In the crypto world, is it impossible to "not play" with leverage?

Being cautious in the crypto space is just a slow way to stay poor.

Acting cautiously in crypto is just a slow way to stay poor.

Written by: rosie

Translated by: AididiaoJP, Foresight News

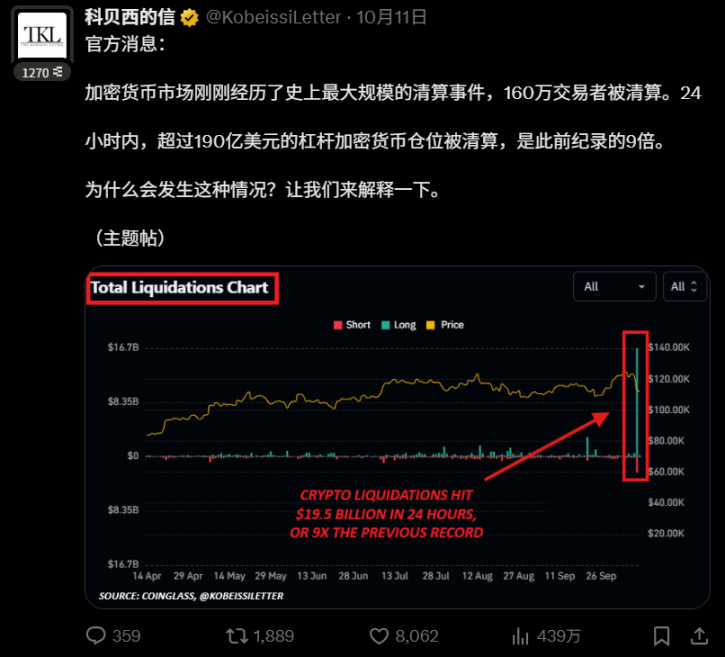

On October 10, 2025, $19 billions were liquidated within 24 hours, leaving 1.6 million traders wiped out.

This was the largest liquidation event in crypto history, with a liquidation scale nine times higher than the previous peak.

And six months later, everyone will come back to do the exact same thing, myself likely included.

Overnight, Everyone Became an Expert

After the crash, Crypto Twitter turned into a risk management seminar. "You should have stayed antifragile." "Never use leverage." "This is why I hold cash."

Interestingly, the loudest voices are always those who have been holding stablecoins all along. Where were these insights on October 9th? Oh right, you were posting about your regret for missing the rally.

The Real Meaning of "Antifragile" (And Why It Doesn't Apply Here)

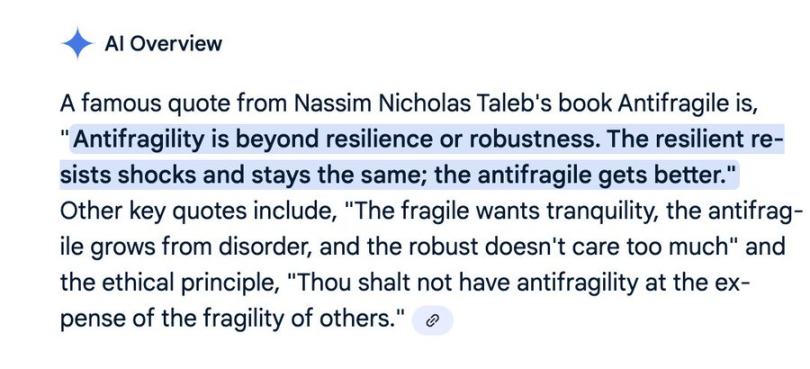

People have been misusing the concept of antifragility without understanding it.

Antifragile doesn't mean "acting cautiously." It means benefiting from volatility, becoming stronger from chaos, not weaker.

But here's the problem: leveraged traders don't benefit from volatility—they get destroyed by it.

When you open a 10x long and the market drops 15%, you don't become stronger from chaos. You get liquidated. That's not antifragile. That's fragility with extra steps.

True antifragility means you don't rely on any single condition; but everyone in crypto relies on one thing: prices going up, or at least not dropping 15% in 20 minutes.

Robust vs. Antifragile

- Robust = "I don't want volatility to affect me"

- Antifragile = "I want volatility to make me stronger"

Holding stablecoins? At best, that's robust. You're protected, but you can't benefit from market moves. You can't profit from rallies either—you're just present, safe, and poor.

And these are the people shouting "just stay antifragile" the loudest. They're on the sidelines, missed everything, and now feel vindicated because others got hurt.

Using leverage? That's just fragility—volatility will destroy you.

So what is truly antifragile in crypto? Honestly, no one has figured it out. Maybe those who short before major news drops, but that just looks like they have insider information.

