Date: Tue, Oct 21, 2025 | 05:24 AM GMT

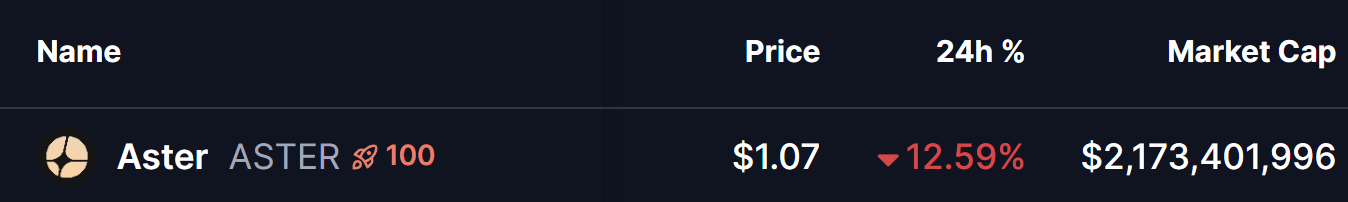

The cryptocurrency market has cooled off after an energetic start to the week that briefly lifted Bitcoin (BTC) above the $111K mark before sliding to $107,800. Ethereum (ETH) also dropped over 4% amid renewed tariff concerns, dragging down major altcoins — including Aster (ASTER).

ASTER has taken a notable 12% correction, but beneath the red candles lies a more interesting technical picture. The token appears to be retesting a major bullish breakout, which could soon determine its next big move — either a continuation higher or a short-term pause.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Falling Wedge Breakout

Over the past few weeks, ASTER has been trading inside a falling wedge — a widely recognized bullish reversal pattern that typically forms after a prolonged downtrend. Prices gradually narrowed within the wedge as selling momentum weakened, while buyers began accumulating near the $1.01 region.

This accumulation phase led to a decisive breakout above the wedge’s resistance line near $1.19, confirming a possible shift in market structure. Following the breakout, ASTER quickly rallied to a local high of $1.25, before short-term traders locked in profits, sparking the recent pullback.

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

Aster (ASTER) 4H Chart/Coinsprobe (Source: Tradingview)

Now, as shown in the chart, ASTER is retesting the breakout zone around $1.07, a level that aligns closely with the wedge’s former resistance — a region that often flips into support when the breakout is genuine.

What’s Next for ASTER?

The next few sessions will be critical for ASTER. If bulls manage to defend the breakout area, renewed buying could lift prices back toward the local high of $1.25, followed by the 50-hour moving average (MA) at $1.2823.

Sustaining momentum above these levels may validate the falling wedge breakout fully, opening the door to the next technical target at $2.21 — representing a potential 100% upside from current prices.

However, failure to hold the $1.07–$1.00 support range could invalidate the bullish setup, pushing ASTER back into consolidation mode before any renewed upward attempt.

For now, the structure remains technically constructive, and the retest phase could be a key turning point that decides whether ASTER resumes its uptrend or remains range-bound in the near term.