At risk of being removed from the index? Strategy faces a "quadruple squeeze" crisis

Strategy is facing multiple pressures, including a significant narrowing of mNAV premiums, reduced coin hoarding, executive stock sell-offs, and the risk of being removed from indexes. Market confidence is being severely tested.

Original Title: "MicroStrategy Faces a Confidence Test: Nasdaq Delisting Risk, Motives for Selling Bitcoin to Buy Back Shares, Executive Sell-Offs"

Original Author: Nancy, PANews

The crypto market is in turmoil, with bitcoin weakness dragging down the overall market, accelerating the clearing of bubbles and making investors walk on thin ice. As one of the key indicators in the crypto space, leading DAT (Digital Asset Treasury) company MicroStrategy is facing multiple pressures: a sharp narrowing of mNAV premium, weakened bitcoin accumulation, executive stock sell-offs, and the risk of index delisting, all severely testing market confidence.

MicroStrategy Faces a Crisis of Trust, Possible Index Delisting?

Currently, the DAT sector is experiencing its darkest hour. As bitcoin prices continue to fall, the premium rates of several DAT companies have plummeted across the board, stock prices remain under pressure, and accumulation activities have slowed or even stalled, putting their business models to the test of survival. MicroStrategy has not been spared and is now mired in a crisis of trust.

