Uniswap launches token burn and fee distribution, reshaping DeFi protocol revenue model

Author: Rhythm Worker

Original Title: Destruction, Uniswap's Last Trump Card

After waking up, UNI surged nearly 40%, driving a general increase across the entire DeFi sector.

The reason for the rise is that Uniswap has played its final trump card. Uniswap founder Hayden released a new proposal, with the core content revolving around the long-discussed "fee switch" topic. In fact, this proposal has already been raised seven times in the past two years and is no longer new to the Uniswap community.

However, this time is different. The proposal was initiated by Hayden himself, and in addition to the fee switch, it also covers a series of measures such as token burning, the merger of Labs and Foundation, and more. Some whales have already expressed support, and in prediction markets, the probability of the proposal passing is as high as 79%.

2 Years, 7 Failures: The Repeatedly Defeated "Fee Switch"

The fee switch is actually a fairly common mechanism in the DeFi sector. Take Aave as an example: it successfully activated the fee switch in 2025, using a "buy + distribute" model to use protocol revenue for AAVE token buybacks, pushing the token price from $180 to $231, an annualized increase of 75%.

Besides Aave, protocols such as Ethena, Raydium, Curve, and Usual have also achieved significant success with their fee switches, providing sustainable tokenomics models for the entire DeFi industry.

Given so many successful precedents, why can't Uniswap get it passed?

a16z Has Relented, But Uniswap's Troubles Are Just Beginning

This brings us to a key player—a16z.

In Uniswap's history, the quorum has generally been low, usually requiring only about 40 million UNI to reach the voting threshold. However, this venture capital giant previously controlled about 55 million UNI tokens, giving it a very direct influence on the voting outcome.

They have always opposed related proposals.

As early as the two temperature checks in July 2022, they chose to abstain, only expressing some concerns on the forum. But by the third proposal in December 2022, when pools like ETH-USDT and DAI-ETH were preparing to activate a 1/10 fee rate on-chain vote, a16z cast a clear "no" vote, using 15 million UNI voting power. This vote ended with a 45% approval rate; although the majority supported it, it failed due to insufficient quorum. On the forum, a16z made it clear: "We ultimately cannot support any proposal that does not consider legal and tax factors." This was their first public opposition.

In subsequent proposals, a16z consistently maintained this stance. In May and June 2023, GFX Labs launched two consecutive fee-related proposals. Although the June proposal received a 54% approval rate, it failed again due to insufficient quorum under the influence of a16z's 15 million opposing votes. In March 2024, the same script played out again with a governance upgrade proposal—about 55 million UNI supported it, but it failed due to a16z's opposition. The most dramatic was from May to August 2024, when the proposers tried to establish a Wyoming DUNA entity to circumvent legal risks. The vote was originally scheduled for August 18 but was indefinitely postponed due to "new issues from unnamed stakeholders," widely believed to refer to a16z.

So what exactly is a16z worried about? The core issue lies in legal risks.

They believe that once the fee switch is activated, the UNI token may be classified as a security. According to the famous Howey Test in the US, if investors have a reasonable expectation of "profits from the efforts of others," the asset may be deemed a security. The fee switch creates exactly this expectation—protocol generates revenue, token holders share in the profits, which is highly similar to the profit distribution model of traditional securities. a16z partner Miles Jennings bluntly stated in a forum comment: "A DAO without a legal entity faces exposure to personal liability."

In addition to securities law risks, tax issues are equally thorny. Once fees flow into the protocol, the IRS may require the DAO to pay corporate taxes, with preliminary estimates of back taxes possibly reaching $10 million. The problem is, the DAO itself is a decentralized organization without the legal entity or financial structure of a traditional company. How to pay taxes and who bears the cost are unresolved issues. Without a clear solution, rashly activating the fee switch could expose all governance participants to tax risks.

As of now, UNI remains the largest single token holding in a16z's crypto portfolio, with about 64 million UNI, still enough to influence voting outcomes alone.

But as we all know, with Trump elected president and the SEC leadership changing, the crypto industry has entered a politically stable spring, reducing Uniswap's legal risks and showing a16z's gradually softening attitude. Clearly, this is no longer a major issue, and the chances of this proposal passing have greatly increased.

But this does not mean there are no other conflicts; Uniswap's fee switch mechanism still has some points of contention.

You Can't Have Your Cake and Eat It Too

To understand these new controversies, we first need to briefly explain how this fee switch actually works.

From a technical implementation perspective, this proposal makes detailed adjustments to the fee structure. In the V2 protocol, the total fee remains at 0.3%, but 0.25% is allocated to LPs and 0.05% goes to the protocol. The V3 protocol is more flexible, with protocol fees set at one-fourth to one-sixth of LP fees. For example, in a 0.01% liquidity pool, the protocol fee is 0.0025%, equivalent to a 25% split; in a 0.3% pool, the protocol fee is 0.05%, about 17% of the total.

Based on this fee structure, Uniswap conservatively estimates annualized revenue of $10 million to $40 million, and in a bull market scenario, based on historical peak trading volumes, this number could reach $50 million to $120 million. Meanwhile, the proposal also includes the immediate burning of 100 million UNI tokens, equivalent to 16% of circulating supply, and the establishment of a continuous burning mechanism.

In other words, through the fee switch, UNI will transform from a "valueless governance token" into a true yield asset.

This is certainly great news for UNI holders, but the problem lies precisely here. The essence of the "fee switch" is the redistribution between LPs and protocol revenue.

The total fees paid by traders do not change; it's just that the profits that originally went entirely to LPs will now be partially allocated to the protocol. The wool comes from the sheep's back: as protocol revenue increases, LP income will inevitably decrease.

You can't have your cake and eat it too. When it comes to "LPs or protocol revenue?" Uniswap has clearly chosen the latter.

Community discussion: Once the "fee switch" takes effect, it will cause half of Uniswap's trading volume on the Base chain to disappear overnight.

The potential negative impact of this redistribution should not be underestimated. In the short term, LP income will be reduced by 10% to 25%, depending on the protocol fee split ratio. More seriously, according to model predictions, 4% to 15% of liquidity may migrate from Uniswap to competing platforms.

To mitigate these negative effects, the proposal also introduces some innovative compensation measures. For example, the PFDA mechanism internalizes MEV, providing LPs with additional income—every $10,000 in trading can bring $0.06 to $0.26 in extra returns. The V4 version's Hooks feature supports dynamic fee adjustments, and aggregator hooks can open up new revenue sources. In addition, the proposal adopts a phased implementation strategy, starting with core liquidity pools, monitoring the impact in real time, and adjusting based on data.

The Dilemma of the Fee Switch

Despite these mitigation measures, whether they can truly dispel LPs' concerns and allow the proposal to be implemented remains to be seen. After all, even with Hayden personally stepping in, it may not be enough to save Uniswap from this predicament.

The more direct threat comes from market competition, especially the head-to-head battle with Aerodrome on the Base chain.

After Uniswap's proposal, Alexander, CEO of Dromos Labs (the Aerodrome development team), mocked on X: "I never expected that on the eve of the most important day for Dromos Labs, our biggest competitor would deliver such a major blunder."

Aerodrome Is Crushing Uniswap on the Base Chain

Data shows that in the past 30 days, Aerodrome's trading volume was about $20.465 billions, accounting for 56% of the Base chain's market share; Uniswap's trading volume on Base was about $12-15 billions, with a market share of only 40-44%. Aerodrome not only leads by 35-40% in trading volume, but also surpasses Uniswap in TVL, with $473 million compared to Uniswap's $300-400 million.

The root of the gap lies in the huge difference in LP yields. Take the ETH-USDC pool as an example: Uniswap V3's annualized yield is about 12-15%, coming only from trading fees; Aerodrome, through AERO token incentives, can offer 50-100% or even higher annualized yields, 3-7 times that of Uniswap. In the past 30 days, Aerodrome distributed $12.35 million in AERO incentives, precisely guiding liquidity through the veAERO voting mechanism. In contrast, Uniswap mainly relies on organic fees, occasionally launching targeted incentive programs, but on a much smaller scale than its competitors.

As someone in the community pointed out: "The reason Aerodrome can crush Uniswap in Base trading volume is that liquidity providers only care about the return on every dollar of liquidity they provide. Aerodrome wins in this regard." This observation hits the nail on the head.

For LPs, they won't stay because of Uniswap's brand influence—they only care about yields. On emerging L2s like Base, Aerodrome, as a native DEX, has established a strong first-mover advantage with its specially optimized ve(3,3) model and high token incentives.

In this context, if Uniswap activates the fee switch and further reduces LP yields, it may accelerate the migration of liquidity to Aerodrome. According to model predictions, the fee switch could cause a 4-15% liquidity loss, and on a fiercely competitive battlefield like Base, this percentage could be even higher. Once liquidity drops, trading slippage increases, trading volume will also decline, forming a negative spiral.

Can the New Proposal Save Uniswap?

