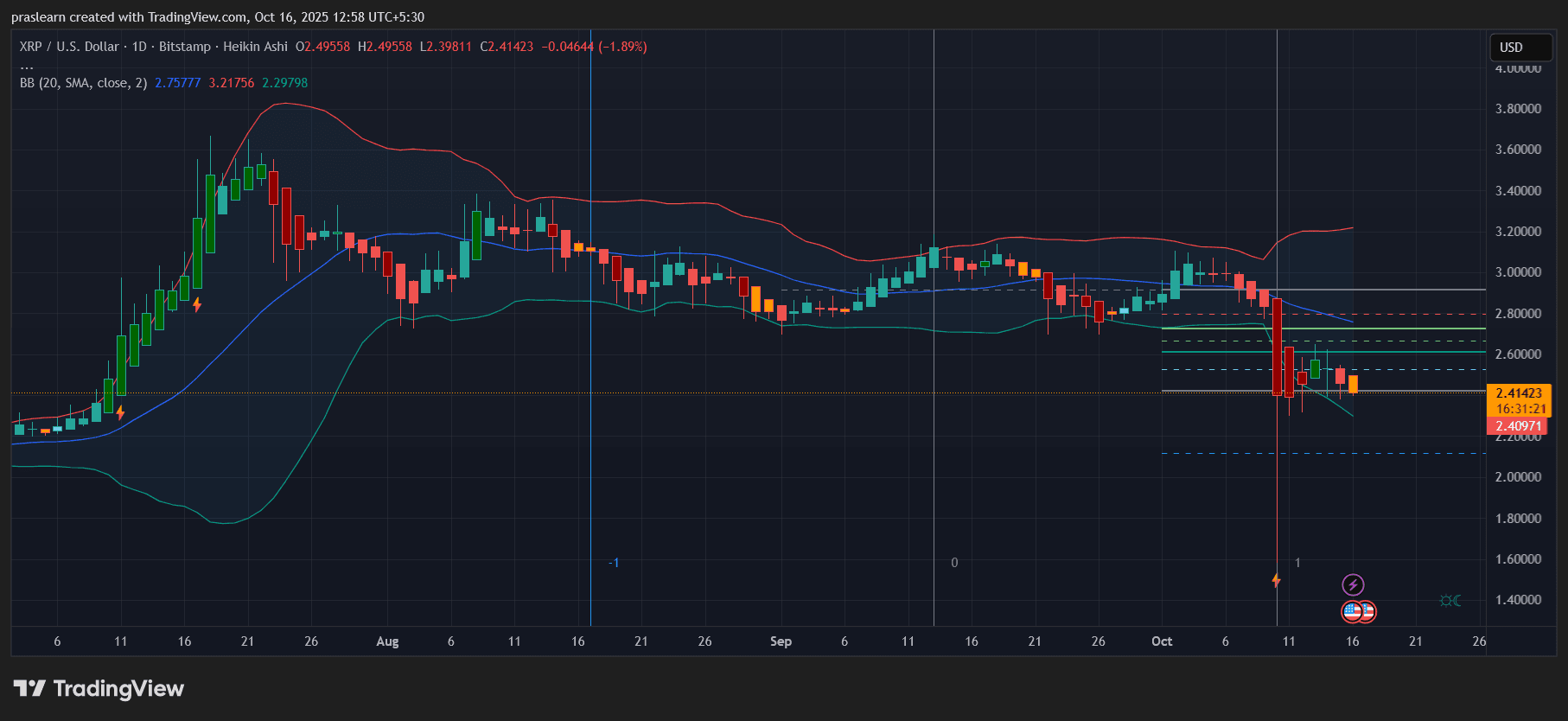

XRP Price Performance and Technical Outlook

Amid market turbulence and heightened anticipation around SEC regulatory decisions, XRP recently failed to clear the $2.60 barrier, echoing the downtrends seen across major cryptocurrencies such as Bitcoin and Ethereum. As of today, XRP is trading below the 20-day moving average and stands at approximately $2.23, down over 17% in the past week and 6.1% in the last 24 hours, according to leading crypto data sources.

Source: CoinMarketCap

Technical analysis reveals a bearish setup:

-

Resistance: Strong levels at $2.40 and $2.45, where the price repeatedly faces rejection.