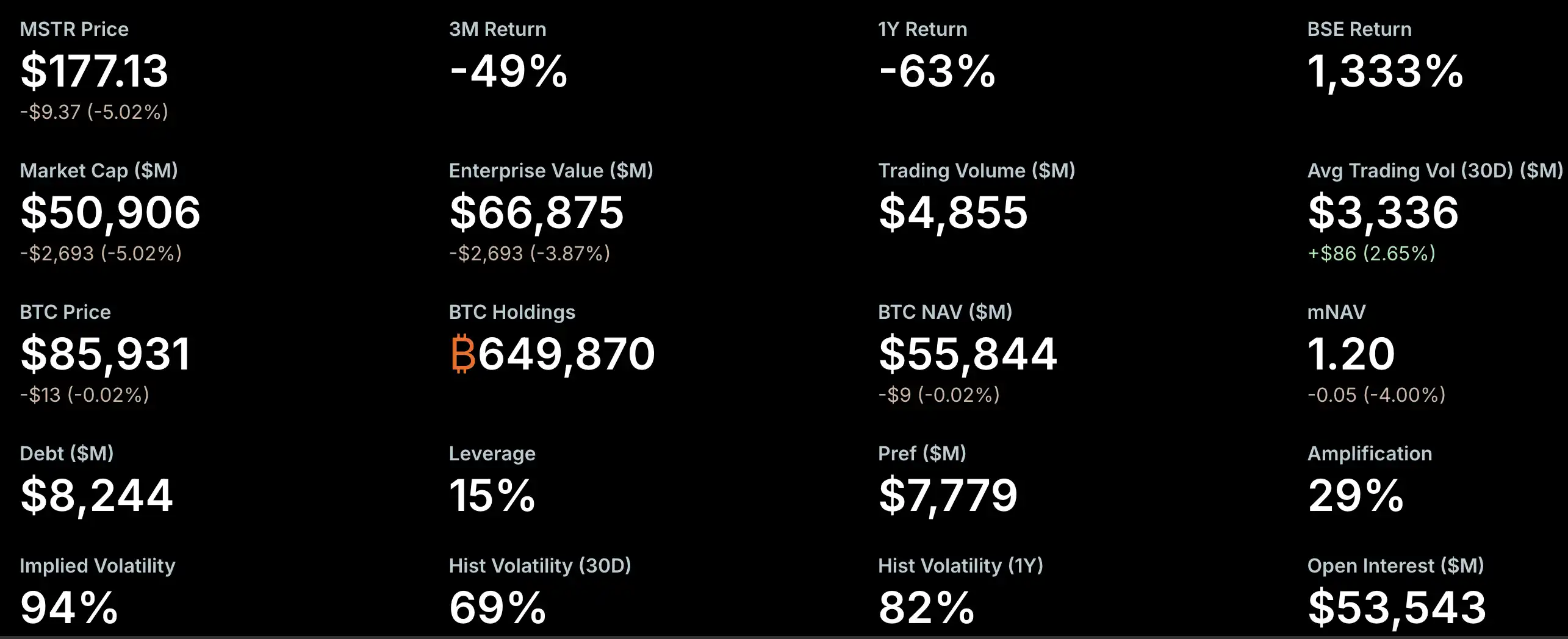

mNAV (market net asset value multiple) is one of the key indicators of market sentiment. Recently, MicroStrategy's mNAV premium has rapidly contracted, at one point approaching the critical threshold. According to StrategyTracker data, as of November 21, MicroStrategy's mNAV was 1.2, having previously fallen below 1. Compared to its historical high of 2.66, this represents a drop of about 54.9%. As the largest and most influential DAT company, the failure of MicroStrategy's treasury premium has triggered market panic. The underlying reason is that the decline in mNAV weakens financing ability, forcing the company to issue shares and dilute existing shareholders, putting further pressure on the stock price and causing mNAV to drop further, creating a vicious cycle.

However, Greg Cipolaro, Global Head of Research at NYDIG, points out that mNAV as a metric for evaluating DAT companies has its limitations and should even be removed from industry reports. He believes mNAV can be misleading because its calculation does not take into account the company's operating business or other potential assets and liabilities, and is usually based on the assumed number of shares outstanding, not including unconverted convertible debt.

Poor stock performance has also raised market concerns. According to StrategyTracker data, as of November 21, MicroStrategy's total market capitalization for MSTR shares was about $50.9 billion, already lower than the total market value of its nearly 650,000 bitcoins (average holding cost of $74,433) at $66.87 billion, meaning the company's stock is trading at a "negative premium." Since the beginning of this year, MSTR's stock price has fallen by 40.9%.

This situation has raised concerns about its potential removal from the Nasdaq 100 and MSCI USA indices. JPMorgan predicts that if global financial index provider MSCI removes MicroStrategy from its stock indices, related outflows could reach as much as $2.8 billion; if other exchanges and index compilers follow suit, the total outflow could reach $11.6 billion. MSCI is currently evaluating a proposal to exclude companies whose main business is holding bitcoin or other crypto assets, and where such assets account for more than 50% of their balance sheet. A final decision will be made by January 15, 2026.

However, for now, the risk of MicroStrategy being removed is relatively low. For example, the Nasdaq 100 index adjusts market capitalization on the second Friday of December each year: the top 100 remain, those ranked 101–125 must have been in the top 100 the previous year to stay, and those ranked above 125 are unconditionally removed. MicroStrategy is still in the safe zone, ranking within the Top 100 by market cap, and recent financial reports show its fundamentals are solid. In addition, several institutional investors, including the Arizona State Retirement Fund, Renaissance Technologies, Florida State Pension Fund, Canada Pension Plan Investment Board, Swedbank, and the Swiss National Bank, all disclosed holdings of MSTR shares in their Q3 reports, which has also helped support market confidence to some extent.

Recently, MicroStrategy's pace of bitcoin accumulation has slowed significantly, which the market interprets as a lack of "ammunition," especially as its Q3 financial report shows cash and cash equivalents of only $54.3 million. Since November, MicroStrategy has added a total of 9,062 bitcoins, far less than the 79,000 added in the same period last year, though this is also affected by the rise in bitcoin prices. Most of this month's accumulation came from last week's latest purchase of 8,178 BTC, with other transactions mostly in the hundreds of bitcoins.

To supplement its funds, MicroStrategy has begun seeking international market financing and launched new financing instruments such as perpetual preferred shares (which require high dividends, 8-10%). Recently, the company raised about $710 million by issuing its first euro-denominated perpetual preferred share, STRE, to support its strategic layout and bitcoin reserve plan. Notably, the company currently has six outstanding convertible bonds, with maturities between September 2027 and June 2032.

