Date: Sun, Oct 12, 2025 | 06:44 AM GMT

After witnessing one of the most unforgettable and painful events on Friday night that triggered a massive $19 billion in liquidations , the cryptocurrency market today is showing flat momentum — except for a few standout altcoins. Among them, Dash (DASH) has caught attention after beating the broader market selloff.

DASH has surged by an impressive 37% today, and its latest technical setup is hinting at a potential bullish reversal structure — one that closely mirrors Zcash’s (ZEC) explosive rally earlier this month.

Source: Coinmarketcap

Source: Coinmarketcap

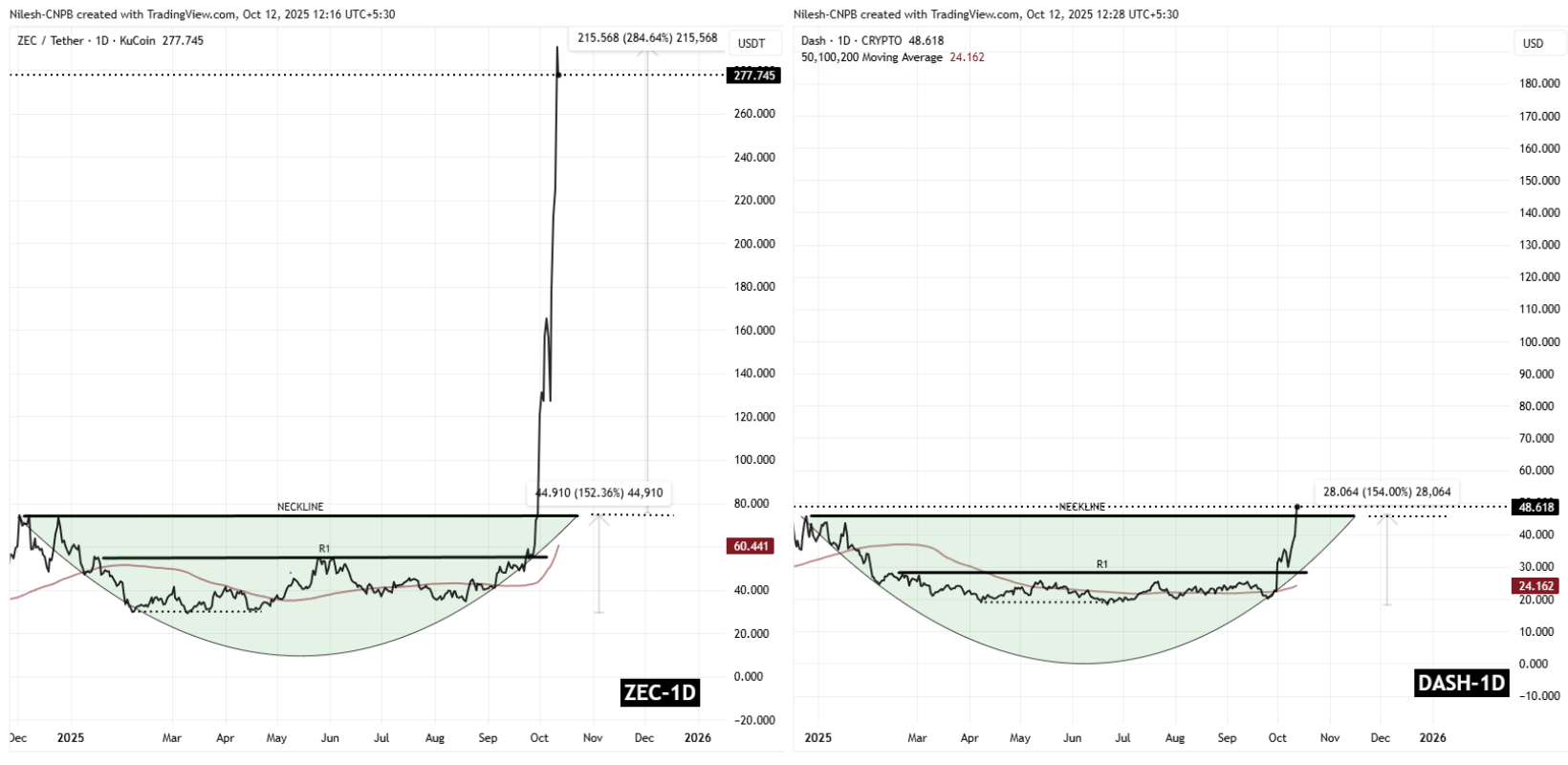

DASH Mirrors ZEC’s Breakout Pattern

A side-by-side comparison of DASH and ZEC on the daily charts reveals a striking similarity in structure, suggesting that a fractal repetition may be unfolding.

As shown in the chart, ZEC reclaimed its 100-day moving average at the bottom and cleared a key resistance before making a massive bullish breakout from a rounding bottom pattern by breaking its neckline. That move triggered a 284% rally, pushing ZEC to new multi-month highs.

ZEC and DASH Fractal Chart/Coinsprobe (Source: Tradingview)

ZEC and DASH Fractal Chart/Coinsprobe (Source: Tradingview)

Now, DASH appears to be following a nearly identical setup. After reclaiming its 100-day moving average and breaking above its R1 resistance, DASH has just made a neckline breakout around $46.0 — a region that looks strikingly similar to ZEC’s consolidation phase just before its explosive move.

What’s Next for DASH?

If DASH continues to mirror ZEC’s fractal behavior, this neckline breakout could act as a launchpad for the next major rally. The $46 level, which previously acted as a strong resistance, now becomes a key support zone to hold.

Should DASH sustain above this support, technical projections suggest the next target could be around the $73 region, representing a potential 55% upside from current levels. If the pattern truly follows ZEC’s trajectory, the token could eventually aim for $180, aligning with the magnitude of ZEC’s recent breakout surge.

However, it’s important to note that fractal patterns do not guarantee identical outcomes. Market sentiment, liquidity, and broader conditions could still influence the final result.