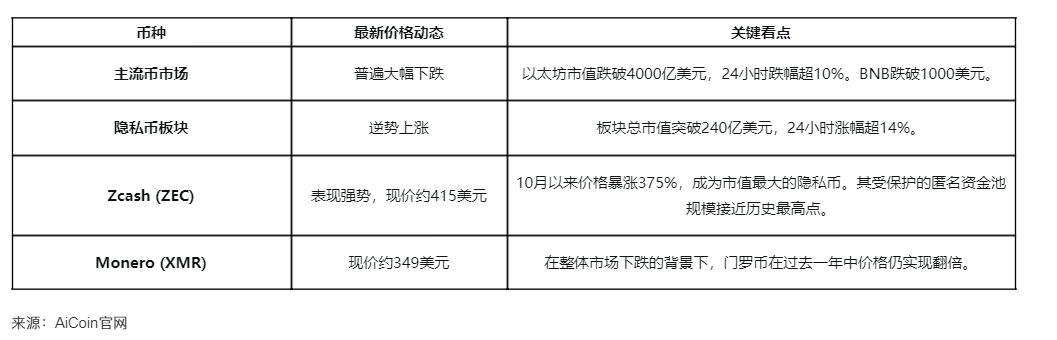

Under the dual pressures of tightening global regulation and a generally declining market, privacy coins have bucked the trend, emerging as the brightest stars in an otherwise gloomy cryptocurrency market. Over the past week, the overall cryptocurrency market has declined, with total market capitalization dropping 3.7% from $3.96 trillion to $3.81 trillion.

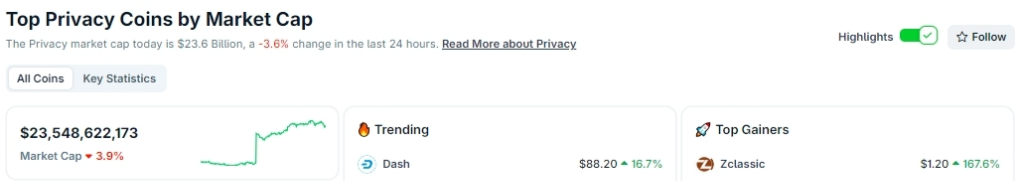

Yet amid this downturn, privacy-focused cryptocurrencies have soared against the tide, with their market cap once surpassing $24 billion, surging by about 80%. Among privacy coins, DASH and ZEC stood out, recording gains of 65% and 9.55% respectively, with DASH's seven-day increase even reaching 68%.

I. Rising Against the Trend: Market Performance of Privacy Coins

While the overall cryptocurrency market declined, privacy coins carved out an independent rally.

● The market cap of privacy coins soared by about 80% over the past week, at one point surpassing $24 billion. This counter-trend surge highlights the rapidly growing demand among investors for financial privacy.

● DASH was the most eye-catching performer among privacy coins, with a 68% surge over the past week, at one point approaching $150.

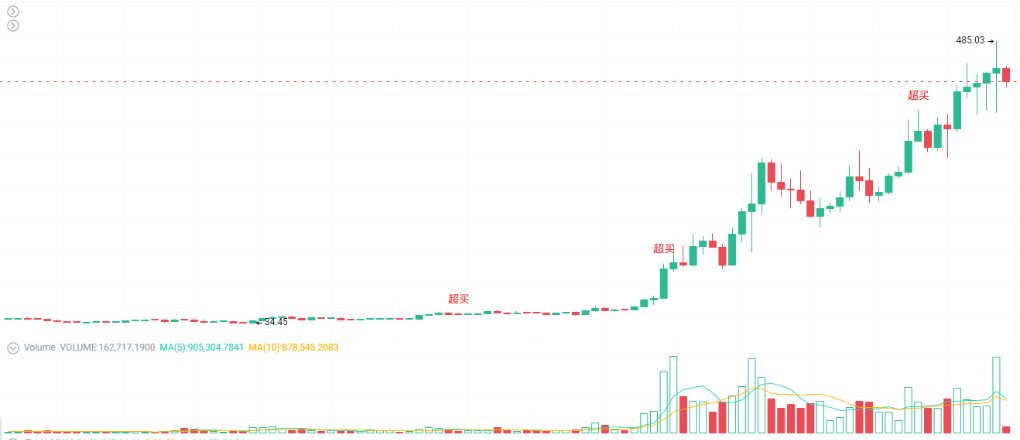

● Zcash also put in a strong showing, with its price soaring to $388 last Friday, marking a new eight-year high and briefly surpassing Monero to become the privacy coin with the highest market cap.

