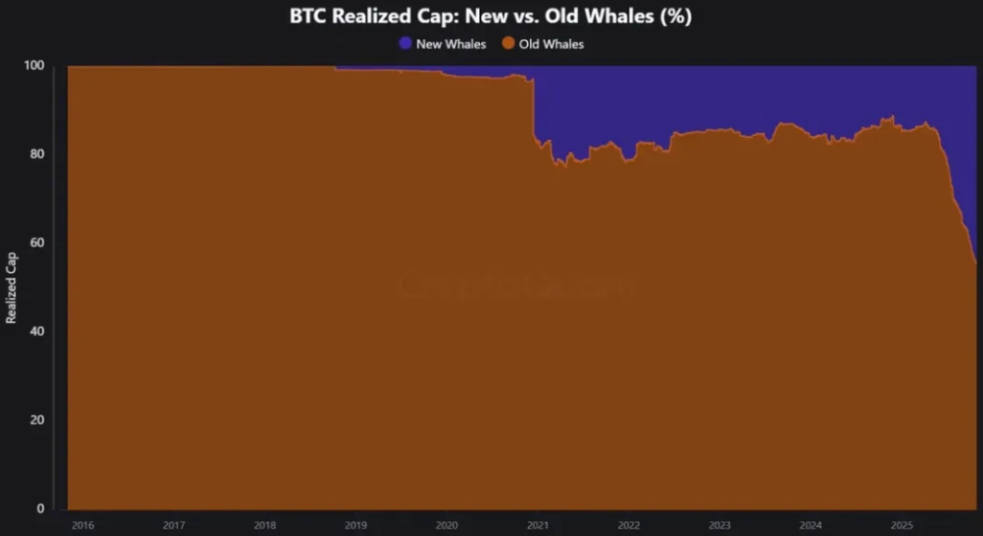

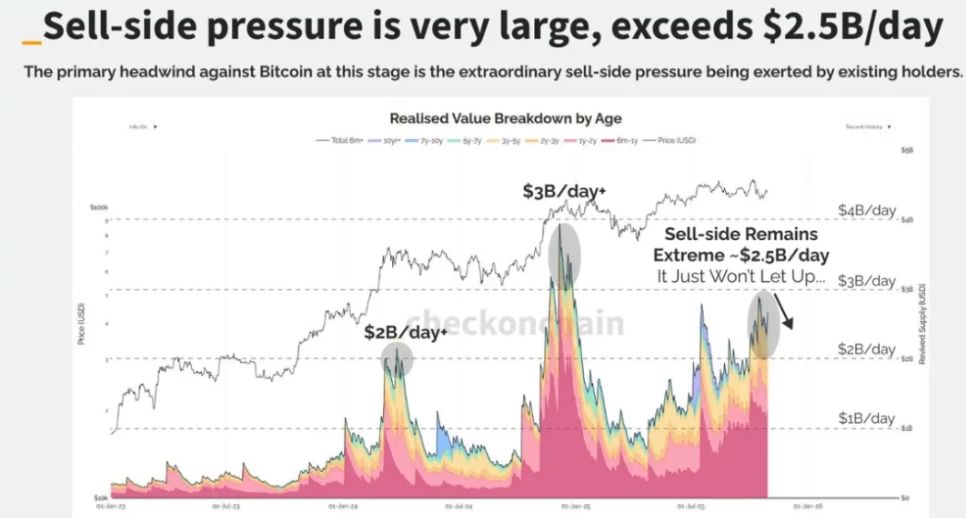

As early whales quietly reduce their holdings and institutional funds flow in silently, a wealth transfer that is reshaping the market landscape is taking place without a sound. On-chain data analysis shows that long-term bitcoin holders have sold 405,000 BTC within 30 days, accounting for 1.9% of the total BTC supply.

Meanwhile, spot bitcoin ETFs continue to absorb capital, with US ETFs alone holding more than 850,000 BTC, accounting for 4.3% of the circulating supply. This silent large-scale transfer of chips is reshaping the future structure of the cryptocurrency market.

1. OG Whales Retreat: Rational Exit of Early Holders

● The bitcoin market is undergoing a historic wealth transfer. On-chain data confirms that early whales have begun to systematically reduce their positions. Take Owen Gunden as an example—this early BTC whale’s associated wallet holds over 11,000 BTC, making him one of the largest individual holders on-chain.

