U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Nvidia Corp. (NVDA) is preparing to announce a crucial earnings report on Nov. 19, drawing intense attention from both investors and analysts as the AI chip giant navigates a turbulent market environment. The upcoming report,

There is a sense of anticipation in the U.S. stock market, with futures ticking upward ahead of the earnings release. Nasdaq-100 futures

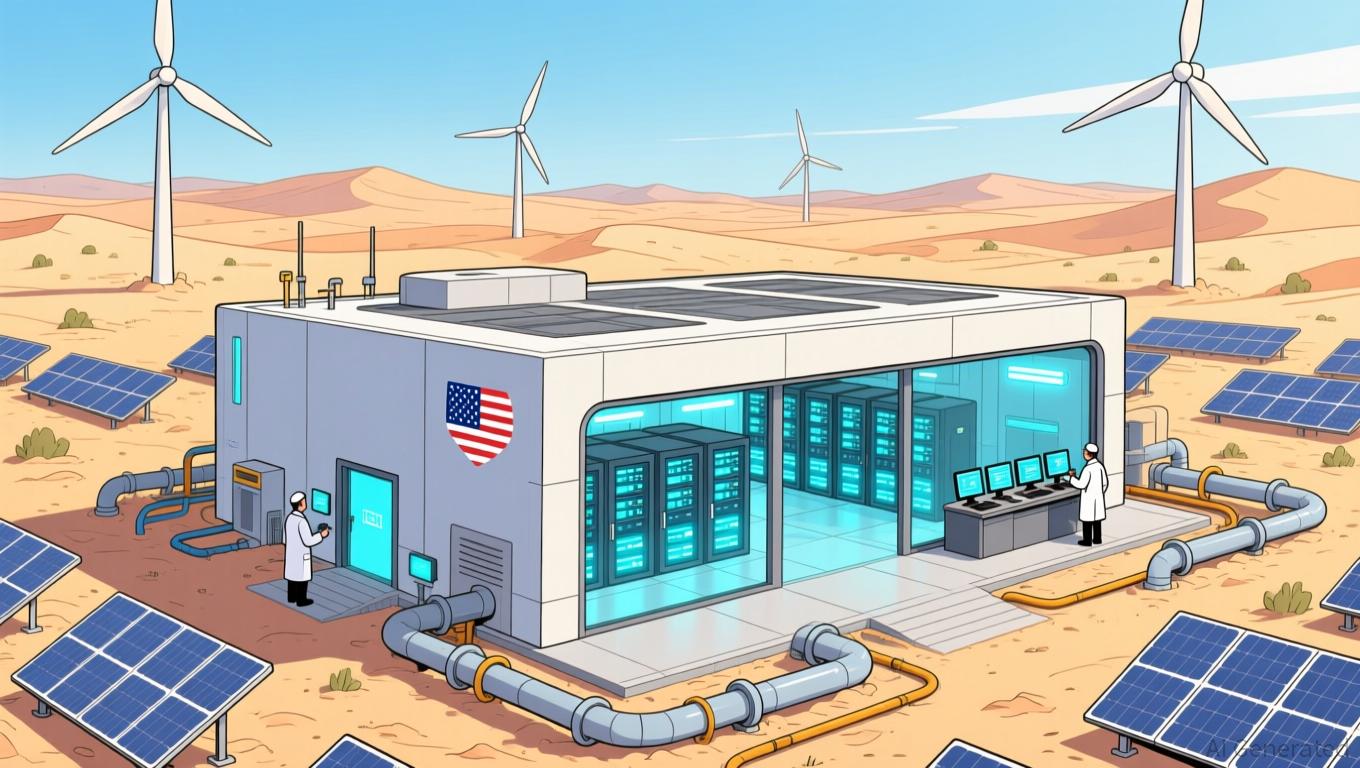

The geopolitical implications are significant. As the U.S. works to regulate the distribution of advanced AI technologies, Saudi Arabia’s Humain, backed by the country’s sovereign wealth fund, is emerging as a major contender in the global AI landscape.

As Nvidia’s earnings approach, the dynamic between business strategy, regulatory developments, and international AI rivalry is set to influence the sector’s direction. Strong results may bolster faith in the AI surge, while disappointing numbers could prompt a move toward more defensive industries. For now, attention is firmly fixed on the San Jose, California-based firm, whose ability to steer through these complex challenges will be a true test of its leadership in a rapidly evolving tech world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Grayscale Seeks Dogecoin ETF Approval: Meme Coin Gains Institutional Traction

- Grayscale files S-1 to convert Dogecoin Trust into spot ETF, seeking SEC approval by Nov 24, 2025. - This follows 2025 crypto ETF success and could drive $500M in inflows, leveraging Coinbase custody and Nasdaq listing. - Bloomberg analyst notes SEC's 20-day review window, suggesting potential rapid approval if no regulatory pushback occurs. - Dogecoin's volatility and regulatory scrutiny pose risks, but institutional adoption and social media momentum may drive growth.

Bitcoin News Update: Bitcoin Faces $83,000 Test as Whale Activity Drives Optimistic Predictions

- Bitcoin whale activity surged, with large holders transferring over 102,900 transactions above $100K and 29K above $1M, signaling a shift from selling to accumulation, per Santiment. - Analysts highlight $83K as a critical Fibonacci level, suggesting a successful defense could reignite Bitcoin's upward trajectory after stabilizing above $92K. - Derivatives markets show neutral funding rates and $83B daily volumes, indicating active participation despite drawdowns, while whale outflows suggest structured

Ethereum News Update: BlackRock's ETH Sell-Off Triggers Downward Trend as $2B Exits ETFs

- Ethereum ETFs face $2B outflows as BlackRock deposits $175.93M ETH into Coinbase Prime, signaling strategic offloading. - Death Cross pattern and oversold RSI highlight technical fragility, with price needing $3,200 to avoid $2,500 retest. - Institutional selling and macroeconomic uncertainty drive $73B ETP outflows since October, deepening bearish sentiment. - Analysts warn BlackRock's absence from crypto purchases since mid-2025 risks prolonged capitulation below $2,800 support.

Chainlink’s cross-chain advancements enhance liquidity, with LINK aiming to surpass the $14 mark

- Chainlink (LINK) partners with TAO Ventures and Project Rubicon to boost liquidity via CCIP, targeting a $14 price breakout. - The collaboration tokenizes Bittensor subnets into ERC-20 assets, enabling cross-chain DeFi access and staking rewards without selling assets. - Technical indicators (MACD convergence, ADX 37) suggest upward momentum, with analysts projecting $15–$20 price targets if $14 resistance breaks. - Institutional and retail interest grows as Chainlink's interoperability role strengthens,