Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs

Today's Outlook

- The SEC is expected to make a decision on Grayscale’s Polkadot (DOT) ETF application by November 8, 2025.

- 72 out of the top 100 cryptocurrencies by market capitalization are down more than 50% from their all-time highs.

- Circle has submitted comments to the U.S. Treasury on the implementation of the GENIUS Act.

Macroeconomics & Hot Topics

- Deribit: Over $5 billion in Bitcoin and Ethereum options are set to expire this Friday.

- The USDC Treasury saw 10 minting and burning transactions exceeding $50 million each in the past 12 hours.

- Next year’s FOMC voting members emphasize inflation risks and oppose further rate cuts.

Market Trends

- BTC and ETH are consolidating in the short term as market sentiment remains cautious and leans towards fear. Around $563 million in liquidations occurred in the past 24 hours, mainly long positions.

- All three major U.S. stock indices closed lower: the Dow fell 0.84%, the Nasdaq plunged 1.90%, and the S&P 500 dropped over 1%.

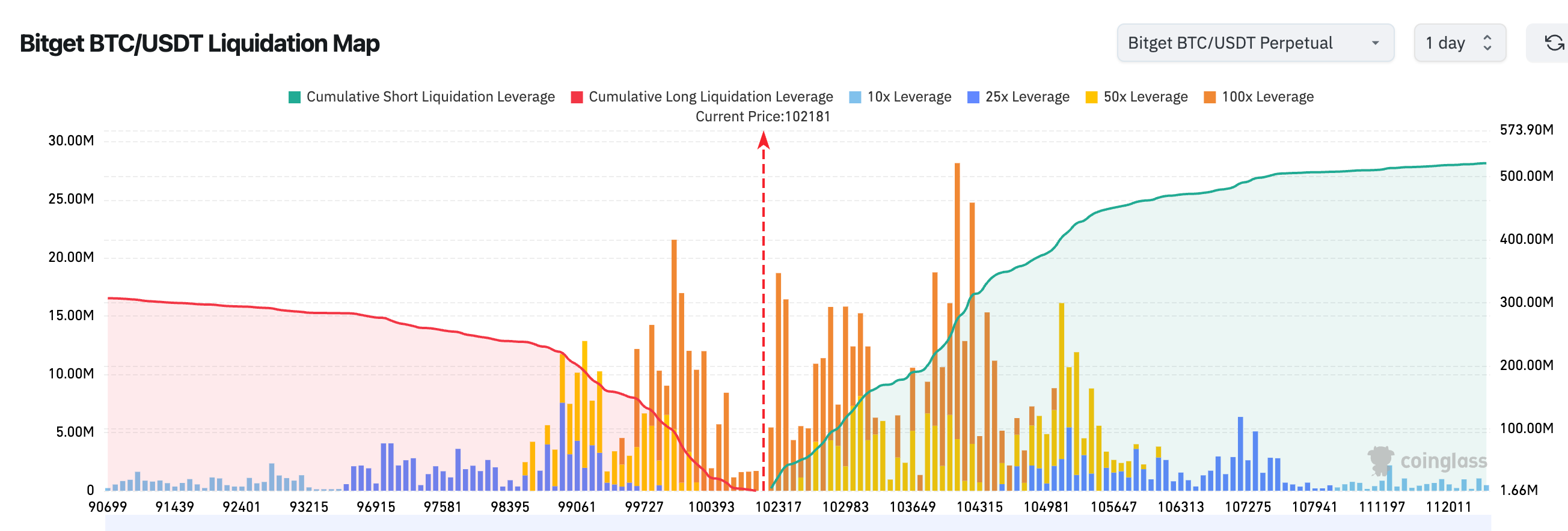

3.According to Bitget’s BTC/USDT liquidation map, BTC is currently priced at $102,181 USDT. There is a concentration of short liquidations in the 101,057 - 102,389 range. A breakdown below this range could trigger a chain reaction of liquidations and significantly increase short-term risks.