● Recently, his wallet started transferring large amounts of BTC to Kraken, moving thousands of BTC in batches. On-chain analysts believe he may be preparing to sell most of his BTC, valued at over $1 billion.

● This retreat is not a panic sell-off, but a natural sign of market maturity. Gunden, who hasn’t tweeted since 2018, is acting in line with the “great rotation” theory—early investors moving into ETFs for tax benefits or selling for portfolio diversification.

● Long-term holders have sold 405,000 BTC within 30 days, a figure significant enough to draw market attention. But this selling is systematic and slow, rather than panic-driven.

2. Changing of the Guard: Silent Structural Market Shift

● As early whales reduce their holdings, new forces are quietly entering the market. Bitcoin’s average cost price continues to rise, proving that new holders are entering at a higher cost basis.

● The rise in MVRV (current price ÷ holders’ cost basis) indicates that ownership is becoming more dispersed and mature. Bitcoin is shifting from a few ultra-low-cost holders to a more distributed group with higher cost bases.

● This shift fundamentally changes the market’s dynamic structure. The new investors differ from the early idealists; they are more often institutional investors and compliant products entering the market through channels like ETFs.

● Currently, about 17.8% of BTC is held by spot ETFs and large treasuries, and this number is growing daily. Michael Saylor’s MicroStrategy has contributed to this shift by continuously purchasing BTC over the years.

This decentralization of ownership is actually a bullish signal, even though it may cause price consolidation and liquidity shortages in the short term.

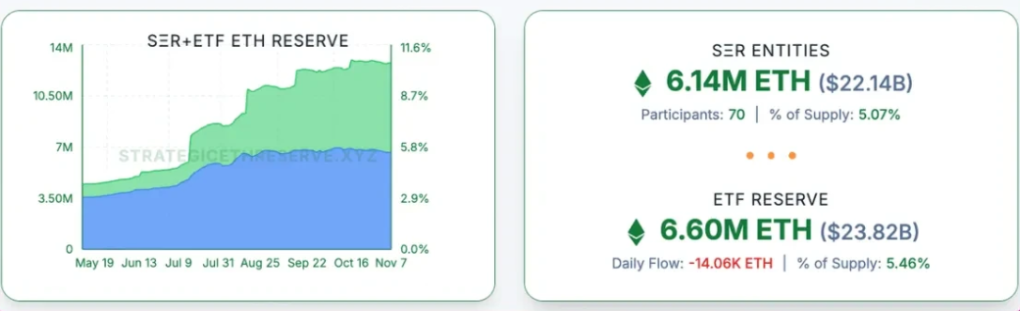

3. Ethereum Follows: Different Path, Similar Outcome

Ethereum is also undergoing a similar transformation, albeit via a different path. Data shows that about 11% of all ETH is held by DAT and ETFs, quickly catching up to BTC’s 17.8%.

● Ethereum’s rotation pattern differs from bitcoin’s in a key way: ETH is shifting from retail to whales, while BTC is moving from old whales to new whales.

● The actual price for large accounts (over 100,000 ETH) is rising rapidly, meaning new buyers are entering at higher prices while small holders are selling.

● The cost bases of wallets of all sizes have now converged at the same level. This indicates that old tokens have basically flowed into the hands of new holders, and such a cost basis reset usually occurs near the end of an accumulation cycle and before a significant price surge.

● Structurally, this suggests that ETH supply is concentrating in the hands of stronger holders, laying the foundation for future price increases.

