Ethereum developers bringing their talents to private enterprises

The open-source community cannot rely solely on passion to sustain itself.

The open-source community cannot simply "run on love."

Written by: Eric, Foresight News

On the evening of the 19th in the East 8th time zone, Bankless co-founder David Hoffman posted on X to "mourn" the departure of the longest-serving Ethereum Foundation researcher, Dankrad Feist, who chose to leave Ethereum and join the stablecoin L1 project Tempo.

David Hoffman believes that the issue of profit-driven companies absorbing talent cultivated by the Ethereum open-source community should not be underestimated, and claims that these companies do not actually bring greater benefits to Ethereum as they claim. David Hoffman bluntly stated, "In my view, the purpose of Tempo's existence is to intercept the trillions of dollars in stablecoins expected to flow in over the next decade and place them on their private blockchain. Of course, this will make the pie bigger, but Tempo still intends to take as much of that pie as possible." He believes that Tempo will inevitably be constrained by compliance issues, and even issuing tokens will not solve this. While both Tempo and Ethereum will bring change to the world, only Ethereum is best suited to be the credibly neutral global settlement layer, with no shareholders and not bound by legal constraints.

The "disappointment" with Ethereum began when its price performance started lagging behind bitcoin in this cycle, but over time, people have begun to realize that the exodus of top talent from the Ethereum community seems to have become an irreversible trend. When dreams and interests conflict, many ultimately choose the latter, which is exactly what many in the industry have long been worried about…

Dankrad Feist is not the first, nor will he be the last

On the 17th of this month, Dankrad Feist announced on X that he would be joining Tempo, while continuing to serve as a research advisor for three strategic initiatives of the Ethereum Foundation protocol cluster (scaling L1, scaling Blob, and improving user experience). Dankrad Feist stated, "Ethereum has powerful values and technical choices that make it unique. Tempo will be a great complement, built on similar technology and values, while being able to push the boundaries in scale and speed. I believe this will greatly benefit Ethereum. Tempo's open-source technology can easily be reintegrated into Ethereum, benefiting the entire ecosystem."

According to LinkedIn, Dankrad Feist officially became an Ethereum researcher in 2019, mainly researching sharding technology to scale the Ethereum mainnet. The most core part of Ethereum's current scaling roadmap, Danksharding, is named after him. Danksharding is a key technical path for Ethereum to achieve high throughput and low-cost transactions, and is widely regarded by the community as the most important upgrade direction after "Ethereum 2.0".

Dankrad Feist promoted the pre-version of Danksharding, Proto-Danksharding (EIP-4844), which introduced the blob transaction type, providing a cheaper and more efficient data availability layer for Rollups, significantly reducing the data publishing cost for Rollups.

In addition, he once had a public debate with Geth development lead Péter Szilágyi over the MEV issue, which eventually prompted Vitalik to step in and coordinate, raising community awareness of MEV mitigation mechanisms (such as PBS, Proposer-Builder Separation).

Tempo researcher Mallesh Pai introduced the new Tempo team members in September, including former OP Labs CEO and ETHGlobal co-founder Liam Horne.

Before Dankrad Feist, the industry was "surprised" by Danny Ryan, who co-founded Etherealize, which raised $40 millions. As a former core member of the Ethereum Foundation known as the "Ethereum 2.0 Chief Engineer," he announced his indefinite departure in September 2024 and joined Etherealize just six months later. However, since Etherealize is similar in nature to ConsenSys, founded by Ethereum co-founder Joseph Lubin who left 11 years ago over commercialization disputes, Danny Ryan's move was understood by most people.

What truly worries David Hoffman are companies like Tempo and Paradigm. Well-known Ethereum developer Federico Carrone also expressed a similar view, retweeting David Hoffman's post about Dankrad Feist joining Tempo and stating that he has been saying for the past two years that Paradigm's influence within Ethereum could become a tail risk for the entire ecosystem.

Federico Carrone wrote that the sole goal of venture capital funds is to maximize returns for LPs, and Ethereum should not form deep technical dependencies on a VC that plays with high-level strategic maneuvers. After the FTX collapse, Paradigm almost erased all crypto-related branding and made a high-profile pivot to AI. Carrone believes this alone proves his point.

