Author: Jarrod Watts

Translation: TechFlow

Application developers are quietly earning millions by building apps on platforms like Hyperliquid and Polymarket, leveraging a brand new revenue attribution system known as “builder codes.”

This is a Roblox model for crypto: the platform serves as a foundation, enabling thousands of applications to build and profit—attributing activity and distributing revenue through unique codes.

In this article, I will break down what builder codes are, how applications are earning millions through them, and how ERC-8021 proposes to natively introduce this system to Ethereum.

What are builder codes?

Builder codes are essentially referral codes designed for application developers—apps can use them to generate trading volume for another platform (such as Hyperliquid) and earn revenue.

This creates an on-chain attribution system, allowing third-party applications (like trading bots, AI agents, and wallet interfaces) to earn fees for the activity they generate on other platforms.

This system is mutually beneficial for all parties involved:

-

Platforms gain more trading volume;

-

Application developers earn revenue for the trading volume they generate;

-

Users enjoy more convenient ways to interact with the platform.

Let’s better understand this with an example—Phantom.

Phantom’s perpetual contract revenue “money printer”

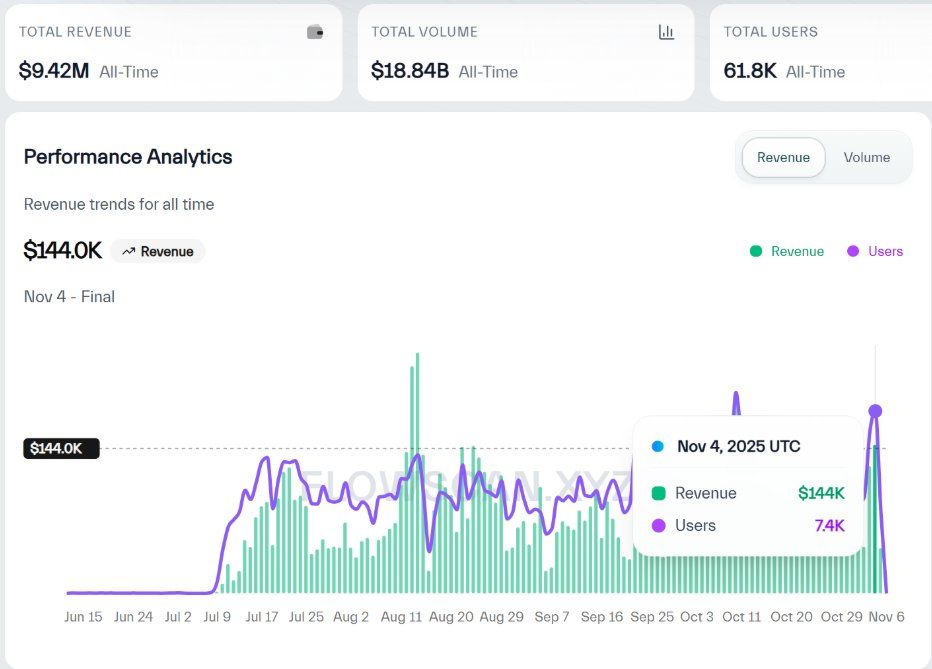

In July this year, Phantom added support for perpetual contract trading by using Hyperliquid’s builder codes, a decision that is currently bringing them about $100,000 in daily revenue.

The way it works is by allowing users to transfer funds into a separate perpetual contract account and conduct long and short trades directly within the mobile app.

For each order, Phantom attaches their builder code and charges a 0.05% fee from users—these fees are recorded through the on-chain attribution system and can be claimed in USDC.

Image: Phantom “tags” user orders from the Phantom wallet app with their builder code, earning these fees

It’s worth noting that all of this relies on Hyperliquid’s external API, making the building process extremely easy and far less costly than developing such complex features independently.

Phantom’s perpetual contract business has already shown an astonishing return on investment (ROI)—since its launch in July, Phantom’s perpetual contract trading volume has approached $20 billions, earning nearly $10 millions in less than six months.

Image: Just yesterday, Phantom earned nearly $150,000 from its perpetual contract business

Interestingly, Phantom’s top perpetual contract user has performed extremely poorly:

-

Lost about 99% of their $2 million perpetual contract portfolio;

-

Net loss of $1.8 million;

-

Paid about $191,000 in fees to Phantom via builder codes. Currently, this user’s only position is a 25x leveraged ETH long (how you interpret this information is up to you).

Unless everyone loses their funds like this user, Hyperliquid will continue to generate huge profits for developers like Phantom who bring trading volume to its platform.

So far, Hyperliquid’s builder codes have achieved:

-

Nearly $40 millions in revenue for application developers;

-

Provided a diverse range of superior user interfaces for perpetual contract trading;

-

Generated over $100 billions in additional perpetual contract trading volume for Hyperliquid!

The success of this model has been rapidly validated, attracting numerous outstanding application developers to build high-quality apps on Hyperliquid.

