2025 Digital Asset Treasury Company (DATCo) Report

How did DATCo grow from a fringe corporate experiment into a powerful force spanning Bitcoin, Ethereum, and various altcoins, with a scale of 130 billions USD?

How did DATCo grow from a marginal corporate experiment into a powerful force spanning bitcoin, ethereum, and various altcoins, with a scale of $130 billions?

Written by: CoinGecko

Translated by: AididiaoJP, Foresight News

Since 2020, the rise of digital asset treasury companies has become one of the most iconic developments in the cryptocurrency sector. Although media attention has mostly focused on ETFs, meme coins, and next-generation DeFi protocols, DATCo has quietly emerged as a powerful new force in the market.

So how did DATCo grow from a marginal corporate experiment into a powerful force spanning bitcoin, ethereum, and various altcoins, with a scale of $130 billions?

This article will help you understand how digital asset treasury companies have become the star companies of this cycle.

Summary

- Public companies began including cryptocurrencies as reserve assets in 2017, and the rise of Strategy brought pure-play DATCos into the spotlight.

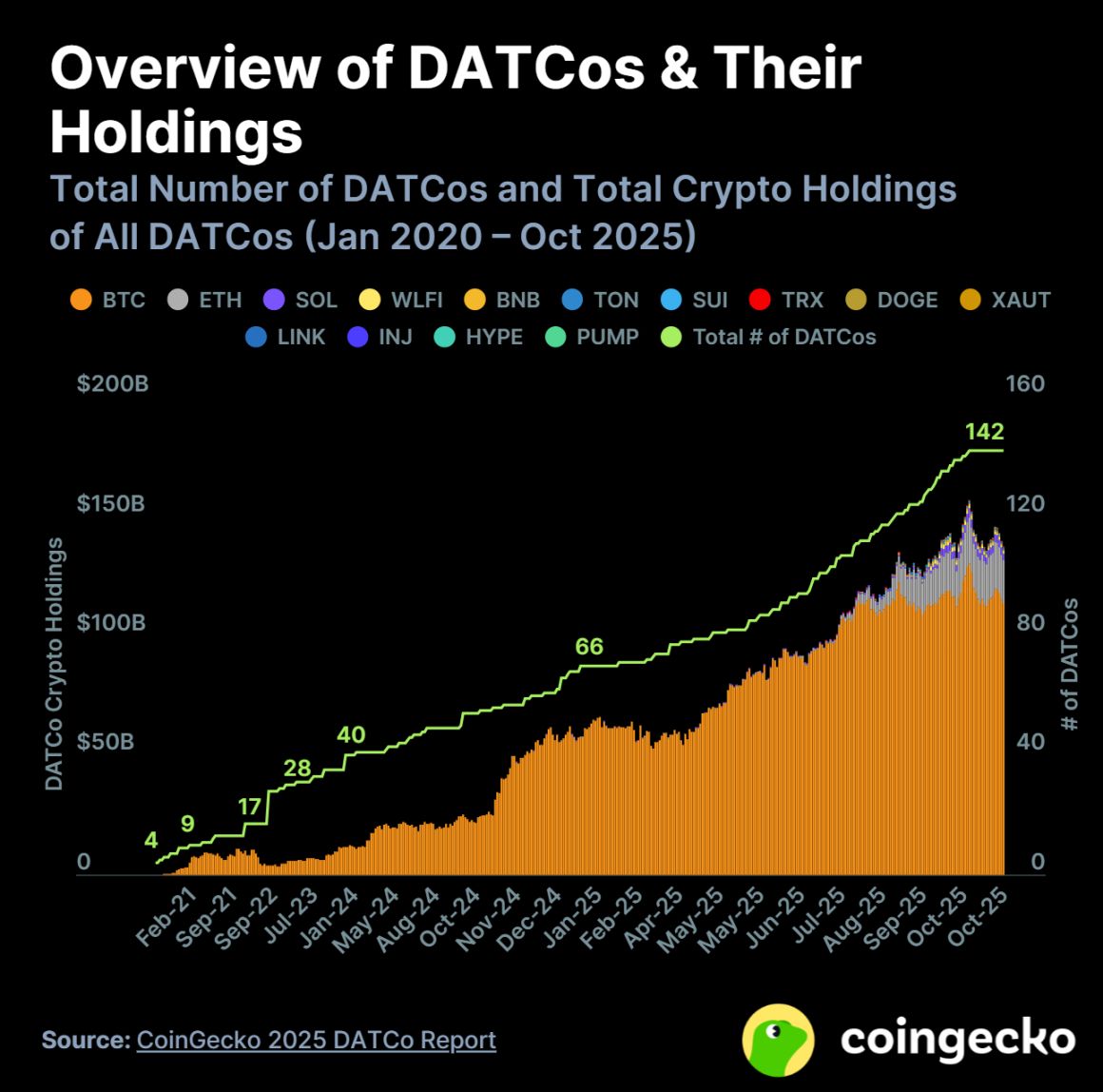

- The number of DATCos surged from 4 in 2020 to 142, with 76 established in 2025.

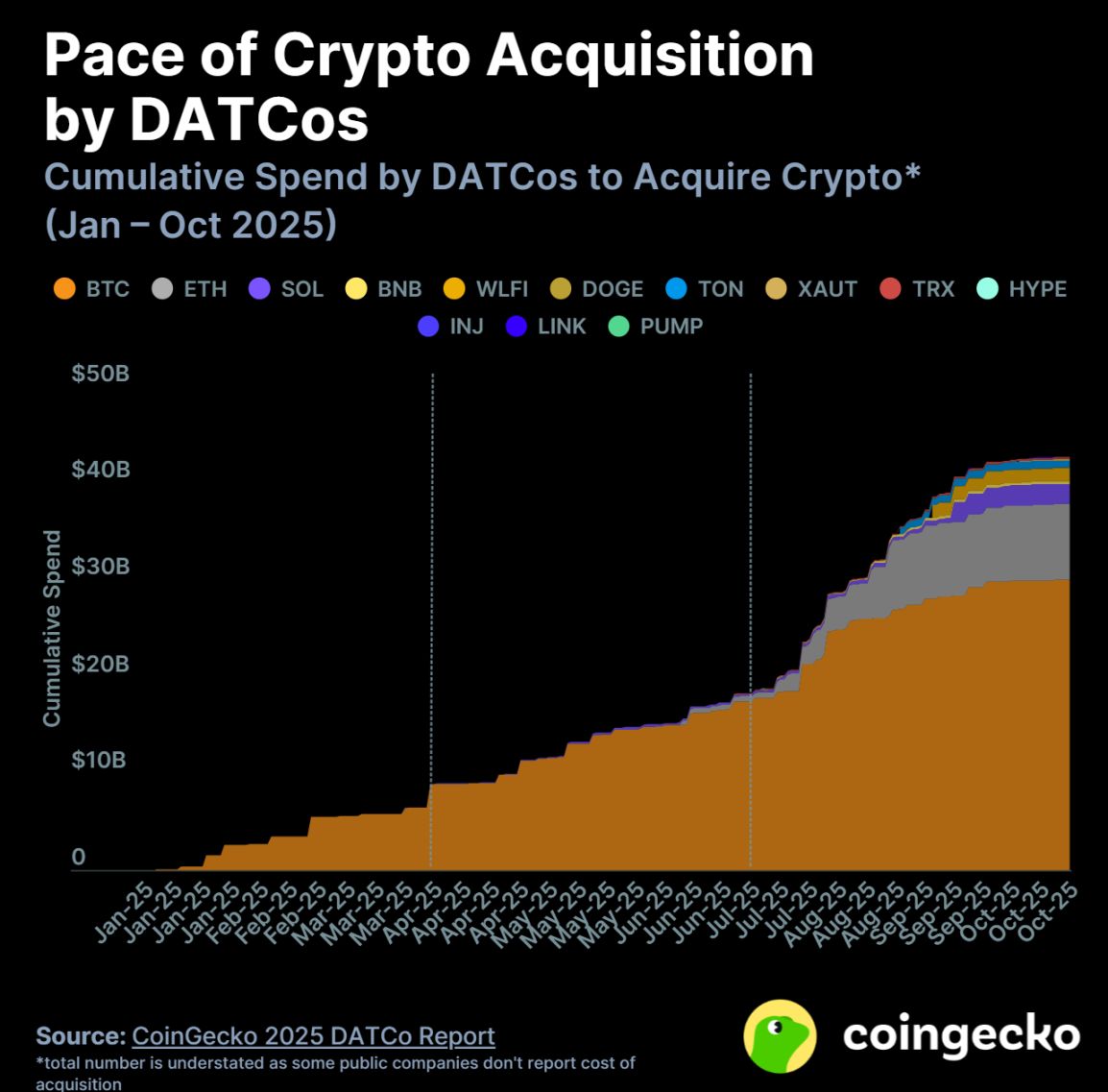

- DATCos invested a total of $42.7 billions in 2025, with more than half occurring after the third quarter.

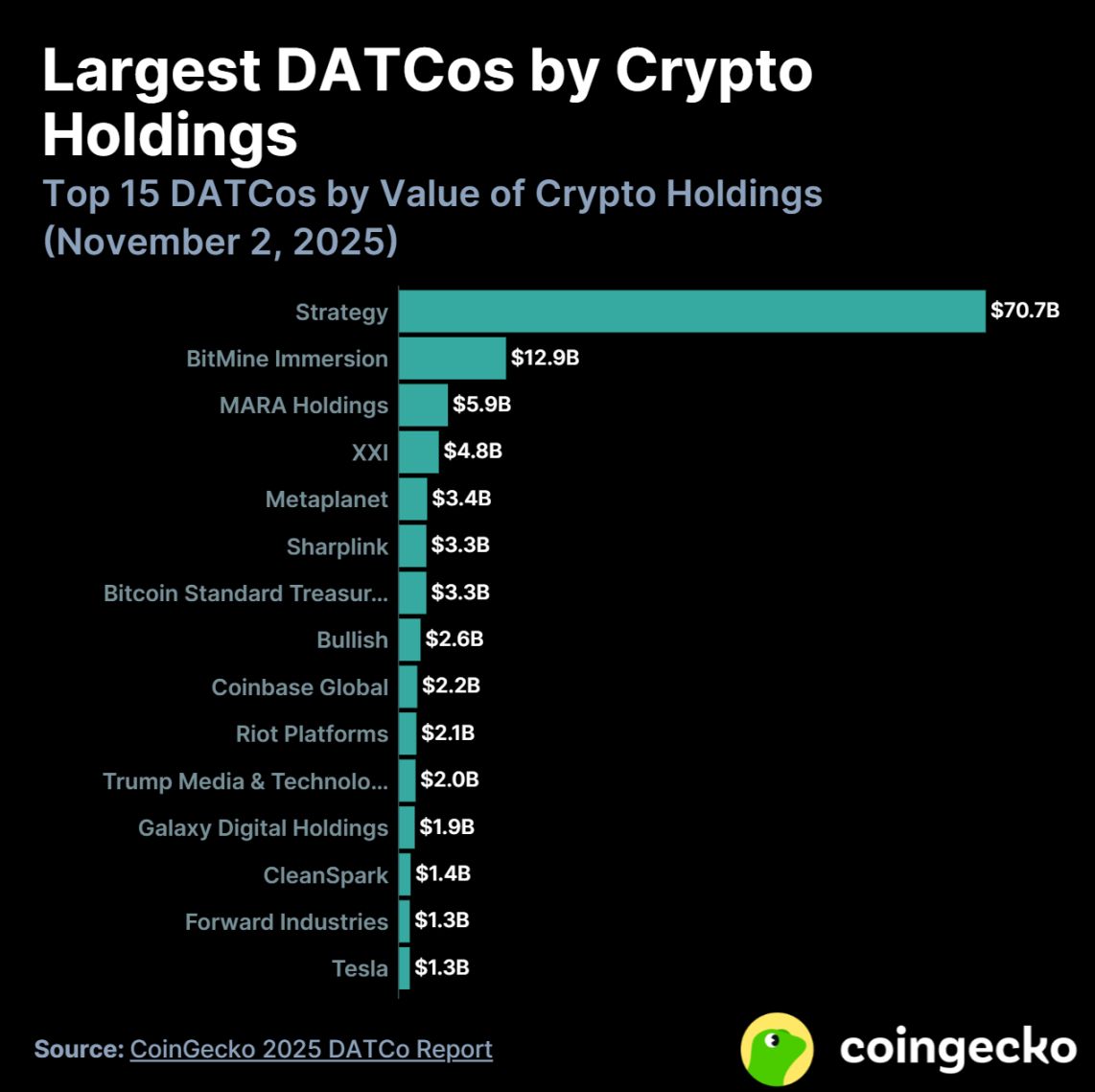

- Strategy dominates the sector, holding $70.7 billions in assets, accounting for about 50% of all DATCo crypto assets.

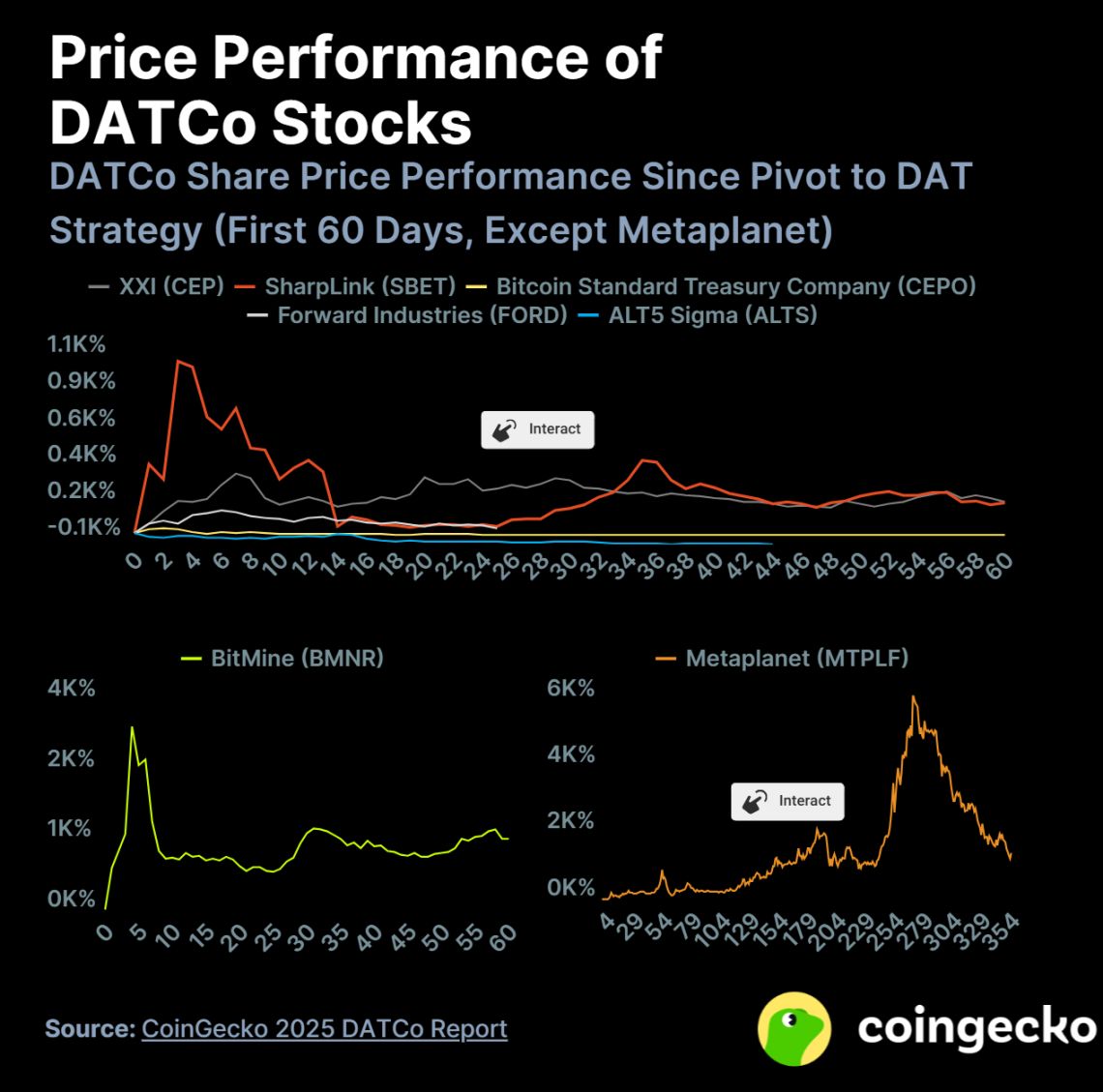

- DATCo stocks soared in the first 10 days (for example, BitMine surged by 3,069%), followed by widespread corrections.

The rise of Strategy brings pure-play DATCos into the spotlight

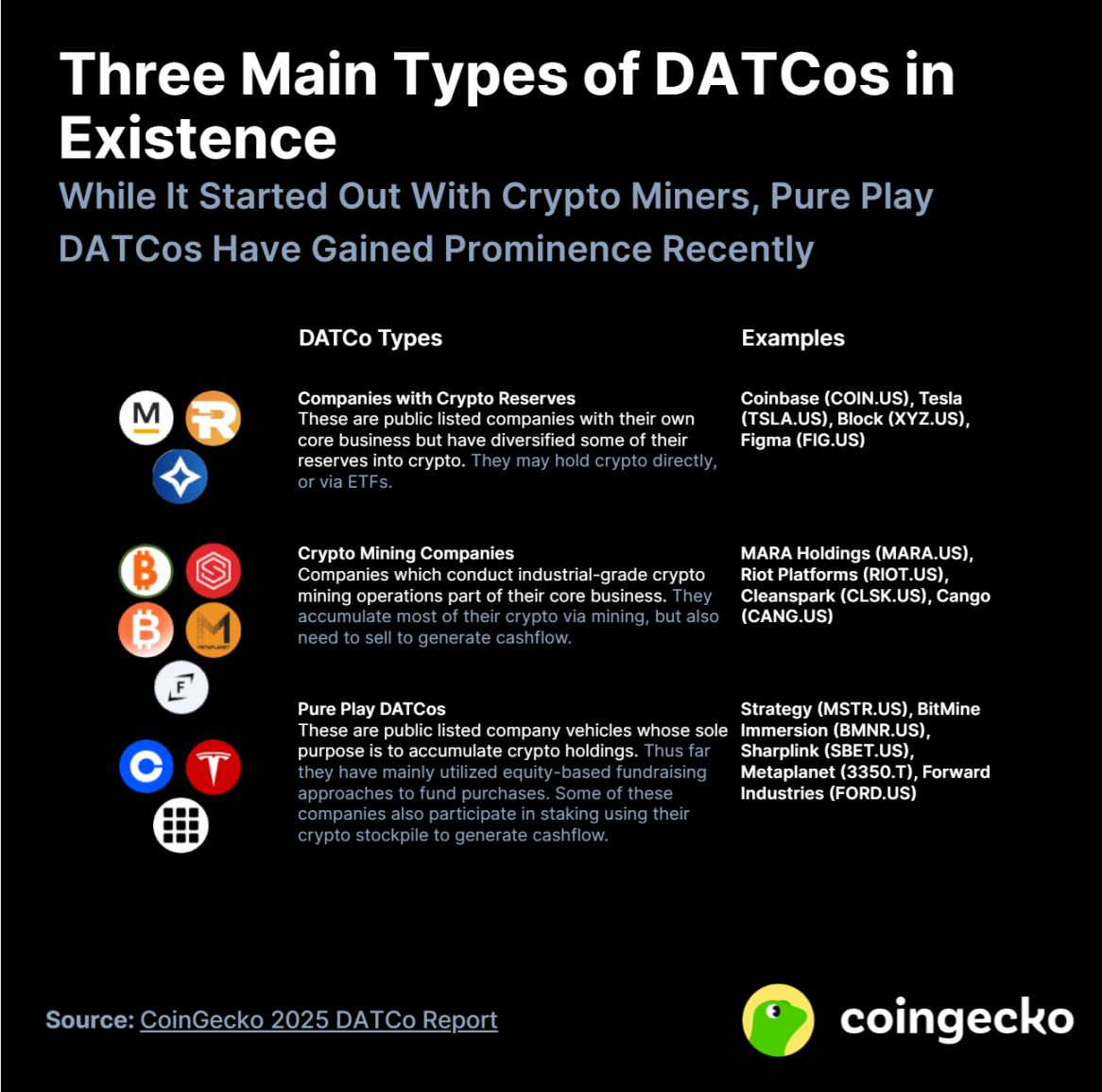

Digital asset treasury companies first appeared in 2017, initially mainly as publicly listed cryptocurrency mining companies. Strategy, as the first pure-play DATCo, emerged in August 2020 and subsequently led to a wave of similar companies.

At the end of 2023, the US Financial Accounting Standards Board introduced cryptocurrency accounting standards, allowing DATCos to measure their crypto assets at fair value and include appreciation in earnings. This policy significantly enhanced the performance of DATCo balance sheets.

In addition, US President Trump’s friendly stance towards cryptocurrencies, along with the surge in prices of bitcoin and other crypto assets, jointly drove a massive influx of Wall Street capital into the sector, including into DATCos.

Against the backdrop of weak fiat currency performance, many publicly listed companies whose main business is not crypto have also begun to include crypto assets in their reserve strategies to hedge against currency depreciation risks.

As of October 2025, there are 142 DATCos, with 76 established in 2025

The first DATCo was Hut 8 Mining Corp, a bitcoin mining company listed on the Toronto Stock Exchange in November 2017. Between 2017 and 2020, crypto mining companies were the main form of DATCo. It was not until August 2020 that Strategy appeared as the first pure-play DATCo.

By the end of October 2025, the total value of crypto assets held by all DATCos had reached $137.3 billions, more than doubling since the beginning of the year (+139.6%).

Among the 142 DATCos, 113 (79.6%) hold bitcoin as a reserve asset, while 15 and 10 hold ethereum and solana, respectively. In terms of US dollar value, bitcoin accounts for 82.6% of all DATCo crypto assets, followed by ethereum (13.2%) and solana (2.1%).

In terms of geographic distribution, the United States has the most DATCos, with 60, accounting for 43.5%; Canada and China follow with 19 and 10, respectively. Although Japan has only 8, it is noteworthy that it is home to the fifth largest DATCo, Metaplanet, which is also the largest DATCo outside the US.

DATCos invested a total of $42.7 billions in 2025, with more than half in the third quarter

In the third quarter of 2025, crypto DATCos invested at least $22.6 billions in new asset acquisitions, making it the largest spending quarter to date. Among these, altcoin DATCos contributed $10.8 billions, accounting for 47.8%. Since the beginning of 2025, DATCos have spent at least $42.7 billions on acquiring crypto assets.

Bitcoin DATCos are the largest buyers, having purchased at least $30 billions worth of BTC since the start of 2025, accounting for 70.3% of all DATCo crypto asset purchases.

Ethereum DATCos are the second largest buyers, with reported purchases of at least $7.9 billions in 2025. Most of these acquisitions occurred in August, with at least $7.1 billions worth of ETH bought in a single month, coinciding with ethereum’s price surge to a historic high of $5,000.

Other assets such as solana, BNB, and WLFI accounted for 11.2% of purchases in 2025. As more altcoins are included in reserves, this proportion is expected to rise. However, bitcoin and ethereum remain the preferred assets for DATCos at present.

Strategy accounts for about 50% of all DATCo crypto assets

Strategy leads all other DATCos by a wide margin, with $70.7 billions in bitcoin holdings. Among the top 15 DATCos, only three are altcoin DATCos: BitMine Immersion (2nd), Sharplink (5th), and Forward Industries (14th). Notably, all three transitioned to DATCos after June 2025, highlighting their rapid asset accumulation.

Among the top 15 companies, seven are pure-play DATCos, while only three are crypto mining companies.

Of the five publicly listed companies holding crypto reserves, all but Tesla are engaged in crypto-related businesses.

Currently, Strategy holds 3.05% of the total bitcoin supply; BitMine Immersion holds 2.75% of the total ethereum supply; Forward Industries holds 1.25% of the total solana supply.

DATCo stocks soar in the first 10 days, then generally correct

Most DATCos experience a rapid surge in stock price within the first 10 days after announcing their transformation, usually followed by a pullback.

Some companies’ stock prices even increased several dozen times within 10 days, with BitMine Immersion achieving a return of up to 3,069%.

The only current exception is Metaplanet, whose stock price rose about 100% in the first 10 days, but then took 269 days to reach a peak return of about 6,200%.

Most DATCo stocks experienced significant volatility before their official transformation, which typically only benefited early buyers or insiders. Such situations have sparked controversy, and the US Securities and Exchange Commission and the Financial Industry Regulatory Authority are investigating insider trading.

However, these rallies are often unsustainable, with most DATCo stocks dropping sharply within days after the transformation. For example, ALT5 Sigma’s stock price fell 71% 44 days after its transformation. Its WLFI holdings also performed poorly, dropping 56% since listing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin faces ‘insane’ sell wall above $105K as stocks eye tariff ruling

Privacy coins surge 80%: Why Zcash and Dash are back in the spotlight

TRUMP memecoin price may increase 70% by end of 2025

[English Long Tweet] Privacy Manifesto: How Zero-Knowledge Technology is Reshaping the Internet