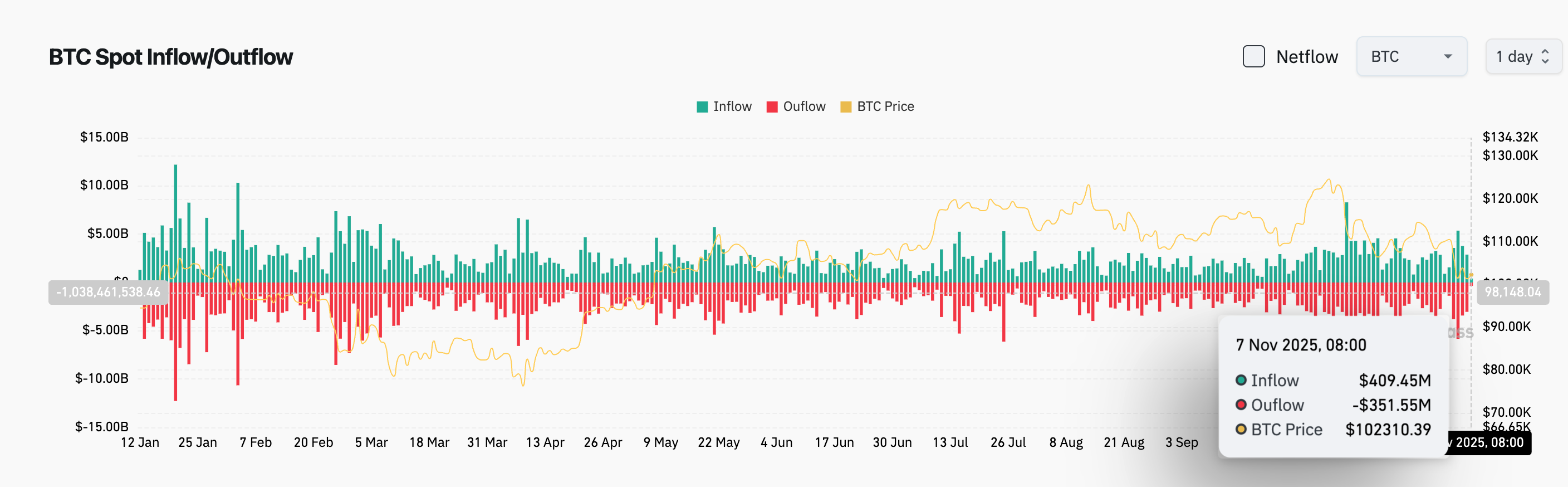

4.In the past 24 hours, BTC spot inflows reached $409 million, outflows were $351 million, for a net inflow of $58 million.

