Three-Minute Quick Overview of MegaETH Public Offering Participation Rules

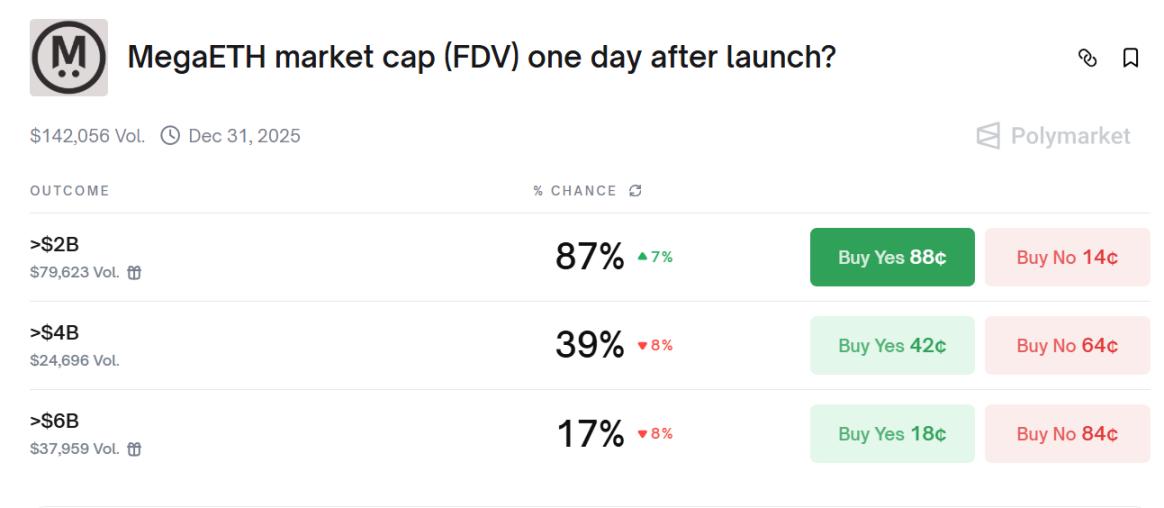

On Polymarket, the probability that MEGA's FDV will exceed $2 billions one day after its launch has risen to 87%.

On Polymarket, the probability that MEGA's FDV will exceed $2 billions one day after its launch has risen to 87%.

Written by: 1912212.eth, Foresight News

MegaETH, an Ethereum scaling solution developed by MegaLabs, has announced a public sale on Sonar, a platform under Echo. A previous Foresight News article, "MegaETH Valuation Game: A Good Entry Point or Imminent Risk?", provided a detailed introduction to its fundraising process and valuation logic. The utility of the MEGA token will be officially announced soon. Recently, MegaETH completed a cash buyback of 4.75% of company equity from its seed round investors.

On the evening of October 23, MegaETH announced that the MEGA token will activate two key platform features: Sequencer Rotation and Proximity Markets. In addition, it disclosed its tokenomics. In the public sale of MEGA tokens on October 27, 500 million MEGA tokens (5% of the total supply) will be fully allocated to buyers, and the issuer will not directly retain any crypto assets.

Additionally, the allocation is as follows: Team and Advisors: 950 million (9.5%), with a 1-year lock-up period and linear vesting over 3 years; Foundation/Ecosystem Reserve: 750 million (7.5%), for ecosystem development, strategic partnerships, and protocol sustainability; KPI Staking Rewards: 5.33 billions (53.3%), performance-based staking rewards distributed over time according to network metrics; Other Investors: 24.7% (including VC 14.7%, Echo investors 5%, Fluffle buyers 2.5%, Sonar reward pool 2.5%).

500 Million Tokens for Public Sale, Starting Price $0.0001

The total supply of MegaETH is 10 billions, with 500 million tokens (5%) available in this public sale. Payment is in USDT, with a maximum purchase limit of $186,282 per person and a minimum of $2,650. The starting price is $0.0001 (FDV of $1 million), and the maximum price cap is $0.0999 (FDV of $999 millions).