II. Driving Forces: The Power Behind the Surge in Privacy Coins

Regulatory Anxiety Drives Demand

Against the backdrop of ongoing global regulatory tightening, the value of privacy coins has become more prominent. Cryptocurrencies are subject to increasingly strict monitoring, including KYC checks, exchange surveillance, and blockchain analytics technologies.

● The European Union has enacted new regulations effective December 30, 2024, requiring exchanges to treat transfers from self-custody wallets as high-risk transactions. The U.S. Treasury will also seek public input on "privacy-enhancing tools" in August 2025, providing a basis for new guidelines.

● These regulatory measures have prompted investors to refocus on privacy solutions. Nansen Senior Research Analyst Jake Kennis noted: "Privacy is increasingly being seen as a necessity rather than just a feature."

Technical Upgrades Enhance Usability

● Zcash's technical upgrades have significantly improved user experience. The new features of its Zashi wallet allow users to perform cross-chain swaps and private payments through integration with Near's Intents system. This means users can easily transfer funds between Zcash's privacy layers without going through centralized exchanges or complex bridging interfaces.

● Zcash's shielded pool has also expanded as a result, now nearing an all-time high of 4.9 million ZEC.

Halving Expectations and Institutional Entry

● Zcash is set for a halving in November 2025, with block rewards dropping from 3.125 coins to 1.5625 coins. David Duong, Head of Institutional Research at Coinbase, stated that this move is expected to reduce supply by about 1,500 coins per day, and the market has already begun to react.

● Meanwhile, institutional investors are quietly positioning themselves. Grayscale Zcash Trust holds over $85 million in assets, indicating growing interest in privacy coins from traditional capital.

III. Major Players: Analysis of the Three Leading Privacy Coins

Zcash: A Token with Optional Privacy

Zcash is one of the earliest privacy-focused cryptocurrencies, launched in October 2016.

● It uses zk-SNARKs technology, allowing users to choose between transparent and shielded addresses, maintaining transaction privacy when needed or providing transparency when necessary.

● This flexibility gives it an edge in compliance. Zcash's developer, Electric Coin Company, has been committed to improving user experience and driving exponential growth in shielded transactions.

Dash: The Comeback of a Veteran Privacy Coin

Dash was born in 2014 and is a veteran cryptocurrency in the privacy sector. It uses the PrivateSend mixing protocol, anonymizing transactions through a process of "splitting-mixing-recombining" funds.

● Dash's core positioning is as "decentralized digital cash," aiming to solve the dual pain points of privacy protection and practical payment scenarios faced by traditional cryptocurrencies.

● Analysts attribute Dash's resurgence to network development initiatives such as the "Thirty Billion Project," which aims to promote large-scale adoption of Dash in underserved markets.

IV. Analysis of Market Sustainability

Short-Term Momentum and Long-Term Value

● In the short term, the surge in privacy coins has been driven by multiple factors. BitMEX co-founder Arthur Hayes' bullish prediction for Zcash sparked market frenzy. After he recently predicted Zcash would reach $10,000, its price quickly climbed from $272 to a peak of $355 within hours.

● However, in the long run, real-world application scenarios and policy direction are the key factors determining the prospects of privacy coins.

Regulatory Uncertainty

● The biggest challenge facing privacy coins comes from regulation. The EU's Anti-Money Laundering Regulation (AMLR) will restrict licensed exchanges from offering privacy coins by July 2027. This could lead to privacy coins being delisted from major exchanges, affecting their liquidity, but may also drive users toward decentralized exchanges and self-custody.

The Push of Technological Innovation

● Privacy technology itself is also constantly evolving. Zcash is undergoing a Crosslink upgrade, introducing a proof-of-stake layer on top of its proof-of-work consensus. Meanwhile, the Tachyon project aims to greatly enhance the scalability of Zcash's shielded protocol, enabling "planetary-scale" private payments.

The rise of privacy coins is no accident. In an era of increasingly pervasive digital surveillance, financial privacy has become a scarce resource. The road ahead for privacy coins will not be smooth, but with technological progress and deeper market education, they are likely to secure a more solid position in the cryptocurrency ecosystem.

The balance between privacy and transparency will be an eternal theme in the digital age.