YFI Declines 49.94% Over the Past Year as Overall Market Faces Downturn

- YFI fell 0.15% in 24 hours to $4006, with 49.94% annual decline amid broader crypto market downturn. - Yearn.finance lacks project updates or governance changes to drive price recovery since November 2025. - Token remains vulnerable to macroeconomic shifts and geopolitical risks affecting risk-on/risk-off investor behavior. - Analysts expect continued consolidation until on-chain metrics show ecosystem improvements or external market confidence rebounds.

As of November 23, 2025, YFI slipped by 0.15% over the previous 24 hours, settling at $4006. This represents a 9.97% decline over the past week, a 15.01% decrease in the last month, and a steep 49.94% drop compared to a year ago. These numbers highlight the persistent difficulties in the digital asset sector, with YFI facing ongoing pressure from widespread economic factors and changing investor attitudes.

The recent trajectory of YFI has been largely influenced by the absence of notable project updates or governance changes that might drive price action. Despite the token’s volatility, the Yearn.finance team has not introduced any major announcements, such as new partnerships or adjustments to tokenomics. Consequently, YFI remains susceptible to larger economic trends and shifts in global investor sentiment.

Observers in the market point out that YFI remains particularly reactive to movements in traditional financial markets, where increased uncertainty and geopolitical tensions are fueling a cautious approach among investors. Experts anticipate that YFI will continue to be affected by these overarching trends in the short term, with any potential stabilization likely depending on renewed optimism in risk assets worldwide.

The overall crypto sector is still navigating a mix of signals, with institutional participation and regulatory changes shaping investment choices. Nevertheless, for YFI, these outside influences are indirect, and there have been no core changes within the Yearn.finance platform to suggest a shift in its present direction.

With no major on-chain activity or protocol enhancements currently underway, investors are encouraged to keep a close eye on Yearn.finance’s on-chain data for any positive developments. Until such signs appear, YFI is likely to remain in a consolidation period, driven by broader economic and market forces.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

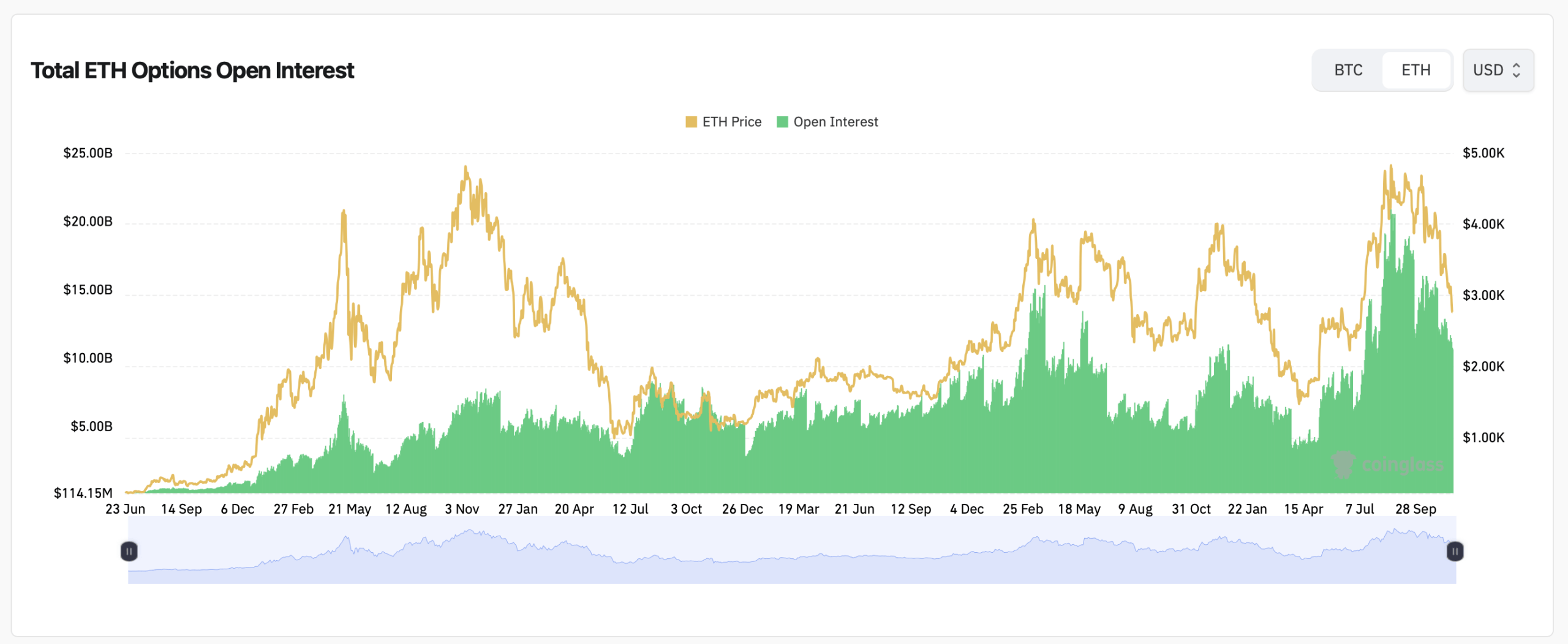

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead