VISA May Integrate with Ripple’s ILP as XRP Holds $1.85–$2 Support

VISA Transactions Could Soon Flow Through Ripple’s Interledger Protocol

A recent report, highlighted by renowned crypto observer SMQKE, reveals a potential breakthrough in payments infrastructure that VISA transactions may soon be integrated with Ripple’s Interledger Protocol (ILP).

Therefore, this development could mark a significant milestone in bridging traditional financial systems with blockchain-based payment networks.

Ripple’s ILP, a protocol designed for seamless, cross-ledger payments, enables instant transfers across different payment networks without relying on intermediaries.

By connecting traditional financial rails like VISA to ILP, financial institutions could achieve faster, more efficient, and cost-effective transaction processing. The integration promises to reduce the friction and delays that often plague cross-border payments, which currently rely on legacy systems such as SWIFT.

The report indicates that VISA could leverage Ripple’s Interledger Protocol to enable near-instant, transparent payments across banks, digital wallets, and financial networks, offering faster fund access, lower fees, and a seamless payment experience for businesses and consumers.

Notably, Ripple’s Interledger Protocol is built for seamless interoperability, enabling real-time connections across diverse ledgers. This positions VISA to modernize its payment infrastructure while maintaining regulatory compliance and operational reliability, bridging traditional finance and digital assets.

Beyond speed and efficiency, integrating Ripple’s ILP with VISA could bridge traditional finance and blockchain, creating a seamless hybrid ecosystem. This move could drive mainstream adoption of digital currencies, positioning ILP as a key infrastructure for global payments.

Therefore, the report highlights the rising convergence of traditional finance and decentralized networks. Integrating VISA transactions with Ripple’s ILP could usher in a new era of cross-border payments, delivering unmatched speed, transparency, and scalability.

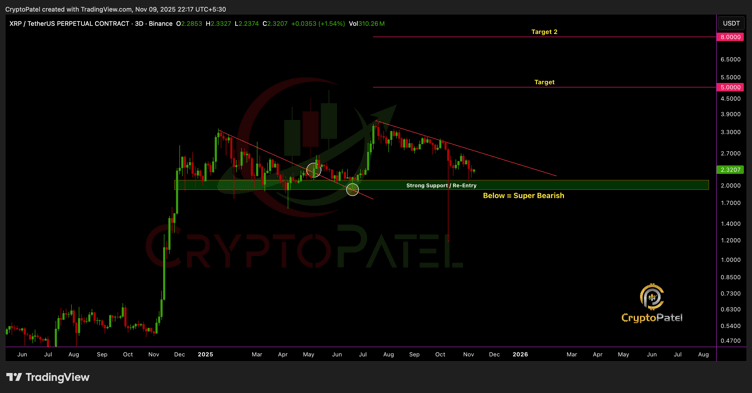

XRP Eyes $5–$8 as Strong Support Zone Bolsters Institutional Confidence

According to prominent market analyst Crypto Patel, XRP has established a decisive support zone between $1.85 and $2, signaling a robust foundation for both retail and institutional investors. This range, Patel notes, represents a strong liquidity and accumulation base, creating a favorable environment for potential price expansion in the months ahead.

XRP’s $1.85–$2 support zone is proving pivotal with the current price being $2.27. Historically, areas of high liquidity and concentrated institutional accumulation absorb selling pressure and anchor markets during volatility.

As Crypto Patel notes, XRP’s consolidation here reflects strong investor confidence and positions the coin for potential structural growth.

XRP continues its bullish momentum across multiple timeframes, with strong trading volumes and clear institutional accumulation signaling strategic positioning. Analyst Patel suggests that if the $1.85–$2 support holds, XRP could see a structural surge toward $5–$8, representing substantial upside potential.

Therefore, XRP’s $1.85–$2 support zone is more than a floor, it signals strong institutional backing, deep liquidity, and bullish momentum. If trends hold, a structural move toward $5–$8 is well-supported by market dynamics and investor activity, reinforcing XRP’s upward trajectory.

Conclusion

Integrating VISA transactions with Ripple’s Interledger Protocol could transform payments, combining traditional network reliability with blockchain’s speed, transparency, and interoperability. This leap promises a faster, more efficient ecosystem and marks a major step toward a truly connected global financial landscape.

On the other hand, XRP’s $1.85–$2 support zone highlights strong institutional interest and deep liquidity. With bullish momentum intact, this level not only defends current valuations but also positions XRP for a potential surge toward $5–$8.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Slide Driven by Leverage, Bottom May Be Near

DOGE drops 15.12% over the past month as Trump’s tariff pledges remain unmet

- DOGE fell 15.12% in 1 month amid unfulfilled Trump tariff dividend promises and political uncertainty. - Trump's Truth Social AI chatbot acknowledged no tangible economic benefits from his DOGE-linked policies. - Treasury Secretary Bessent highlighted legislative hurdles for $2,000/person tariff payments, facing legal skepticism. - Technical indicators show DOGE remains bearish, lacking catalysts for market optimism despite sector trends.

TWT’s 2025 Tokenomics Revamp: Redefining Utility and Investor Rewards on Solana

- Trader Joe's (TWT) 2025 tokenomics prioritizes utility over speculation, offering gas discounts, DeFi collateral, and governance rights. - A deflationary model with 88.9B tokens burned creates scarcity, while loyalty rewards redistribute existing tokens to avoid dilution. - Community governance allows holders to vote on platform upgrades, aligning token value with ecosystem growth and user participation. - This Solana-based approach redefines DeFi incentives by linking price appreciation to real-world ut

HYPE Token: Evaluating Immediate Price Fluctuations and Speculative Dangers in the Meme-Based Cryptocurrency Sector

- HYPE token, a meme-driven crypto, relies on social media hype and influencer endorsements rather than traditional financial metrics. - The $TRUMP meme coin example highlights extreme volatility, with large profits for top wallets and massive losses for retail investors. - Institutional products like CMC20 exclude meme coins, signaling limited recognition of their market utility despite growing crypto infrastructure. - Regulatory scrutiny intensifies as SEC targets influencer promotions, while foreign inv