Gold Rush Handbook: Why Are Top VC Benchmarks Focusing on Fomo?

Benchmark, which has previously invested in Uber, X, and Instagram, is making another move: betting on the minimalist social crypto trading app fomo.

Benchmark, the investor behind Uber, X, and Instagram, makes another move: betting on the minimalist social crypto trading app fomo.

Written by: KarenZ, Foresight News

In recent years, the crypto industry has made tremendous progress at the infrastructure level. However, truly consumer-facing crypto applications have yet to break into the mainstream. Fragmented blockchain ecosystems, complex wallet operations, and Gas fees remain experience-level obstacles for ordinary users, becoming the last shortcoming hindering mass adoption.

Emerging in 2025, the social crypto trading app fomo is attempting to "break down the technical barriers of crypto trading" and rewrite the rules of the game with an extremely simple user experience. Not only has it attracted over 140 top industry angel investors, but it also secured a $17 million Series A round led by the top VC Benchmark, which has always been cautious in the crypto field, making it one of the most watched dark horse apps in the crypto sector this year.

Team Background: Crypto Veterans' "Dimensional Reduction Attack"

fomo's core positioning is as a "social crypto trading mobile app for everyone," with product design centered around "eliminating technical friction" and "enhancing user connections," aiming to break the status quo of poor user experience in the crypto industry.

fomo co-founders Paul Erlanger and Se Yong Park previously worked together at the crypto derivatives trading platform dYdX. Team members hail from dYdX, Uniswap, OpenSea, Square, Two Sigma, and other companies, covering DeFi, NFT ecosystems, and traditional fintech. This "cross-disciplinary + strong collaboration" team DNA has been key to fomo's rapid breakthroughs.

Funding Path

fomo's funding path is unconventional but precisely targets the core of capital and resources. Instead of following the traditional "seed round → Series A" rhythm, fomo first built the most luxurious early supporter network in the crypto industry through an "angel investor list" strategy, then attracted a "rare bet" from top institution Benchmark.

In February 2025, fomo completed a $2 million angel pre-seed round, with support from over 140 angel investors covering the three core groups of the crypto ecosystem: builders, operators, and traders. These include Solana co-founder Raj Gokal, Polygon CEO Marc Boiron, Balaji Srinivasan, LayerZero CEO Bryan Pellegrino, Berachain CEO Smokey Bera, Sei co-founder Jeffrey Feng, Wintermute CEO Evgeny Gaevoy, Privy CEO Henri Stern, Kaito CEO Yu Hu, Pantera Managing Partner Paul Veradittakit, Dragonfly General Partner Rob Hadick, and others.

Among these angel investors are key forces from multi-chain ecosystems, providing crucial support for fomo's cross-chain technology integration; there are also top traders, who are not only early adopters of the product but also help fomo optimize its trading experience and social feature design.

fomo's founder told TechCrunch that the team initially listed a "dream investor list" of 200 people, and through networking and direct communication, only a very small number declined—this "high conversion rate" reflects investors' recognition of the direction of "simplifying crypto trading."

In November 2025, fomo secured another $17 million Series A round led by Benchmark. Benchmark is a legendary venture capital firm whose portfolio includes world-changing consumer products such as Uber, Snapchat, Instagram, and X. Benchmark has always been cautious about investing in consumer crypto applications—since 2018, it has made very few investments in crypto startups, with only a handful of Web3 projects like Chainalysis, Toncoin, and the Web3 social protocol Towns.

Benchmark General Partner Chetan Puttagunta told TechCrunch that he was attracted by fomo's "clear vision" and "truly outstanding growth." He noted that three people proactively introduced fomo to him. After learning about fomo's growth and clear vision, Chetan Puttagunta also joined fomo's board of directors.

In addition to Benchmark, other angel investors in this Series A round include Pudgy Penguins CEO Luca Netz, Moonpay CEO Ivan Soto-Wright, and Zora CEO Jacob Horne.

Product Highlights: A "Cross-chain + Social" Crypto Super App

fomo's operation process is designed to be extremely simple: use the same balance across chains, buy any asset with one click, no need for a new wallet, no cross-chain steps, no Gas fees—even users with no crypto experience can complete transactions quickly.

- Multi-chain asset coverage: Currently supports major blockchains such as Bitcoin, Ethereum, Solana, Base, and BNB Chain, offering millions of asset trades from mainstream coins (like BTC, ETH) to meme coins and altcoins. The founder promises that within the next six months, "almost all blockchain assets will be covered," so users won't need to switch between multiple wallets or exchanges.

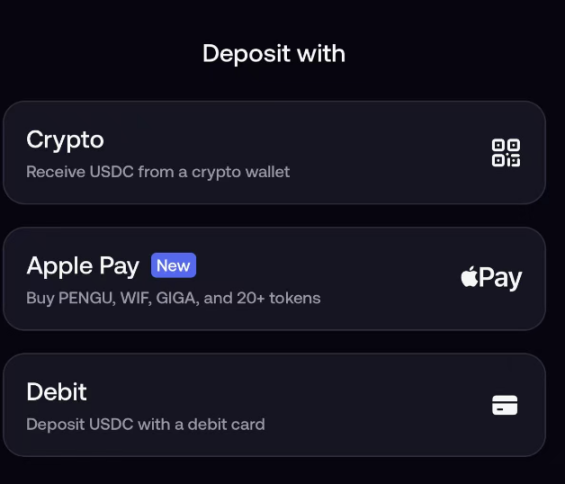

- Supports direct crypto purchases via Apple Pay: After downloading the app, users can register with Google or Apple ID, without creating complex mnemonic phrases. Deposits support direct crypto transfers, Apple Pay, or Debit Card.

- No Gas: Zero Gas fees for users.

- Fees: Trading fees are uniformly set at 0.50%, with a minimum fee of $0.95 only for the Solana network. There is no minimum fee for low-cost chains like Base and BNB Chain.

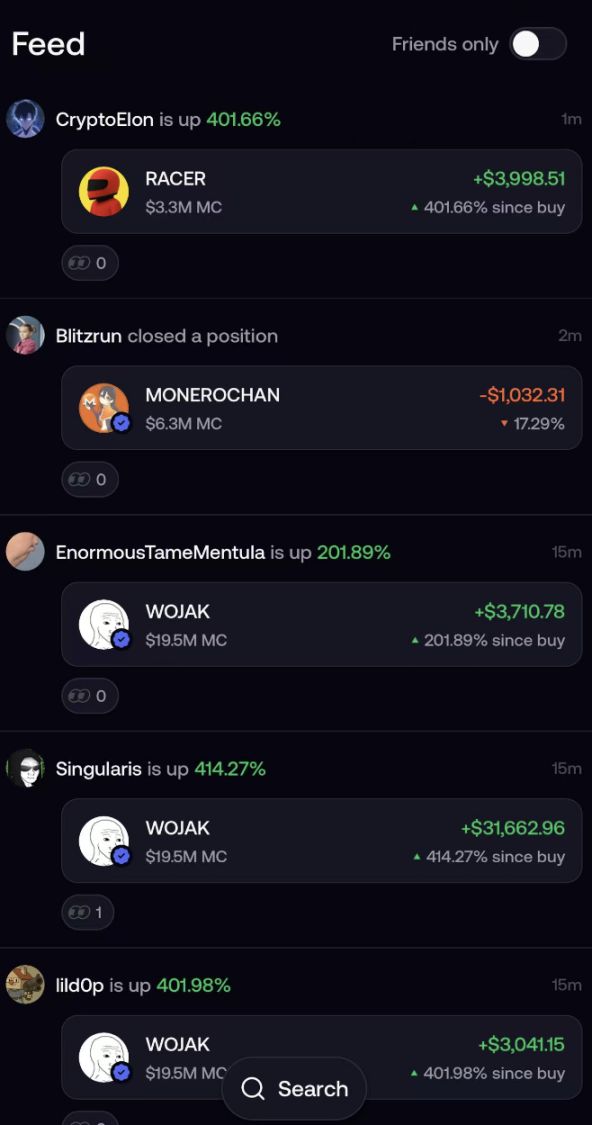

- Social discovery: fomo also has built-in social features. Users can follow KOLs, traders, or friends, view their trading records in real time (such as buying/selling certain assets, position changes), and explore "hot assets," "trend trading," and "top trader rankings" to quickly capture market opportunities.

fomo's ultimate goal is not limited to cryptocurrencies. fomo founder Paul Erlanger told TechCrunch that the platform will gradually expand asset categories in the future to cover prediction markets, bonds, and other traditional securities.

How is fomo performing in terms of data?

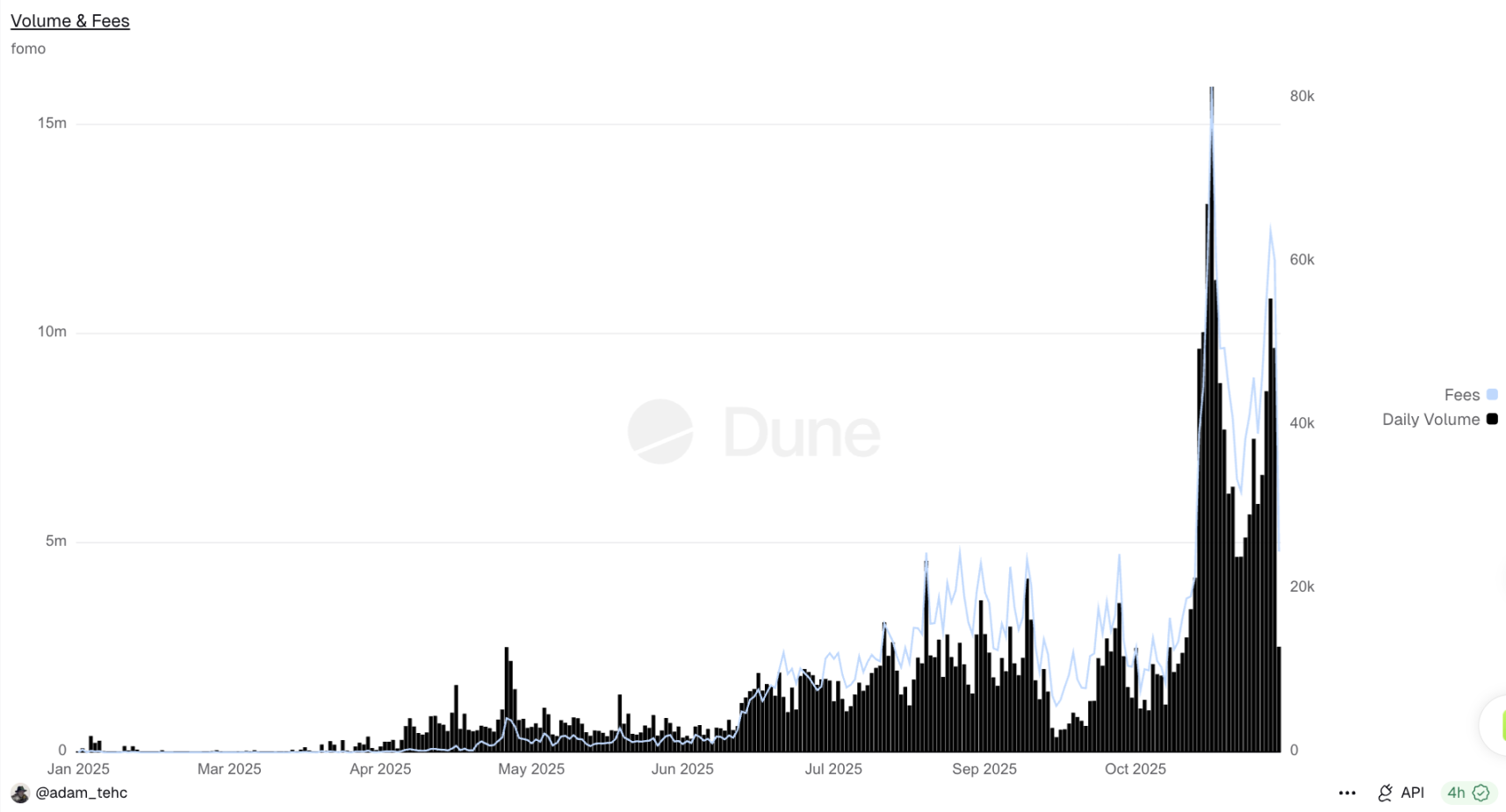

Since the beta version launched in May 2025, fomo's user and trading data have shown "exponential growth," validating the feasibility of its product model:

Source: Dune

Trading volume: According to Dune data, as of the time of writing, fomo's cumulative trading volume is close to $850 million, generating a total of $2.47 million in fees.

