Whale ‘BitcoinOG’ Boosts $227M Short, Sends $587M BTC to CEXs

A Bitcoin whale, known as BitcoinOG (1011short), is making waves again. Fresh on-chain data shows that the trader has deposited over 5,252 BTC, worth nearly $587.88 million. He is into major centralized exchanges, including Binance, Coinbase and Hyperliquid. At the same time, he has expanded his Bitcoin short position on Hyperliquid to 2,100 BTC, valued at $227.8 million.

Massive Deposits Signal Active Trading

According to blockchain analytics platform Lookonchain, the whale has been extremely active since the October 11 market crash. Depositing such large amounts of BTC into exchanges often signals selling pressure or short-term trading moves. In this case, it appears the trader is doubling down on his bearish stance. This move follows earlier reports showing that BitcoinOG had closed all his previous shorts. He earned nearly $197 million in profit across two wallets. Shortly after those profits, he sent $89 million USDC to Binance . A move many analysts viewed as a signal that he was preparing for another round of short positions.

10x Short and Growing Confidence

More recent data from Hyperdash reveals that BitcoinOG deposited an additional $30 million USDC. Into Hyperliquid to open a 10x leveraged short position worth about $75.5 million on 700 BTC. His overall short exposure has now ballooned to $226.9 million, with leverage around 6.2x and a margin usage rate of 61.88%. Despite this aggressive stance, his portfolio still shows a healthy 29.4% return on equity (ROE). With over $6.67 million in unrealized profit. His liquidation price stands near $123,275. This suggests he remains safely positioned below current price levels, for now.

Market Reactions and Speculation

The whale’s activity has caught the eye of traders and analysts. Some speculate that BitcoinOG’s massive moves could be influencing broader Bitcoin open interest, especially on Binance. In fact, after one of his previous deposits, open interest on the exchange surged by $510 million. It hints that large players may be following his lead or reacting to his strategies. However, others warn that such concentrated short positions could trigger sharp liquidations if the market turns bullish. Given Bitcoin’s volatility, a sudden price rebound could flip these trades quickly.

A Familiar Pattern

This isn’t the first time BitcoinOG has made headlines for his bold positions. His trading pattern, closing massive shorts for millions in profit. Then, re-entering the market with even bigger leverage. It has turned him into one of the most watched anonymous traders in crypto. As Bitcoin continues to hover in the six-figure range. All eyes are once again on this enigmatic whale. Whether he’s anticipating another correction or orchestrating a massive market play. His latest moves are shaping the short-term narrative of the Bitcoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

X Layer Mainnet to undergo technical upgrade on October 27

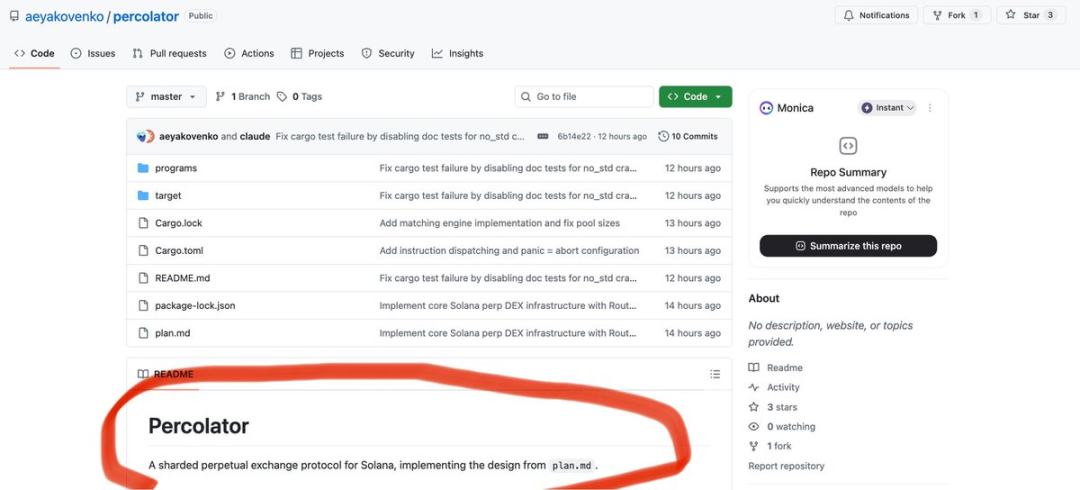

Solana official Perp protocol revealed, launching the DEX counterattack

Solana has the potential to provide Perp DEX infrastructure with a real application scenario that can meet the trading demands of traditional financial assets, rather than remaining limited to native crypto asset trading.

Trump Slams Putin and Takes Tough Measures Against Russian Oil Giants, Moscow Remains Unusually Silent

When Trump's decision to cancel the summit and the heavy blow targeting the lifeblood of the Russian economy struck simultaneously, the Kremlin remained unexpectedly silent...

The old order of Hyperliquid collapses, DeriW reconstructs the future of perpetual DEX.

DeriW may be becoming the starting point of a new round of dividends. In March 2025, Hyperliquid due to ...