Bitcoin News Today: Bitcoin's Surge Brings Whale's $131M Short Position Close to Liquidation Point

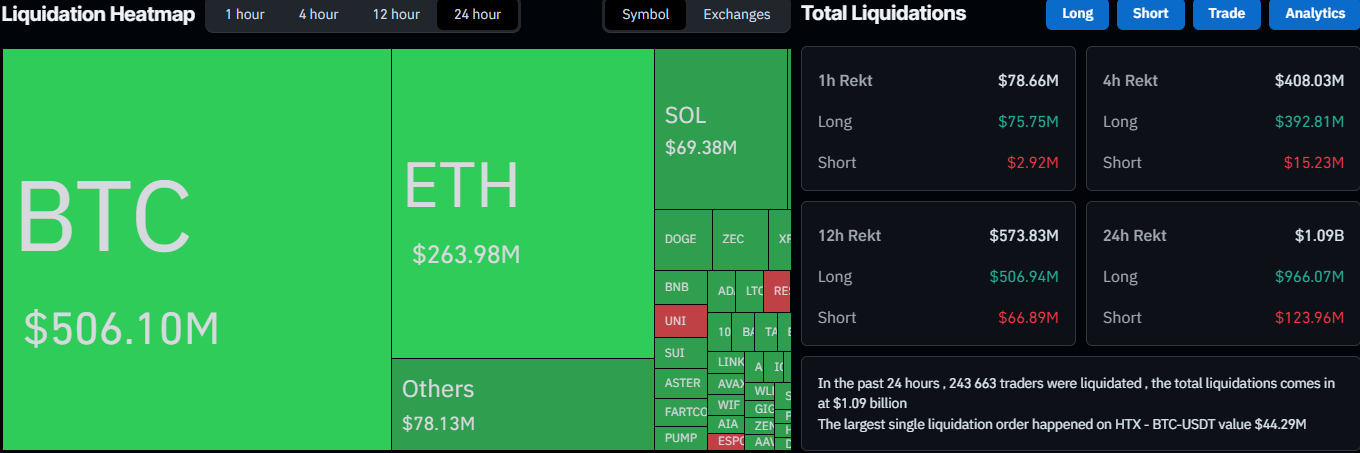

- A $131M Bitcoin short faces liquidation if price exceeds $111,770, per Hyperliquid data. - Market rally triggered $343.89M in 24-hour liquidations, with 74.7% from shorts, pushing Bitcoin higher. - Technical indicators and institutional buying signal bullish momentum, risking self-reinforcing price gains. - Whale’s aggressive leverage history contrasts with recent large long positions, highlighting market volatility.

An extremely risky

This trader's significant risk has become a focal point during a broader market upswing that

The wallet's previous trades show a pattern of high-leverage strategies.

Technical analysis continues to support a bullish

The combination of forced buying from short liquidations and increasing institutional investment is creating a feedback loop. Should Bitcoin's rally persist, reaching the $111,770 liquidation mark could spark a chain reaction in the market, driving prices even higher. This highlights the inherent volatility of leveraged trades, where even small price movements can have major effects on large-scale investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

India’s Top Court Declares Crypto—and XRP—Legal Property Under Indian Law

Ark Invest, Led by Cathie Wood, Turned Crypto Market Declines into Opportunity! Here Are the Purchases It Made

Bitcoin price slips toward $97K as spot BTC ETFs record second-largest outflow of $867M