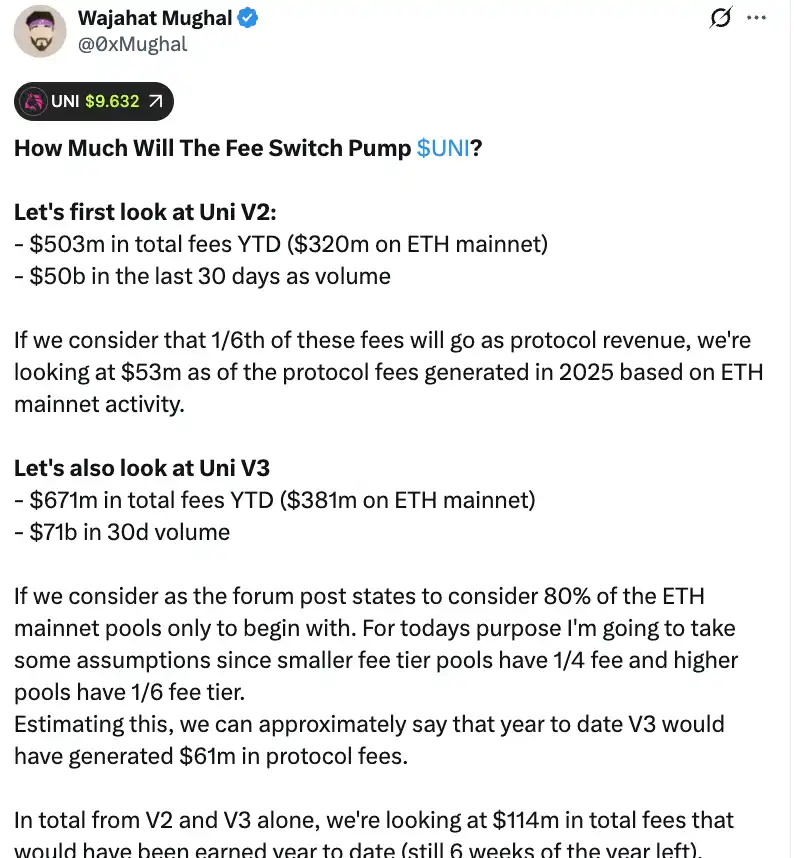

From a purely numerical perspective, the fee switch can indeed bring considerable revenue to Uniswap. According to detailed calculations by community member Wajahat Mughal, the situation is already quite impressive just looking at V2 and V3.

The V2 protocol has generated $503 million in total fees from early 2025 to now, with $320 million contributed by the Ethereum mainnet and $50 billions in trading volume in the past 30 days. If calculated at a 1/6 fee split, based on Ethereum mainnet activity, protocol fee income in 2025 is expected to reach $53 million. V3's performance is even stronger, with total fees reaching $671 million since the beginning of the year, $381 million from the Ethereum mainnet, and $71 billions in 30-day trading volume. Considering the different split ratios for various fee pools—low-fee pools charge a 1/4 protocol fee, high-fee pools charge 1/6—V3 may have already generated $61 million in protocol fees so far this year.

Adding V2 and V3 together, protocol fee income since the beginning of the year is estimated to be $114 million, and that's with six weeks left in the year. More importantly, this figure has not yet tapped Uniswap's full income potential. This calculation does not include the remaining 20% of V3 pools, fees from all chains outside the Ethereum mainnet (especially the Base chain, whose fees are almost equal to the mainnet), V4 trading volume, protocol fee discount auctions, UniswapX, aggregator hooks, or Unichain sequencer revenue. If all these are included, annualized income could easily exceed $130 million.

Combined with the plan to immediately burn 100 million UNI tokens (worth over $800 million at current prices), Uniswap's tokenomics will undergo a fundamental change. After the burn, fully diluted valuation will drop to $7.4 billions, with a market cap of about $5.3 billions. Based on $130 million in annualized income, Uniswap could buy back and burn about 2.5% of circulating supply each year.

This means UNI's P/E ratio is about 40x. While this may not seem cheap, considering there are many income growth mechanisms yet to be fully realized, this number has plenty of room to fall. As someone in the community remarked: "This is the first time the UNI token truly seems attractive to hold."

However, behind these impressive numbers, there are also hidden concerns that cannot be ignored. First, the trading volume in 2025 is significantly higher than in previous years, largely thanks to the bull market. Once the market enters a bear cycle and trading volume drops sharply, protocol fee income will shrink accordingly. Using bull market data as the basis for long-term valuation is clearly misleading.

Second, the method of burning and the specific operation of the potential buyback mechanism are still unknown. Will it use an automated buyback system like Hyperliquid, or be executed in other ways? The frequency of buybacks, price sensitivity, and market impact—all these details will directly affect the actual effect of the burn mechanism. If not executed properly, large-scale market buybacks could trigger price volatility, putting UNI holders in an awkward "left hand to right hand" situation.

When platforms like Aerodrome, Curve, Fluid, and Hyperliquid Spot are all attracting liquidity with high incentives, will Uniswap's reduction of LP yields accelerate capital outflows? The data looks great, but if liquidity—the foundation—is lost, even the most beautiful income forecasts are just castles in the air.

The fee switch can undoubtedly provide value support for UNI. But whether it can truly "save" Uniswap and restore this former DeFi giant to its peak remains to be tested by both time and the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zero flow to Bitcoin ETFs: The market sulks despite a favorable context

Bitcoin Eyes Year-End ‘Santa Claus Rally’ After October Setbacks

SOL Price Prediction 2025: Is Solana Heading Toward a Deeper Correction Before 2025?

Chainlink Price Prediction 2025: Is LINK Positioned to Gain Most from Tokenization Growth?