Key takeaways:

Bitcoin analyst Timothy Peterson expects two to six months for recovery, though forecasts remain divided.

One model cites historical price action breakout phases from 2017, 2021 and 2024.

Bitcoin’s ( BTC ) recent correction has tempered bullish enthusiasm, with analysts now projecting a slower path toward new highs.

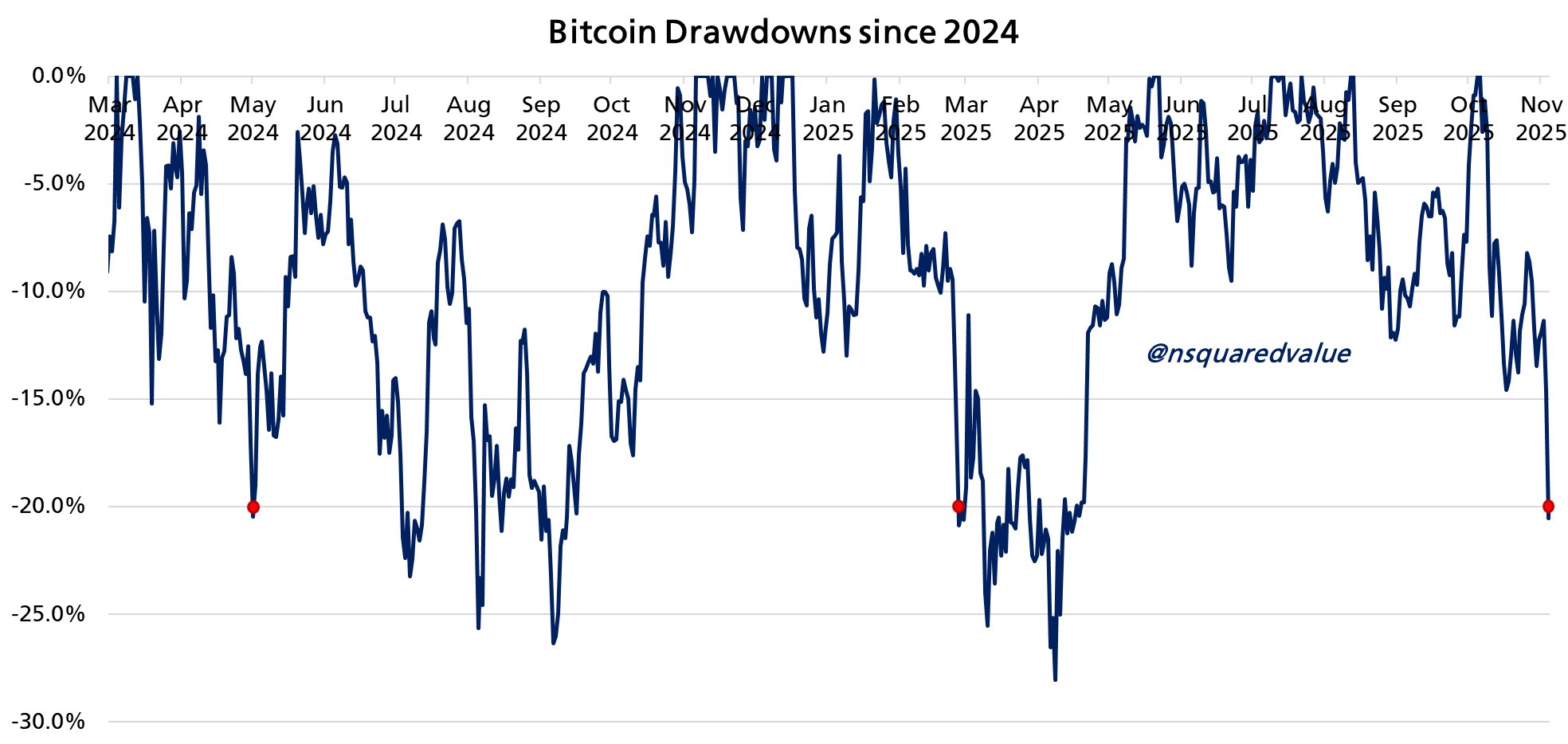

Since reaching an all-time high of $126,200 on Oct. 6, Bitcoin ( BTC ) has dropped roughly 20%, currently hovering under the $100,000 mark. According to network economist Timothy Peterson, this pullback aligns with Bitcoin’s historical recovery patterns. Peterson explained ,

“This is the third 20% drawdown from an all-time high since 2024. The average recovery to a new ATH from these levels is 2–6 months.”

20% Bitcoin drawdown since 2024. Source: Timothy Peterson/X

20% Bitcoin drawdown since 2024. Source: Timothy Peterson/X

The economist wrote that AI-created simulations suggest less than a 20% probability of Bitcoin hitting $140,000 by year-end, a 50% chance of finishing above $108,000, and a 30% chance of ending 2025 in the red.

Similarly, Galaxy Head of Research Alex Thorn has cut the company’s year-end BTC target to $120,000 from $185,000, citing market maturation. Thorn noted that Bitcoin is entering a phase where institutional participation, passive inflows and reduced volatility define price behavior.

Thorn added that maintaining the $100,000 support could keep the three-year bull trend structurally intact, but that “future gains may unfold at a slower, steadier pace as Bitcoin transitions into a maturity era.”

Meanwhile, crypto trader Titan of Crypto offered a more mixed outlook, forecasting a potential new all-time high near $130,000 by year-end, but warned that Bitcoin could plunge below $70,000 by the first quarter of 2026, based on Wyckoff distribution analysis.

Titan of Crypto’s Wyckoff distribution analysis. Source: X

Titan of Crypto’s Wyckoff distribution analysis. Source: X

Related: Bitcoin crisscrosses $100K as BTC price ‘bottoming phase’ begins

Market reset for Bitcoin’s next phase remains active

Despite widespread caution, Bitcoin commentator Shanaka Anslem Perera presented a contrasting view, arguing that the recent correction may actually prime BTC for a parabolic phase.

Perera said 29.2% of Bitcoin’s supply is now underwater, a level historically preceding major rallies. Perera pointed out that similar metrics appeared before the 2017, 2021 and 2024 bull runs, each leading to 150% to 400% gain within six months.

According to Perera, leverage across derivatives markets has been flushed out, while long-term holders now control roughly 70% of supply. Institutional accumulation through ETFs and rising stablecoin reserves suggests “liquidity is recharging beneath the surface.”

The analyst concluded that, unless triggered by a major macro or geopolitical shock, Bitcoin’s current structure mirrors previous pre-breakout conditions, with the next 180 days potentially marking the start of another explosive cycle.

Related: Bitcoin at $100K is ‘speed bump’ to $56K, but data signals no signs of panic