Aster Phase Two: From Trading Products to Market Infrastructure

From Perp DEX to privacy public chains, Aster is attempting to make trading itself the new consensus.

From Perp DEX to privacy public chains, Aster is attempting to make trading itself the new consensus.

Written by: Sanqing, Foresight News

In this cycle, perpetual contract DEXs have evolved from an innovation to a standard feature. From on-chain leverage, funding rates, and market-making subsidies, to rounds of trading points and trading competitions, the story has been repackaged many times, but the gap between trading experience and decentralization has yet to be truly bridged. Aster’s choice is not to keep refining a “faster Perp DEX” within the existing framework, but to elevate the problem to a higher level, aiming directly at “a public chain born for trading.” According to founder Leonard, the next step for perpetual DEXs is to no longer be attached to the periphery of a general-purpose chain, but to become infrastructure capable of supporting the entire on-chain trading order.

In the latest community AMA, Leonard did not stay at the level of functional iteration, but instead rewove privacy L1, public chain-level order books, the Trade & Earn narrative, USDF stablecoin, Rocket Launch, and a global regional partner network into a clear main thread. Perp DEX is only Aster’s starting point, not its end.

A Chain Built for Order Books, Embedding Privacy into the Consensus Layer

To understand Aster’s reconstruction experiment, one must first return to a seemingly basic but often overlooked question: Who are existing public chains actually designed for? Most general-purpose public chains are architected to serve “programmable assets” and “verifiable settlement,” while trade matching is often attached externally via contracts or off-chain systems, making the blockchain more like a sluggish and expensive database. For simple AMMs or low-frequency interactions, this structure can still function, but once a centralized order book is moved on-chain, its limitations become glaringly obvious.

Aster’s L1 approach is to pull the order book from its external position back into the protocol core. Placing orders, matching, canceling, and withdrawing are no longer just contract functions, but are encoded into the consensus and execution layers, becoming the primary constraints for resource scheduling and performance optimization on this chain. It no longer asks, “How to adapt trading on a general-purpose chain,” but instead, “If a chain is designed from the perspective of trading, what should its architecture look like?”

Interestingly, Leonard, who has a background in high-frequency trading infrastructure, does not fall into the trap of TPS worship. He candidly admits that in terms of pure performance, no chain at this stage can defeat centralized matching engines and databases; if the sole pursuit is ultimate matching speed, the answer will always be “stay on CEX.” The real value provided by blockchain is that, under the premise of being “fast enough,” it overlays verifiability and self-custody, allowing participants to personally verify assets and rules instead of entrusting everything to a black box. Aster does not seek to surpass the speed of centralized matching engines, but to achieve a balance between verifiability and self-custody under the premise of being “fast enough.”

Privacy is raised to the same level of importance as performance in this structure. Founder Leonard repeatedly emphasizes that for professional trading teams, not exposing the full position structure and execution rhythm is not a luxury, but the baseline for strategy survival. While a fully transparent order book is conceptually pure, in practice it is likely to drive away the institutional funds that truly provide depth and liquidity. What Aster wants to build is an L1 that matches mainstream high-performance chains in speed, while providing selective privacy at the order and position level.

In terms of design philosophy, this privacy is not a denial of the principle of transparency, but a finer-grained control. Dimensions that require building reputation and trust can remain verifiable; dimensions that need to protect strategy and intent are given a constrained privacy space. Leonard compares Aster to the recent privacy token boom, believing that the combination of order books and privacy will be one of the hot directions in the next wave of on-chain infrastructure competition. On the timeline, the team has set a high-pressure pace for itself. The internal goal is to complete the final L1 test and launch the testnet by the end of this year, and to enter the externally available phase in the first quarter of next year.

A Near Zero Gas World: How the ASTER Economic Loop “Hardens”

When an L1 claims to push gas costs close to zero, the first question that must be answered is: how do validators and the protocol’s economic loop sustain themselves? Aster avoids vague talk of “ecosystem incentives” and directly reveals the sharing of protocol-level trading revenue and the ecosystem fund pool reserved for this purpose.

At the current stage, the ASTER token already serves several directly tangible functions. Trading fee discounts and VIP tiers give high-balance and highly active users a clear advantage in rates, which is a real competitive edge for professional funds that use cost and slippage as model inputs. Various platform activities and new project launches such as Rocket Launch also require ASTER tokens as a prerequisite for participation, turning the token from a static position into a ticket for involvement.