After Trump returned to the White House, Paradigm also returned to the Web3 space, aggressively recruiting top community researchers, funding key open-source libraries for Ethereum, and supporting Stripe in launching Tempo. Carrone believes that although Paradigm claims everything they do is beneficial to Ethereum—more funding, more tools, more testbeds, and new ideas that can feed back into Ethereum, all of which are indeed potential benefits—when companies have too much visibility and influence over open-source projects, priorities can shift from the community's long-term vision to corporate interests.

Ethereum's technical debt is accumulating

The mere loss of talent from the Ethereum open-source community may not cause widespread concern, but if the loss of talent is accompanied by the accumulation of technical debt, it is worth being highly vigilant.

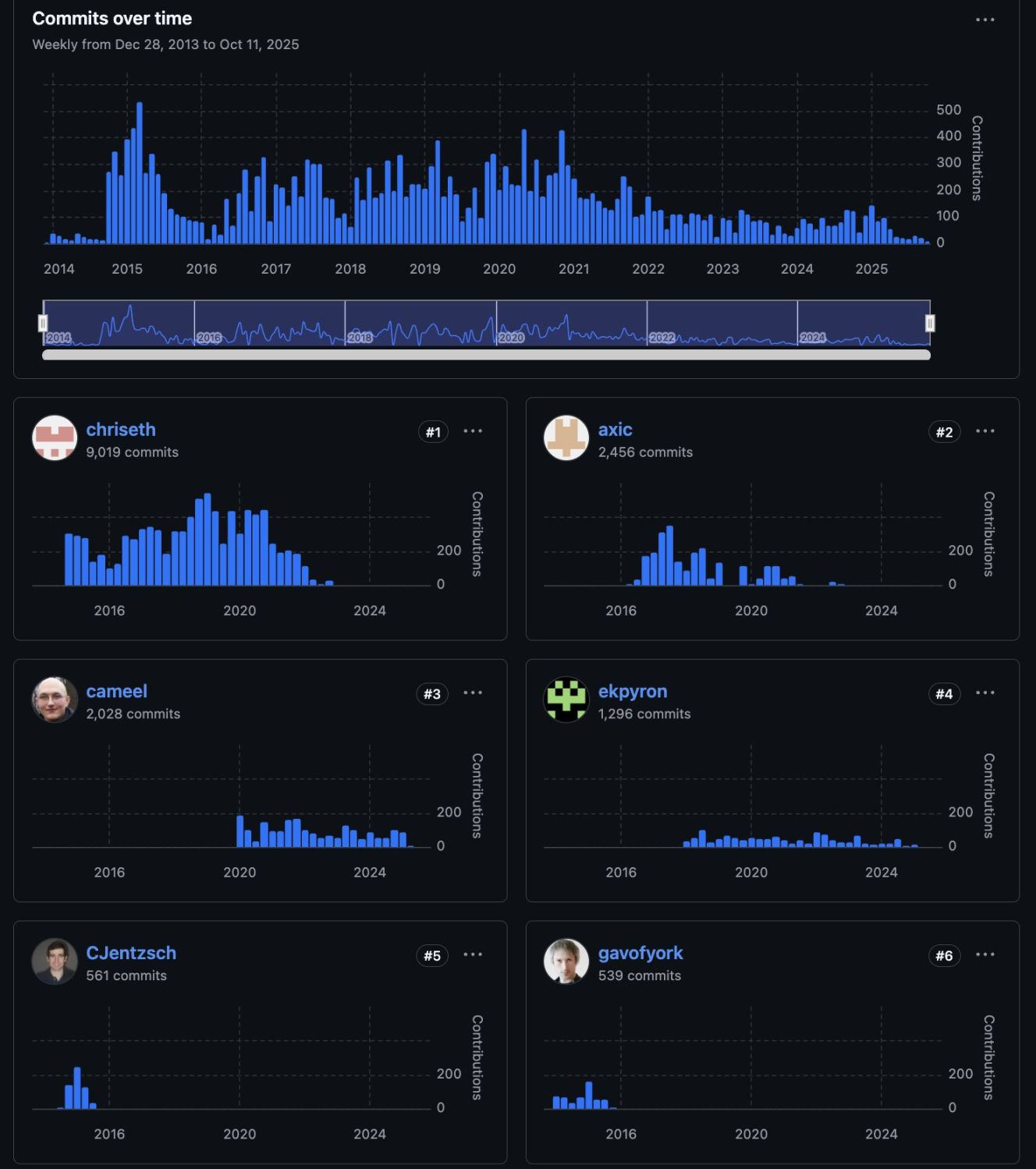

A week ago, a community user posted a screenshot on X, pointing out that the top contributors to the Solidity language have almost stopped developing. Only Cameel continues to raise new issues and push technical progress, but it seems to be just in maintenance mode. The user believes the community needs to invest more resources to support this programming language.

