After $20 billions in liquidations, crypto investors must master these risk management strategies

Leverage is not a profit multiplier, but simply a tool to improve capital efficiency.

Leverage is not a profit multiplier, but simply a tool to improve capital efficiency.

Written by: Spicy

Translated by: Luffy, Foresight News

The epic $2.0 billions liquidation event that occurred over the weekend taught many crypto traders a profound lesson. The importance of risk management is often overlooked. Veteran crypto trader Spicy shares 5 key risk management insights: from understanding the formula for long-term profitability expectations, to leverage usage that avoids liquidation, and practical methods for controlling bet size. These methods may help investors go further and last longer in the crypto market. Below is the translated content of the article:

There are many important aspects in trading, but nothing is more important than risk management.

I was once a professional trader and have been trading cryptocurrencies for 8 years now. Thank you for taking the time to read this article. In return, I will share all my knowledge about risk management with you without reservation.

Expected Value (EV) Formula

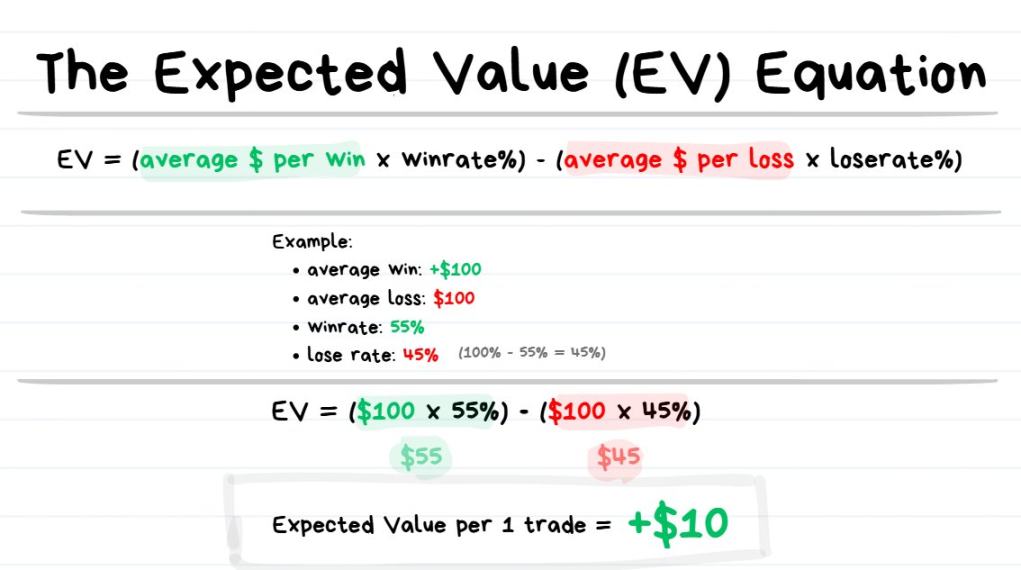

Expected value formula: EV = (average profit × win rate) – (average loss × loss rate)

Tip: Expected value refers to "the average result you can expect when you repeatedly make the same decision."

Every trader must understand the concept and calculation of expected value. Why is expected value so important? The expected value of a trade helps us estimate "the profit we can expect after making N trades in the future."

For example, if the expected value of each trade is +$10, then after making 1,000 identical trades, your expected profit is about $10 × 1,000 = $10,000.

- If you have a positive expected value (+EV), you will make a profit in the long run;

- If you have a negative expected value (–EV), you will eventually lose money in the long run.

Next, I will introduce "Monte Carlo simulation," which visually presents the actual effect of expected value.

Monte Carlo Simulation

First, a quick understanding of Monte Carlo simulation

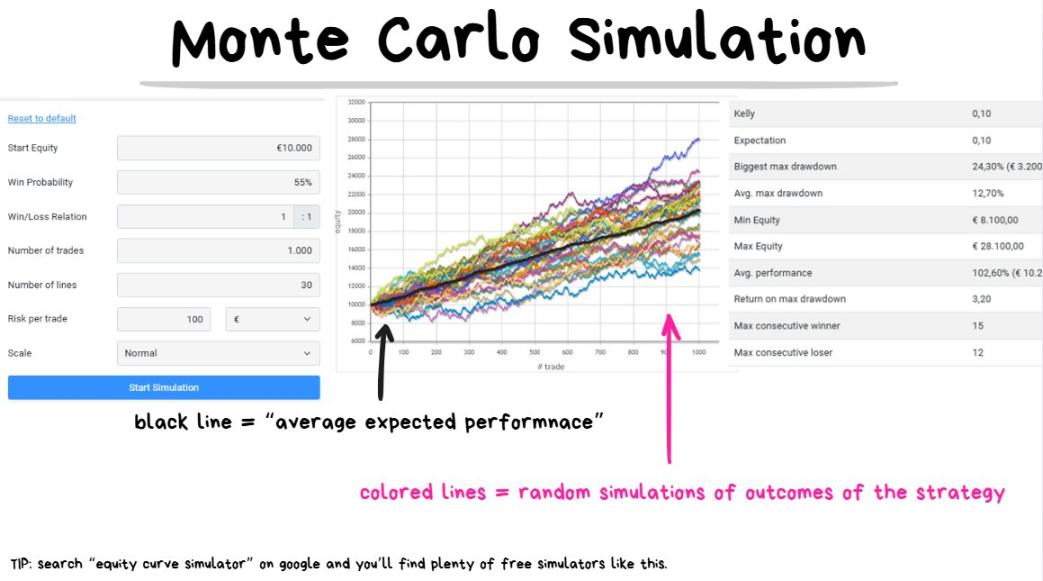

Suppose a trading strategy has a win rate of 55% and a risk-reward ratio of 1:1. We simulate the performance of the next 1,000 trades 30 times. This is a profitable strategy with a positive expected value (+EV).

Tip: Monte Carlo simulation refers to predicting all possible outcomes after N trades by running a large number of random hypothetical scenarios.

Monte Carlo simulation helps us manage expectations and roughly judge the profit potential of a strategy.

Just enter the initial capital, win rate, average profit and loss ratio, and number of trades, and the simulation program will generate random combinations of possible trading performance.

The thick black line in the chart represents the average expected result: if the expected value of each trade is +$10, after 100 trades, the total profit is about +$1,000; after 1,000 trades, the total profit is about +$10,000.

Please note the word "about," because the results cannot be fully guaranteed and there may be some variance.

Next, a quick understanding of variance

Whether you like it or not, randomness will affect trading performance.

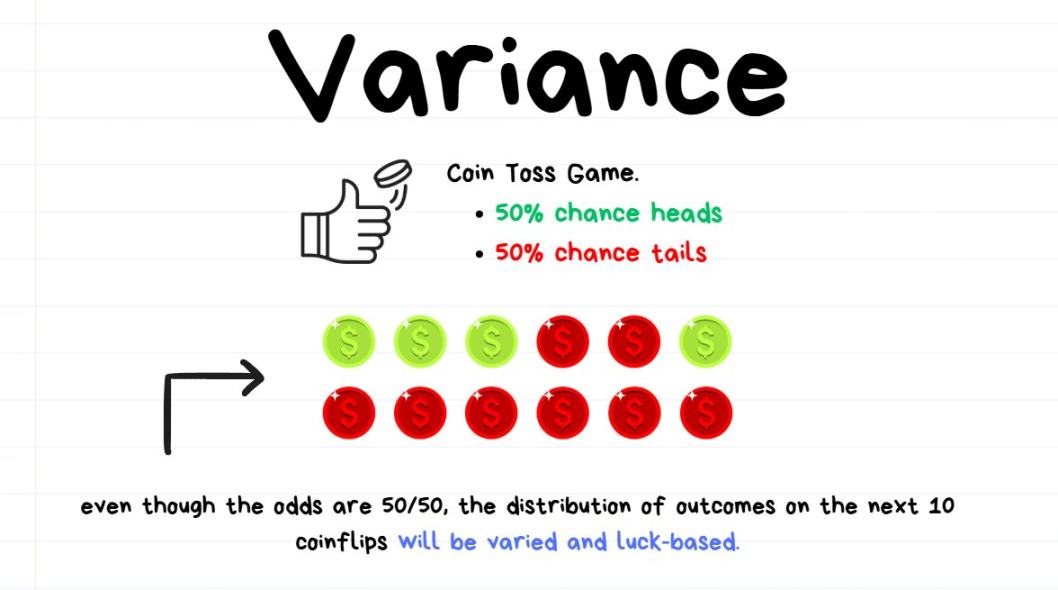

Using a coin toss as an analogy: suppose you play a coin toss game, and the probability of heads and tails is 50% each.

If you toss the coin 10 times, you may get 8 heads and 2 tails; although the probability of heads should be 50%, the actual occurrence is 80%.

This does not mean the coin is rigged or that the probability of heads is 80%, but simply that the number of tosses is insufficient for the probability to fully reveal its true distribution.

The difference between the actual result (80%) and the theoretical probability (50%) is the variance (80% - 50% = 30%).

If you toss the coin 10,000 times, the result may be 5,050 heads and 4,950 tails. Although there are 50 more heads than expected, in percentage terms, the variance is only 0.5% (50 ÷ 10,000).

