NEAR Holds $2: Will It Soar 350% or Wait Until 2026?

- NEAR Protocol's token stabilizes near $2 support as network fees surge to $22.7M over three years, signaling strong user adoption. - Analysts highlight 350% bullish potential if price holds above $2, contrasting with broader crypto market consolidation. - Growing developer activity and fee generation suggest NEAR's ecosystem is insulating it from sector-wide volatility. - On-chain metrics and macro trends position NEAR as a potential outperformer if $2 support holds through 2025-2026.

NEAR Protocol’s native token is exhibiting early signs of a possible trend reversal as open interest on the network increases, with experts citing a blend of robust fundamentals and promising technical signals. The blockchain, recognized for its advanced smart contract performance, has seen its token price steady around key support zones, even as transaction fees and user activity continue to climb, according to a

NEAR (NEAR) has recently benefited from heightened network usage. Over the last three years, total fees have reached $22.7 million, with October 2025 alone accounting for $3.641 million. This momentum has carried into November, where the first week has already yielded $1.521 million in fees. These numbers point to ongoing user adoption and rising demand for the platform’s services, supporting a positive long-term outlook, as noted in the Coinpedia report.

From a technical perspective, NEAR has been trading sideways near the $2 support mark, which many see as a crucial accumulation region. Should the price remain above this level, past trends indicate a possible 350% surge toward $10, echoing the momentum from early 2024. Conversely, if the price dips below $2, the accumulation period could extend into early 2026, postponing any significant rally, according to Coinpedia. Investors are watching on-chain data closely, with many viewing the current price as a “last opportunity before takeoff” to enter before a potential breakout.

Wider market dynamics also shape NEAR’s outlook. While leading cryptocurrencies like

The relationship between NEAR’s on-chain statistics and larger market forces highlights the token’s distinctive position. While the overall market contends with ETF outflows and subdued investor confidence, NEAR’s rising fees and developer engagement point to a thriving ecosystem. For now, attention is on whether the $2 support can be maintained—a key factor that could decide if the token sees a breakout in 2025 or faces a delayed rally into 2026, as the Coinpedia report emphasizes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