In the comments, some users questioned why effort should be spent on improving and upgrading Solidity instead of just maintaining it for stability and security. The original poster explained that even changing the Solidity compiler would not affect any deployed contracts, but it could improve security, enhance the development experience, or support new contract usage. As shown in the image above, it was at the beginning of the last major bull market that development activity began to decline sharply.

Federico Carrone also commented that what worries him most is that many core tools and libraries built around Solidity may not receive long-term maintenance at all. Even the latest Solidity compiler is currently supported by only a handful of developers. In addition, companies related to L2 and ZK technology are downsizing, so the iteration of cutting-edge technology may ultimately depend on just a few companies; as the Gas Limit increases, many execution clients have not made substantial performance improvements, and from the libraries, it seems that these client development teams are falling behind.

Federico Carrone stated, "Ethereum's technical debt is constantly accumulating, not only because the protocol itself must continue to evolve, but also because many dependent libraries and peripheral repositories are already stagnant. The entire ecosystem continues to expand, safeguarding hundreds of billions of dollars in assets, while some of its foundations are quietly eroding."

The open-source community cannot simply "run on love"

For an open-source community like Ethereum, which carries a massive amount of real, calculable value, balancing "running on love" and economic incentives is a problem with no precedent to refer to. For the Ethereum Foundation, this should have been a highly important issue, but it seems to have been overlooked.

Péter Szilágyi, who joined the Ethereum Foundation in 2015 and was responsible for Geth development and maintenance, pointed out three of his biggest disappointments in a letter to the Ethereum Foundation leadership a year and a half ago: being portrayed as a leader externally but marginalized internally; income being seriously disproportionate to Ethereum's market cap growth; and Vitalik and a small group around him having too much say in the Ethereum ecosystem.

At the end of 2024, Péter Szilágyi discovered that the Ethereum Foundation was secretly incubating an independent Geth fork team. He was later dismissed due to disputes with the Ethereum Foundation and repeatedly refused to be rehired. Afterwards, the Ethereum Foundation even offered to pay Péter Szilágyi $5 millions to have Geth spun out of the Foundation, but he refused. Péter Szilágyi currently continues to maintain the Geth codebase as an independent contributor.

Rumors of internal corruption within the Ethereum Foundation are endless, but this is actually a problem that should have been anticipated from the moment the Ethereum Foundation was established. As the saying goes, "Where there are people, there are disputes." We cannot eliminate human greed, but we also cannot allow Ethereum to gradually lose its core values due to commercialization.

Ethereum has achieved a market cap of hundreds of billions of dollars and has supported trillions of dollars in on-chain value transfer over the years, all based on infrastructure built by professional technical teams, with a permissionless open-source spirit at its core, and driven by the commercialization brought by many enterprises. But such a huge system requires a large number of people just to maintain it, and as we have said, these people are leaving due to disappointment or choosing to join other projects for economic reasons.

The Ethereum Foundation has carried out drastic reforms this year, but so far, there have been no impressive results. Ethereum can still be called the world computer, and its potential for commercial applications is still being explored by brilliant teams one after another. But as the foundation of all this, Ethereum cannot continue to let those who persist for ideals become disheartened.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet introduces multichain gas abstraction for simpler crypto transactions

Ethereum fails again above $4K as traders grow frustrated with shakeouts

Will Solana price bounce below $180? Double bottom hints at 40% rally

The Eye of the Crypto Storm: Hyperliquid—No Board of Directors, No Investors, the "Leverage Tool"

The decentralized exchange Hyperliquid, operated by only 11 people, has become a major force in the crypto world with daily trading volumes exceeding $13 billion, thanks to its anonymity and high leverage.