The longer-term design is reserved for the post-L1 world. Validators and nodes will need to stake ASTER tokens to participate in block production and governance, and a portion of the protocol-level trading fees will be returned to stakers and infrastructure providers according to rules. In addition, the team is working with lending and yield protocols (such as Lista and Venus) to further expand the sources of yield and capital efficiency for ASTER tokens. In a near-zero gas environment, the importance of this portion of trading revenue is actually amplified—it is both a continuous subsidy for network security and a real-time feedback on the health of the ecosystem’s cash flow. Aster can maintain a near-zero gas model in the long term mainly because the protocol has continuously generated positive cash flow, which supports validator incentives and ecosystem subsidies.

The community’s highly anticipated buyback and burn mechanism is also being gradually advanced to an “auditable” dimension, with Aster already executing buybacks on the on-chain secondary market using real revenue. Once L1 is launched, the buyback logic can be directly written into smart contracts for automatic execution, making the quantity, price, and address of each buyback publicly verifiable, avoiding front-running and information asymmetry, while retaining enough algorithmic flexibility to allow different buyback parameters at different stages.

As this mechanism extends from short-cycle exploration to more stable time windows, the “protocol revenue–buyback–burn” will evolve from a public commitment to a repeatedly verifiable on-chain path. In this structure, the ASTER token is no longer just a narrative vehicle, but simultaneously serves as a trading experience regulator, participation credential, and security cornerstone. The process of the ASTER economic structure truly “hardening” will be built up in every block cycle through the repeated overlay of cash flow and governance actions.

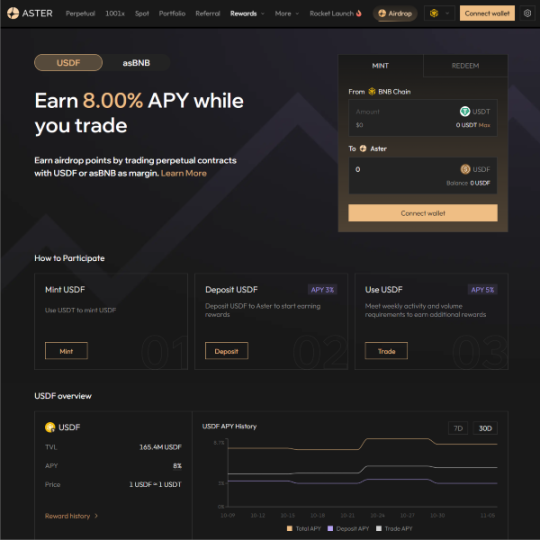

Trade & Earn: The Landing Point for USDF, Stable Yield, and Strategy Migration

Breaking down Aster’s vision into two sentences, one half is “reconstructing trading infrastructure,” and the other is “internalizing the yield layer into the trading experience.” The Trade & Earn narrative is the vehicle for this latter half. A truly attractive trading environment should not only offer leverage and market data, but also provide a relatively stable yield curve, so that funds have a basic “floor” before taking on risk exposure.

To this end, Aster is expanding trading targets, from traditional crypto spot and derivatives to gold and other commodities, and further to more commodities and stock indices. These assets often lack on-chain liquidity and require patient market-making arrangements and more detailed risk control. The team does not deny this is a shortcoming, and deliberately treats it as a high-potential experimental ground, using more targeted market maker incentives and risk control structures to fill long-ignored market gaps.

On the other hand, they are trying to deeply bind stable yield itself to the trading system. The team has already operated a type of stable yield product that can provide a relatively smooth return curve for funds and allows users to use it as collateral for leveraged trading. For institutional accounts with huge capital and high leverage, this means that every unit of notional position is backed by a continuously operating yield stream—even a few percentage points of difference will accumulate into a visible advantage under high turnover.

The USDF stablecoin is the embodiment of this idea. Unlike the traditional model of holding large amounts of assets on third-party platforms and stacking multiple layers of leverage, Aster chooses to encapsulate its own understanding of risk-neutral strategies directly into USDF. The counterparty risk and off-chain leverage issues frequently exposed in the recent stablecoin market are here redesigned into an internal loop that relies more on its own infrastructure. USDF thus becomes a hub asset that serves both trading and yield, rather than existing solely for the sake of having a stablecoin.