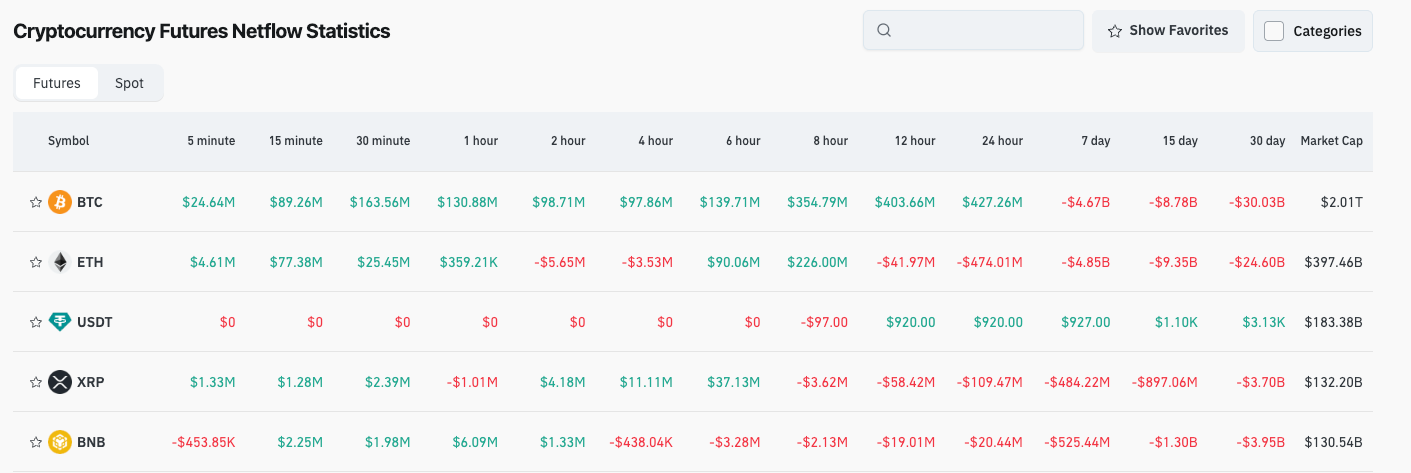

5.Over the last 24 hours, derivatives trading in BTC, ETH, USDT, XRP, and BNB saw net outflows. It's recommended to continue monitoring major cryptocurrencies for potential trading opportunities.

News Updates

- Elon Musk: SpaceX should become a publicly traded company.

- Block posted nearly $2 billion in Bitcoin revenue in Q3, accounting for almost one-third of its total revenue.

- Google will integrate prediction data from Kalshi and Polymarket into Google Finance.

- OpenAI CEO: Does not seek "government guarantees" for its data centers; annualized revenue is expected to surpass $20 billion by the end of this year.

Project Developments

- Credit Blockchain: Launched an AI-driven intelligent financial platform, combining AI with blockchain innovation.

- Ondo Finance appoints former McKinsey executive Ian De Bode as President.

- Aave founder: Gauntlet has suspended Compound withdrawals.

- Aerodrome: Major system upgrades to be released, including Slipstream V2 and Autopilot.

- Folks Finance: Native token FOLKS officially launched on November 6 with an initial circulation of 25.4%.

- Cipher issues $1.4 billion in high-yield bonds to fund Google-related data center construction.

- ORE mining program is now available on the Solana Mobile dApp Store for Seeker users.

- Berachain: Plans to launch a claims page for fund returns early next week and may execute an additional hard fork.

- ZachXBT collaborates with BNB Chain to strengthen Web3 security infrastructure.

- Hourglass: Adjusts Stable pre-deposit activity limits, clarifies KYC and settlement times.

Disclaimer: This report is AI-generated and has been manually verified for accuracy. It does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Split Over December Decision: Focus on Employment or Tackle Rising Prices?

- Fed officials debate December rate cut likelihood (67.3%), balancing labor market risks vs. inflation amid divided policy views. - Governor Cook prioritizes employment risks over inflation, while Daly supports "modestly restrictive" policy to curb price pressures. - Goolsbee warns of rising inflation, contrasting with Myron's call for 50-basis-point cuts to prevent recession, highlighting policy uncertainty. - Fed's $125B liquidity injections and balance-sheet pause signal easing, yet Powell cautions aga

The $9.8M FAST NY Grant and Transformation of the Xerox Campus: Maximizing Industrial Property Potential in Webster, NY

- NY's $9.8M FAST NY Grant funds Xerox campus redevelopment in Webster, aiming to boost industrial real estate and advanced manufacturing. - The 300-acre brownfield site will receive infrastructure upgrades, creating 1M sq ft of industrial space by 2025 with proximity to major transportation and talent. - Secondary markets like Webster outperform primary cities in growth, driven by affordability, skilled labor, and public-private partnerships aligning with state economic goals. - Infrastructure investments

Japan’s FSA Backs Major New Stablecoin Initiative

In Brief Japan’s FSA supports a major new stablecoin pilot involving three major banks. The initiative explores regulatory compliance for stablecoins as electronic payment instruments. This marks the first project of the newly formed "Payment Innovation Project" (PIP).

JPMorgan’s Analyst Says Bitcoin Needs to Hit $170k to Match Gold’s Private Investment Value