Bitcoin (BTC) has teased the potential onset of its bear market after dropping to a four-month low. The flagship coin dropped over 5% on Tuesday, November 4, to reach a range low of around $99,955 before rebounding to trade about $101k at press time.

The sudden Bitcoin price selloff influenced the wider altcoin market led by Ethereum (ETH), XRP, BNB, and Solana (SOL). As such, the total crypto market cap has shed nearly $400 billion in valuation during the past 24 hours.

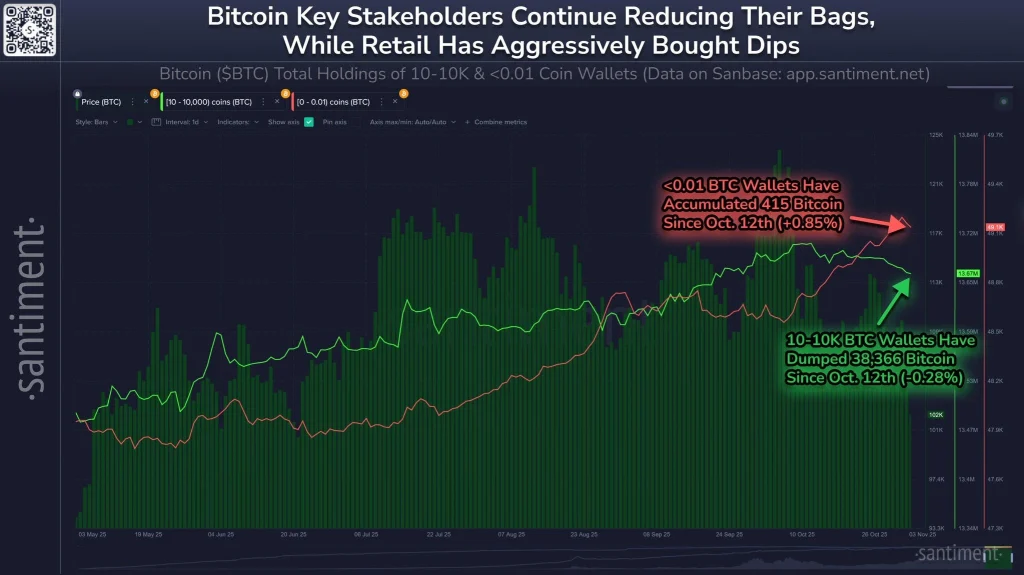

According to on-chain data analysis, Bitcoin whales have accelerated booking profits in the recent past while retail traders have continuously bought the dips. Bitcoin wallets with a balance of between 10 and 10k sold nearly 38.4k BTCs since October 12 to date.

Source: Santiment

Meanwhile, retail traders, with a balance of above 0.01 BTCs have accumulated 415 coins since October 12.

“Bulls need to see this trend completely flip in order to expect a sustained price rebound for all of crypto. Markets rise when key stakeholders accumulate the coins that small wallets shed,” Santiment noted.

Following the ongoing crypto bloodbath , more than $1.1 billion was liquidated from leveraged traders. Notably, around $1.01 billion involved long traders, thus fueling the impact of a long squeeze.

Following the sustained choppy crypto market, CoinMarketCap’s Fear and Greed index dropped to around 27/100, signaling extreme traders’ fear.

The fear of further capitulation is heavily rooted in the fact that the Bitcoin CME Futures has an unfilled gap between $92k and $93k.