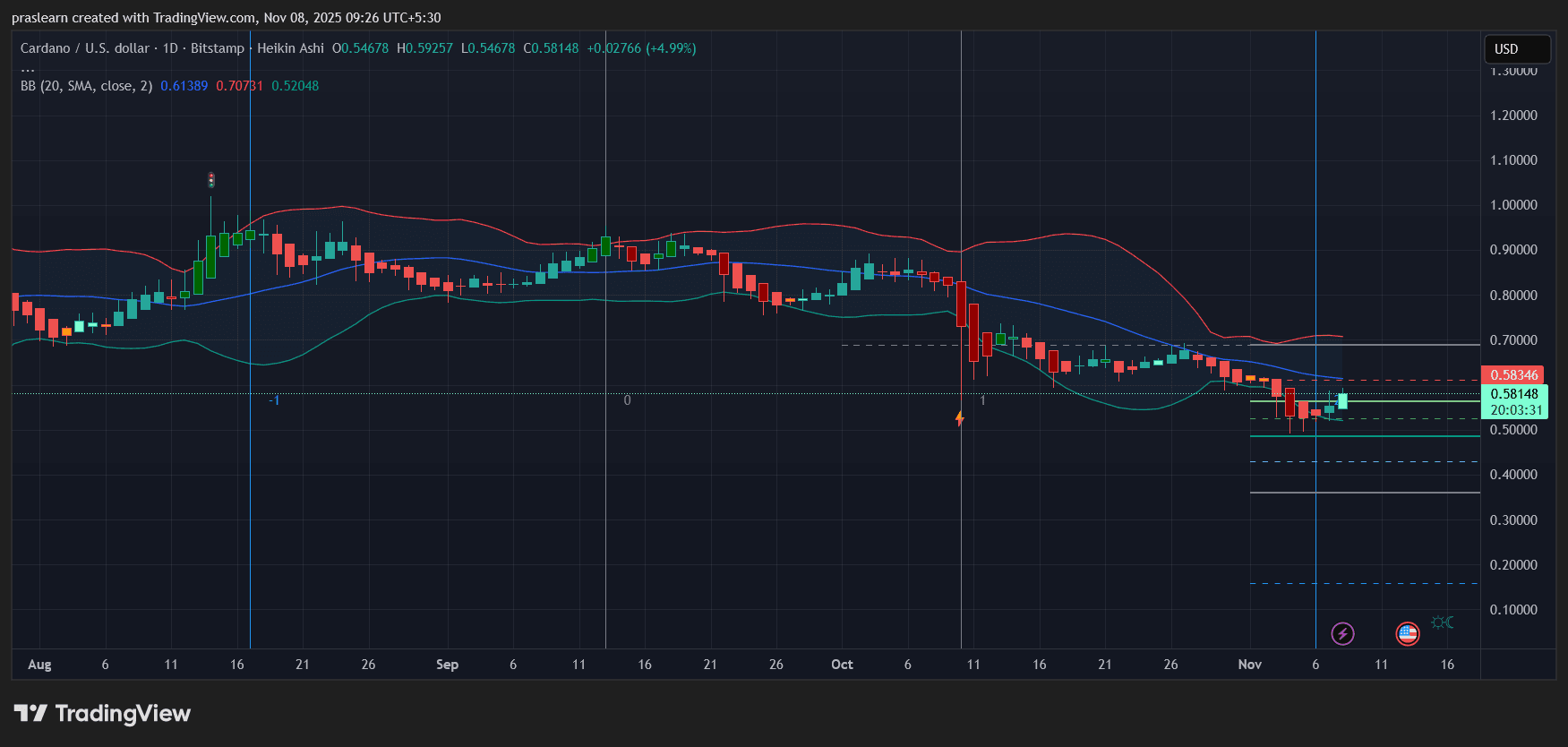

Cardano (ADA) Price Prediction: Can ADA Hold Its Recovery Amid Fed Uncertainty?

Hyperliquid's Rapid Rise: Emerging as a Major Player in Decentralized Trading?

- Hyperliquid captures 73% of decentralized perpetual trading volume with $12.9B daily trading and $9.76B open positions in October 2025. - Platform executes $645M HYPE token buybacks (46% of crypto buybacks) while 62.26% of Arbitrum's USDC liquidity flows to Hyperliquid. - Institutional adoption grows with 21Shares proposing SEC-approved HYPE ETF, while HIP-3 protocol enables permissionless market creation via HYPE staking. - Faces competition from new rivals (Aster, Lighter) and leadership risks, but exp

Bitcoin News Today: Is Bitcoin’s Recent Sell-Off Driven by Corporate Debt Reduction or Market Manipulation?

- Bitcoin fell below $100,000 on Nov. 4, 2025, with $1.3B in liquidations as whales and firms like Sequans sold BTC to reduce debt. - Analysts argue sellers may amplify bearish narratives via social media to profit from lower prices, while corporate treasury strategies face risks amid falling prices. - On-chain data shows moderate unrealized losses (3.1% stress level), suggesting potential stabilization, though some warn a $56,000 cascade could follow a $100,000 break. - Diverging strategies emerge: Americ

"Study Reveals 25% of Polymarket's Trading Volume is Artificial Due to Ghost Trades"

- Columbia University study reveals 25% of Polymarket's trading volume may involve wash trading, where users self-trade to inflate activity. - Sports and election markets showed highest manipulation rates (45% and 17% fake volume), peaking at 95% in election markets in March 2025. - Platform's lack of transaction fees and pseudonymous wallets enabled manipulation, despite CFTC regulatory actions since 2022. - Researchers urge Polymarket to adopt their detection methods to exclude fraudulent wallets and res