Ethena Labs founder: Still believes USDe pegging to USDT is reasonable; minting and redemption did not go down during market turbulence

Jinse Finance reported that the founder of Ethena Labs posted on X, stating: The oracle attempts to identify two different scenarios: one is a temporary mispricing in the secondary market, and the other is a permanent devaluation of collateral. The latter has never occurred with USDe, and for most assets including USDe, the likelihood of such an event is much lower. Although DeFi money markets have been heavily criticized for anchoring USDe to USDT, we do believe this approach is reasonable, as it can prevent liquidations caused by temporary price imbalances. Ethena provides on-demand proof of reserves to a select few entities, some of which are also oracle providers, including Chaos Labs and Chainlink. During this week’s market volatility, Ethena’s minting and redemption functions did not experience downtime. Major liquidity venues on-chain, such as Curve, Uniswap, and Fluid, experienced price misalignments, but over $9 billions in on-demand stablecoin collateral was available for immediate redemption, with only a small portion actually utilized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

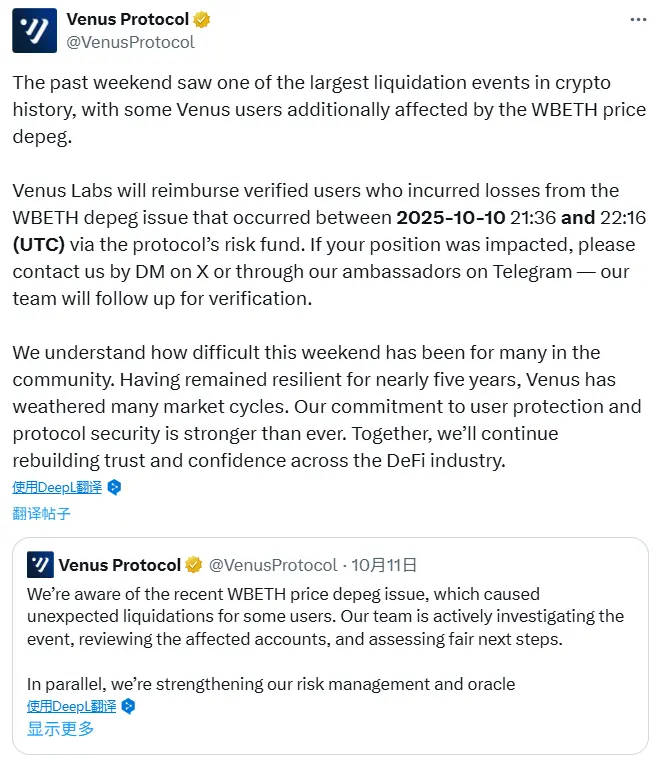

Venus: Users affected by the WBETH depegging on October 11 will be compensated through the Protocol Risk Fund

Multichain staking platform Cryptomesh completes $2.5 million Series A financing

Data: A new address purchased approximately $520,000 worth of "4" in the past hour