-

Support: Initial support at $2.30 and $2.28, but a break below could expose $2.25 and then $2.12.

-

The descending channel since October continues, and unless bulls reclaim $2.60 on significant volume, the bias remains downward.

-

The hourly MACD is in the bearish zone, and the hourly RSI is below 50—both suggestive of further downside risk.

-

If XRP breaks and closes below the $2.28 support, the next major downside targets are $2.12 and ultimately $1.95. Some analysts warn that extended bearish sentiment or disappointing regulatory outcomes could see XRP test levels as low as $1.5, a key Fibonacci support area.

Short-term price recovery would depend on reclaiming $2.40 and then $2.47–$2.50, which could open a path to $2.55–$2.60. However, the prevailing market structure suggests caution.

Source: TradingView

The XRP ETF Narrative: SEC Decisions Loom

One of the most crucial catalysts in the coming weeks is the anticipated SEC ruling on spot XRP ETF applications. Decisions are expected between October 18 and 25, 2025, involving issuers like Grayscale, 21Shares, Bitwise, CoinShares, Canary Capital, and WisdomTree. These proposals, if approved, would offer regulated, mainstream investment vehicles for XRP, increasing accessibility for both institutional and retail investors.

Recent delays and the U.S. government shutdown have extended the wait, but major issuers keep amending their filings, signaling ongoing confidence in eventual approval once the regulatory process resumes.

Why do ETFs matter for XRP’s price?

Historically, the approval and launch of spot crypto ETFs have brought large institutional flows and renewed optimism to token prices. If the SEC greenlights any XRP ETF applications, many project that a surge in demand—similar to what followed Bitcoin and Ethereum ETF launches—could drive XRP sharply higher, with price targets from $5 up to even $10–$15 in highly bullish scenarios.

However, the period leading up to an ETF decision often sees choppy trading and heightened volatility, as investor sentiment swings between optimism and caution.

Ripple’s Digital Asset Treasury (DAT): A Strategic Move

Adding another dimension to the market outlook, Ripple Labs is reportedly spearheading a campaign to raise at least $1 billion to establish a new digital asset treasury (DAT). This fund aims to accumulate and strategically utilize XRP, reflecting ongoing corporate confidence in the token’s long-term potential, regardless of recent market turmoil.

Insiders note that the raise may be conducted through a special purpose acquisition company (SPAC), and Ripple itself could allocate some of its XRP holdings to the DAT. This war chest could act as a buffer during times of volatility and provide Ripple with enhanced enterprise cash and liquidity management capabilities—further advanced by Ripple’s $1 billion cash-and-stock deal to acquire financial management company GTreasury.

How the ETF and DAT Could Impact XRP Price

Potential ETF Approval

If the SEC approves one or more spot XRP ETFs, it would mark a transformational moment for XRP’s market prospects:

-

Institutional Access: New regulated investment products could attract capital infusions from asset managers, hedge funds, and ETFs, mirroring the experience seen with BTC and ETH.

-

Market Sentiment: Approval could trigger a new wave of retail and institutional enthusiasm, driving up price and liquidity.

-

Upside Scenarios: In bullish conditions and amid sustained inflows, XRP could reach and even exceed the $5 mark.

Risks—Possible Downside to $1.5?

On the other hand, if the SEC delays or denies ETF applications, or if overall crypto sentiment worsens, XRP could face further downside. Technical levels suggest that if $2.30, $2.28, and $1.95 are breached, the next major support sits around $1.50. A combination of regulatory disappointment and risk-off market behavior could see XRP trading down to this key level in the short term.

Ripple’s DAT

Ripple’s DAT initiative, by accumulating a significant XRP war chest, might help stabilize the market during periods of heavy selling and provide strategic liquidity. This could mitigate some downside risk if ETF outcomes disappoint, and set a foundation for future growth once broader conditions improve.

Conclusion

The upcoming SEC decisions on spot XRP ETFs represent a pivotal moment for XRP investors. While ETF approval could catalyze a powerful recovery driven by institutional demand, ongoing market weakness and regulatory uncertainty put downward pressure on the price, with important support seen as low as $1.5. Ripple’s establishment of a digital asset treasury underscores its long-term commitment to XRP, potentially providing stability in volatile periods.