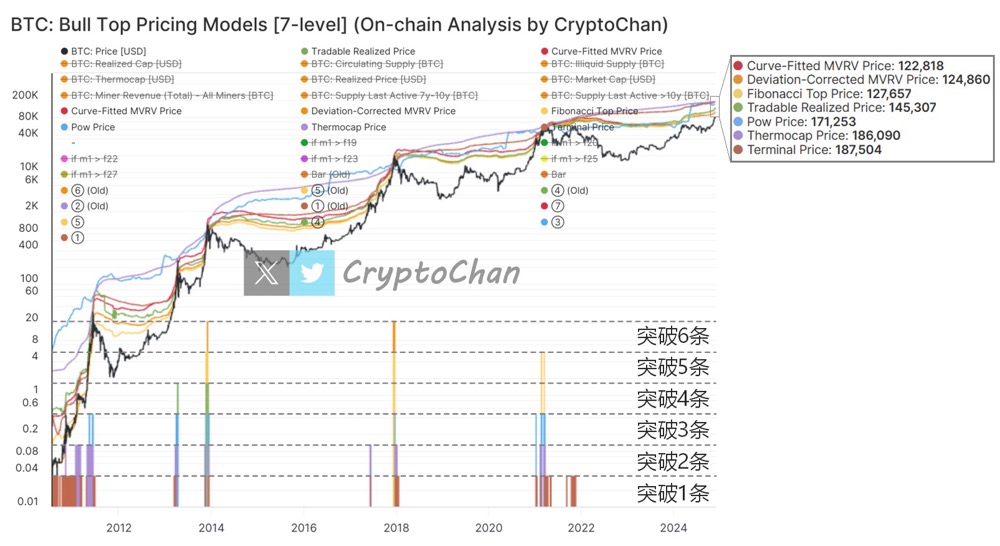

BTC price approaches key resistance, multiple model target price reveals bull market potential

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid Reclaims Fee Dominance from ASTER

[Long English Thread] Verifiable Cloud: How EigenCloud Ushers in a New Era for Crypto Applications and AI

Mars Morning News | $692 million liquidated across the network in the past 24 hours; Fed rate cut pace may switch between "fast-slow-fast"

The article covers topics such as cryptocurrency market liquidation data, Federal Reserve interest rate cut forecasts, the surge in ZEC prices, regulatory relief measures by the US SEC, the Democratic Party's DeFi regulatory proposal, trends in central bank reserves, the release of the CPI report, and whale trading dynamics. The summary was generated by Mars AI. The accuracy and completeness of this AI-generated content are still being iteratively improved.