Against the trend, has Morpho perfectly replicated the core mechanisms of traditional asset management?

Deposit collateral, borrow funds, deposit the borrowed funds again as new collateral, and repeat the cycle—continuously adding leverage to this fundamentally institution-level strategy-based market-neutral basket.

Deposit collateral, borrow money, deposit the borrowed money again as new collateral, and repeat the cycle—continuously stacking leverage on this essentially institution-level, market-neutral basket of strategies.

Written by: hersch

Translated by: AididiaoJP, Foresight News

Have you noticed that deposits on Morpho have surpassed $12 billions?

Will $12 billions in deposits be the limit?

Let me explain to you in detail what's going on here, because at first glance, it seems completely illogical.

Overcollateralized loans mean that if you put $1 into this "vending machine," it only gives you back 75 cents. Why would anyone willingly lock in more funds than they can actually access? This seems totally counterintuitive, but hear me out—when you really look at who the users are and what they're doing, you'll start to see some truly interesting things.

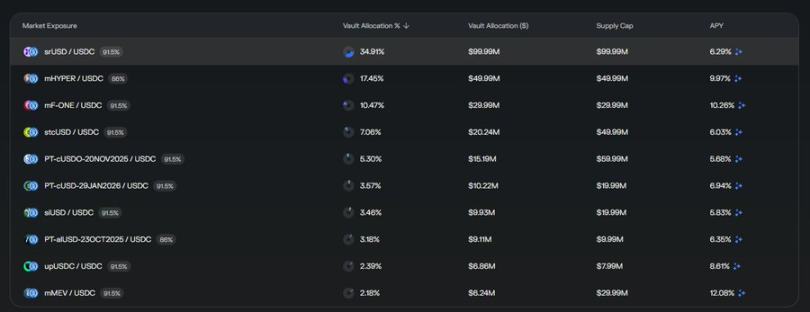

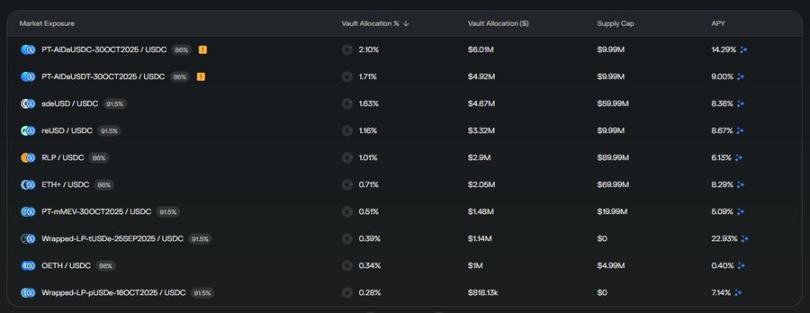

Take a look at all the positions in the second largest vault on Morpho

These are not your average meme players, nor are they whales arbitraging between exchanges. This is a carefully constructed asset portfolio that looks almost professional—very strategic—as if the operators really know what they're doing.

In fact, something very cool is happening here.

DeFi Replicates Traditional Asset Management Models

Among the world's top 10 hedge funds—the serious giants managing hundreds of billions of dollars—eight are basically doing the same thing. They build diversified, nearly market-neutral portfolios, systematically hedge away overall market volatility risk to capture their own excess returns, and then leverage the entire portfolio to amplify returns. This is standard practice—this is how big money plays in traditional finance. It's not that sophisticated; at its core, it's complex risk management plus leverage, magnifying returns that would otherwise be modest.

But here's the strange thing: DeFi doesn't have portfolio leverage at all. Not a single decentralized exchange in the industry offers the core functionality that almost all mainstream asset management firms use. We've built an entire parallel financial system—automated market makers, yield aggregators, perpetual contracts, options protocols, lending markets—but somehow, we've forgotten to implement the key feature that enables institutional-level asset management to operate at scale.

So what does this have to do with Morpho? It doesn't even offer simple undercollateralized loans, let alone the complex portfolio margining that would make institutional traders feel at home.

Advanced Strategies

The flashy logos in the screenshots above look like DeFi protocols but feel a bit out of place. In fact, almost all of them are market-neutral funds that operate mainly off-chain. These are traditional funds executing real strategies in traditional markets. The clever part is: they've issued a token on-chain for distribution. It's a wrapper that allows DeFi users to access these off-chain strategies without having to worry about traditional fund administration, compliance, KYC, accredited investor checks, or those painfully slow operational processes.

The managers of Morpho vaults combine these tokens to construct diversified, market-neutral off-chain fund portfolios. They play the role of "fund of funds" managers, selecting which strategies to include, how to allocate weights, and how to balance overall risk. Then, users and investors use this vault to apply recursive leverage to this diversified, market-neutral portfolio: deposit collateral, borrow money, deposit the borrowed money again as new collateral, borrow again, and so on—continuously stacking leverage on this essentially institution-level, market-neutral basket of strategies.

In this way, the "put in $1, get back 75 cents" vending machine suddenly makes sense. If you're running a market-neutral strategy that generates stable, low-volatility returns, then by leveraging the strategy 3 to 4 times through recursive leverage, you can turn an annualized return that might have been only 8% into a much more attractive 24% to 32%. And because the underlying portfolio is market-neutral and diversified across multiple uncorrelated strategies, even with high leverage, the liquidation risk is relatively low.

This is how DeFi has found a way to perfectly replicate the core mechanisms of traditional asset management—diversification, market neutrality, and portfolio leverage—using the most suitable tools currently available. The $12 billions in deposits on Morpho is proof: as long as you give people the tools, they'll find a way to rebuild the financial system they truly need, even if it means making do with "duct tape" and overcollateralized lending protocols.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Alpen Labs Collaborates with Starknet to Develop Bitcoin DeFi Bridge for Enhanced Trust

Alpen Labs' 'Glock' Verifier to Bolster Starknet's Security as Execution Layer for Bitcoin Holders

Bitcoin Teetering on the Edge: A Black Friday Prelude?

Bitcoin's Price Plummets Below $112,000 Amid Global Market Tensions, Signaling Potential Short-Term Instability

Mt. Gox Repayment Triggers $544 Million Liquidation in Crypto Market

Bitcoin Tests $110K Support as Market Braces for Mt. Gox Creditor Repayments Amidst Surge in Crypto Liquidations

MicroStrategy Nears S&P 500 Entry After 70 Days of Qualification