A 30x big golden dog is born, which other projects under the x402 protocol are worth paying attention to?

What opportunities are worth paying attention to in the payment protocol launched by Coinbase?

Author: Rhythm BlockBeats

Yesterday, a special golden dog was born on Base, and that is $PING. Calculating based on the cost of minting and the current token price, a successful mint yields a return of about 18 times.

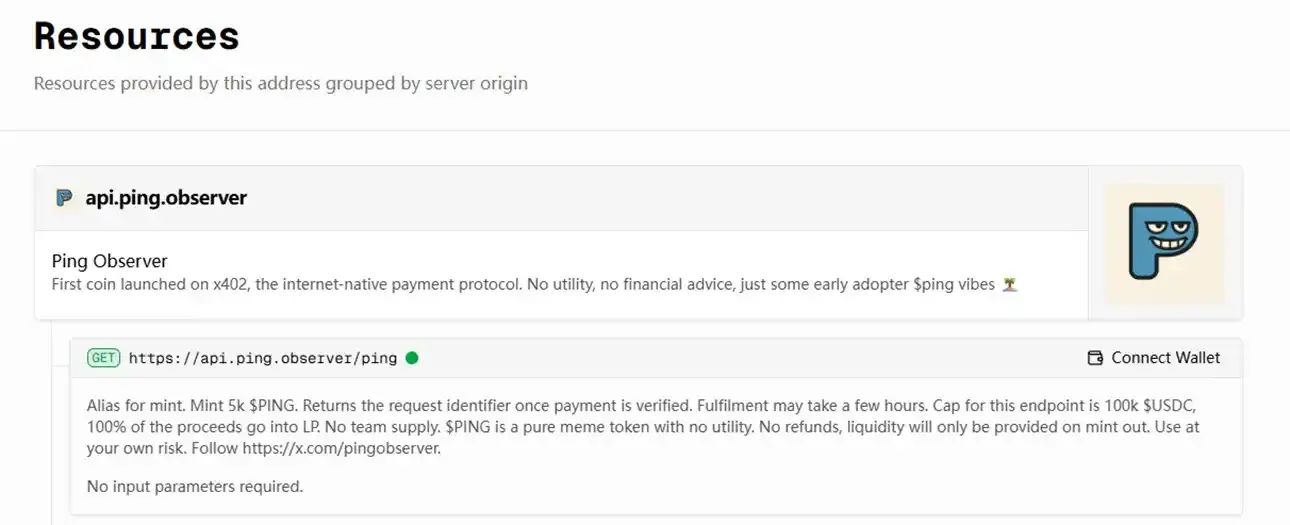

The special thing about $PING is that its minting process is reminiscent of inscriptions from two years ago. The cost to mint $PING is about $1, and if successful, you receive 5,000 $PING. The minting page for $PING, just like the inscription days, lacks a fancy frontend and appears quite hardcore.

This is the first token issued through the x402 protocol. So, what is the x402 protocol? Why is the minting process for $PING so unique? And what is the current state of the protocol’s ecosystem?

What is the x402 Protocol?

x402 is an open payment protocol developed by Coinbase, enabling AI agents to autonomously complete transactions.

The x402 protocol leverages the long-reserved “HTTP 402 ‘Payment Required’” status code to require payment before completing API requests or loading web pages. If an API request lacks payment information, x402 returns an HTTP 402 status code, prompting the client to pay and retry the request.