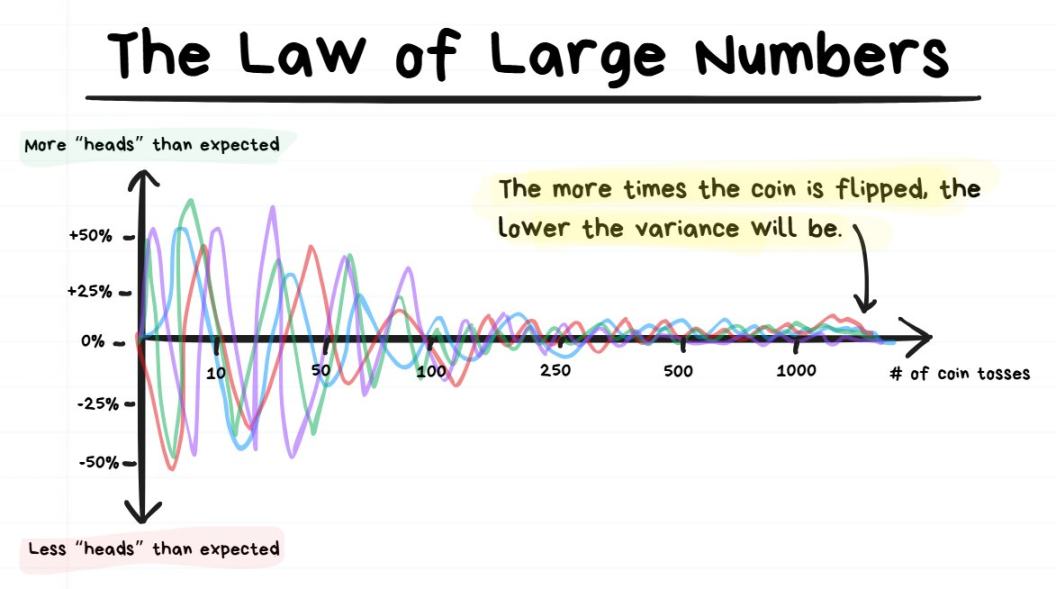

Finally, a quick understanding of the Law of Large Numbers

The more times you toss the coin, the closer the variance gets to 0.

Tip: The Law of Large Numbers states that the more times a random event is repeated, the closer the result gets to its true average value.

If you only toss the coin 10 times, the variance in the probability of heads may be large; if you toss it more than 10,000 times, the variance in the probability of heads will be very small.

Simply put, the more times an event occurs, the closer the result gets to the true probability.

How do Monte Carlo simulation, variance, and the Law of Large Numbers relate to trading?

Monte Carlo simulation helps us manage expectations based on variance and judge the possible performance of N trades in the future; the more trades, the smaller the expected variance.

It can also answer these key questions:

- After N trades, what is the expected profit?

- What is the maximum possible number of consecutive wins?

- What is the maximum possible number of consecutive losses?

- With the current win rate and risk-reward ratio, after N trades, what percentage loss of the account is within the normal range?

At the same time, it also brings a reality check:

- Even high-profit strategies may experience long-term drawdowns (drawdown refers to the percentage loss of the account);

- Even high win-rate strategies may experience large consecutive losses;

- Even low win-rate strategies may experience large consecutive wins;

- The result of the next trade doesn't matter; what matters is the overall result of the next 100+ trades.

Key points of this section:

- Sometimes you make a good trade but still lose money;

- Sometimes you make a bad trade but unexpectedly make a profit.

These situations arise from variance (or luck). It is not advisable to judge whether a trade is correct based on the result of a single trade.

Two extreme examples:

- You place an order based on a trading strategy with a 90% win rate and a 1:1 risk-reward ratio. Even if this trade loses, it is still the right decision. Because if you repeat the same trade 1,000+ times and let the Law of Large Numbers take effect, you will inevitably make a profit in the end.

- You play slots at a casino. Even if you win once, it doesn't mean it's a wise bet—it's just good luck due to variance. If you keep betting 1,000+ times and let the Law of Large Numbers take effect, you will eventually lose all your money.

Key conclusion:

Don't judge the quality of a trade based on the profit or loss of the next trade, but on the expected value of the trade. You need to be patient and endure some variance for profits to gradually emerge.

Leverage and Liquidation

Leverage may be one of the most misunderstood concepts among traders.

Before reading further, remember that you don't need to memorize all the details or feel pressured. As long as you grasp the basic concept of leverage, that's enough for trading.

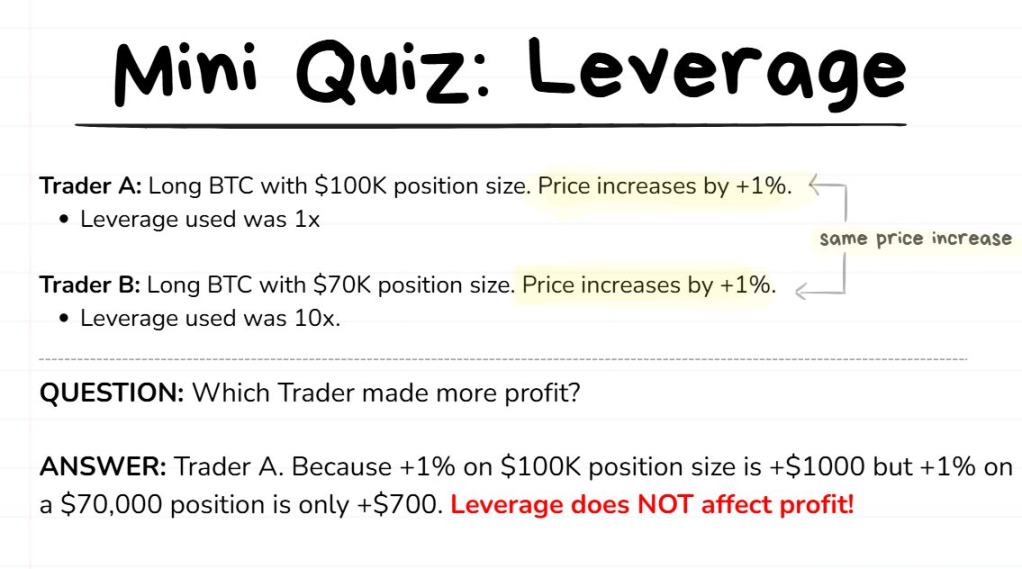

Let's do a quick test to see if you understand the basics of leverage (assuming both traders have the same entry price).

Most people have a misconception about leverage (absolutely wrong): Leverage is a profit multiplier; increasing leverage magically increases trading profits.

I can say with certainty that leverage is not like that at all.

The real function of leverage (correct): Leverage is a tool to reduce counterparty risk and improve capital efficiency.

Counterparty risk: This refers to the risk you face by holding funds on an exchange. Exchanges can run away or commit fraud (such as the FTX incident), so funds are not absolutely safe.

Capital efficiency: This refers to the efficiency with which you use your funds to earn more profit. For example: earning $1,000 per month with $1,000 in principal is 100 times more efficient than earning $1,000 per month with $100,000 in principal.

Before going deeper, let's clarify the definitions of a few terms and then return to learning about leverage.

- Trading account balance: the total funds you are willing to use for trading;

- Exchange account balance: the funds you deposit on the exchange, usually only a small part of your trading account balance. It is not recommended to deposit all your trading funds on the exchange;

- Margin: the deposit required to open a trade;

- Leverage: the multiple of funds you borrow from the exchange;

- Position size: the total amount of tokens (or their USD value) you actually buy/sell in a trade.

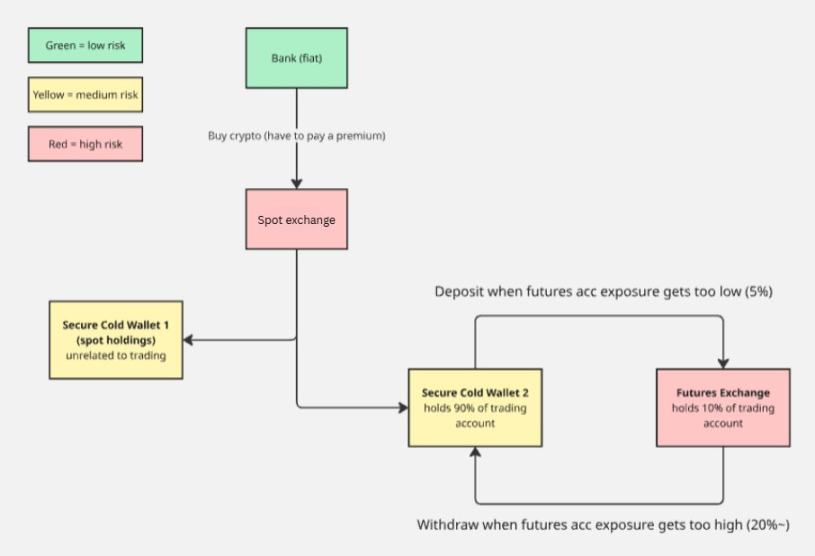

Additional note: The diagram below shows my process for managing deposits and withdrawals on exchanges. The core principle is "never concentrate all funds on a single exchange to avoid overexposure to risk."

Understanding the above concepts through an example

Suppose you have $10,000 available for trading—this is your trading account balance.

You don't want to deposit the entire $10,000 on the exchange (worried about the exchange freezing funds, fraud, or being hacked), so you only deposit 10%, which is $1,000. At this point, your exchange account balance is $1,000.

You spot a good trading opportunity in bitcoin and want to go long $10,000 worth of BTC. When you click buy, the system will prompt you that you have insufficient funds because your exchange account balance is only $1,000. You need to use leverage to borrow the required funds to open the position.

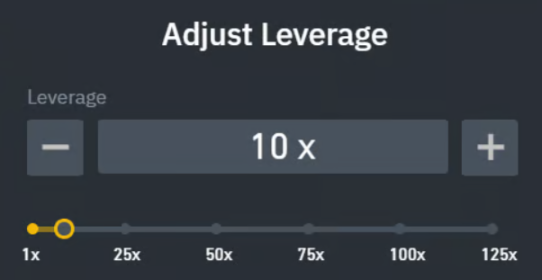

After setting leverage to 10x, click buy again to successfully open the position:

- The position size of this trade (the actual value of BTC bought) is $10,000;

- The margin (your deposit) is $1,000;

- The leverage multiple is 10x.

Tip: Whether you use 1x or 100x leverage, the profit from a $10,000 position is always the same. The essence of a $10,000 position does not change with leverage. Even if you adjust leverage during the trade, it will not affect the final profit.

The purpose of liquidation

When you use leverage to open a position, you are essentially borrowing money from the exchange. These funds do not come out of thin air.

If you open a $10,000 position with 10x leverage and your exchange account balance is only $1,000, then $9,000 is borrowed from the exchange, and this borrowed money can only be used to open the position.

To ensure the exchange can recover the funds it lent, there is a liquidation mechanism.