The Game We're All Deeply Involved In

Here's a fact no one wants to admit: in crypto, you can't "not play" leverage.

Sit completely on the sidelines? You'll watch everyone around you make money over a few months. Your purchasing power erodes with ongoing inflation, and opportunities disappear.

And honestly, if you only have $5,000 to play with, you won't make life-changing money through spot trading. So people use leverage—not because it's smart, but because turning $5,000 into $6,000 in a year doesn't change anything.

Being on the sidelines feels responsible—until you watch everyone else 10x their money while you're still being "smart." At least getting wrecked means you tried.

Why Everyone Will Repeat the Same Mistakes

Six months later, those who lost everything will use leverage again—not because they're stupid, but because what's the alternative?

Hold stablecoins forever and miss the next cycle? Watch others buy houses with dog coin profits while you keep being "smart"?

Everyone knows people who missed out when bitcoin was $100, ethereum was $10, or solana was $1. They were "cautious" every time. Now they're still working 9-to-5 jobs while others have retired.

Acting cautiously in crypto is just a slow way to stay poor.

We All Know the Game Is Rigged

You know the game is rigged. You know some people have better information. You know the infrastructure collapses during crashes. You know all of this.

But the problem is: everyone else is playing. And when everyone else is playing, you're not making an independent choice—you're reacting to the behavior of everyone around you.

This is really just a coordination game. When your entire social network is in crypto, when your timeline is full of profit screenshots, when opportunities flow to those who participate, sitting out means you're left behind.

If you're the only one not at the table, you won't make life-changing money. If you don't participate, you can't stay connected to the ecosystem.

Why Those "Experts" Are Talking Nonsense

Those giving advice after October 10 fall into a few categories:

They also got liquidated but won't admit it. They sat out, missed the entire rally, and now feel vindicated because others lost money. Or they just got lucky and think it's skill.

The stablecoin holders are the worst. They sat out for months, posting regret, while everyone else made money. Now they get to feel superior because someone got liquidated.

No one really understands this game. We're all just making different bets in an uncertain game.

What Might Happen Next

Here's the cycle everyone has seen:

- Months 1-2: Everyone swears off leverage. "Never again." "Crypto is a scam." "I'm out."

- Months 3-4: New narratives emerge. Those who stayed start posting profits. FOMO slowly builds.

- Months 5-6: Leverage returns. "This time is different." "I learned from last time." "Just a small position."

Then everything repeats.

Most people will become part of this cycle. Not because they're dumb, but because the alternative is sitting on the sidelines watching everyone else play.

Both Choices Suck

You can participate and risk getting liquidated. Or sit out and watch everyone else possibly change their lives.

The logical response to information asymmetry should be smaller positions, longer timeframes, more diversification. But that's not what actually happens, because when everyone around you is using leverage and posting profits, conservative strategies feel like losing.

It's not rational—it's reflexive. You're not making decisions in a vacuum; you're making them while watching everyone else make money with the strategies you avoided.

If You Got Wrecked on October 10

If you lost everything, take a break.

Close the charts, delete the apps for a while, go outside, hit the gym, talk to people who don't even know what perpetual contracts are.

The FOMO will still be there in a month, the narratives will continue, crypto isn't going anywhere.

But if you rush to make it all back while your mindset is off, trying to recover everything you lost? That will get you wrecked twice.

Accept the loss, learn what you can. Come back when your mind is clear, not when you're desperate to recover losses.

Remember: those shouting about being antifragile probably never even participated. Don't let them make you feel worse for having tried.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After the epic crypto liquidation on "10.11", how are the stocks of DAT companies doing?

