Hyperliquid News Today: Doubts from Investors Cause Sharp Drop in AI Shares as Profits Fall Short of Justifying High Valuations

- AI sector stocks plummeted as investors questioned valuations despite strong Q3 earnings from Nvidia ($57B revenue) and AMD , with Nasdaq down 2.2%. - C3.ai faced 5%+ stock declines and 19% YoY revenue drop, deepening partnerships with Microsoft cloud to streamline enterprise AI deployment. - Decentralized platforms like CUDOS Intercloud gained traction, offering cost-effective GPU access via vetted data centers and smart contracts. - Sector struggles with sustainability of valuations, leadership changes

The artificial intelligence industry experienced a volatile week as investors questioned lofty valuations, even though major companies posted robust earnings.

Investors’ shift toward defensive industries such as healthcare

Nevertheless, C3.ai continues to face financial headwinds.

In contrast, decentralized computing platforms are emerging as viable alternatives to conventional cloud solutions.

As the AI industry contends with valuation challenges and operational hurdles, the dynamic between established cloud leaders and emerging decentralized options is poised to influence the sector’s next wave of growth and investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

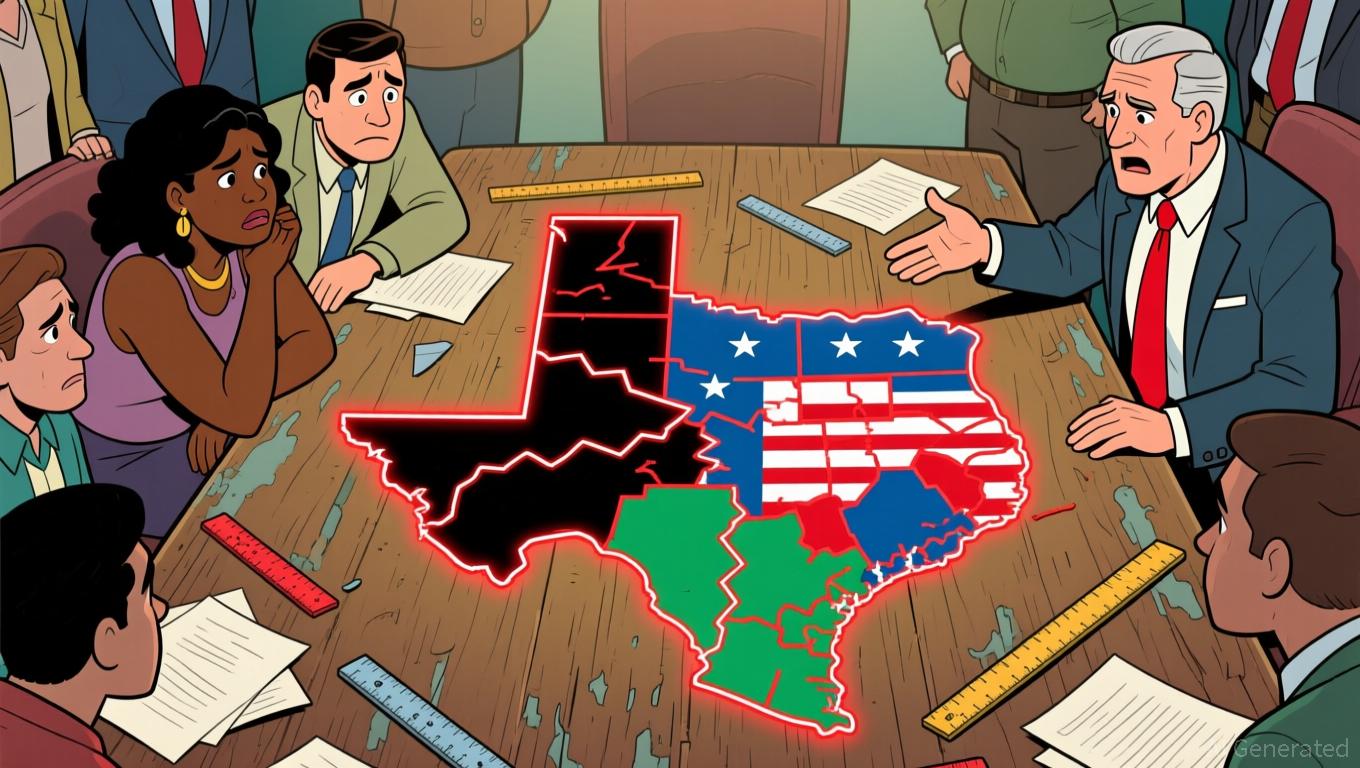

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov