Key Market Information Discrepancy on November 7th - A Must-Read! | Alpha Morning Report

1. Top News: Stablecoin USDe Market Cap Drops Below $9 Billion, Decreasing by Around 45% in the Past Month 2. Token Unlocking: $ACE, $GFAL

Featured News

1. Stablecoin USDe Market Cap Falls Below $9 Billion, Down About 45% in a Month

2. Storage Sector Tokens Soar, FIL Surges Over 51.34%

3. Cryptocurrency Market Sees General Decline, Bitcoin Falls Below $101,000, US Stock Crypto-Related Stocks Significantly Affected

4. Nasdaq Extends Losses to 2%, NVIDIA Falls 3.43%

5. "Binance Life" Sees Large Buy-Ins Yesterday, Average Entry Price Around $0.17

Articles & Threads

1. "DeFi’s Potential $80 Billion Minefield, Only $1 Billion Exploded So Far"

The fund manager, a figure once trusted and later demystified in the stock market and enshrined with countless retail investors' wealth dreams. At first, everyone was chasing after fund managers who graduated from prestigious schools and had impressive resumes, believing that funds were a lower-risk, more professional alternative to direct stock trading. However, when the market plummeted, investors realized that the so-called "professionalism" couldn’t withstand systemic risks. Even worse, holding management fees and performance incentives, gains were seen as personal skills while losses translated to investors' money. Now, when the role of "fund manager" arrives on-chain with a new moniker "Curator" (an external curator), the situation becomes even more perilous.

2. "Intensifying Market Volatility, Why Bitcoin Still Aims to Reach $200,000 in Q4?"

This article was first published on October 27, 2025. On November 6, Tiger Research published again, stating that amidst increased market volatility, they are maintaining their $200,000 price target. This article elaborates on the specific reasons.

Market Data

Daily Market Overall Funding Heatmap (as reflected by the Funding Rate) and Token Unlocks

Data Sources: Coinglass, TokenUnlocks

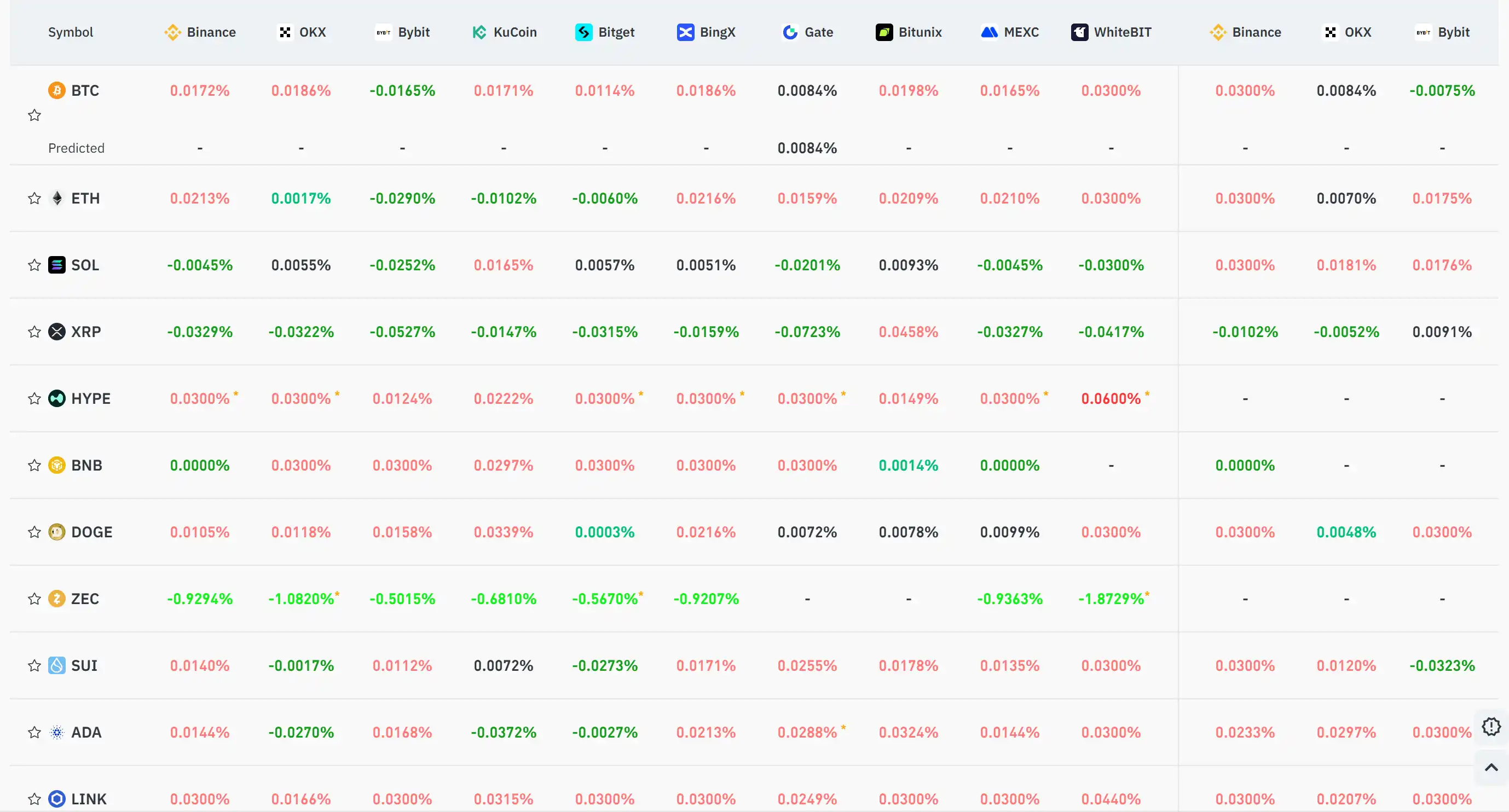

Funding Rate

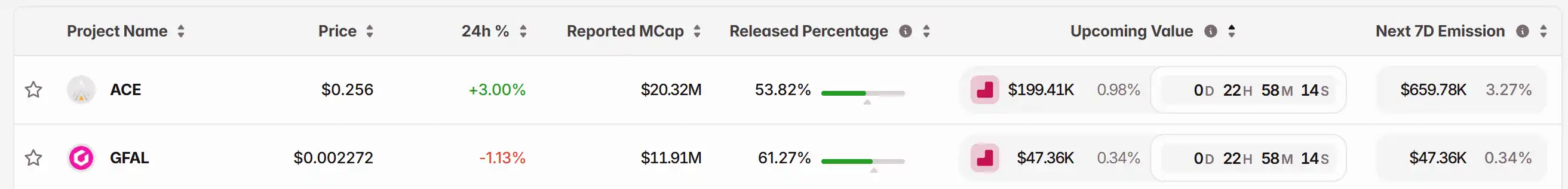

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP whales cap selling as wallet growth hits 8-month high

XRP News Today: BlackRock's Investment in XRP Encounters Regulatory Hurdles While Trillions Remain on Hold

- BlackRock's Maxwell Stein highlighted XRP Ledger's role in tokenizing $trillions of real-world assets, partnering with Securitize to boost blockchain infrastructure. - Ripple's $500M funding at $40B valuation and XRP's ISO 20022 compliance intensify ETF speculation amid regulatory uncertainty over SEC's stance. - BlackRock faces scrutiny after a $500M fraud scandal at HPS, raising doubts about its crypto credibility despite XRP's Mastercard/WebBank integrations. - Industry splits on XRP's potential: Blac

Bitcoin Plummets Unexpectedly: Has It Hit the Floor or Is a Larger Downturn Ahead?

- Bitcoin fell 15% in August 2025 amid Fed policy shifts, China's crypto ban, and ETF outflows, testing its macro asset status. - The Fed's delayed rate cuts and inflation ambiguity created market uncertainty, while China's ownership ban disrupted liquidity and global demand. - On-chain data shows 375,000 BTC accumulation and a 1.8 MVRV ratio, suggesting structural resilience despite regulatory shocks. - ETF outflows ($291M total) reflect investor caution over inflation risks and regulatory gaps, but could

Bitget Connects Web2 and Web3 by Offering Zero-Fee Trades and Up to 50x Leverage on AI-DeFi Trading Pairs

- Bitget launched 50x-leveraged USDT-margined perpetual contracts for UAI and FOLKS, alongside automated trading bots to boost algorithmic accessibility. - The zero-fee U.S. stock token campaign and Kite (KITE) listing aim to bridge Web2/Web3 by integrating traditional assets with blockchain infrastructure. - With 120M+ users, Bitget's UEX model combines centralized efficiency with tokenized finance, targeting AI/DeFi growth through macroeconomic and onchain exposure.