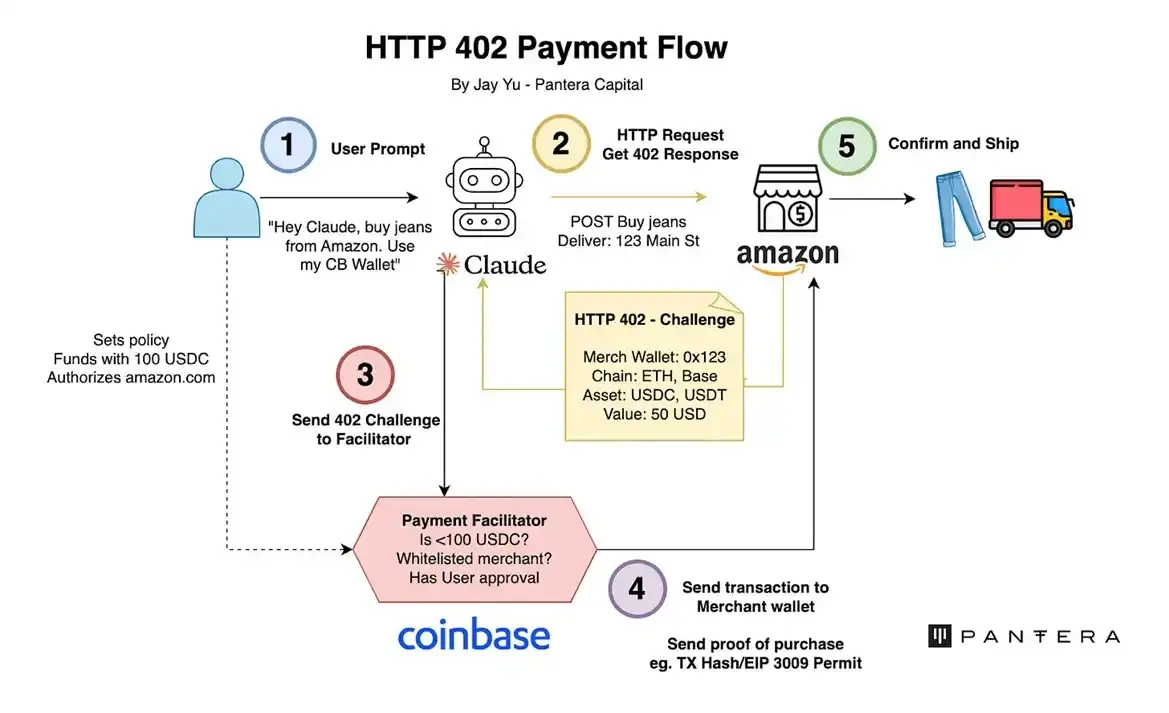

The following workflow diagram intuitively explains how the x402 protocol operates:

(Image source: Jay Yu – Pantera Capital)

A user makes a request to Claude: “Use my Coinbase wallet to help me buy a pair of jeans on Amazon.” The AI receives the request and initiates a purchase request to Amazon. Amazon then constructs a preliminary transaction, including the wallet address to be used, the blockchain, the token, and the specific amount. The AI then sends this transaction to the x402 protocol validator to check whether the corresponding wallet has sufficient assets on the chain, whether the product is tradable, and whether the user has confirmed authorization. Once all is complete, the amount and payment proof are sent to the merchant’s address. At this point, the transaction is complete.

Overall, the HTTP 402 status code serves as an “information relay” in the protocol, indicating whether the transaction was successful. Coinbase built on top of this status code, adding blockchain-based payment functionality, resulting in the x402 protocol.

It may sound simple, but from the above workflow, there are two exciting aspects. First, the channel for using on-chain assets for real-world payments is further simplified; users no longer need to cash out to fiat to spend, but can directly use USDT, USDC, or other on-chain assets for consumption. However, the key to this is widespread adoption and enough merchants supporting it.

Any web API or content provider (crypto or Web2) that wants to offer low-cost, frictionless payment paths for micropayments or usage-based transactions can integrate x402.

The second point is AI Agents. As payers/receivers, AI Agents are highly compatible with blockchain payments, since unlike humans, they cannot inherently own bank or payment app accounts via KYC. As AI Agents become more intelligent, novel consumption or on-chain experiences are worth looking forward to.

The workflow also explains why the minting process for $PING resembles inscriptions, as it requires confirmation from the x402 validator. During the minting process, a large number of minting requests not only overwhelmed the minting interface repeatedly, but also served as the first real stress test for the x402 protocol.

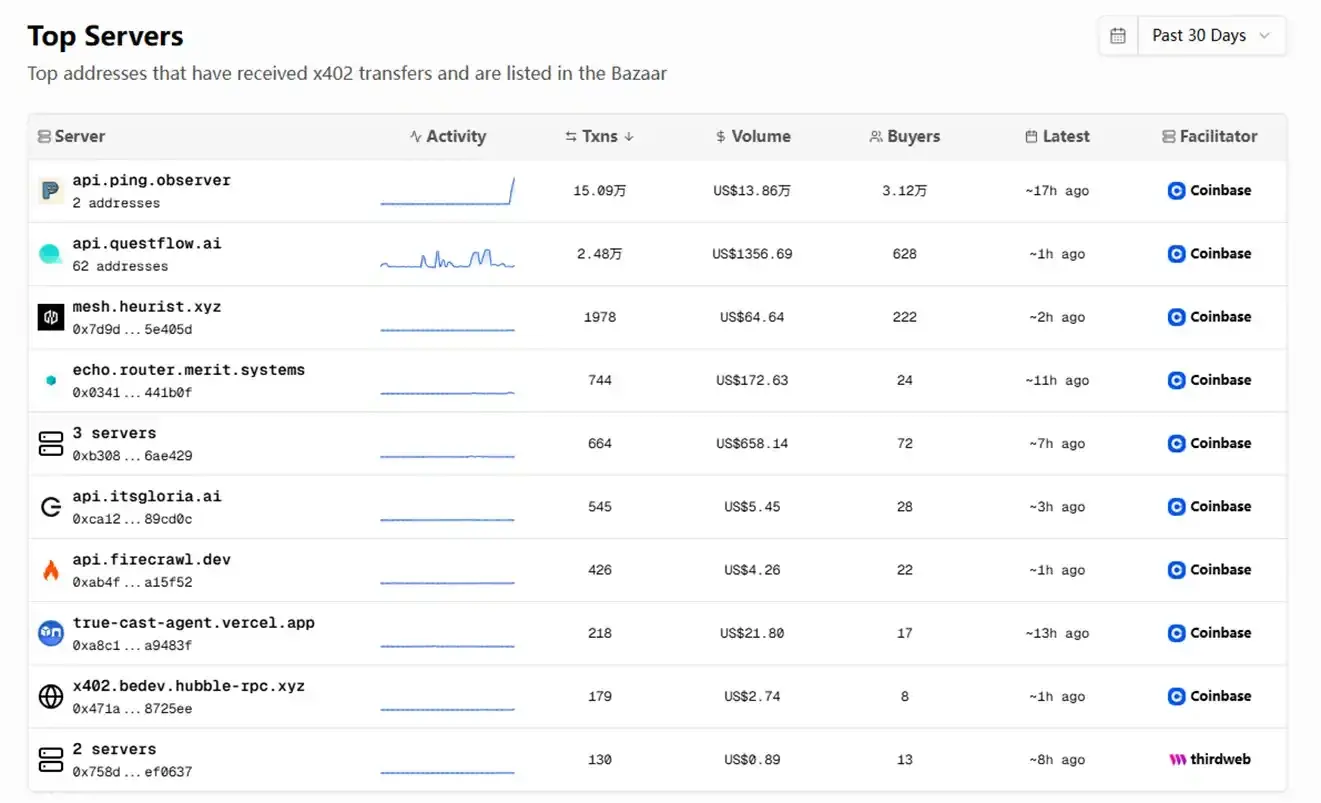

Data from the past 30 days shows that the $PING interface received over 150,000 x402 transactions, amounting to about $140,000, far ahead of the second-ranked Questflow.

