Date: Tue, Oct 14, 2025 | 06:30 AM GMT

The cryptocurrency market is once again tilting downward after showing early signs of recovery on Monday that pushed Ethereum (ETH) to a 24-hour high of $4,292, before sliding back into red around $4,070 today.

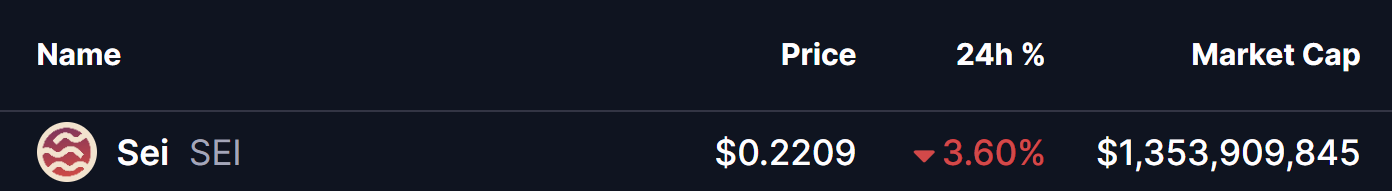

Following ETH’s retreat, several altcoins have also turned weaker — including Sei (SEI), which is now flashing a confirmed bearish breakdown on its lower timeframe chart.

Source: Coinmarketcap

Source: Coinmarketcap

Rising Wedge Breakdown

On the 1-hour chart, SEI had been trading within a rising wedge — a bearish reversal formation characterized by higher highs and higher lows within narrowing price boundaries. This pattern often signals that buying momentum is fading and a potential breakdown may follow.

After facing repeated rejections near the wedge’s upper resistance zone, SEI finally broke below its critical support trendline at $0.2312, confirming the bearish breakdown. The move triggered a quick wave of selling pressure, pulling the token sharply lower.

Sei (SEI) 1H Chart/Coinsprobe (Source: Tradingview)

Sei (SEI) 1H Chart/Coinsprobe (Source: Tradingview)

At the time of writing, SEI is changing hands around $0.2193, and the overall structure suggests that bearish momentum is starting to dominate.

What’s Next for SEI?

With the breakdown confirmed, traders will be watching whether SEI attempts to retest the broken wedge support — now flipped into resistance. If the token fails to reclaim that level, it would likely reinforce the bearish trend and open the door for a further decline toward the next key support around $0.2012.

Alternatively, if bulls manage to push the price back above $0.2312, a short-term rebound could occur — though the broader outlook would remain cautious until SEI re-enters the wedge structure.

For now, the bias remains bearish, and how SEI reacts around its newly formed resistance will likely determine the strength and direction of its next move.