The total market value of publicly listed bitcoin mining companies has risen to $90 billion.

Jinse Finance reported that on Wednesday, bitcoin mining stocks continued their strong rebound, with the total market capitalization of 15 major listed mining companies surpassing $90 billions, more than doubling from less than two months ago. Leading this surge was Bitdeer, whose stock price once soared 32% to $26.61, reaching a new high in over a year. The Singapore-based company disclosed on Tuesday that, thanks to the launch of its self-developed mining machines, its actual hash rate in September increased by 32.9% month-on-month, thus surpassing a certain exchange to become the world's fifth largest listed bitcoin mining company. The stock price of Canaan, a mining machine manufacturer and operator of its own mining equipment, also rose as much as 11.1% to $2.00. The company recently received an order for 50,000 A15 Pro Avalon mining machines and expanded its natural gas-powered mining pilot project in Canada. This momentum has spread to almost the entire industry. Applied Digital and Hut 8 also achieved double-digit gains on Wednesday, while the stock prices of almost all other companies are close to or have already reached new 52-week highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

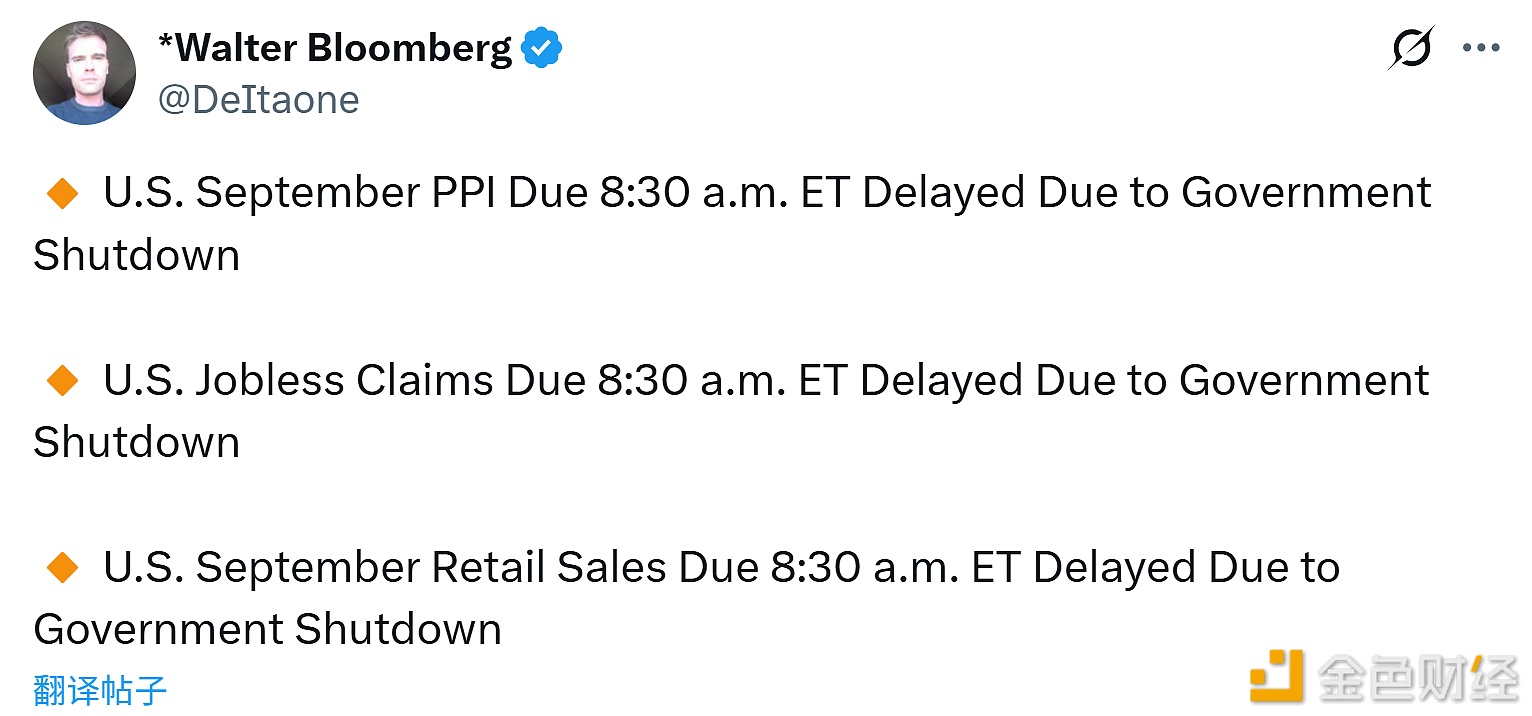

U.S. September economic data delayed due to government shutdown

FSB warns that inconsistent crypto regulation may trigger contagion risk

Euler plans to launch a synthetic dollar product in the coming weeks

BlackRock to launch a money market fund compliant with the GENIUS Act this Thursday