This is the first time in nearly half a year since the launch of the x402 protocol that it has seen such excitement and recognition. Regardless of the chain or protocol, new asset issuance is always a perennial hot topic in the crypto space.

x402 Ecosystem Overview

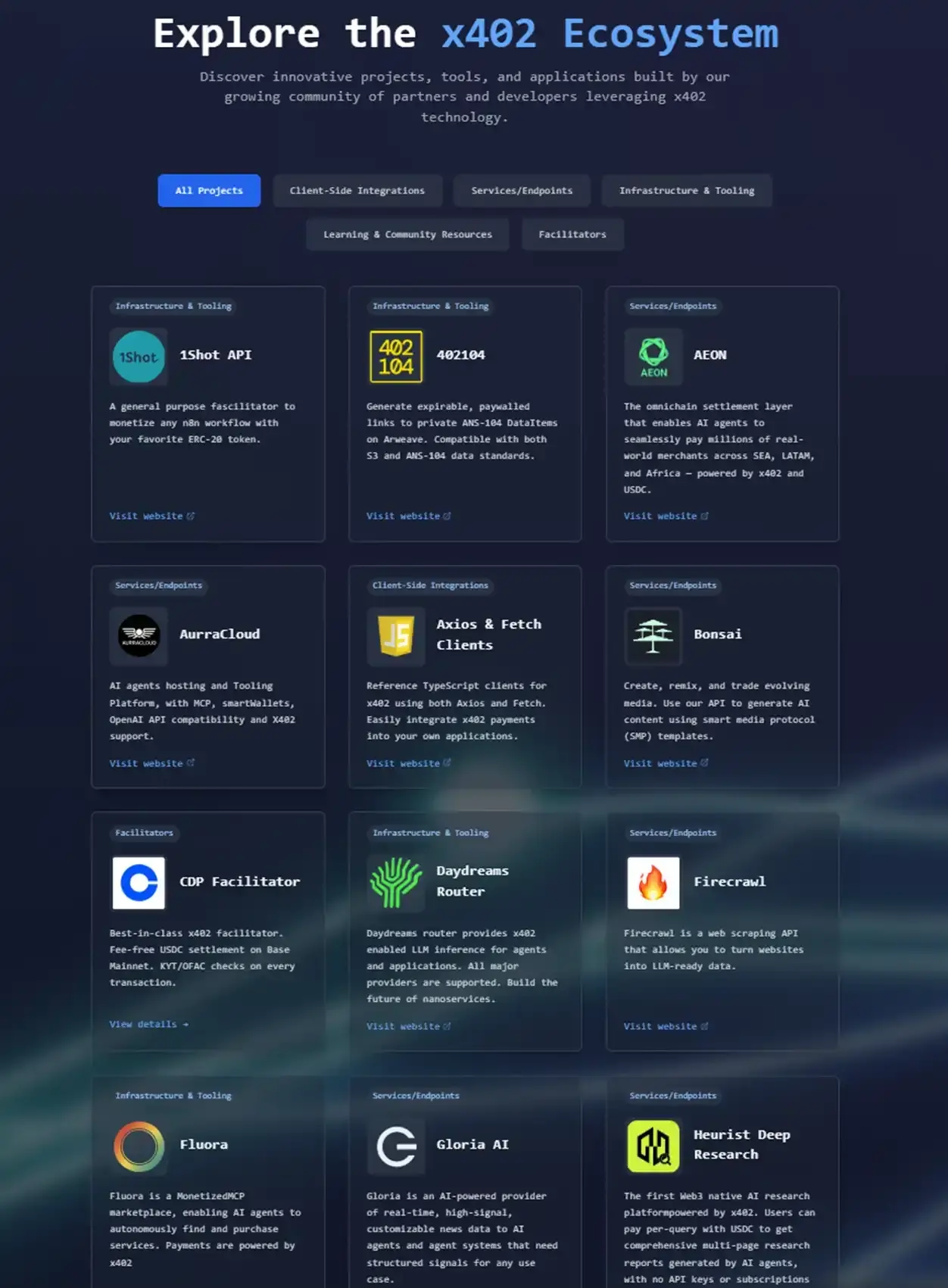

So, besides $PING, what other projects in the x402 protocol are worth paying attention to?

The Ecosystem page on the x402 protocol’s official website lists the current projects. If you check each project one by one, you’ll find that the protocol is still at a very early stage of development. Many links go directly to technical documentation or redirect to Github projects.

Here, we summarize some projects that already have tokens or are about to issue tokens.