Liquidation: If the price hits a specific point (the liquidation price), the exchange will forcibly close your position and confiscate your margin. After that, the position will be taken over by the exchange, and subsequent profits and losses have nothing to do with you.

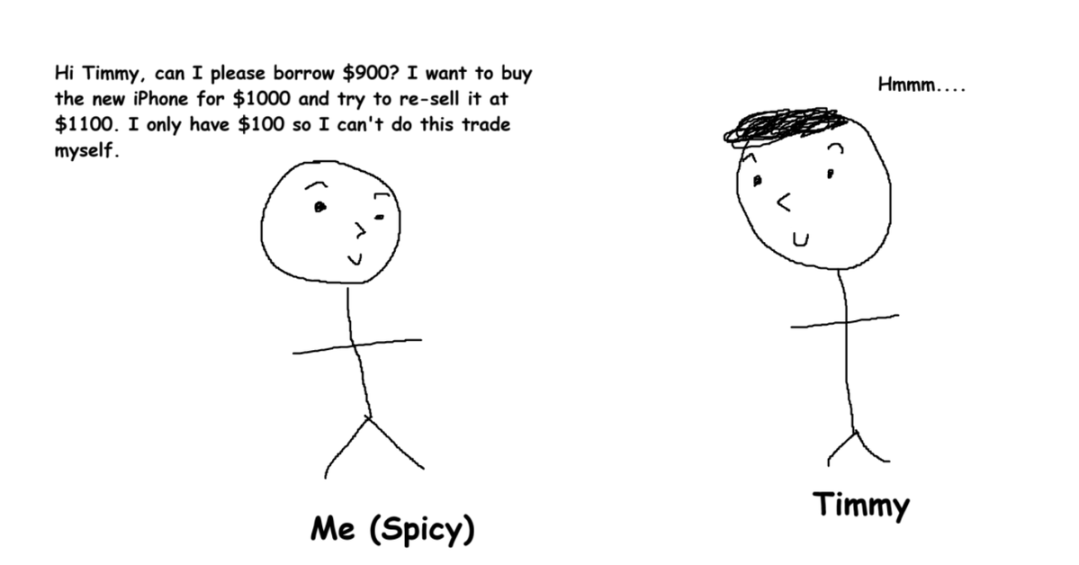

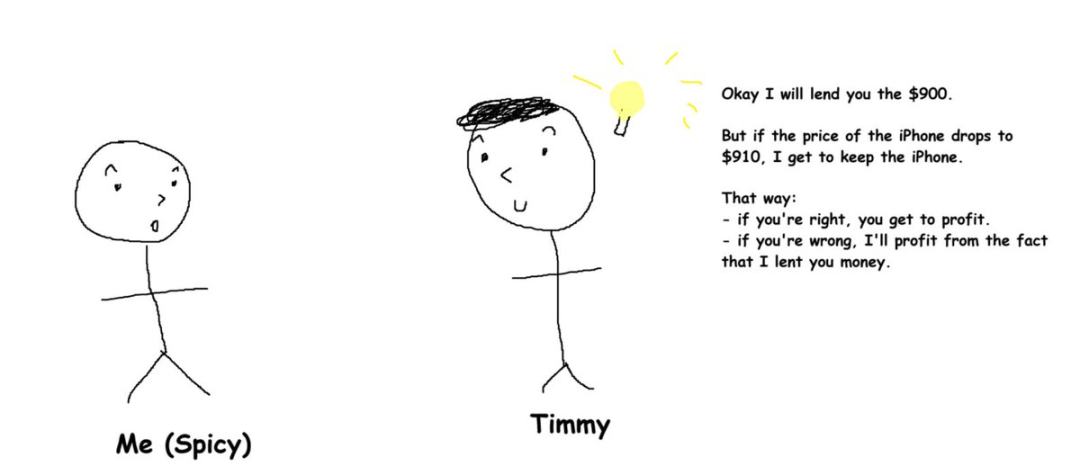

Simplifying understanding with an analogy

Suppose you are optimistic about a new iPhone, which is currently priced at $1,000. You expect it to rise to $1,100 (a 10% increase), so you plan to buy at $1,000 and sell at $1,100 to make a $100 profit.

But the problem is, you only have $100 in your bank account.

So you find a rich guy, Timmy, and borrow $900 from him to do the iPhone trade.

Potential risk

If Timmy lends you $900 and the iPhone price drops below $900, even if you sell the iPhone, you can't fully repay Timmy's loan, and Timmy will lose money for no reason, which he is unwilling to bear.

Solution

The two parties sign a mutually beneficial agreement (the essence of a perpetual contract is an agreement between the trader and the exchange):

You and Timmy agree: if the iPhone price falls below $910, you must hand over the purchased iPhone to Timmy, which is equivalent to your position being liquidated.

At this point, you lose the initial $100 you paid (the margin); Timmy will try to sell the iPhone himself. If the price hasn't fluctuated much and he can sell it for more than $900, he can make a profit.

Timmy requires "taking over the iPhone if the price falls below $910 instead of $900" because he deserves a reasonable return for "lending you money." This gives him enough room to "sell the iPhone and recover his principal."

Key points of this section

You don't need to memorize all the term definitions. The most important thing is to understand that leverage is just a tool to help you achieve the desired position size.

Also, never put yourself at risk of liquidation. The cost and fees of liquidation are extremely high.

Tip: Every trade must have a stop loss. Trading without a stop loss is extremely risky.

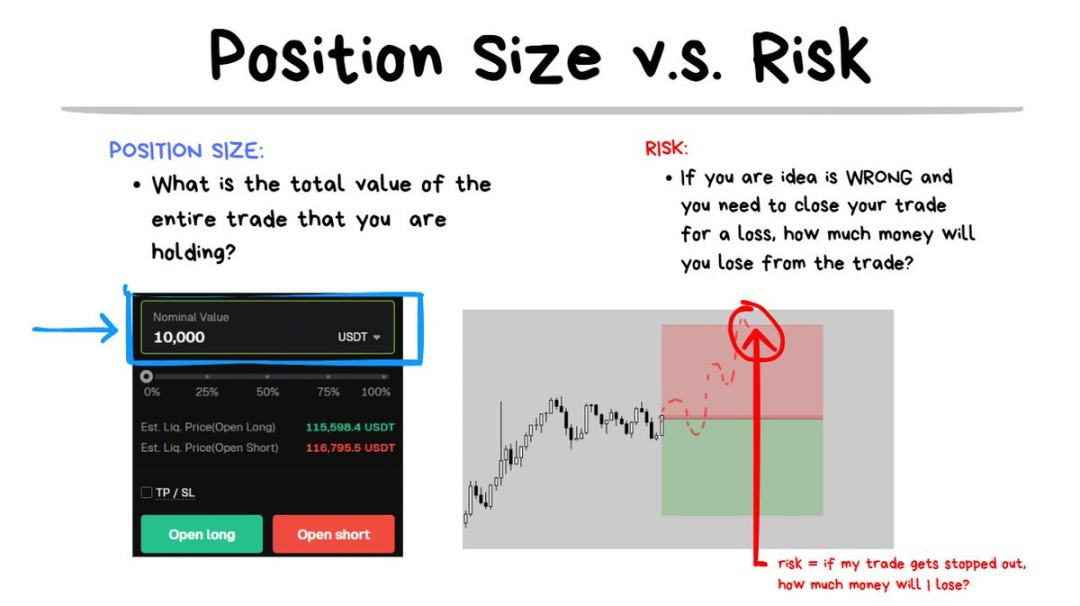

The Difference Between Position Size and Risk

Another concept often misunderstood by traders is the difference between position size and risk.

Position size refers to the total amount of tokens (or USD value) involved in a trade. For example: I bought $10,000 worth of BTC, so the position size is $10,000.

Risk refers to the amount of money you will lose if your trade is wrong and you need to stop out. For example: if the price hits the stop loss, I will lose $100, so the risk is $100.

Before making any trade, I always ask myself: "If I'm wrong and have to stop out, how much loss can I accept?"

This is a key question, but many traders completely ignore it. They firmly believe their trading idea is absolutely correct and can't go wrong. Combined with FOMO, they often end up in trouble.

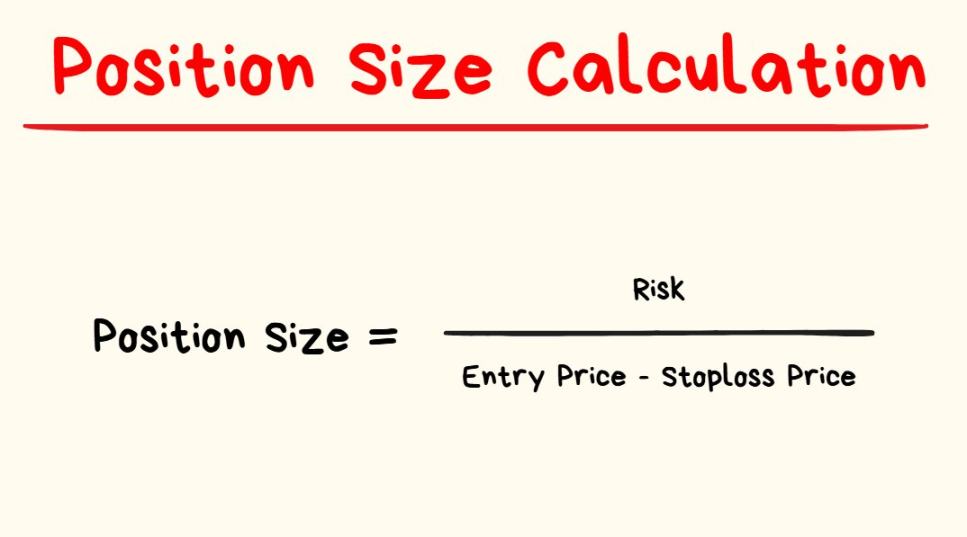

After determining the acceptable loss amount for the next trade, the next step is to calculate the required position size.

