AI’s Bold Bet: Some Soar While Others Falter Amid Turbulent Tech Transformation

- AI sector volatility highlights divergent outcomes as firms adopt agentic AI systems, with SoundHound AI and Rightmove exemplifying contrasting success and risk. - SoundHound AI's Red Lobster partnership and margin improvements reduced risk perception despite high valuation, driving analyst optimism about enterprise AI adoption. - Rightmove's 25% stock plunge followed AI investment plans that slashed 2026 profit forecasts, reflecting investor skepticism toward short-term profitability trade-offs. - C3.ai

The AI industry is experiencing rapid and significant changes as organizations grapple with the demands of deploying sophisticated agentic AI technologies. Some businesses are harnessing AI to accelerate progress and foster innovation, while others are encountering financial and operational setbacks that highlight the sector’s unpredictability. The differing outcomes for companies such as

SoundHound AI, recognized for its expertise in conversational AI, has become a standout performer during this period of upheaval. The firm posted robust third-quarter numbers, featuring stronger non-GAAP gross margins and a notable partnership with Red Lobster to implement agentic AI across the enterprise

In contrast, the UK’s property platform Rightmove saw its shares tumble by 25% after disclosing a major shift of resources toward AI development. The company is allocating £18 million to AI projects aimed at digitizing the home-buying journey, focusing on long-term transformation at the expense of immediate profits

The instability of the industry is further demonstrated by the difficulties facing enterprise AI company C3.ai. After founder Thomas Siebel stepped down for health reasons, the company is now considering a sale amid falling revenues and a 54% decline in its stock price this year

At the same time, Chinese firm Moonshot AI has shaken up AI benchmarks with its open-source Kimi K2 Thinking model. This trillion-parameter system surpasses GPT-5 and Claude 4.5 Sonnet in several key areas, achieving 44.9% on Humanity’s Last Exam and 71.3% on coding tests

These varied stories highlight the complex challenges AI-focused companies face. While innovation and strategic alliances can drive expansion, the initial investments and operational risks of adopting AI remain substantial obstacles. For those investing in the sector, it is crucial to weigh the promise of AI’s transformative impact against the practical risks of execution and ongoing market instability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Rally: On-Chain Usage Growth and DeFi Cross-Chain Innovations Fuel Upward Trend

- Astar (ASTR) surged to $1.26 in late 2025 after Binance's CZ bought $2M in tokens, but ecosystem upgrades drove sustained momentum. - Q3 2025 saw 20% active wallet growth, $3.16M whale accumulation, and $2.38M TVL resilience amid broader DeFi declines. - Astar 2.0's 150,000 TPS cross-chain hub and partnerships with Casio/Mazda bridged Web2/Web3, enhancing DeFi interoperability. - Whale activity showed mixed signals, but strategic upgrades and $0.80–$1.20 2030 price targets highlight long-term investment

Hyperliquid News Today: The Reason 2025 Crypto Presales Focus on Practical Use Rather Than Hype

- 2025 crypto presales prioritize utility-driven projects like Noomez ($NNZ), Bonk ($BONK), and Floki ($FLOKI) with structured tokenomics and transparency. - Noomez employs a 28-stage BNB Chain price ladder, liquidity locks, and token burns to create scarcity, currently at $0.0000151 in Stage 3. - Bonk transitions from meme coin to utility-focused Solana project with DeFi integrations, while Floki combines meme appeal with metaverse and staking tools. - Presales offer early-stage advantages over listed tok