Polymarket follows closely

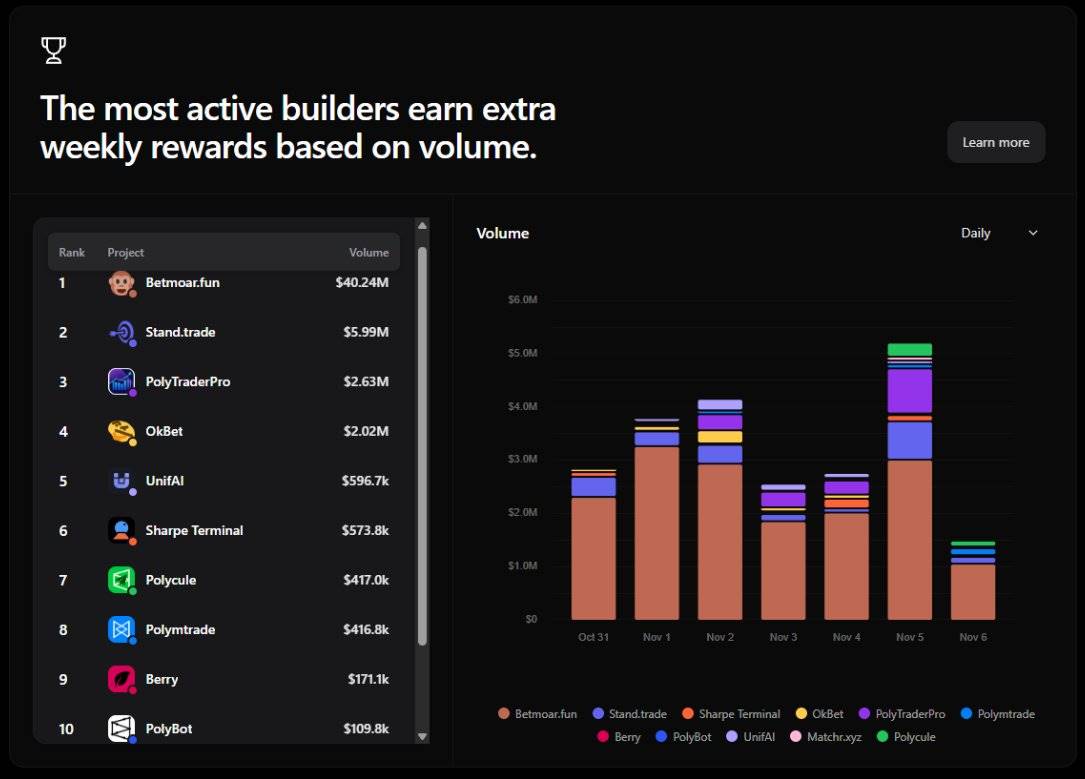

This week, Polymarket announced a similar Builders Program, aiming to reward application developers for bringing trading volume to its prediction markets.

To promote the integration of Builder Codes, Polymarket launched a weekly USDC reward program based on integrated trading volume.

Although trading volume from third-party Polymarket applications is currently much lower than Hyperliquid, its builder codes have already attracted some teams to develop user interfaces, offering users unique ways to make predictions.

Image: Over $50 millions in bets completed through third-party Polymarket applications

Polymarket appears to be helping expand the scope of builder applications, from trading terminals to AI assistants, and has also created a dashboard similar to Hyperliquid’s to showcase top builders and their rewards.

It is expected that other prediction markets will launch similar programs to compete, and a broader application ecosystem may follow this successful referral system model.

However, Ethereum has the opportunity to take this model to new heights, encouraging high-quality application developers to create innovative user interfaces based on the mature and reliable Ethereum platform.

ERC-8021 and Ethereum’s opportunity

Ethereum now has the chance to natively integrate builder codes into both L2 and L1 layers, and a recent proposal has put forward an interesting implementation.

ERC-8021 proposes to embed builder codes directly into transactions, combined with a registry where developers can provide wallet addresses to receive revenue.

Implementing this proposal would provide a standardized way to add builder codes to any transaction, while defining a universal mechanism for platforms to reward application developers for the trading volume they generate.

ERC-8021 consists of two core components:

-

New transaction suffix: Developers can add small data at the end of a transaction to include their builder code, such as “phantom,” “my-app,” or “jarrod.”

-

Code registry: A smart contract where developers can map their builder code to a wallet address to receive platform revenue distribution.

Builder codes can be added to the end of transaction data and optionally mapped to a wallet address to receive revenue.

This would allow any platform to attribute on-chain activity to the originating application and transparently and programmatically distribute revenue directly to those developers.

Conclusion

Hyperliquid users may already be familiar with builder codes, but upon deeper research, it’s truly shocking how widely they have been adopted in such a short time.

The reason for their success is obvious: builders are rewarded for creating high-quality consumer applications based on powerful crypto primitives.

Ethereum has a vast pool of existing high-quality platforms that can be integrated into a standardized builder code system to drive a new wave of consumer-facing applications.

Builder codes unlock new revenue streams for high-quality application developers—revenue that doesn’t depend on grants from conference parties, but is based on the value they provide to users.