Investors with US addresses must undergo a 1-year lock-up and enjoy a 10% discount. Non-US participants can choose whether to lock up. According to Hyperliquid perpetual contract data, the current price of MEGA is $0.44. Calculated at the maximum public sale price of about $0.1, there is still about a 4x return.

On Polymarket, the probability that MEGA's FDV will exceed $2 billions one day after its launch has risen to 87%. If calculated at $2 billions, the return is still about 1x.

As of October 23, zkSync's FDV is $690 millions, OP's FDV is $1.808 billions, and Arbitrum's FDV is $3.033 billions.

Social Media Wallet Addresses and NFTs Help Increase Allocation

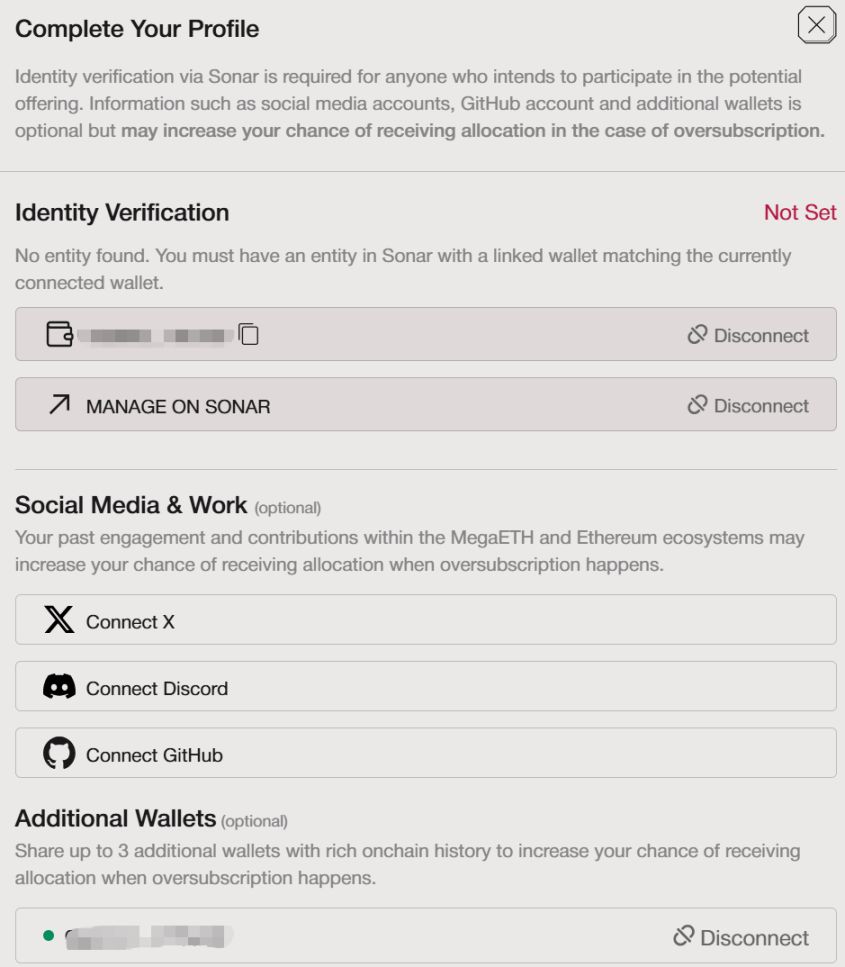

Verify your identity and wallet address on Sonar. Before the end of the sale, you can choose to enjoy a 1-year lock-up discount, but once submitted, you cannot opt out. When the price reaches the cap of $0.0999, over-subscription is allowed, and bidding can continue at this price.

Bidding ends after 72 hours (UTC+8), and the final transaction price is determined. Bids equal to or above this price will fill the total allocation.

