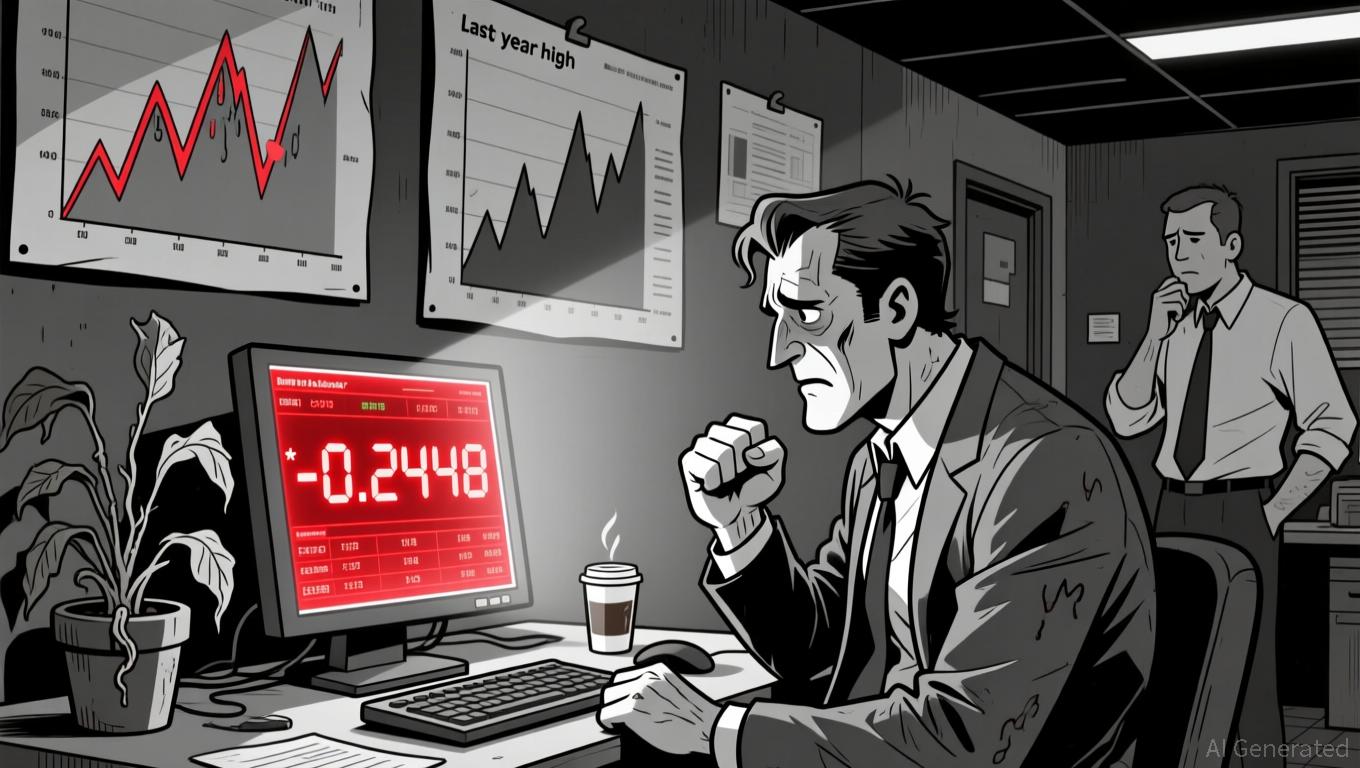

Stellar (XLM) Drops 4.18% Over 24 Hours as Market Fluctuates

- Stellar (XLM) fell 4.18% in 24 hours to $0.2448, with 19.57% monthly and 26.27% annual declines. - The drop reflects broader crypto market volatility, not direct XLM-specific news or catalysts. - While Bitcoin and Ethereum rose, XLM's decline persists independently, lacking short-term momentum. - Analysts cite macroeconomic uncertainty and regulatory shifts as potential future risks for XLM's trajectory.

On November 19, 2025,

The news summary provided covers a range of business and market updates, but none are connected to Stellar (XLM) or its ecosystem. Announcements from organizations like XPLR Infrastructure, Maryland-based firms, Quanex Building Products, and Xometry pertain to unrelated matters such as tender offers, school enrollment statistics, securities lawsuits, and business growth awards. While significant in their own sectors, these developments have no bearing on XLM’s price or direction.

Likewise, updates about Husky Inu (HINU) mention a slight price uptick during its pre-launch period, but this has no direct impact on XLM’s market. The article also points to a general rebound in the crypto sector, with

With no direct news affecting XLM and only broad market commentary available, the ongoing decline seems to stem from general market forces rather than any specific event related to the Stellar network. Experts suggest that ongoing macroeconomic challenges and shifting regulatory landscapes may influence XLM’s future performance, but there are currently no immediate triggers affecting its price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE drops 6.26% following rebranding to GDOG ETF amid market volatility

- Grayscale rebrands its Dogecoin Trust as GDOG ETF, set to list on NYSE Arca by November 24, 2025, under a revised governance framework. - The move aims to enhance institutional accessibility and transparency for DOGE , aligning with evolving crypto investment standards despite recent market declines. - DOGE has fallen 5.26% in 24 hours and 51.54% annually, reflecting broader bearish trends amid cautious investor sentiment ahead of Fed policy updates. - The rebranding signals crypto's institutionalization

Aifinyo AG Steps Up Its Bitcoin Exposure With Another Strategic Buy

Wintermute urges SEC to exempt on-chain settlement from legacy rules

Bitwise CIO Matt Hougan Says 100+ Crypto ETFs “Palooza” Is Coming