Bitcoin miner hashprice nearing $40, miners back in 'survival mode': Report

Bitcoin’s mining sector is under mounting pressure as the hash price, the industry’s key profitability metric, slips toward levels that could force smaller operators offline and strain the wider supply chain.

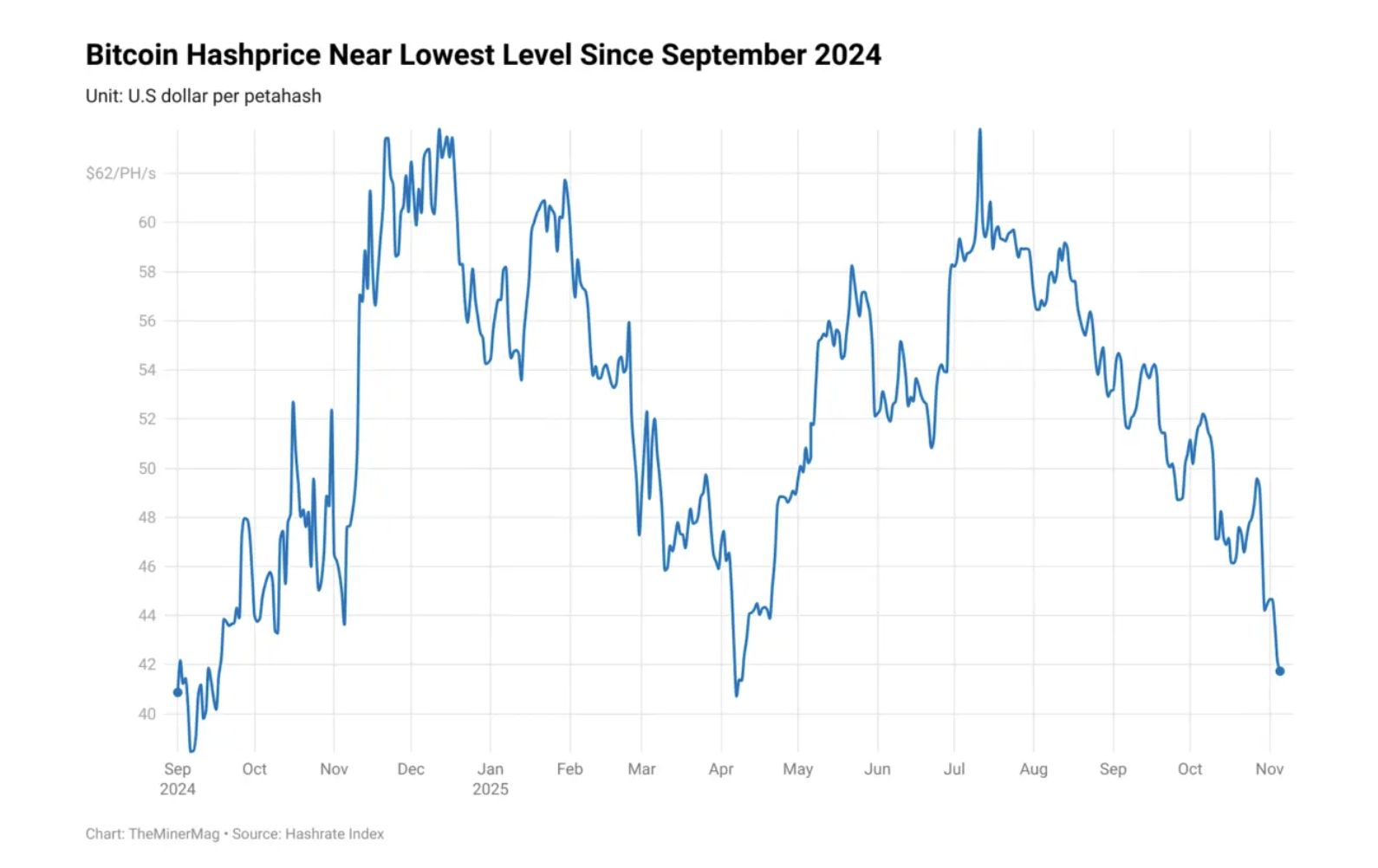

Hash price, which measures expected daily revenue per unit of computational power, is currently around $42 per petahash per second (PH/s). The metric has been in steady decline since July, when it surged above $62 per PH/s.

The push toward the $40 level leads Bitcoin mining operations, which are already facing razor-thin profit margins, to consider shutting down their rigs, according to TheMinerMag.

The decline in hash price is also affecting the mining supply chain. Hardware providers are filling fewer orders to struggling miners and are also taking a hit on any BTC-denominated sales due to the drop in price after the October market crash, the report said.

Mining hardware manufacturers, such as Bitdeer, have turned to self-mining to offset the shortfall in demand for mining machines.

The razor-thin profit margins, high capital expenditure on upgrading hardware and rising energy costs have caused many Bitcoin miners to pivot to AI and high-performance computing data centers to generate revenue as Bitcoin mining becomes more competitive.

