BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

Bitcoin’s price turbulence collided with one of the biggest days in AI this year. Elon Musk dropped Grok 4.1, Google launched Gemini 3 just hours later, and a global Cloudflare outage disrupted key platforms — including X and ChatGPT. Here’s what shaped today’s tech and crypto landscape.

1. Grok 4.1 Launches With Major Upgrades in Speed and Intelligence

Elon Musk announced the release of Grok 4.1 , describing it as a significant leap in speed, accuracy, and real-world reasoning.

According to xAI, Grok 4.1 brings major improvements in:

- Conversational intelligence

- Emotional understanding

- Practical problem-solving

The model is free on Grok’s apps, increasing pressure on competitors.

2. Google Drops Gemini 3 — Just Hours After Grok 4.1

In a highly strategic move, Google launched Gemini 3 only a few hours after Grok 4.1 went live .

Google claims Gemini 3 is its “most intelligent” AI model yet , with advancements in:

- Deep reasoning

- Code generation

- Multimodal understanding

Why the rapid back-to-back releases matter

The timing fuels what many now call the AI arms race, with xAI and Google competing directly for dominance in next-gen conversational models.

Both launches are expected to push the AI sector into another hype cycle.

3. Cloudflare Outage Knocks Major Platforms Offline

A global Cloudflare outage impacted millions worldwide, temporarily taking down:

- X (Twitter)

- ChatGPT

- Exchange dashboards

- Multiple major websites

Although Cloudflare confirmed recovery later , the outage highlighted how the modern internet still relies heavily on centralized infrastructure.