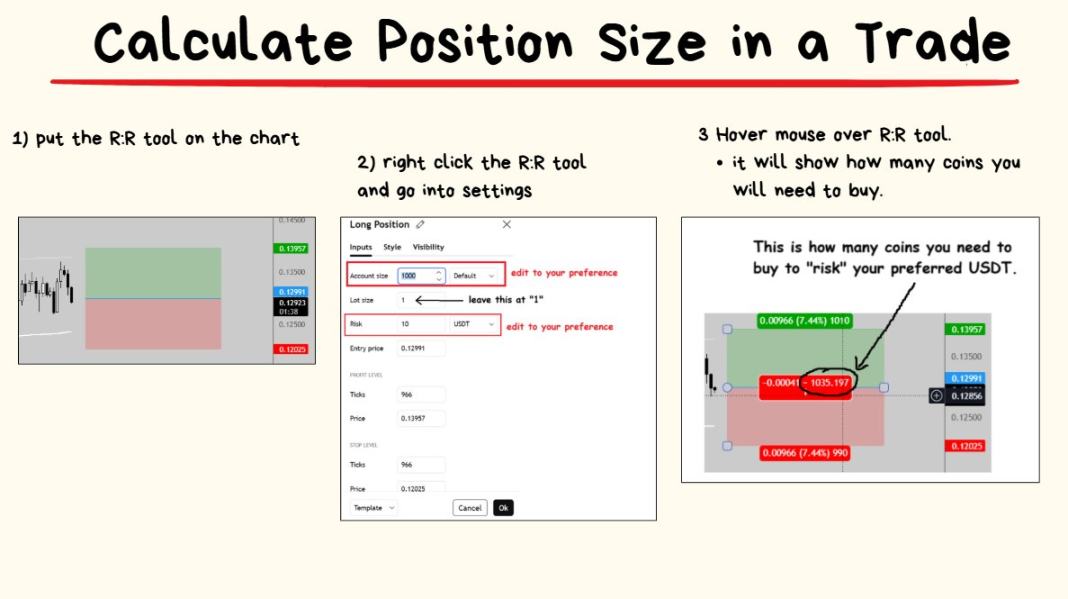

You don't have to worry about doing math before every trade; there's a simpler way.

TradingView's risk-reward tool has built-in calculation functions:

It's very simple to use. Let's move on to the last key point 🤓

Risk of Ruin and Reasonable Bet Sizing

All traders eventually ask a common question: How much risk per trade is appropriate?

Answer: It depends.

Common answer: The widely circulated advice is that the risk per trade should not exceed 1% of your trading capital. For example, if you have $10,000 in capital, the expected loss for the next trade should be $100.

My personal answer: The higher the trade quality, the more I bet; the lower the trade quality, the less I bet.

This section will discuss risk of ruin and the Kelly criterion.

First, understand risk of ruin

Even if you have a trading edge (a profitable strategy with positive expected value), it doesn't mean you won't get liquidated.

Tip: The first rule of trading is never to get liquidated. Once you are liquidated, you can no longer participate in trading. The core of trading is to stay in the market for the long term.

In fact, if you risk too much on each trade, even if your strategy is profitable, you will eventually lose everything.

Extreme example:

Suppose you risk 100% of your capital on every trade, and your strategy has a 90% win rate and a 10:1 risk-reward ratio. This is an extremely good strategy, but the problem is that trading with full capital every time will inevitably lead to liquidation.

