From $140K Call to $80K Put: Bitcoin (BTC) Positioning Reverses Completely

Bitcoin BTC$90,470.56 options have flipped the script with a full 180-degree shift from last year’s uber bullish bets to a sharply bearish stance.

Since late last year, traders were aggressively chasing bullish moves by piling into call options at strikes of $100,000, $120,000, and $140,000 on Deribit. Up until recent weeks, the $140,000 call was the most popular on Deribit, with notional open interest (OI), or the dollar value of the active contracts, consistently above $2 billion.

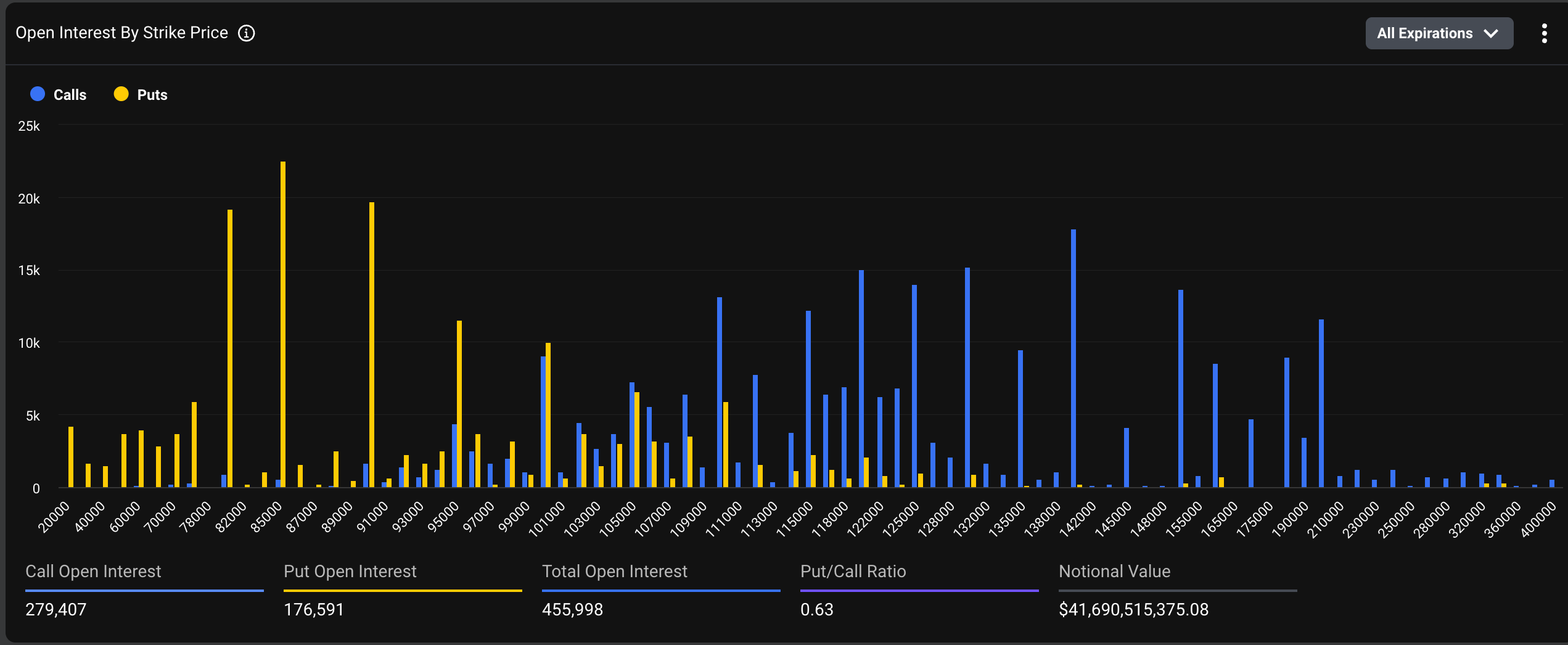

Now, that’s changed. The $140,000 call’s open interest stands at $1.63 billion. Meanwhile, the $85,000 put has taken the lead with $2.05 billion in open interest. Puts at $80,000 and $90,000 strikes also now eclipse the $140,000 call.

Clearly, the sentiment has shifted decisively bearish, and not surprisingly so, as BTC's price has collapsed over 25% to $91,000 since Oct. 8, CoinDesk data shows.