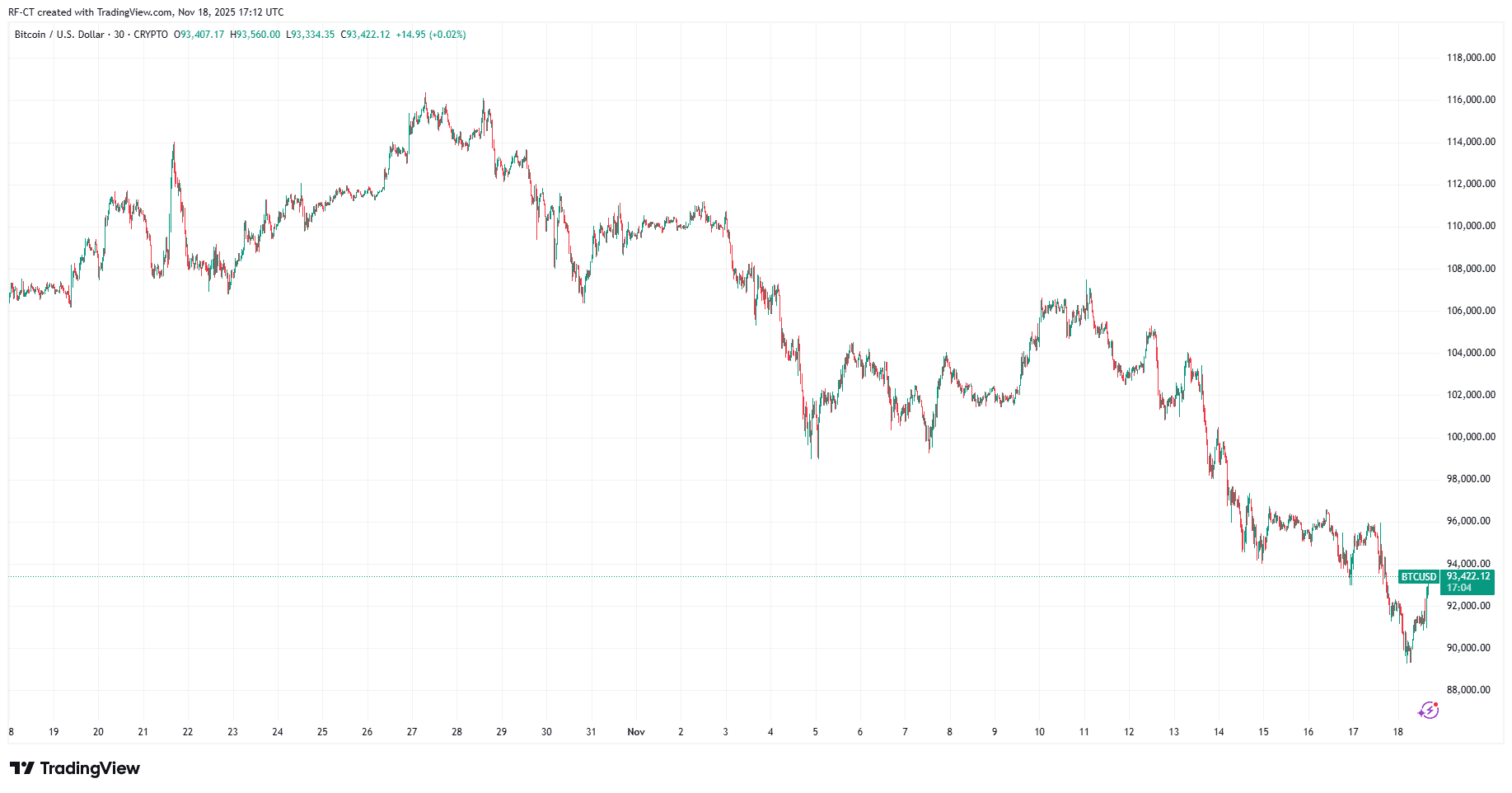

4. Bitcoin Faces Turmoil as Markets Digest AI Hype

Bitcoin hovered around a volatile range as the day’s tech news dominated headlines.

Sentiment remains mixed:

- Some analysts warn BTC could revisit deeper levels

- Cameron Winklevoss claimed this may be the “last time Bitcoin ever falls below $90K”

- Correlations between tech-sector hype and BTC volatility remain strong

The market is now watching for whether AI-driven optimism or macro pressures will dictate Bitcoin’s next move.

By TradingView - BTCUSD_2025-11-18 (1M)

By TradingView - BTCUSD_2025-11-18 (1M)

Today delivered a rare convergence of crypto volatility, AI breakthroughs, and global infrastructure issues. Grok 4.1 and Gemini 3 mark a new chapter in the AI rivalry, while Cloudflare’s outage exposed systemic risks — all against the backdrop of an increasingly unstable Bitcoin price .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: DeFi’s High-Leverage Trading Environments Increase Systemic Spoofing Threats

- Hyperliquid, a fast-growing decentralized perpetuals exchange, suffered a $4.9M bad debt loss from a third 2025 market manipulation attack targeting Solana-based memecoin POPCAT. - Attackers used $3M in USDC to create artificial demand via 19 wallets, triggering a 30% price drop and cascading liquidations that shifted losses to liquidity providers. - The incident highlights systemic risks in high-leverage, illiquid crypto markets, where spoofing attacks exploit thin order books and decentralized governan

Walmart’s Insider Advantage and Target’s Cautious Turn: A Split in Retail Leadership

- Walmart’s internal CEO succession to John Furner has drawn praise for its planned transition and institutional expertise. - Target’s appointment of Michael Fiddelke raised skepticism, with shares down 15% amid concerns over stagnant growth and groupthink. - A Yale study supports internal promotions, citing faster adaptation and stronger stock performance, aligning with Walmart’s 300% gains vs. Target’s 60%. - Market reactions highlight divergent strategies: Walmart’s stock nears 52-week highs, while Targ

Fed's Interest Rate Divide and NVIDIA's Results Challenge the Boundaries of AI Enthusiasm

- U.S. Fed minutes and NVIDIA's Q3 earnings will test AI optimism amid policy uncertainty and governance scrutiny. - Fed's October rate cut debate reveals internal divisions, while ethics probes into Kugler's trades raise transparency concerns. - NVIDIA faces $54.9B revenue test for AI chips, with market valuations hinging on its ability to sustain growth amid short-seller bets. - Strong NVIDIA results could reinforce AI sector momentum, while weak performance risks dampening tech stock enthusiasm.

VanEck Launches Solana ETF, Stirring Investor Interest in Altcoin Market

In Brief VanEck introduced VSOL, a Solana-focused ETF providing staking rewards. Major players like Fidelity and Grayscale also launched similar Solana ETFs. Analysts see the Solana ETF trend as a shift in investor altcoin risk evaluation.