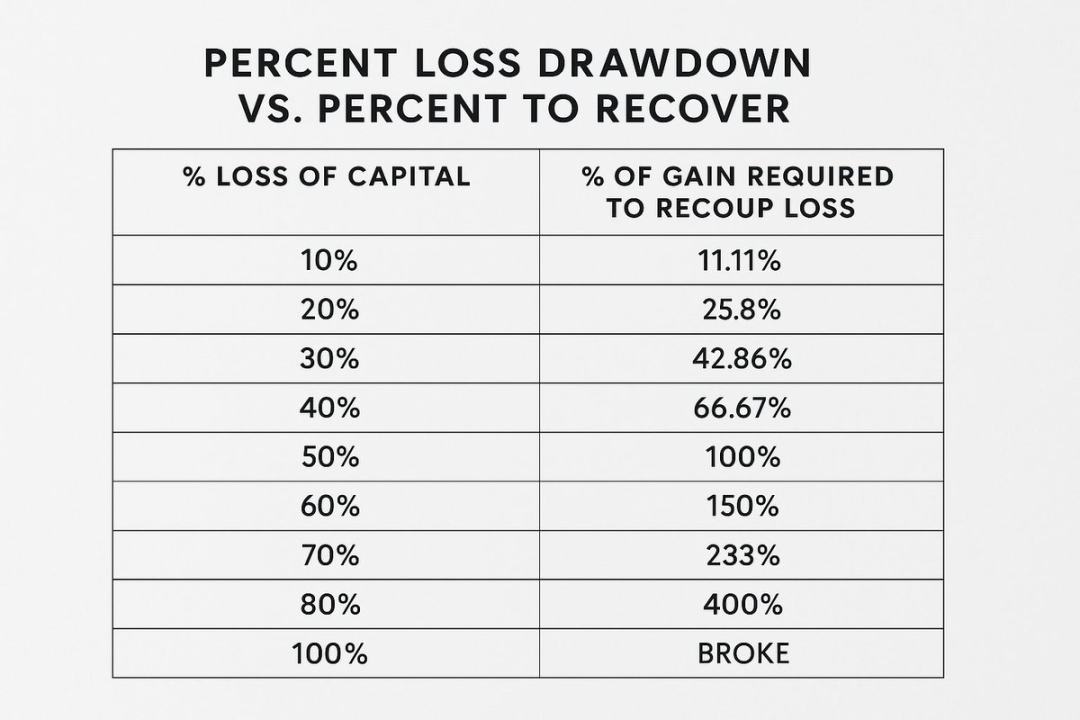

Once you are liquidated, the game is over; even if you are just close to liquidation, it will be extremely difficult to recover your account.

This is why it feels hard to grow your account, but liquidation is so easy.

Obviously, there is a clear upper limit to risk. Even with an excellent strategy, if you bet too much, you will eventually get liquidated.

But conversely, if the risk is too low (for example, risking only 0.0000001% of your capital per trade), your account will never grow effectively.

So, where is the balance point for reasonable risk?

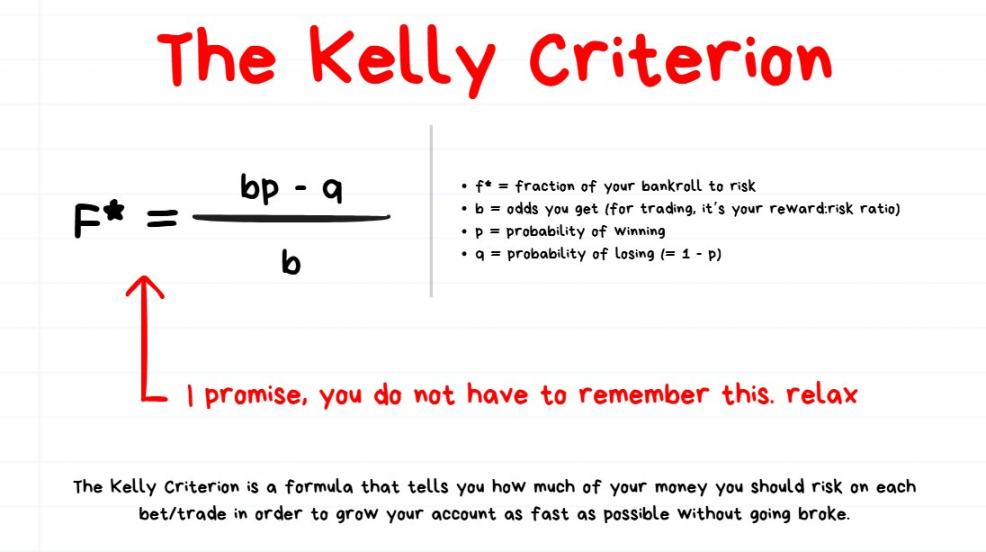

Next, understand the Kelly criterion, which tries to solve the "balance point" problem

You don't need to memorize the exact formula for the Kelly criterion; I list it here just for curious readers.

Some traders believe the Kelly criterion is the best way to calculate the optimal bet size; others think it is too conservative and slow-growing, so they multiply the Kelly result by a factor (e.g., bet size = Kelly result × 2); others think it is still too aggressive and does not account for unexpected errors, so they divide the Kelly result by a factor (e.g., bet size = Kelly result ÷ 2).

My core view on the Kelly criterion and optimal bet sizing formula

I don't think there is a perfect method for calculating bet size.

Even if you use the Kelly criterion or other complex formulas to calculate bet size, there is no absolutely perfect solution in trading.

As I mentioned before, I prefer to dynamically adjust bet size:

- Low-quality trades: skip them, do not participate;

- Standard-quality trades: risk 1% of capital;

- High-quality trades: risk 2% of capital;

- Ultra-high-quality trades: risk up to 4% of capital.

Additional note: Is this the optimal betting method? I'm not sure! But I like simple methods, and this one works well for me.

I judge trade quality based on the strategy used and the variables present in the market before opening a position.

Summary

- Understanding the numbers behind trading edges is crucial. In trading, which is a probability-based activity, expected value is the core concept;

- Focus on the overall results of the next 100 trades, not the profit or loss of the next trade. Let the Law of Large Numbers work for you;

- Leverage is not a profit multiplier, but simply a tool to improve capital efficiency. Remember, never put yourself at risk of liquidation;

- Position size is the value of the tokens you buy/sell, while risk is the amount of money you will lose if you are wrong;

- It's easy to fall into a drawdown and hard to recover, so control your bet size reasonably. If you are a beginner, simplify your approach: keep risk per trade within 1%, and adjust only after you are familiar with high-quality A+ trade setups.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock Sell-Off Deepens Ripple Effect on Global Markets

Ripple Effect of Trump’s Tariff Threat Triggers $19B Crypto Liquidation

$300 million in funding + CFTC endorsement, Kalshi challenges the prediction market giant

Led by Sequoia Capital and a16z, Kalshi's valuation has soared to $5 billions.