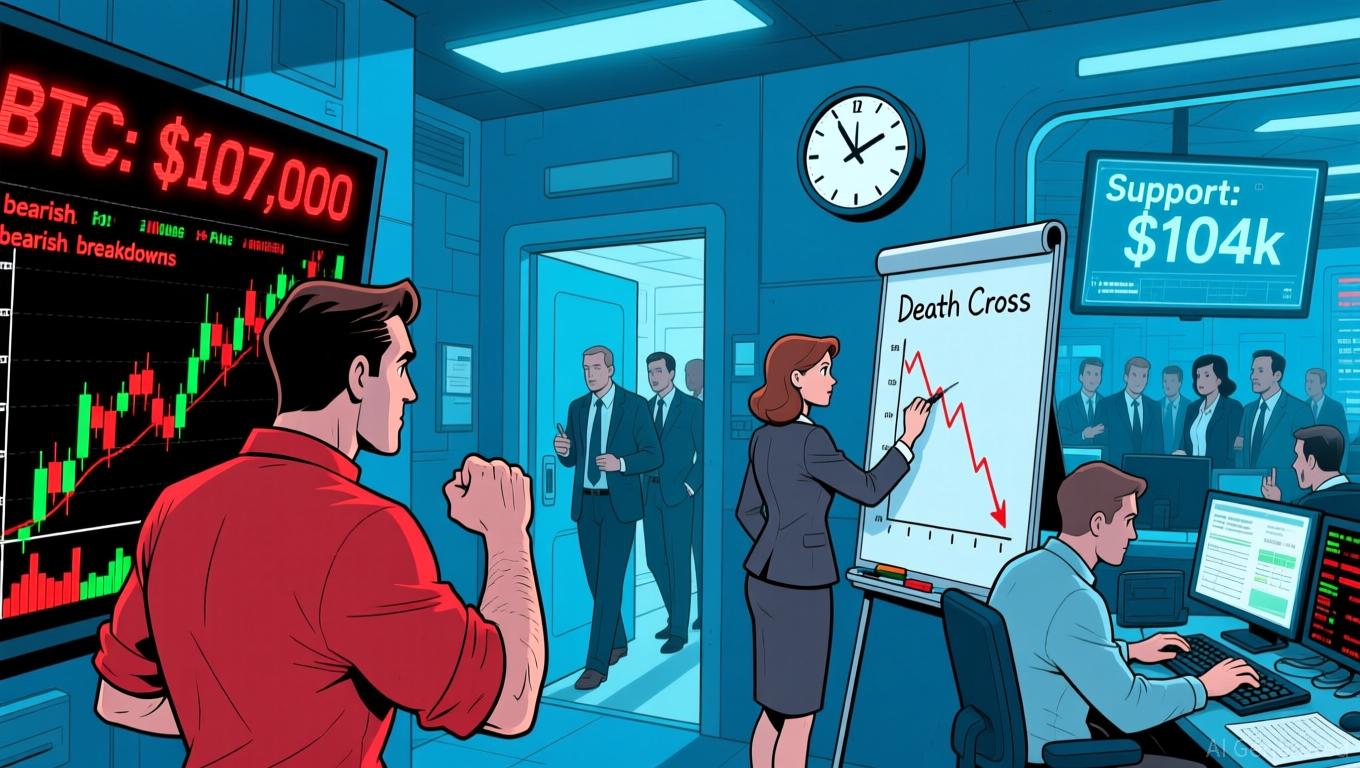

Bitcoin News Update: Bitcoin’s $100,000 Support Falters Amid Rising Death Cross and Increased Miner Sell-Off

- Bitcoin's failed $107,000 breakout triggered a "death cross" bearish pattern as 50-day SMA fell below 200-day SMA, signaling prolonged downward pressure. - Key support at $104,000 becomes critical for stabilizing BTC, with CME futures gaps potentially enabling bounces if buyers intervene. - Institutional panic selling risks accelerating declines below $100,000, with ETF liquidity "air pockets" at $93,000 amplifying volatility concerns. - Miner selling and weak ETF inflows constrain recovery attempts, whi

Transparent scarcity is what fuels Noomez's attractiveness within the speculative cryptocurrency market

- Analysts highlight Noomez ($NNZ) as 2025's top crypto pick due to deflationary mechanics and transparent on-chain metrics. - Project's 28-stage presale model burns unsold tokens, raising prices as supply shrinks, with $20,000+ raised in Stage 3. - Noom Engine ecosystem and 15% liquidity lock differentiate it from speculative projects, offering post-launch utility and staking rewards. - Vault Events and KYC-verified team address security concerns, while real-time tracking on Noom Gauge builds investor tru