User scale: When disclosing its Series A funding, fomo stated that its user base continues to grow by nearly 10% per week. fomo has attracted over 120,000 users and 35,000 traders, among whom nearly 15,000 are first-time crypto users (who deposited via Apple Pay). Dune data shows that more than 30,000 users have made more than one trade on the fomo platform.

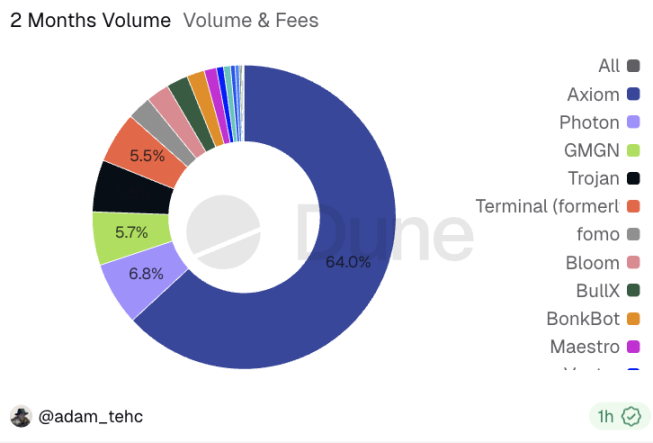

From an industry comparison perspective, in the Solana Bot sector, fomo's market share of trading volume reached 5.5% in the past two months, ranking sixth.

Source: Dune

What are the interaction methods?

The core of fomo's interaction strategy is trading. It is currently unclear whether invitations count towards the leaderboard, but inviting others can earn a 25% fee reward from the referred user's transactions.

Currently, fomo has launched a leaderboard feature in its mobile app. After making two small trades, the author found their ranking had already entered above 12,000.

Summary

When crypto infrastructure is mature enough, whoever can lower the user threshold will capture the next wave of growth.

fomo's core value lies in solving the crypto industry's "last mile" problem—focusing on optimizing user experience, which precisely matches the core demand for the mass adoption of consumer-grade crypto applications.

At the same time, the lineup of hundreds of angel investors and the addition of Benchmark mark a renewed industry consensus and institutional capital's re-examination of the long-term value of consumer crypto applications.

From a product perspective, fomo is redefining the standard for a "good trading app": not by piling on features, but by achieving ultimate simplicity; not as an isolated trading tool, but as a social financial network.

According to the official plan, fomo aims to support almost all assets on all major blockchains within six months and eventually expand to prediction markets and traditional securities. Whether fomo has the potential to become a bridge connecting the crypto world and traditional finance is worth watching.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

As economic cracks deepen, bitcoin may become the next liquidity "release valve"

The US economy is showing a divided state, with financial markets booming while the real economy is declining. The manufacturing PMI continues to contract, yet the stock market is rising due to concentrated profits in technology and financial companies, resulting in balance sheet inflation. Monetary policy struggles to benefit the real economy, and fiscal policy faces difficulties. The market structure leads to low capital efficiency, widening the gap between rich and poor and increasing social discontent. Cryptocurrency is seen as a relief valve, offering open financial opportunities. The economic cycle oscillates between policy adjustments and market reactions, lacking substantial recovery. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

The wave of cryptocurrency liquidations continues! US Bitcoin ETF sees second highest single-day outflow in history

Due to the reassessment of Federal Reserve rate cut expectations and the fading rebound of the U.S. stock market, the crypto market continues to experience liquidations, with significant ETF capital outflows and options traders increasing bets on volatility. Institutions warn that technical support for bitcoin above $90,000 is weak.

When traditional financial markets fail, will the crypto industry become a "pressure relief valve" for liquidity?

As long as the system continues to recycle debt into asset bubbles, we will not see a true recovery—only a slow stagnation masked by rising nominal figures.

A Quiet End to 2025 Could Prime Crypto for a 2026 Breakout, Analysts Say