Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

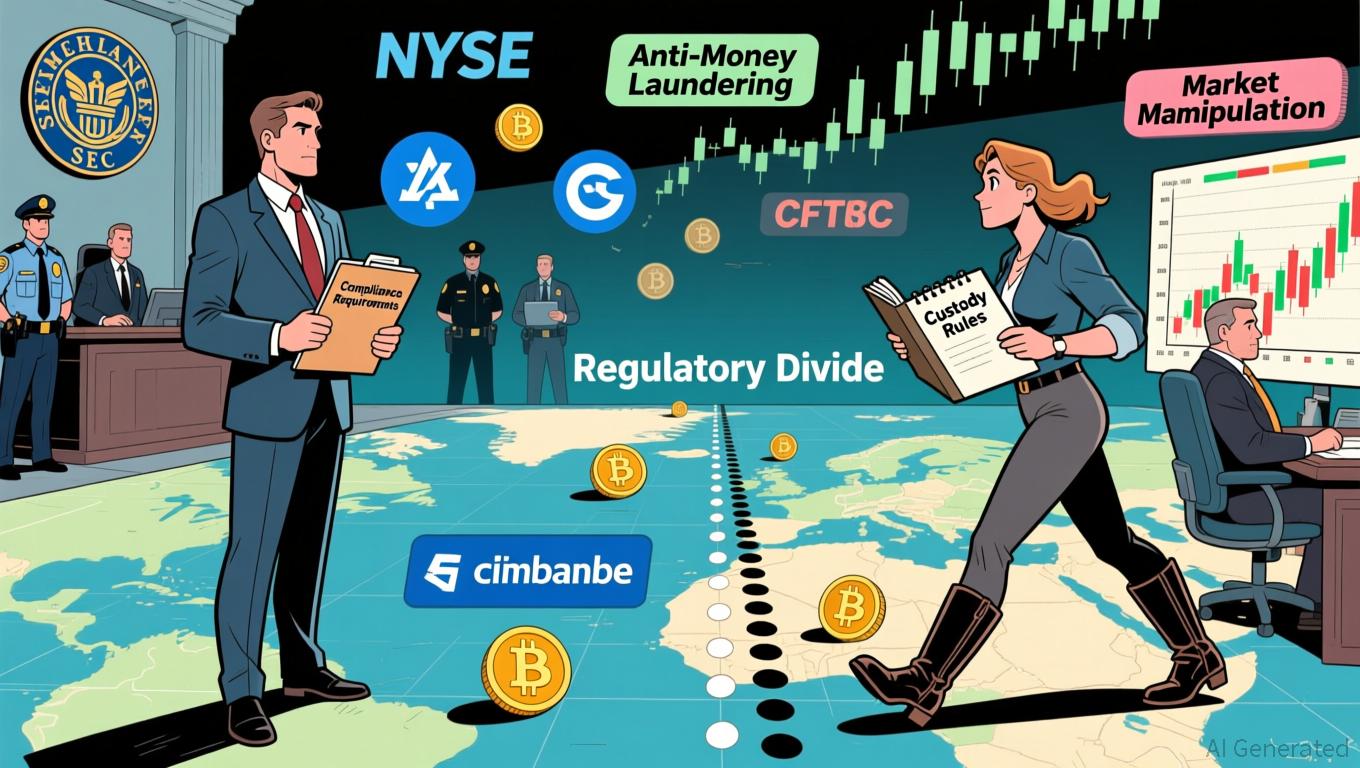

The regulatory environment for cryptocurrencies in the United States is at a turning point as lawmakers work to resolve the ongoing jurisdictional dispute between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Two rival Senate proposals—the Agriculture Committee’s CFTC-led structure and the Banking Committee’s SEC-oriented “ancillary asset” approach—stand to significantly alter how digital assets are classified, how custody is managed, and how exchanges operate. These legislative efforts, along with renewed enthusiasm for new crypto ventures and

The Agriculture Committee’s proposal, spearheaded by Senators John Boozman and Cory Booker, would make the CFTC the main regulator for “digital commodities” and their spot trading platforms. This model draws from established commodity oversight, mandating that exchanges, brokers, and dealers register with the CFTC and comply with rigorous standards for capital and asset custody. While

Market sentiment has improved recently after the conclusion of the 43-day U.S. government shutdown, which had previously dampened risk appetite.

Technical analysis points to ongoing

For those investing in crypto, the balance between regulatory developments, technological progress, and market cycles is becoming ever more important. While the Senate’s proposals are still under debate, the rapid progress of blockchain projects and the durability of privacy coins highlight the industry’s disruptive potential. As the 2025 market cycle unfolds, the ability to adapt to regulatory changes and seize new opportunities may be just as crucial as any on-chain metric.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Privacy-Centric AI Platforms Emerge as AlphaTON and SingularityNET Transform the Standards of Responsible Technology

- AlphaTON and SingularityNET partner to deploy high-performance GPUs in Sweden’s hydro-powered data centers for Telegram’s Cocoon AI network, prioritizing privacy-first and sustainable AI infrastructure. - The collaboration combines CUDO Compute’s expertise and Vertical Data’s GPUFinancing.com to enable encrypted machine learning with user-controlled data, addressing gaps in ethical AI development. - Executives highlight privacy and decentralization as competitive advantages, aligning with Telegram’s 1B+

Beyond Meat’s Five-Year Losses and $1.2 Billion Debt Lead Analysts to Lower Ratings

- Beyond Meat's Q3 earnings miss and revenue drop led to an 8% stock decline, extending its 78.8% annual slump. - Analysts downgraded to "Underperform" as $1.2B debt and $77.4M impairment charges highlight ongoing financial strain. - International sales showed mixed results, with U.S. retail and foodservice revenue falling sharply by 18.4% and 27.3%. - Despite cost cuts and debt restructuring, the company remains unprofitable since its 2019 IPO, with Q4 guidance below expectations.

Crypto Mining in 2025: The Intersection of AI Advancement and Real-World Risks

- C3 AI explores sale amid 54% stock drop and $116M loss, signaling crypto cloud mining sector's strategic shifts. - Palantir's 129% stock surge highlights AI-driven enterprise dominance over traditional mining players. - Physical mining faces crises: Bitdeer's Ohio fire and TeraWulf's 22% output decline expose infrastructure fragility. - Regulatory focus on ESG reporting accelerates digital mining adoption despite operational and geopolitical risks.

Galaxy: Institutional Tokenization Demand Grows Beyond Bitcoin

Tokenization demand surges as institutions value blockchain independently of Bitcoin, says Galaxy exec.What’s Driving the Institutional Shift?Looking Ahead: A New Era for Digital Assets