- 50%+ of hedge funds now invest in crypto

- Crypto adoption among institutions continues to grow

- Wall Street is signaling long-term crypto interest

Wall Street Deepens Its Crypto Bets

Crypto is no longer just a fringe asset class. In a major shift, over half of traditional hedge funds now report crypto exposure, up from 47% in 2024. This increase marks a significant step toward broader institutional adoption of digital assets, and it could reshape the financial landscape in the years to come.

For an industry that was once skeptical of cryptocurrencies, this pivot highlights a growing belief in blockchain-based assets as a legitimate part of diversified portfolios.

From Skepticism to Strategy

Just a few years ago, many hedge funds were openly wary of Bitcoin and other cryptocurrencies, citing volatility, regulatory concerns, and security risks. But with maturing infrastructure, clearer regulations, and stronger custodial services, the barriers to entry have lowered.

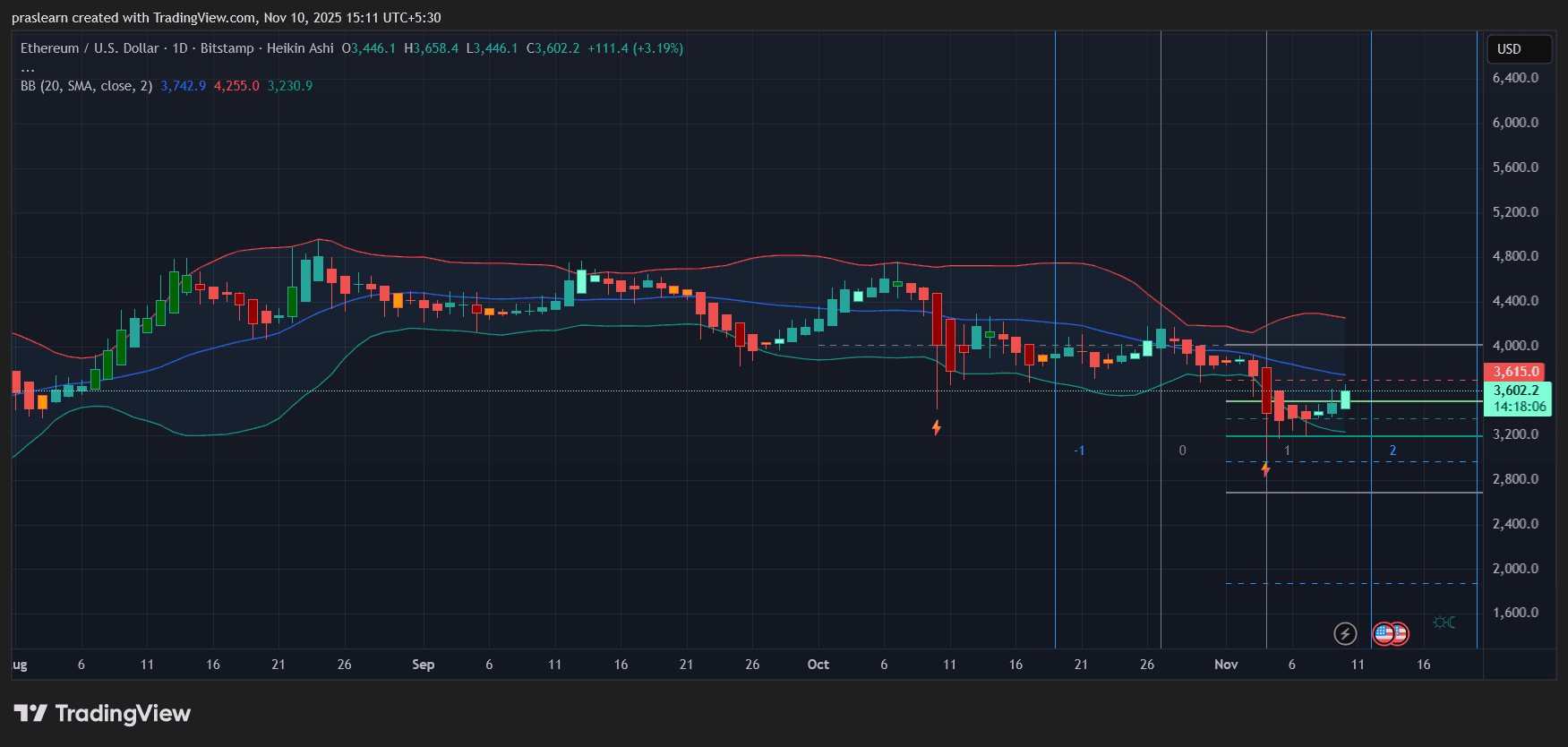

Funds are no longer just dabbling—they’re making meaningful allocations. Some are investing directly in assets like BTC , ETH , and Solana, while others are exploring DeFi , NFTs, and blockchain startups.

Notably, crypto exposure doesn’t always mean buying coins on exchanges. Many funds now use derivatives, futures, or structured products to manage risk and gain exposure more efficiently.

What This Means for Crypto Markets

This rising participation from hedge funds brings more liquidity, stability, and legitimacy to the space. It also suggests that crypto is becoming a permanent fixture in modern investment strategies.

If the trend continues, retail investors may benefit from stronger market confidence, fewer wild swings, and more professional-grade services across the ecosystem.

Read Also:

- U.S. Banks Building Stablecoin Rails After GENIUS Pilot

- Hedge Funds Increase Crypto Exposure in 2025

- Roobet Gambler Closes XRP Short, Doubles Down on BTC

- Crypto Market Sheds $900B Since October Peak

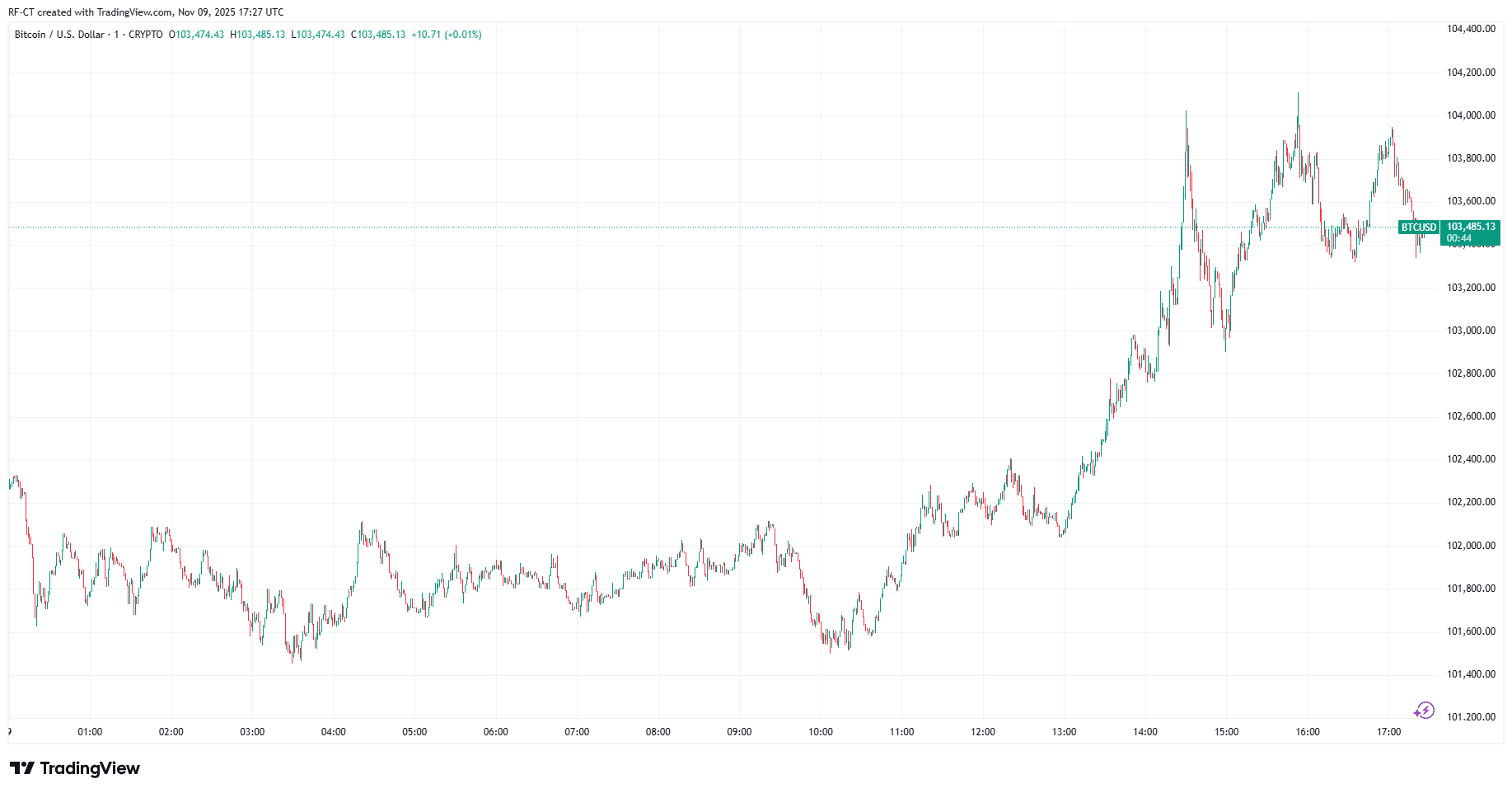

- Remember the Bitcoin November Rally of 2024?