XRP traded at $2.24, down 0.93% in the past 24 hours, according to CoinMarketCap data. The token moved in a tight range through most of the day, hovering near $2.27 before a late-evening selloff pushed it lower.

XRP 24-Hour Price Chart. Source : CoinMarketCap

XRP 24-Hour Price Chart. Source : CoinMarketCap

After reaching a short-lived peak above $2.30, XRP lost momentum and slid through several intraday supports. The chart shows a pattern of lower highs and brief rebounds that failed to hold above the previous levels.

Overnight, buyers attempted to stabilize price action near $2.10, but recovery attempts faded early on November 5. As the morning session progressed, XRP regained minor traction, returning to the $2.20–$2.25 zone.

Trading volumes stayed moderate, reflecting hesitation among both buyers and sellers. For now, the token remains in a narrow band, signaling consolidation after recent volatility.

Franklin Templeton updates XRP ETF filing; launch signals grow

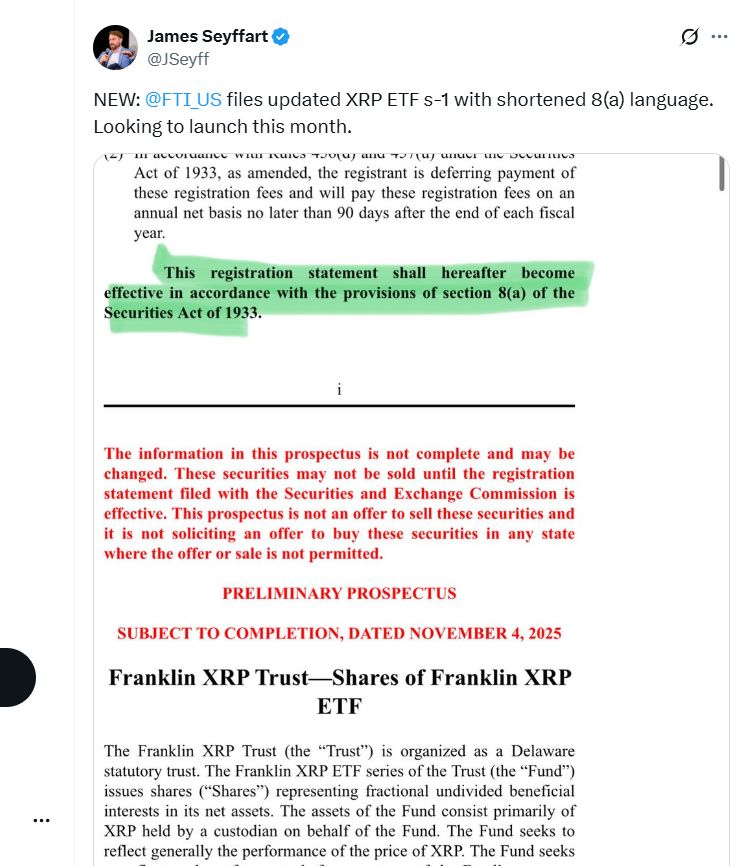

Meanwhile, Franklin Templeton filed Amendment No. 2 to its XRP ETF Form S-1, removing the Section 8(a) language that can delay effectiveness. The update streamlines the path to effectiveness under the Securities Act, according to the revised prospectus excerpt shared on X.

Bloomberg’s James Seyffart noted the shortened 8(a) wording and said the issuer is looking to launch this month. The comment follows similar S-1 updates from Canary Funds and Bitwise, which also tightened language as they move toward potential approvals.

Franklin Templeton XRP ETF Filing. Source: James Seyffart on X

Franklin Templeton XRP ETF Filing. Source: James Seyffart on X

As a result, the XRP ETF race accelerated. Franklin Templeton’s change, alongside rival amendments, signals issuers are aligning filings for a near-term launch window while they await the SEC’s next steps.

XRP tests demand zone; upside bias if $1.90–$2.25 holds

The chart shows XRP pulling back into a broad demand box around $1.90–$2.25. Buyers defended the area after a sharp wick lower, then price rebounded back above $2.20. This action flips a former range top into support and keeps the uptrend structure intact.

XRPUSDT Perpetual 1D Demand Zone. Source: TradingView / X

XRPUSDT Perpetual 1D Demand Zone. Source: TradingView / X

Momentum remains fragile. Yet higher-timeframe support sits beneath price, and liquidity above $2.32–$2.40 could attract a push toward $3.00–$3.50 next. However, if XRP loses the box with a daily close below $1.90, the setup weakens and exposes $1.57–$1.50. For now, the path of least resistance tilts up while the demand zone holds.

Nov. 5, 2025 — XRP forms bullish flag; measured target near $4.17

XRP traded around $2.24 today and printed a bullish flag on the daily chart. The pattern follows July’s strong rally, then a downward-sloping channel that holds above the prior base. A bullish flag is a brief consolidation after a sharp climb; price often pauses inside a falling channel and, once it breaks topside, resumes the prior move.

XRPUSD Daily Bullish Flag. Source: TradingView

XRPUSD Daily Bullish Flag. Source: TradingView

Price sits near the flag’s lower boundary around $2.02–$2.20 while the upper trendline tracks toward $2.50–$2.60. The 50-day EMA ~$2.61 caps near that line, so a daily close above the flag top and EMA would confirm the setup. Volume recently expanded on down days, yet RSI hovers in the mid-30s to mid-40s, showing bearish pressure is easing but not gone.

If bulls clear the flag, the measured move points roughly 86% above today’s level, which implies a target near $4.17. Until then, the structure remains a watch. A close below $2.02 would weaken the case and open room toward prior supports.