Put options give the purchaser the right, but not the obligation, to sell the underlying asset at a predetermined price at a later date. A put buyer is implicitly bearish on the market, looking to profit from or hedge against expected price slides in the underlying asset. A call buyer is bullish.

The chart shows the distribution of open interest in BTC options at various strike price levels across expiries. Clearly, OI is getting stacked at lower strike puts, the so-called out-of-the-money put options.

While the number of active calls is still notably higher than puts, the latter are trading at a significant premium (or skew), reflecting downside fears.

"Options reflect caution heading into year-end. Short-dated puts with strikes at $84K to $80K have seen the largest trading volumes today. Front-end implied volatility sits around 50%, and the curve shows a heavy put skew (+5%-6.5%) for downside protection," Deribit Chief Commercial Officer Jean-David Pequignot said in an email.

Options activity on decentralized exchange Derive.xyz paints a similar bearish picture, with the 30-day skew falling to -5.3% from -2.9%, a sign of traders increasingly paying up for downside insurance, or put options.

"Looking ahead to year-end, there’s now a sizeable concentration of BTC puts building around the December 26 expiry, particularly at the $80K strike," Dr. Sean Dawson, head of research at leading onchain options platform Derive.xyz, told CoinDesk.

With ongoing concerns about the resilience of the U.S. job market and the probability of a December rate cut slipping to barely above a coin toss, there’s very little in the macro backdrop giving traders a reason to stay bullish into the close of the year, Dawson explained.

What next?

While the path of least resistance appears to be on the downside, the selling may soon run out of steam as technical indicators point to oversold conditions and sentiment is at bearish extremes.

"With a Fear & Greed index around 15 and an RSI nearing 30 (oversold but not yet extreme), whale wallets (>1,000 BTC) have increased notably in the past week, hinting at smart-money accumulation at undervalued levels," Pequignot said.

"Overall, downside fears are justified in the short term and the path of least resistance remains lower for now, but extreme setups like this have rewarded the bold in crypto's past," he added.

Read: Bonds Hint at Rebound: Crypto Daybook Americas

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC Grants Approval for XRP ETF as a Commodity, Sidestepping Security Status Debate

- SEC approves Franklin Templeton's XRP ETF (ticker EZRP), marking XRP's institutional legitimacy as a commodity asset. - The ETF, holding XRP via Coinbase Custody, avoids airdrops/forks and sidesteps SEC's security classification dispute over XRP. - Market sees it as a catalyst for institutional crypto adoption, with potential inflows mirroring Bitcoin/ETH ETF success. - XRP's 11% post-approval price drop and regulatory uncertainty highlight risks despite 0.19% competitive fee structure.

Bitcoin Updates: Amid Bitcoin’s Plunge, Saylor’s Company Amasses $835M, Bucking the Market Sell-Off

- Michael Saylor's Strategy Inc. bought 8,178 BTC ($835.6M) despite Bitcoin's 25% drop, boosting holdings to 649,870 BTC ($61.7B). - The purchase, funded by perpetual preferred stock sales, reflects confidence in Bitcoin's long-term value despite market selloffs and ETF outflows. - Saylor's firm maintains a conservative leverage ratio (8B debt vs. 61B BTC) and claims resilience against multi-year price collapses. - Institutional Bitcoin adoption persists as Harvard allocates $443M to crypto ETFs, though St

Prisoner Exchange Approaches Amid Intensified Russian Energy Attacks on Ukraine

- Ukraine and Russia near agreement to resume large-scale prisoner exchanges, targeting 1,200 Ukrainian captives by November, mediated by Turkey and the UAE. - Russia escalates energy infrastructure attacks, including Odesa solar plant strikes, while Ukraine retaliates with strikes on Russian oil refineries and drone facilities. - Trump administration proposes 28-point peace plan for Ukraine, inspired by Gaza ceasefire model, with unclear details on territorial concessions and NATO membership. - Kyiv secur

Bitcoin News Update: Trump Supporter Gill Increases Bitcoin Investment by $300K Despite Crypto Downturn

- Rep. Brandon Gill (R-Texas) added $300K to Bitcoin and BlackRock's IBIT ETF, totaling $2.6M in crypto investments amid market declines. - His strategy involves buying during dips, including $1.5M in BTC purchases below $100,000 in June-July 2024. - Gill missed reporting $500K in Bitcoin buys under the STOCK Act, raising transparency concerns despite nominal $200 fine penalties. - The purchases align with Trump's pro-crypto policies, including a "strategic Bitcoin reserve" initiative and reduced regulatio