For professional traders, this brings not just a new collateral asset, but a trackable and assessable source of yield. As the hub in the Trade & Earn narrative, USDF connects the platform’s endogenous strategies and income on one end, and users’ leveraged positions and risk preferences on the other. Rather than calling it a “product-type stablecoin,” it is better described as a foundational component designed to make strategy migration smoother.

The Triangular Balance of Self-Custody, Transparency, and Privacy

When the market places Aster in the same comparison framework as other Perp DEXs or even some on-chain derivatives platforms, Leonard’s response does not attempt to simply dismiss competitors as “outdated.” On the contrary, he admits that in terms of institutional flow, the real competitors today are still centralized exchanges. The key incentives for institutions to choose on-chain trading are not only the trustless self-custody, but also the higher capital efficiency and optional strategy privacy brought by Aster’s USDF design.

For these funds, the fee structure is important, but the primary concern is always fund security and counterparty risk. After the FTX collapse, more and more institutions began to seriously review custody models and asset paths. Self-custody is no longer an ideological slogan, but a hard constraint in internal compliance and risk control processes. On-chain verifiable ledgers offer a new possibility, and the advantages of Perp DEXs in funding rates and product flexibility have been revalued in this round of scrutiny.

Here, Aster is trying to provide a “structural marginal advantage.” On one hand, it offers a thicker yield layer for funds in the same market volatility through more competitive rates, rebates, and the Trade & Earn combination. On the other, it provides a realistic path for strategy migration on-chain through future privacy L1 and optional privacy order books.

Fully transparent position structures may be an “intelligence advantage” for retail groups capable of capturing liquidity and sentiment, but for institutional funds with complex strategies, it is exposure. This is why Aster regards privacy options as a key variable for the success of a new chain, not just an “add-on feature” in a whitepaper. Only when self-custody, transparency, and privacy are reconstructed into a reconcilable triangle will professional funds seriously consider on-chain execution as a main channel rather than an experimental ground.

On the liquidity layer, Aster is also reconstructing its incentive structure. The depth of major coin pairs has been steadily increasing, and the next stage will focus on long-tail assets. The market maker program will favor professional market makers willing to provide stable two-way quotes for small coins and new assets. For users, this means that on one chain, they can see the robust depth of traditional mainstream assets and also capture opportunities in the broader pool of long-tail assets where efficiency has not yet been fully unleashed.

Rocket Launch and On-Chain Asset Generation: Building the Same Infrastructure for Both Degens and Institutions

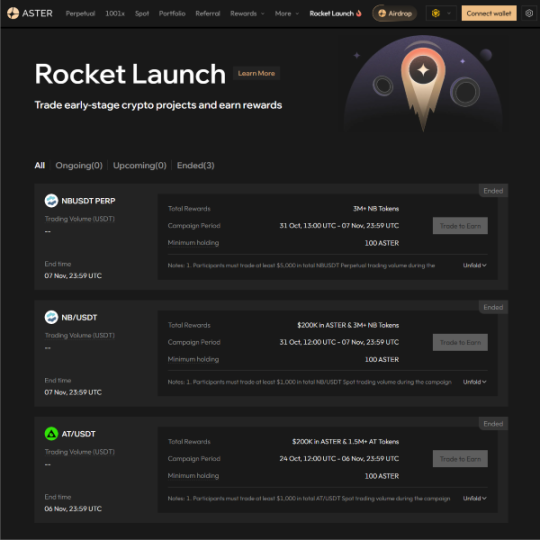

Rocket Launch is the most easily perceived “surface product” by outsiders, but in Aster’s product line, it is more like a long-term experiment around the mechanism of on-chain asset generation.

In terms of launching new perpetual and spot products, Aster’s principle is to “satisfy trading willingness first.” For perpetual products, the focus is on whether there is real trading demand and liquidity; for spot launches, more attention is paid to team integrity and project fundamentals. As long as liquidity can be ensured and there are enough opinions and positions willing to trade around a certain asset, it is eligible to enter the perpetual list. Because in a scenario where two-way trading is possible, price movement is no longer the only value judgment dimension—what matters is whether the market is sufficiently controversial and whether volatility can support strategies.

For spot listings and early project support, the criteria are significantly tightened. The team looks at product and technical fundamentals, team execution and integrity records, and whether they can “push the project up a level” in terms of liquidity and users. The ideal Rocket Launch target is not a “narrative coin” created out of thin air, but projects that already have some product foundation and community base but are stuck at the liquidity bottleneck stage. Aster hopes to create a liquidity accelerator for these projects through market-making support, launch activities, and airdrop design, while allowing participating users and market makers to share in the growth gains.

