Aave DAO has cumulatively repurchased 100,000 AAVE and plans to use them as collateral to initiate GHO credit.

PANews reported on October 13 that since Aave DAO launched its buyback program on April 9, it has accumulated the purchase of 100,000 AAVE at an average price of approximately $239.35, with a total cost of about $24 million and a current value of about $25.1 million, resulting in an overall return of approximately 4.36%. According to TokenLogic, Aave DAO's annual revenue is about twice its annual expenditure. It plans to use the repurchased AAVE and treasury assets as collateral to open a GHO credit line, with the funds to be used for growth initiatives and repaid with returns. This proposal has not yet entered the voting process.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After the epic crypto liquidation on "10.11", how are the stocks of DAT companies doing?

For companies exposed to the dual risks of the crypto market and the stock market, has the worst already passed?

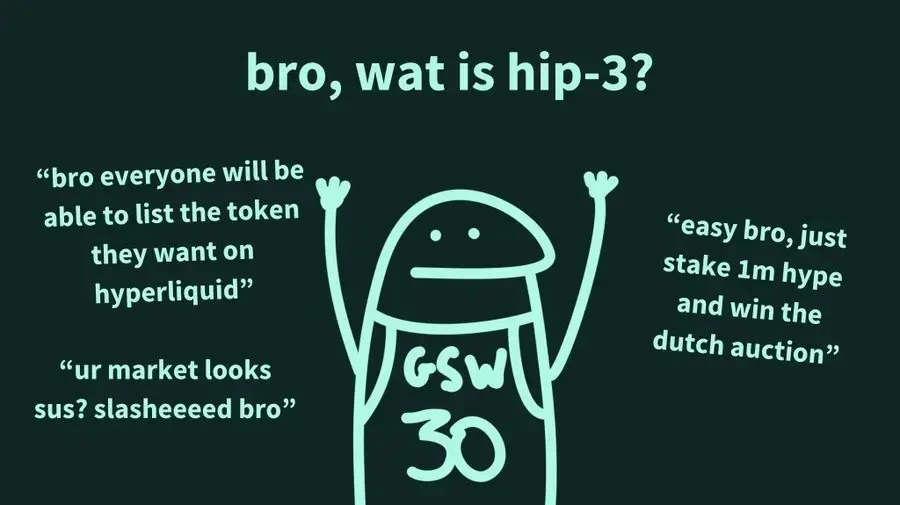

A Simple Explanation of Hyperliquid's HIP-3 Upgrade Today

HIP-3 is a major improvement proposal for the Hyperliquid exchange, aimed at decentralizing the launch process of perpetual contract markets by allowing any developer to deploy new contract trading markets on HyperCore.

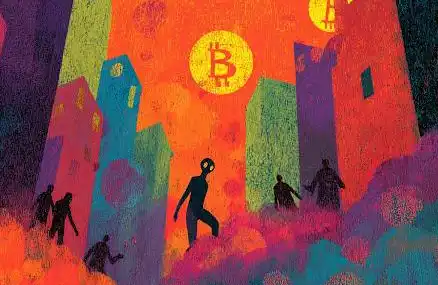

Bitcoin price rebounds, fear turns to hope—here are the reasons

Bitcoin rebounds as trade tensions ease and Israeli hostages are released, with buyers returning to the market after last week's cryptocurrency crash.

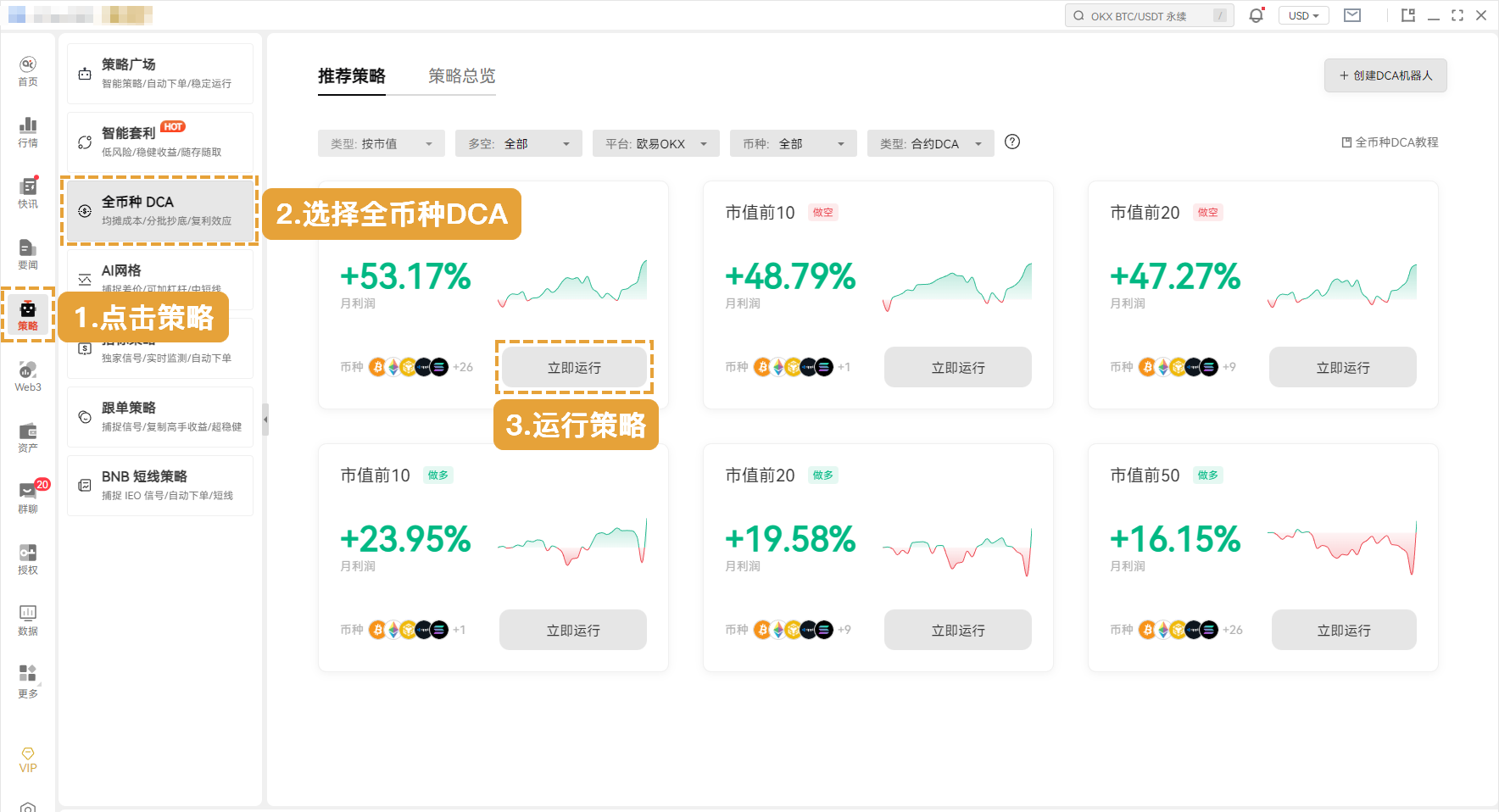

Spot DCA: Use "brainless" operations to outperform 90% of anxious traders!