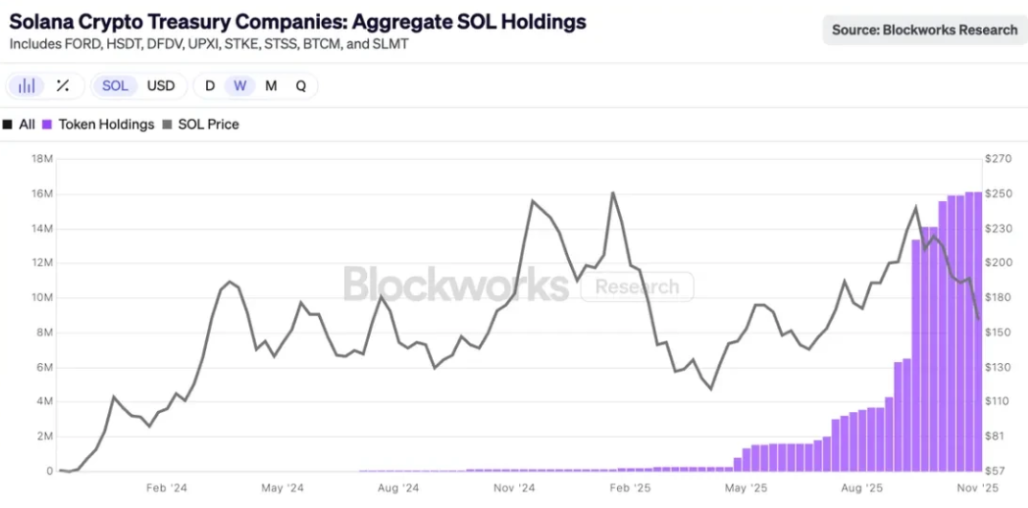

4. Solana’s Beginning: Institutionalization Just Starting

Solana’s institutionalization process started later, but it has quietly begun. It is quite difficult to determine which stage SOL is in within the rotation theory, and even identifying institutional wallets or major holders is challenging.

● Last month, SOL spot ETFs quietly appeared on the market. Although there was no large-scale hype, there have been positive inflows every day. Some DAT companies have also started buying SOL in considerable quantities.

● Currently, 2.9% of all circulating SOL is held by DAT companies, valued at $2.5 billion. SOL on-chain data is still concentrated in early insiders and venture capital wallets, and these tokens are slowly flowing to new institutional buyers through ETFs and treasuries.

The great rotation has already reached SOL, only it happened a cycle later. If the rotation for BTC and, to some extent, ETH is nearing its end, then SOL’s situation is not hard to predict.

5. Market Rotation: Investment Logic of the New Cycle

● The rotation pattern of the cryptocurrency market is being redefined. In previous cycles, the strategy was simple: BTC would surge first, then ETH, and the wealth effect would gradually spread to altcoins.

This time is completely different. BTC stagnates at some stage of the cycle; even if prices rise, old players either switch to ETFs or cash out and improve their lives outside of crypto.

● No traditional wealth effect, no spillover effect. The market now presents more complex dynamics. Altcoins no longer compete with BTC for monetary status but instead compete in utility, yield, and speculation.

● Categories worth watching now include: blockchains in real use (Ethereum, Solana, etc.), products with cash flow or real value appreciation, assets with unique demand that BTC cannot replace (such as ZEC), infrastructure that can attract fees and attention, stablecoins, and RWA.

6. The Milestone Significance of Uniswap’s Fee Switch

● Uniswap’s activation of the fee switch has become a milestone event in the DeFi sector. This change marks the transformation of DeFi protocols from purely utilitarian tools to on-chain enterprises with sustainable business models.

Specifically, for v2 pools, liquidity provider fees will drop from 0.3% to 0.25%, with the difference going to protocol fees; for v3 pools, the protocol will collect 1/4 of the LP fees from smaller pools and 1/6 from larger pools.

● This shift creates the so-called “self-funding DeFi ecosystem.” According to analysis, after the protocol fee switch is activated, Uniswap could generate $10.3 million to $40 million in annual income for UNI holders.

● The market has responded extremely positively—UNI’s price has risen 15% since the proposal was announced, and other data shows UNI has soared 48% since the proposal. The fee switch has also brought an unexpected positive effect: fraudulent pools have “disappeared” overnight, as these pools relied on a zero protocol fee rate.

7. Hidden Dangers on the Road Ahead

● Liquidity risk is one of the main challenges facing the fee switch. Analysts worry that the fee switch could disrupt the stability of liquidity pools, especially creating short-term liquidity risks in smaller pools.

Startups relying on stable liquidity to provide crypto payment or trading solutions may face: increased slippage for small trades, reduced execution reliability during volatile periods, and the need to reroute trades to larger pools or other venues, among other challenges.

● Regulatory uncertainty still hangs over the DeFi sector. Regulators are increasing their focus on decentralized exchanges like Uniswap, and emerging crypto companies may face compliance and legal risks.

● Governance centralization is also reflected in Uniswap’s proposal. Research shows that Uniswap’s on-chain governance remains highly concentrated, with a Gini coefficient of 0.938—indicating extremely unequal distribution of voting rights.