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

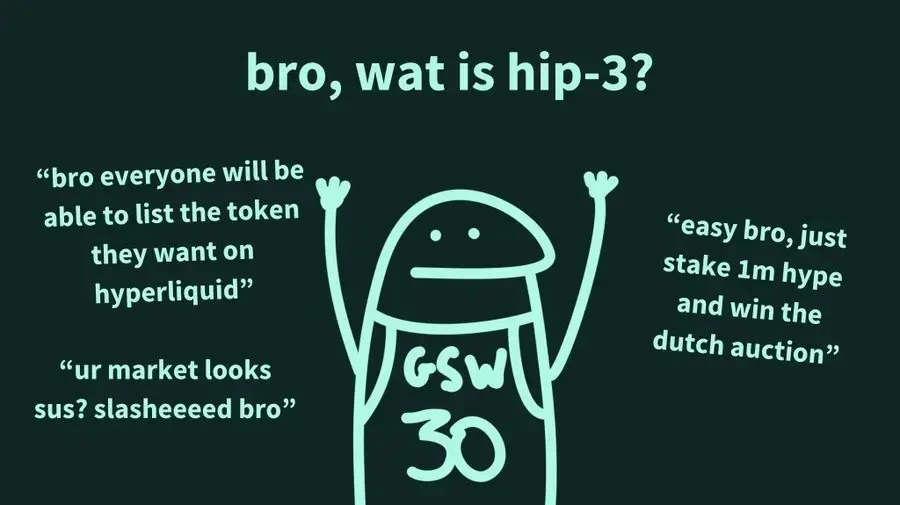

A Simple Explanation of Hyperliquid's HIP-3 Upgrade Today

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

Bitcoin price rebounds, fear turns to hope—here are the reasons

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

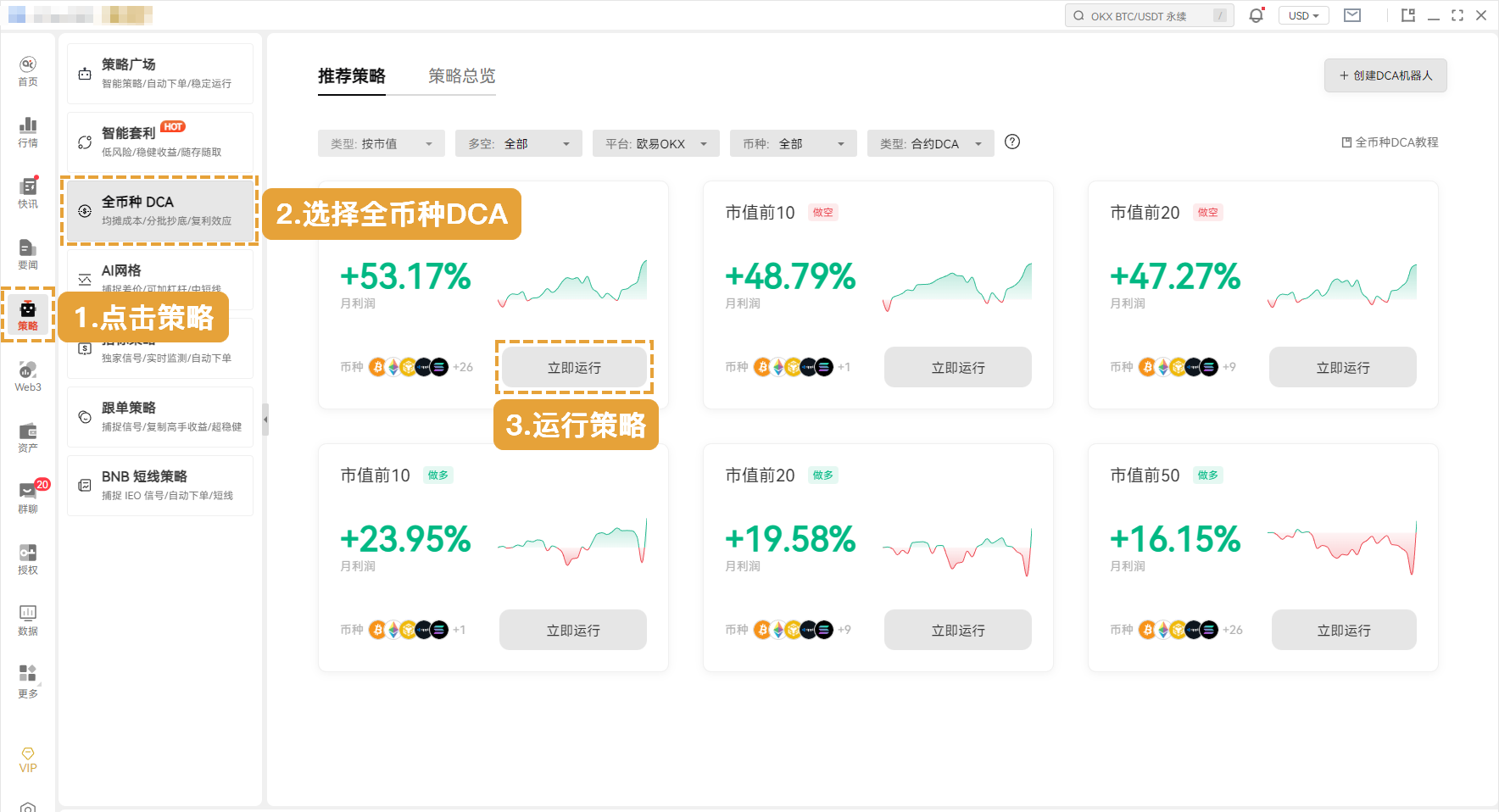

Spot DCA: Use "brainless" operations to outperform 90% of anxious traders!