While broader markets fluctuate, specialized crypto-gaming projects are steadily gaining momentum

- Kamirai bridges DeFi and gaming via Kamirex Exchange, a high-speed DEX for Asia's crypto demand, and a PlayStation/Xbox RPG using its token for transactions and governance. - $HUGS meme coin leverages Milk Mocha IP with 60% APY staking, deflationary token burns, and charity-linked revenue, combining viral branding with blockchain utility. - Mutuum Finance's Ethereum-based lending protocol raised $18.7M in presale, offering institutional-grade DeFi solutions with 250% token price growth and 18,000+ holder

The cryptocurrency and gaming sectors are experiencing heightened momentum as fresh ventures close liquidity gaps, harness emotional marketing, and roll out innovative utility concepts. Despite ongoing market turbulence, specialized projects are drawing both investors and participants by offering real value, deflationary features, and collaboration across industries.

The Web3 platform is carving out a niche where decentralized finance (DeFi) meets gaming, with a mission to resolve liquidity fragmentation in Asian markets. The company recently

At the same time, is making waves as a meme coin that combines emotional resonance with practical use. Centered on the globally popular Milk Mocha IP, the $HUGS token is making a splash,

In the DeFi space, is building momentum,

Together, these advancements underscore a larger movement: ventures that blend speculative opportunities with genuine utility are outperforming conventional assets. Kamirai’s integration of gaming and DeFi, Milk Mocha’s brand-centric tokenomics, and Mutuum Finance’s institutional-grade platform all serve markets eager for innovation in uncertain times. Investors are increasingly drawn to projects that offer clear applications, deflationary structures, and partnerships that span multiple industries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crash Reasons: Here is why Cryptos are Crashing

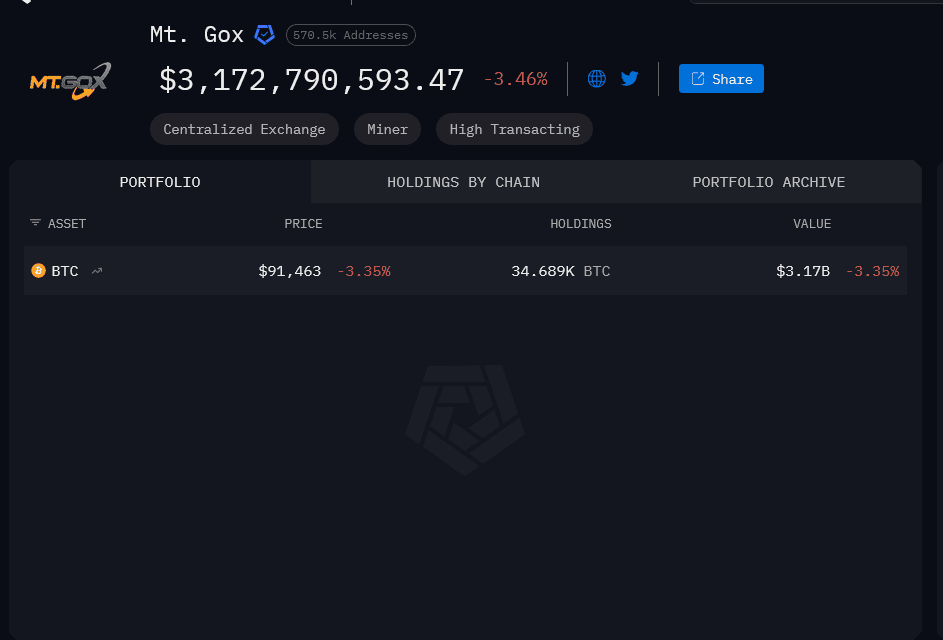

Mt. Gox Just Moved Nearly $1B in Bitcoin. Should You Be Worried?

Bitcoin News Update: Canaan's Shift Toward Bitcoin Mining Drives 18% Increase and Sets New Record in Holdings

- Canaan Inc. shares surged 18% pre-market after Q3 revenue jumped 104.4% to $150.5M, surpassing estimates. - Bitcoin mining revenue soared 241% to $30.6M, driven by 267 BTC mined and 10 EH/s computing power sold. - Company boosted crypto holdings to 1,610 BTC/3,950 ETH by October 2025 and secured a 50,000-unit mining machine order. - Q4 revenue guidance ($175-205M) exceeds $148. 3M estimates, but risks include U.S. tariffs and regulatory shifts. - Analysts maintain "buy" ratings with a $3.00 price target

BCH Climbs 5.6% Over 24 Hours as Institutions Adjust Their Portfolios

- BCH surged 5.6% in 24 hours to $514.6 amid mixed 1-month (-3.14%) and 1-year (19.29%) performance. - Institutional investors reshaped holdings: Itau Unibanco cut 21.3% stake, while Goldman Sachs and Robeco increased positions. - Analysts raised price targets to $33-$35 with "neutral" ratings, though Zacks upgraded to "strong-buy" amid improved long-term outlook. - BCH maintains 1.24% institutional ownership, 12.92 P/E ratio, and stable financial metrics (quick ratio 1.53, debt-to-equity 2.00).