A $2 Billion "Game of Probability": Is the Prediction Market Approaching Its "Singularity" Moment?

An in-depth analysis of the underlying logic and core value of prediction markets, along with a preliminary assessment of their key challenges and future development directions.

Original Title: "Bitget Wallet Research: The $2 Billion 'Probability Game': Is the Prediction Market Reaching Its 'Singularity' Moment?"

Original Source: Bitget Wallet Research

Introduction

From the casual talk of "Will Zelensky wear a suit" to global focal points like the U.S. presidential election and the Nobel Prize, prediction markets always seem to periodically "catch fire." However, since Q3 2025, a real storm appears to be brewing:

In early September, industry giant Polymarket was granted regulatory approval by the U.S. CFTC, returning to the U.S. market after three years;

In early October, ICE, the parent company of the New York Stock Exchange, planned to invest up to $2 billion in Polymarket;

In mid-October, the weekly trading volume of prediction markets hit a historic high of $2 billion.

The surge of capital, regulatory green lights, and market frenzy have arrived simultaneously, accompanied by rumors of a Polymarket token launch—where does this craze come from? Is it just another fleeting hype, or is it a "value singularity" for an entirely new financial sector? Bitget Wallet Research will take you through an in-depth analysis of the underlying logic and core value of prediction markets, and provide a preliminary assessment of their core challenges and development directions.

I. From "Dispersed Knowledge" to "Dual Oligopoly": The Evolution of Prediction Markets

Prediction markets are not unique to the crypto world; their theoretical foundation can even be traced back to 1945. Economist Friedrich Hayek proposed in his classic discourse: Fragmented, localized "dispersed knowledge" can be effectively aggregated by the market through price mechanisms. This idea is considered the theoretical cornerstone of prediction markets.

In 1988, the University of Iowa launched the first academic prediction platform—the Iowa Electronic Markets (IEM), which allowed users to trade futures contracts on real-world events (such as presidential elections). Over the following decades, numerous studies have generally confirmed: A well-designed prediction market often outperforms traditional opinion polls in accuracy.

However, with the advent of blockchain technology, this niche tool found new ground for large-scale implementation. The transparency, decentralization, and global accessibility of blockchain provide prediction markets with an almost perfect infrastructure: automated settlement via smart contracts breaks down traditional financial barriers, allowing anyone worldwide to participate, greatly expanding the breadth and depth of "information aggregation." Prediction markets have gradually evolved from a niche gambling tool into a powerful on-chain financial sector, becoming deeply intertwined with the "crypto market."