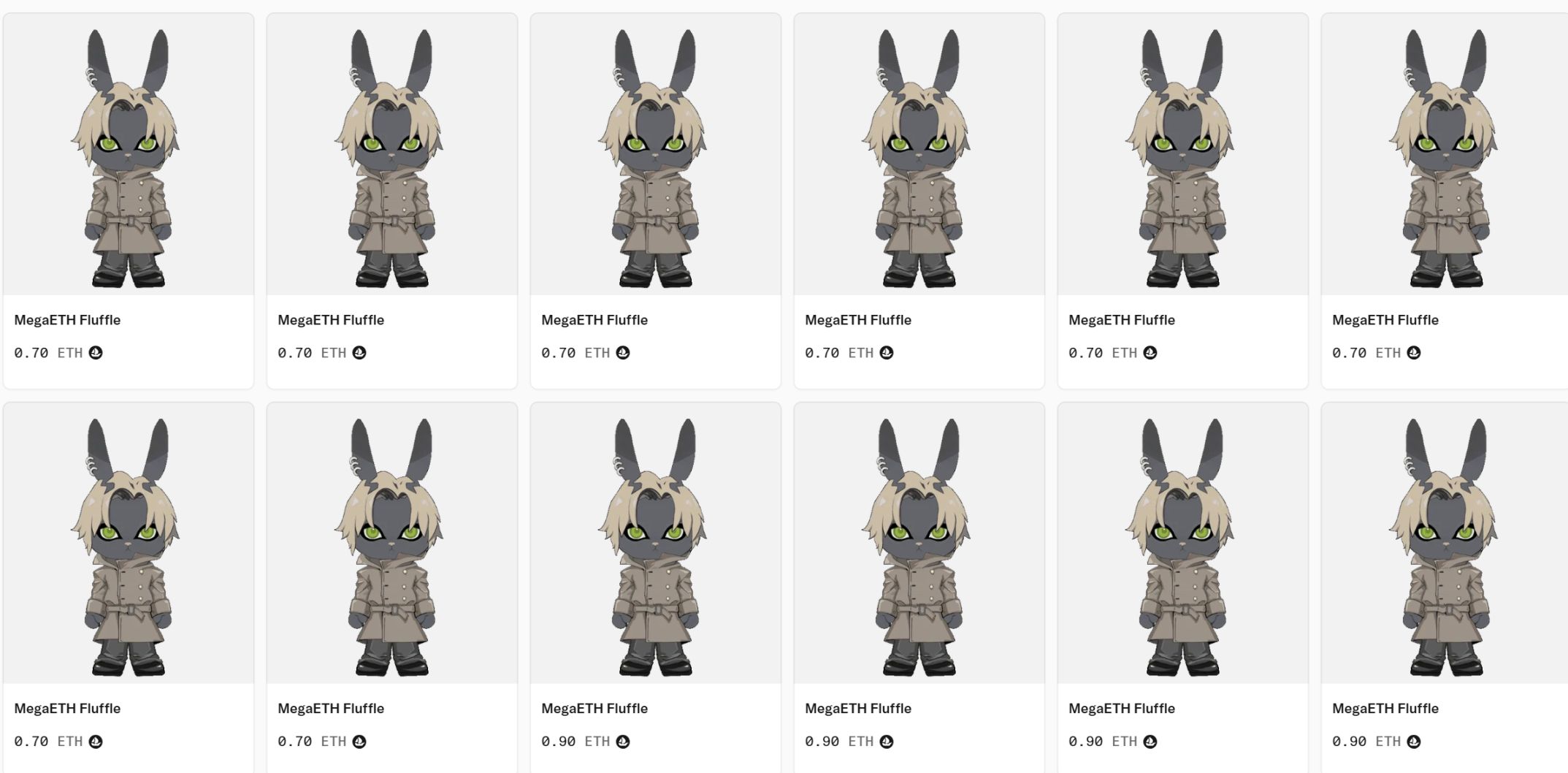

If there is over-subscription, a special allocation mechanism will be used. Bids and additional information proving past participation in the MegaETH and Ethereum communities (social media, GitHub, other wallet addresses, etc.) will help determine allocation. MegaETH's Fluffle NFT can increase allocation; the current floor price on Opensea is 0.7 ETH.

If you do not meet on-chain and social standards, choosing lock-up may help increase your allocation.

Official Auction on October 27

From October 15 to 27, users must complete their KYC registration, wallet address verification, and (for US investors only) certification. From October 27 to 30, the public auction period starts at 9:00 PM (UTC+8) on October 27 and lasts for 72 hours. Bidders must stake USDT on the Ethereum mainnet to reserve MEGA tokens. The auction will follow an English auction format with a price cap of $0.0999.

An English auction is an open ascending price auction where all participants can see the current highest bid and have the opportunity to place higher bids. The auction starts with an initial price, usually low to attract more participants. Participants can start bidding, and each bid must be higher than the current highest bid. The increment for this auction is $0.0001. The advantage of this auction is that it can discover the market value of the asset through a competitive bidding process.

From October 30 to November 5, allocation will be calculated. After calculation, unsuccessful bidders will receive a full refund. From November 5 to 19, winning bidders who wish to forfeit their allocation can choose to fully withdraw their bid and receive a full USDT refund to their Ethereum mainnet wallet address.

Forfeited tokens will be allocated to some of the winning bidders from November 19 to 21. Unused/unallocated funds will be refunded. Winning bidders who choose a 1-year lock-up period will receive 10% of their purchased tokens as a reward.

After MegaETH mainnet goes live, eligible users (Fluffle holders and anyone who tried to obtain an allocation in Echo or the public sale) will have the opportunity to receive additional tokens after actively using applications in the MegaETH ecosystem.

When MEGA tokens become available, they will be automatically distributed to wallet addresses. For users who choose or are required to accept a 1-year lock-up period, they will receive their tokens one year after that date.

KYC Certification

The official website currently states that users in China are prohibited from participating in this sale, as well as users from Afghanistan, Belarus, Bosnia and Herzegovina, Burkina Faso, Cameroon, Central African Republic, China, Cuba, Democratic Republic of the Congo, Ethiopia, Eritrea, Iran, Iraq, Lebanon, Libya, Mali, Myanmar, North Korea, Palau, Russia, Somalia, Sudan, Syria, Ukraine, United Kingdom, Venezuela, and Yemen.

However, there are still many ways to solve address verification in the Twitter community.

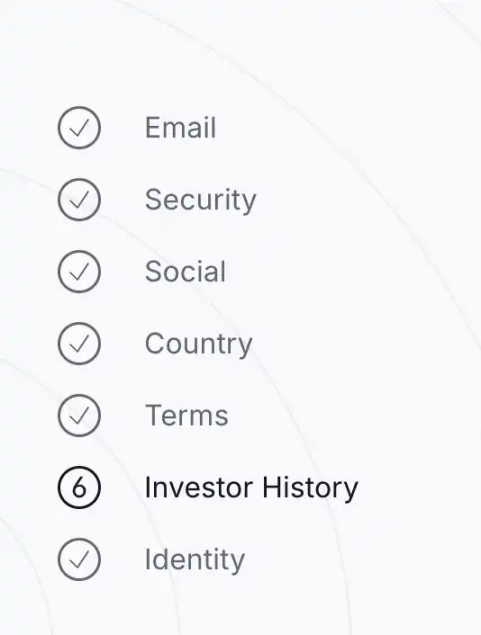

Users must complete verification on the Echo public sale platform. The investor questionnaire is a qualification review by the platform, and users should emphasize their extensive experience and high annual income when checking the boxes, otherwise they will be directly rejected.

Secondly, users also need to complete KYC certification on MegaETH. Binding identity addresses and social media accounts can increase allocation weighting.

Next is submitting identity proof. After uploading, facial recognition will be performed.

After completing facial recognition, the next step is to upload proof of address. If you receive an email indicating failure, you need to try uploading other supporting documents. During the payment stage, there may still be a secondary facial verification or a request to resubmit proof of address within the past 90 days, so users should closely follow official announcements.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Faces Pressure at $108K After ETF Exodus

The Journey of Hyperliquid (Part 3): No Battles in CLOB

Why the CLOB (Central Limit Order Book) architecture is suitable for perpetual contracts, and where are the limits of the CLOB architecture?

HIVE Digital Boosts Bitcoin Mining with 100MW Hydroelectric Expansion in Paraguay

Boosting Renewable Mining Operations with a New 100-Megawatt Hydroelectric-Powered Data Center

Hyperliquid Strategies’ $1B Accumulation Boosts HYPE Price by 12%

Hyperliquid Strategies Bolsters Balance Sheet with $1 Billion Equity Offering, Boosting HYPE Price by 12%