Questflow

A multi-AI Agent task sequencing layer, enabling multiple AI Agents to autonomously coordinate and execute tasks. In July this year, it announced the completion of a $6.5 million seed round led by cyber•Fund, with participation from Delphi Labs, Systemic Ventures, Eden Block, HashKey Capital, Animoca Brands, Tezos, and others. It also received grants from Coinbase Developer Platform, Aptos, and Virtuals.

There is currently no official token, but last December, Questflow and Virtuals jointly launched $SANTA, an autonomous Agent cluster built using Questflow’s QDP (Questflow Developer Platform) and MAOP (Multi-Agent Orchestration Protocol).

$SANTA currently has a market cap of about $4.5 million.

AurraCloud

An AI Agent infrastructure for crypto-native applications. It allows instant hosting of AI Agents using OpenAI-compatible APIs or MCP servers, and enables AI monetization via the on-chain x402 protocol on Base.

Additionally, earlier this month, the project also provided x402 verification services.

The $AURA token was launched via Virtuals and currently has a market cap of about $1.6 million.

Meridian

Incubated by uOS, it provides multi-chain settlement and custody services for the x402 protocol.

The $MRDN token currently has a market cap of about $1.5 million.

PayAI

Provides multi-chain x402 payment service support, including Solana, and also offers x402 verification services.

The $PAYAI token currently has a market cap of about $5 million.

Daydreams

Provides x402-supported LLM inference processes for applications and AI Agents. At the same time, it is building Lucid—a platform where anyone can deploy Daydreams Agents to solve problems. Users sign transactions via x402 to pay in USDC, and Agents can pay each other for access.

The $dreams token currently has a market cap of about $6.7 million.

Gloria AI

A real-time news platform built for traders, creators, AI Agents, and automated systems, where services can be accessed via x402 and paid for with $GLORIA.

The $GLORIA token currently has a market cap of about $1.65 million.

Kite AI

Kite AI is building the foundational transaction layer for the “Agentic Internet,” providing unified identity, payment, and governance infrastructure for autonomous agents. What Kite AI is doing is highly relevant to x402; as early as July, it already mentioned support for x402, and it can be considered the only project in the x402 ecosystem that can be categorized as a “chain.”

On September 2, according to Fortune, Kite AI announced the completion of a total of $33 million in funding, with the latest Series A round raising $18 million, led by PayPal Ventures and General Catalyst, with participation from 8VC, Samsung Next, SBI US Gateway Fund, Vertex Ventures, Hashed, HashKey Capital, Dispersion Capital, Alumni Ventures, Avalanche Foundation, GSR Markets, LayerZero, Animoca Brands, Essence VC, and Alchemy.

Kite AI has not yet issued a token, but recently launched the Kite Foundation X account, making it clear that a token will be issued soon. The currently tradable related asset is the official FLY THE KITE NFT, with a floor price of 0.375 ETH.

Conclusion

In September this year, Coinbase and Cloudflare announced the joint establishment of the x402 Foundation to promote protocol development. Although there are some similar competitors, such as bitGPT’s h402 and Radius’s EVMAuth, there is no doubt that x402 has the strongest backing and the highest level of attention.

If the market cap of $PING rises sharply in the near future, x402 will attract even more market attention. This is good news not only for meme coins, but also for infrastructure projects.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock’s BTC and ETH Acquisition Amid Grayscale’s Sell-Off: The Future Unveiled

Examining the Capital Rotation Between ETF Managers as BlackRock Acquires $97.63M in Bitcoin and Ethereum from Coinbase Prime and Grayscale Deposits $138.06M

A Hedged Market Shrouded in Fear: Bitcoin May Require a Longer Consolidation

The market has not yet bottomed out, so be cautious when buying the dip.

Bitcoin and Global Liquidity: Follower or Leader?

Bitcoin is declining, possibly as a "pre-emptive move" in response to tightening liquidity.

The inevitability of x402's explosive popularity

The Agent Internet will operate based on verifiable truth, and currency is merely the opening act.