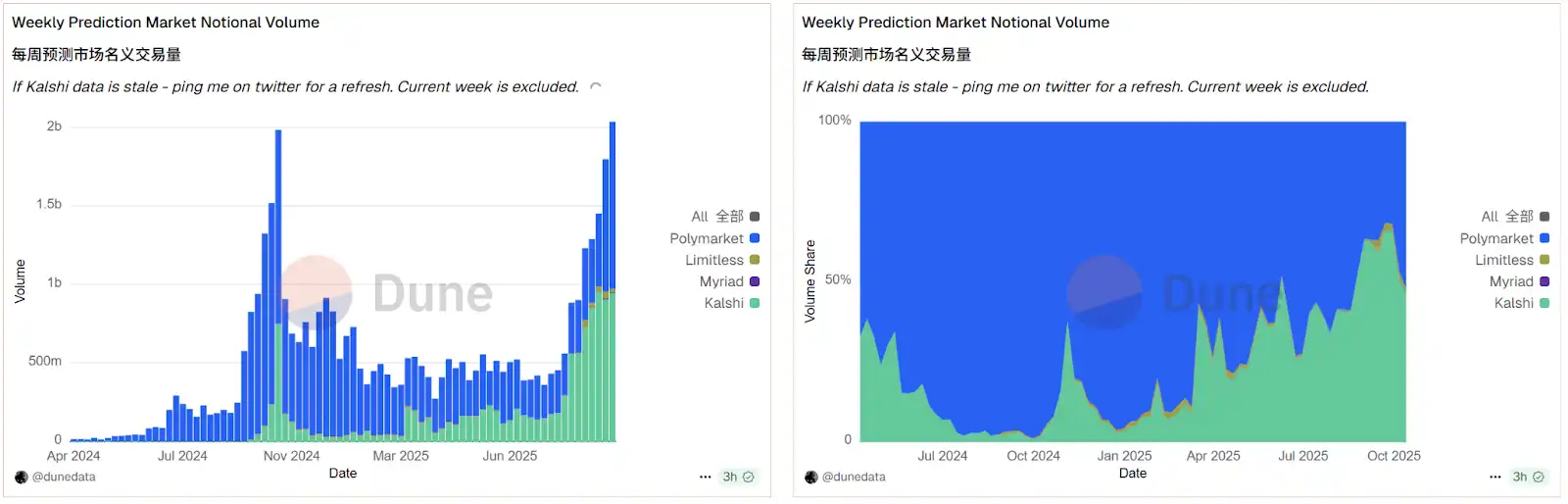

Data Source: Dune

Data from the Dune platform vividly confirms this trend. On-chain data shows that the current crypto prediction market has formed a highly monopolized "dual oligopoly": Polymarket and Kalshi together account for over 95% of the market share. Stimulated by both capital and regulatory tailwinds, the sector is being activated as a whole. In mid-October, the weekly trading volume of prediction markets surpassed $2 billion, exceeding the previous historical peak before the 2024 U.S. presidential election. In this explosive growth phase, Polymarket, with its regulatory breakthrough and potential token expectations, has temporarily gained an edge over Kalshi in fierce competition, further consolidating its leading position.

II. "Event Derivatives": Beyond Gambling—Why Is Wall Street Betting?

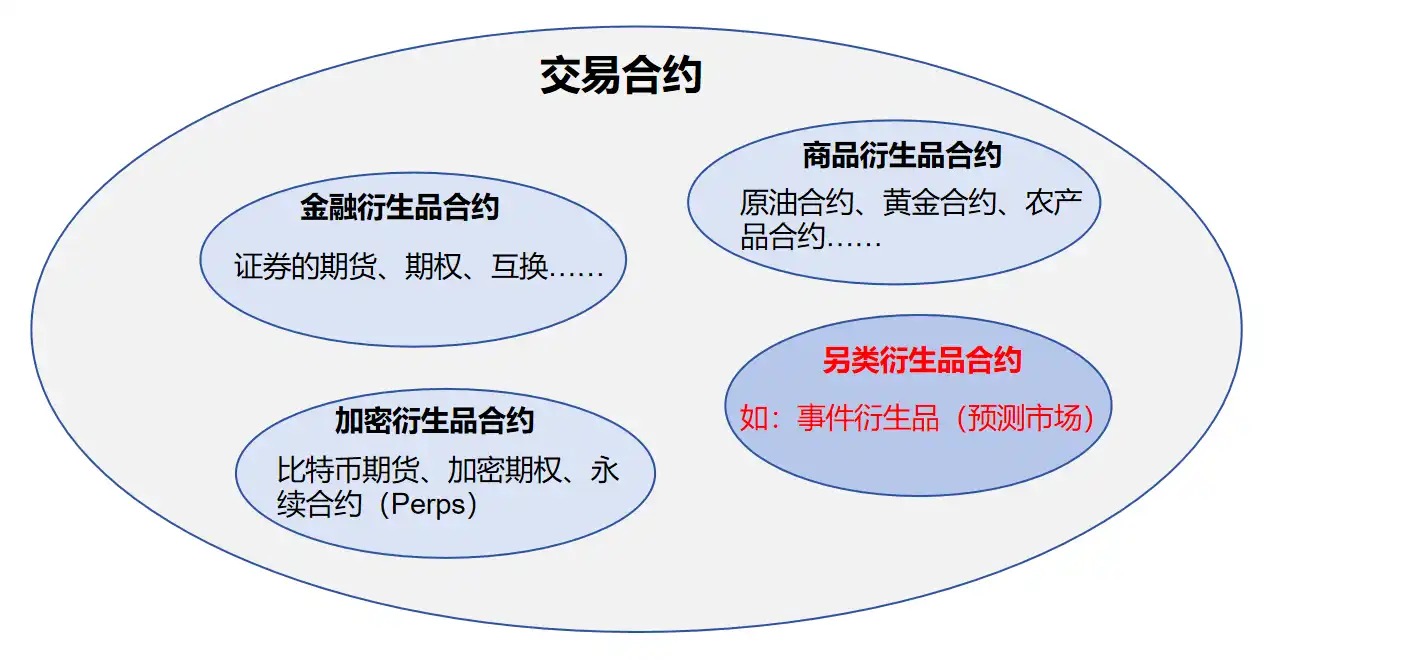

To understand why ICE is investing heavily in Polymarket, one must strip away the "gambling" facade of prediction markets and see their core as "financial instruments." The essence of prediction markets is an alternative trading contract, classified as an "event derivative."

This is fundamentally different from the "price derivatives" we are familiar with, such as futures and options. The latter are based on the future price of assets (like crude oil or stocks), while the former are based on the future outcome of specific "events" (such as elections or climate). Therefore, the contract price does not represent asset value, but rather the collective market consensus on the "probability of an event occurring."

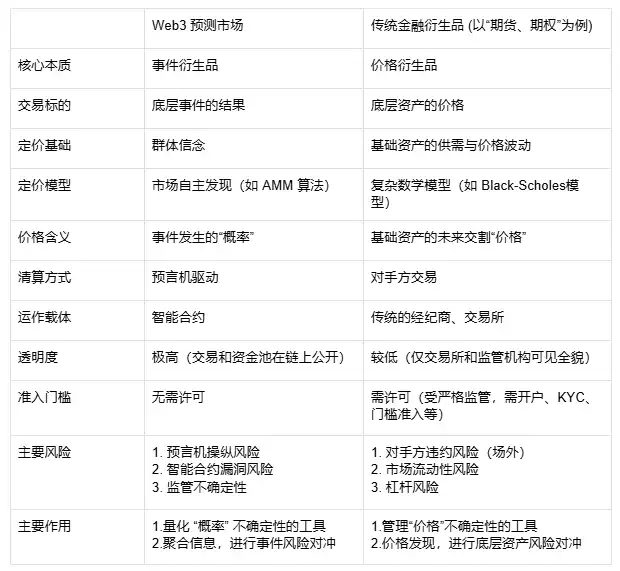

With the empowerment of Web3, this difference is further amplified. Traditional derivatives rely on complex mathematical models like Black-Scholes for pricing and are settled through brokers and centralized exchanges; on-chain prediction markets, however, are executed automatically via smart contracts and settled by oracles, with pricing (such as AMM algorithms) and liquidity pools being fully transparent on-chain. This greatly lowers the entry barrier but also introduces new risks (such as oracle manipulation and contract vulnerabilities), which contrast sharply with the counterparty and leverage risks of traditional finance.

Comparison Table: Prediction Markets vs. Traditional Financial Derivatives

This unique mechanism is precisely what attracts mainstream financial institutions. It offers three core values that traditional markets cannot match, which is the real reason giants like ICE are betting big:

First, it is an advanced "information aggregator" that reshapes the landscape of information equality. In an era of AI-generated content, fake news, and information silos, "truth" has become expensive and hard to discern. Prediction markets provide a radical solution: truth is not defined by authorities or media, but is "bid" into existence by a decentralized, economically incentivized market. This addresses the growing distrust (especially among younger generations) of traditional information sources, offering a more honest alternative information source where "money votes." More importantly, this mechanism goes beyond traditional "information aggregation" by enabling real-time pricing of "truth," forming a highly valuable "real-time sentiment indicator" and ultimately achieving information equality across dimensions.

Second, it turns "information asymmetry" itself into an asset, opening up a brand-new investment track. In traditional finance, investments target "property certificates" like stocks and bonds. Prediction markets, however, create a new tradable asset—"event contracts." This essentially allows investors to directly convert their beliefs or informational advantages about the future into tradable financial instruments. For professional information analysts, quantitative funds, and even AI models, this is an unprecedented profit dimension. They no longer need to express their views indirectly through complex secondary market operations (like going long/short on related company stocks), but can directly "invest" in the event itself. The huge trading potential of this new asset class is the core interest point attracting exchange operators like ICE.

Finally, it creates a risk management market where "everything can be hedged," greatly expanding the boundaries of finance. Traditional financial instruments struggle to hedge the uncertainty of "events" themselves. For example, how can a shipping company hedge the geopolitical risk of "whether a canal will be closed"? How can a farmer hedge the climate risk of "whether rainfall will be below X millimeters in the next 90 days"? Prediction markets provide a perfect solution. They allow participants in the real economy to turn abstract "event risks" into standardized, tradable contracts for precise risk hedging. This is equivalent to opening up a brand-new "insurance" market for the real economy, offering a new entry point for finance to empower the real economy, with potential far beyond imagination.

III. Hidden Concerns Amidst Prosperity: The Three Core Dilemmas Facing Prediction Markets

Despite a clear value proposition, prediction markets still face three interlinked real-world challenges on their path from "niche" to "mainstream," collectively forming the industry's ceiling.

First dilemma: The contradiction between "truth" and "arbiter," i.e., the oracle problem. Prediction markets are "outcome-based trading," but who announces the "outcome"? A decentralized on-chain contract paradoxically relies on a centralized "arbiter"—the oracle. If the event itself is ambiguously defined (such as the definition of "wearing a suit"), or if the oracle is manipulated or makes mistakes, the entire market's foundation of trust can instantly collapse.

Second dilemma: The contradiction between "breadth" and "depth," i.e., the liquidity drought in the long tail. The current prosperity is highly concentrated on headline events like the "U.S. presidential election." But the real value of prediction markets lies in serving those vertical, niche "long-tail markets" (such as the aforementioned agricultural and shipping risks). These markets naturally lack attention, resulting in extremely dry liquidity and prices that are easily manipulated, thus losing their actual functions of information aggregation and risk hedging.

Third dilemma: The contradiction between "market makers" and "informed traders," i.e., the "adverse selection" problem of AMMs. In traditional DeFi, AMM market makers (LPs) bet on market volatility to earn trading fees. But in prediction markets, LPs are directly betting against "informed traders." Imagine, in a market about "whether a new drug will be approved," when an LP bets against a scientist with inside information—this is a sure-loss "adverse selection." Therefore, in the long run, automated market makers are unlikely to survive in such markets, and platforms must rely on expensive manual market makers to operate, greatly limiting their scalability.

Looking ahead, the breakthrough points for the prediction market industry will inevitably revolve around the above three dilemmas: more decentralized and manipulation-resistant oracle solutions (such as multi-party verification and AI-assisted review) are the cornerstone of trust; guiding liquidity into long-tail markets through incentive mechanisms and better algorithms (such as dynamic AMMs) is key to realizing real-world value; and more sophisticated market maker models (such as dynamic fees and information asymmetry insurance pools) are the engines for scalability.

IV. Conclusion: From "Probability Game" to "Financial Infrastructure"

The CFTC's green light and ICE's entry send a clear signal: prediction markets are shifting from a marginalized "crypto toy" to being regarded as a serious financial instrument. With "truth aggregation" as their core value and "event derivatives" as their financial core, they provide a new dimension of risk management for modern finance. Admittedly, the road from "probability game" to "financial infrastructure" is far from smooth. As mentioned above, the oracle dilemma of "arbiters," the liquidity challenge of long-tail markets, and the "adverse selection" faced by market makers are all real challenges the industry must soberly face after the frenzy.

Nevertheless, a new era integrating information, finance, and technology has already begun. When top-tier traditional capital starts betting heavily on this sector, what it leverages will be far more than $2 billion in weekly trading volume. This may truly be a "singularity" moment—signaling that a new asset class (pricing power over "belief" and "the future") is being embraced by the mainstream financial system.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Odaily Exclusive Interview with Stable CEO: The Stablecoin Chain Race Accelerates—What Makes Stable Stronger than Plasma?

While all eyes are on Plasma, what exactly is Stable doing?

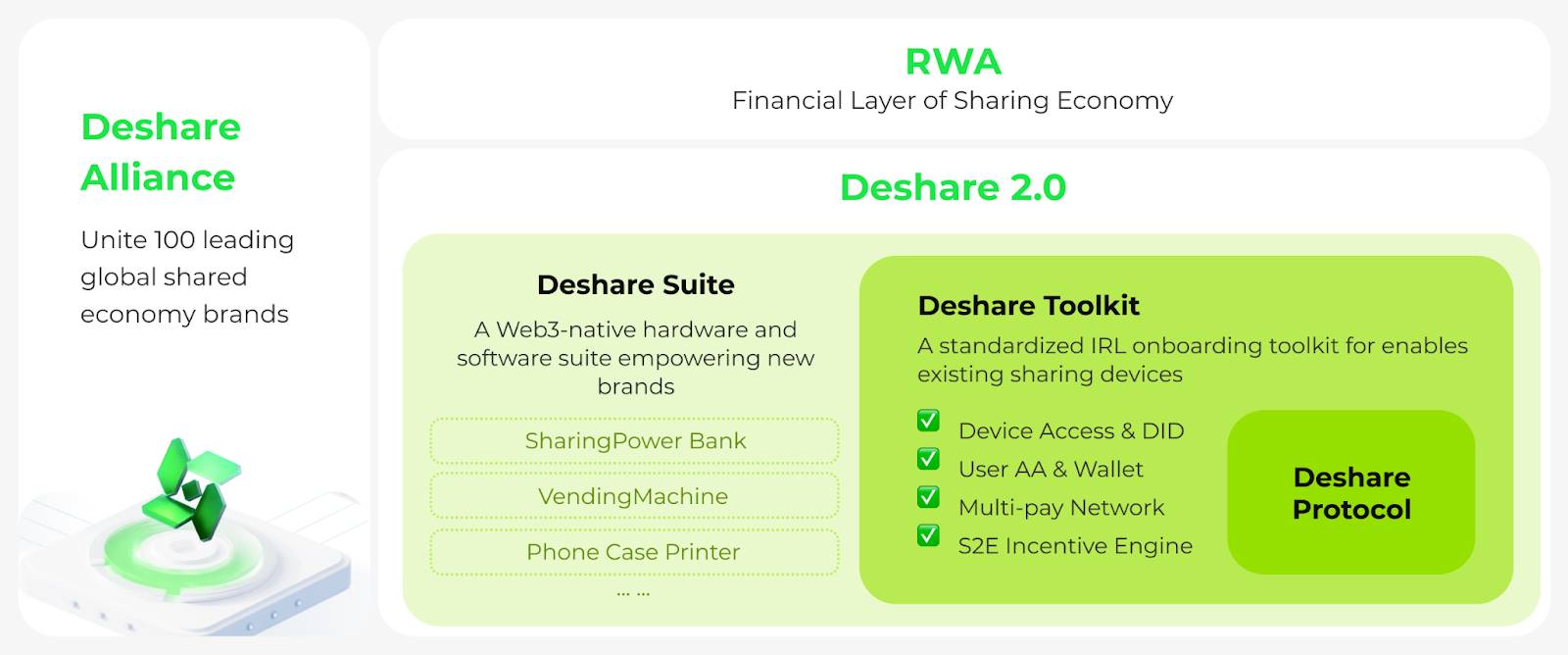

From Trusted Data to Trusted Devices: ShareX Releases Deshare 2.0, Defining a New Standard for Real-World Asset On-Chain Integration

Deshare 2.0 marks an upgrade in shared economy infrastructure: moving from "trusted data" to "trusted devices."

Bloomberg: Peso crisis escalates, stablecoins become a "lifeline" for Argentinians

The role of cryptocurrency in Argentina has fundamentally changed: it has shifted from being a novelty that sparked curiosity and experimentation among the public, including Milei himself, to becoming a financial tool for people to protect their savings.