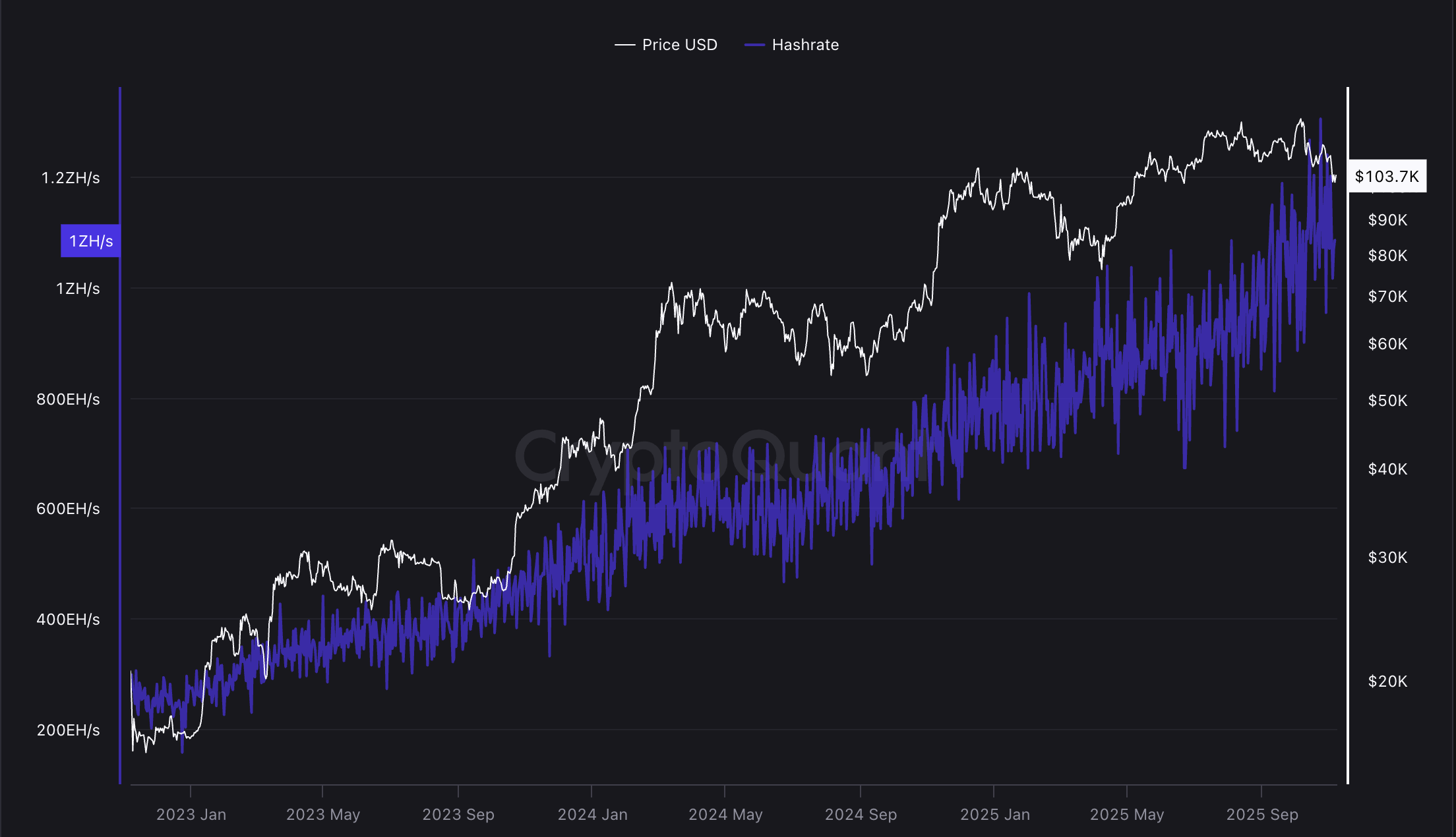

Miners pivot to AI amid constantly increasing hashrate

Bitcoin miners are guaranteed to have their rewards slashed by 50% every four years during the Bitcoin halving, as the computational power and electricity needed to mine blocks continue to climb.

The initial block reward for successfully mining a block in 2009 was 50 BTC, and node runners were mining BTC using CPUs on personal computers.

Following the April 2024 halving, the BTC block reward decreased to 3.125 BTC, and today, specialized mining hardware known as application-specific integrated circuits (ASICs) is required to mine BTC.

These challenging economics have forced many miners to diversify into adjacent AI data center and compute businesses, which have generated billions of dollars in revenue for companies that made the switch.

In October, Cipher Mining inked a $5.5 billion deal with tech giant Amazon to provide compute power to Amazon Web Services over a 15-year period.

IREN, a Bitcoin mining company, signed a similar deal with Microsoft in November to provide GPU computing services, valued at $9.7 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi Faces a Crisis of Trust: Influencers Promote False Profits While Followers Remain Engaged

- Crypto analyst ZachXBT exposed Brandon Hong for fabricating investment profit screenshots, sparking trust concerns in crypto influencers. - Hong's active community highlights risks of unverified advice in DeFi, where KOLs operate with minimal oversight. - The case underscores growing calls for on-chain verification tools and regulatory clarity to combat misinformation in crypto markets.

Bitcoin Updates: Webley Questions Market's Low Valuation While SWC Adopts New Brand for Greater Bitcoin Transparency

- SWC CEO Andrew Webley confirmed adding 4 BTC to corporate reserves, reinforcing Bitcoin's role in long-term value creation. - The rebranding initiative, paired with a £0. 3M capital raise, aims to enhance transparency and align identity with Bitcoin-focused mission. - Institutional Bitcoin adoption grows as Metaplanet (30,800 BTC) and ABTC (4,004 BTC) expand holdings, signaling strategic reserve trends. - Market volatility sees $100B Bitcoin inflows and Ethereum whale purchases, while Anchorage Digital e

November Surge Incoming: Top 5 Meme Coins Set to Pump 300% as Market Heats Up

TOTAL3 Nears Its Final Bottom: 5 Best Altcoins to Trade Before the Next Massive Upswing