Still dare to play with DeFi? This feeling is all too familiar...

The crypto market enters another sleepless night amidst a cold front. Bitcoin has dropped nearly 12% in a week, Ethereum has fallen back to around $3,300, and risk assets are collectively under pressure.

Against the backdrop of a sluggish market, decentralized finance (DeFi) has once again become the eye of the storm: the veteran protocol Balancer v2 suffered the largest hack in its history, losing over $120 million; shortly after, the yield optimization platform Stream Finance disclosed a loss of $93 million, with its staked stablecoin xUSD dropping below $0.3.

The storm did not stop there. The risks triggered by Stream are spreading to more protocols along the chain of "composability."

In the latest round of chain reactions, DeFi risk management company Gauntlet has submitted an emergency proposal to the Compound governance forum, recommending a temporary pause on the Ethereum mainnet USDC, USDS, and USDT markets to prevent risk contagion.

Hacking incidents occurring against the backdrop of a weakening market have put "intermediary-free finance" to a severe real-world test:

When price declines and risk events overlap, do you still dare to "play" DeFi?

Hacking Incidents Starting from Balancer

On Monday, Balancer v2 was exposed to a core vulnerability. Attackers exploited a logical flaw in Composable Stable Pools, sweeping away $128 million across multiple chains including Ethereum, Arbitrum, and Base within hours.

Researchers pointed out that the attackers may have forged "fee credits" and triggered withdrawals, turning "fake points" into "real funds." Ironically, this system module had undergone more than ten security audits, including by OpenZeppelin and Trail of Bits. Years of reputation and technical accumulation still failed to prevent a logical attack.

Flashbots and Lido strategy lead Hasu commented: "Every time an old contract like this is breached, overall DeFi adoption is set back by 6 to 12 months."

Less than 24 hours later, Stream Finance disclosed that its "external fund manager" caused a loss of $93 million in assets. The platform suspended deposits and withdrawals, and the staked stablecoin xUSD deeply depegged, dropping from $1 to $0.27.

On-chain data shows that the total collateral exposure related to xUSD, xBTC, and xETH is about $285 million, involving multiple lending protocols such as Euler, Silo, and Morpho. The TVL of multiple markets evaporated by hundreds of millions of dollars in a single day.

Your Funds Are Not Yours: The Backlash of "Composability"

To put it simply, DeFi's most attractive feature—"composability"—is like a set of financial Legos: you can stack the yield pool of protocol A on top of the lending of protocol B, then use the stablecoin of protocol C as collateral, layering them one after another.

In a bull market, this approach is indeed exhilarating. Yields are interconnected, and efficiency is astonishing. But many people don't realize that the higher you stack the blocks, the harder the fall when things go wrong.

Once the market turns cold, or a foundational "Lego block" has issues—such as a core protocol like Balancer or Stream blowing up—risk will propagate along the original construction path, like a domino effect.

Johnny Time, founder of security company Ginger Security, provided a detailed explanation of this transmission mechanism.

Many people have bought what was claimed to be the "safest USDC vault" on Beefy Finance, thinking their funds were safe and sound. But in reality, the money never stayed at Beefy; instead, it was transferred layer by layer, with the fund path as follows:

Beefy → Silo → Arbitrum → another institution called Valarmore → ultimately flowed into the now-exploded Stream Finance.

You thought you bought USDC, but in fact, you were passively holding the now-collapsed xUSD.

In this chain, the front-end platform Beefy presents users with a "safe USDC vault," but the funds are then reallocated by the intermediary Valarmore into Stream protocol's xUSD strategy.

In this chain, the front-end platform Beefy presents users with a "safe USDC vault," but the funds are then reallocated by the intermediary Valarmore into Stream protocol's xUSD strategy.

Johnny Time pointed out that the problem lies in each protocol layer pursuing yield maximization, yet lacking information disclosure and risk isolation mechanisms.

This "nested layering" structure allows risk to be invisibly transmitted along the chain: upstream protocol decisions, underlying asset volatility, or misallocation of intermediate strategies can all amplify risk along the way.

Ultimately, when the bottom-most asset (such as xUSD) encounters problems, the entire structure collapses like dominoes.

The Debate on Decentralization

As a result, the community debate on decentralization has reignited.

Dragonfly partner Haseeb Qureshi believes: "Even in decentralized systems, as long as enough participants reach consensus, accounts or funds can be frozen."

But critics quickly rebutted: "If enough people can agree to do something, they can do anything—which itself is not decentralization."

This debate reveals DeFi's governance paradox: when the system requires human consensus to intervene and stop the bleeding, the boundaries of "decentralization" begin to blur.

OneSource founder Vladislav Ginzburg believes that risk is the underlying tone of the DeFi ecosystem: "The complexity of smart contracts and financial engineering means users must accept uncertainty."

Security researcher Suhail Kakar bluntly stated: "'Audited' means almost nothing. Code is hard, DeFi is harder."

Komodo CTO Kadan Stadelmann added that frequent security incidents will drive institutional funds away from complex structures, returning to a "bitcoin only" strategy.

Nansen researcher Nicolai Søndergaard pointed out that the Balancer attack vulnerability was in the billing logic rather than permission control—such design risks are difficult to detect in audits, and governance mechanisms struggle to respond in time.

Summary

The problem with DeFi has never been technology, but governance.

During a bull market, protocol stacking and high yields are attractive; now the bear market reveals the truth—no layer is completely safe.

Projects that survive in the future will no longer win by annualized returns, but must prove three things:

Funds are verifiable, risks are isolatable, and governance is enforceable.

For ordinary players, experience has also been rewritten: if you can't even figure out where your own money ultimately goes, you might as well just buy BTC for peace of mind.

Ultimately, in the DeFi world: risks you understand are opportunities, yields you don't understand are traps.

Author: Seed.eth

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

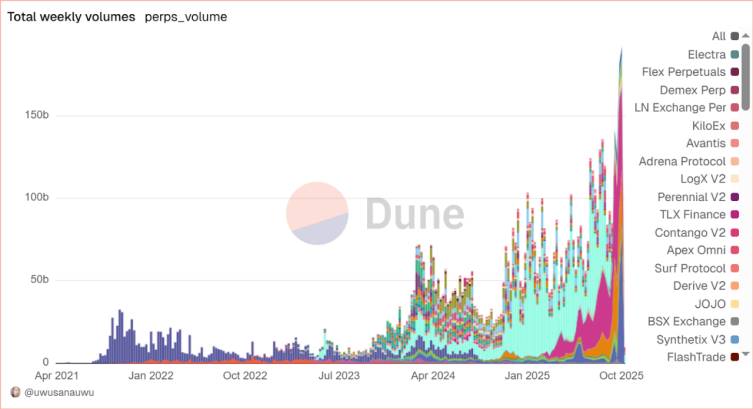

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.

Space Review|Farewell to the Era of “Narrative Equals Hype”, TRON Rebuilds Market Confidence with Real Yields

As the crypto market shifts from “listening to stories” to “seeing results,” TRON demonstrates a feasible path through its solid ecosystem foundation and value circulation.

Bitcoin (BTC) Holds Key Support — Could This Pattern Trigger an Rebound?

Crypto News Today [Live] Updates On November 5,2025: Bitcoin Price,Ethereum Price,XRP ETF News