In line with this thinking, Aster remains restrained in its chain coverage and integration strategy. The number of natively supported new chains will not expand indefinitely, and access to non-EVM chains requires clear business and technical justification. More long-tail assets and cross-chain scenarios will be handled by mature cross-chain bridges and external infrastructure. Cooperation with fair launch platforms and crowdfunding-type Launchpads gives Aster the opportunity to intervene at the early stage of assets, becoming part of the “liquidity journey” rather than just a distribution terminal in the mid-to-late secondary market.

Rocket Launch thus carries two seemingly contradictory qualities. On one end, it embraces the high-volatility, high-uncertainty degen world; on the other, it uses market-making and screening mechanisms to maintain basic order. This contradiction is not a side effect, but precisely the tension that Aster has maintained and operated for the long term.

Starting from Asia, Piecing Together a Global Frontend with a Partner Network

Geographically, Aster’s current user base is mainly concentrated in Asia, especially in active derivatives markets like Korea. Founder Leonard mentioned a case of launching a white-label Perp DEX in cooperation with a brokerage, which, although not yet publicly disclosed, has proven that the “infrastructure-centric, local partner as frontend” model is replicable. In this model, Aster provides the matching engine, liquidity, and products, while local partners provide branding, channels, and localized operations, and together they reach end users.

Next, Aster’s BD pace will focus more on the US and European markets, Southeast Asia, and other emerging regions. Wallets, asset management applications, and regional community platforms could all become Aster’s “frontend extensions.” The recent integration with Trust Wallet exemplifies this approach. For end users, they may just open a familiar wallet or interface, but the underlying matching and liquidity are actually powered by Aster’s infrastructure.

On the technology and developer ecosystem side, CTO Oliver will take on more external roles, serving as both the gatekeeper of the technical roadmap and the “interface” for the developer community. Once privacy L1 and order book infrastructure are implemented, they will naturally be able to serve as the backend for other applications and protocols. At that point, how to encourage more quant teams, strategy developers, and even AI-driven trading systems to choose Aster as their preferred base will become another true measure of the chain’s competitiveness.

Trading Becomes the New Consensus

From the perspective of Perp DEX, Aster’s story appears to be a deep breakthrough, extending from the matching engine all the way to stablecoins, yield products, and Launchpad. But looking back on the timeline of public chain history, what it does is actually extremely pure: returning to trading itself, asking what a chain born for trading should possess, and questioning whether the balance between privacy and transparency, self-custody and efficiency, yield and risk can be re-sculpted.

The success or failure of this reconstruction experiment will not be determined by any one round of activity data or price fluctuation, but will slowly settle into every record on the chain. Whether privacy L1 can be implemented as planned and truly support the strategy migration of professional funds, whether ASTER’s economic structure can gradually “harden” with protocol revenue and buyback mechanisms, whether the USDF and Trade & Earn systems can find a long-term viable path between stability and innovation, and whether Rocket Launch can maintain tension between hype and selection—none of these questions have simple answers.

If the endgame for Perp DEX is indeed a public chain, then that public chain must not be an empty general ledger. Aster is trying to write this understanding into a new chain. Meanwhile, CTO Oliver will participate more frequently in community discussions, promoting a developer ecosystem based on Aster L1, so that quant teams and AI strategy systems can build directly on this infrastructure.

When that day comes, the standard for measuring it will no longer be “how are the numbers of yet another DEX,” but how much real position, strategy, and risk preference this chain actually carries, and how many trading logics that once succeeded in the centralized world are willing to restart here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A Brief Discussion on the Eight Major Potential Risks of Stablecoins

As a significant innovation in the cryptocurrency sector, stablecoins are designed with "stability" as their primary intention. However, their potential risks and hazards have attracted widespread attention from global regulatory bodies, academia, and the market.

A heavyweight player enters the gold market! Stablecoin giant Tether poaches top HSBC trader

Tether has recruited the core precious metals team from HSBC, making a strong entry into the precious metals market and challenging the existing industry landscape. In recent years, the company has accumulated one of the world's largest gold reserves.

Robinhood makes a rare bet: Lighter and its genius founder

Aster has aligned itself with Binance, while Lighter has chosen to embrace capital investment.

Coin Metrics: Why has the current bitcoin cycle been extended?

Institutional adoption combined with cooling volatility indicates that Bitcoin is entering a smoother, more mature cycle.