In addition, internal executive movements have also drawn market attention. MicroStrategy disclosed in its financial report that Executive Vice President Wei-Ming Shao will leave the company on December 31, 2025, and since September this year, he has sold MSTR shares worth $19.69 million in five transactions. However, these sales were carried out according to a pre-arranged 10b5-1 trading plan. Under SEC rules, a 10b5-1 trading plan allows company insiders to trade shares according to pre-set rules (specifying quantity, price, or schedule), thereby reducing the legal risk of insider trading.

Multiple Analyses Suggest Debt Risk Is Exaggerated, High-Premium Investors Under Significant Pressure

In the face of bearish sentiment in the crypto market and multiple concerns about the DAT business model, MicroStrategy founder Michael Saylor reiterated the "HODL" philosophy in a post, expressing continued optimism despite the recent drop in bitcoin prices, and emphasizing that MicroStrategy will not sell its holdings unless bitcoin falls below $10,000, in an effort to boost market confidence.

Meanwhile, the market has analyzed MicroStrategy from multiple angles. Matrixport points out that MicroStrategy remains one of the most representative beneficiaries of this bitcoin bull market. The market has long worried whether the company would be forced to sell its bitcoin holdings to repay debt. From the current asset-liability structure and debt maturity distribution, Matrixport judges that the probability of "forced bitcoin sales to repay debt" in the short term is low and not the main risk at present. The greatest pressure is currently on investors who bought in at high premiums. Most of MicroStrategy's financing occurred when its stock price was near the historical high of $474 and per-share NAV was at its peak. As NAV has gradually declined and the premium compressed, the stock price has fallen from $474 to $207, leaving early investors who bought at high premiums facing significant unrealized losses. Compared to the current bitcoin rally, MicroStrategy's stock price has clearly corrected from previous highs, making its valuation relatively more attractive, and there are still expectations that it will be included in the S&P 500 index in December.

Crypto analyst Willy Woo further analyzed MicroStrategy's debt risk and expressed strong doubt that it would be liquidated in a bear market. In a tweet, he stated that MicroStrategy's debt is mainly in the form of convertible senior notes, which can be repaid in cash, common stock, or a combination of both upon maturity. MicroStrategy has about $1.01 billion in debt maturing on September 15, 2027. Woo estimates that to avoid having to sell bitcoin to repay debt, MicroStrategy's stock price at that time must be above $183.19, roughly equivalent to a bitcoin price of about $91,502.

CryptoQuant founder and CEO Ki Young Ju also believes the probability of MicroStrategy going bankrupt is extremely low. He bluntly stated, "MSTR would only go bankrupt if an asteroid hit the earth. Saylor will never sell bitcoin unless shareholders demand it, and he has emphasized this publicly many times."

Ki Young Ju pointed out that even if Saylor sold just one bitcoin, it would shake MSTR's core identity as a "bitcoin treasury company," triggering a double death spiral for both bitcoin and MSTR's stock price. Therefore, MSTR shareholders not only hope that bitcoin's value remains strong, but also expect Saylor to continue using various liquidity strategies to ensure that MSTR rises in tandem with bitcoin's price.

Addressing market concerns about debt risk, he further explained that most of MicroStrategy's debt is in the form of convertible bonds, and failing to reach the conversion price does not mean liquidation risk. It simply means the bonds must be repaid in cash, and MSTR has many ways to handle upcoming debt maturities, including refinancing, issuing new bonds, obtaining secured loans, or using operating cash flow. Failure to convert does not trigger bankruptcy; it is just a normal debt maturity event and unrelated to liquidation. While this does not mean MSTR's stock price will always remain high, the idea that they would sell bitcoin to boost the stock price or go bankrupt as a result is completely absurd. Even if bitcoin fell to $10,000, MicroStrategy would not go bankrupt; the worst-case scenario would be a debt restructuring. In addition, MSTR could choose to use bitcoin as collateral to raise cash, though this would bring potential liquidation risk and would therefore be a last resort.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Does DeFi's security dilemma have to compromise with "unlimited authorization" and "trusted third parties"?

The security challenges faced by DeFi have never been unsolvable problems.

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

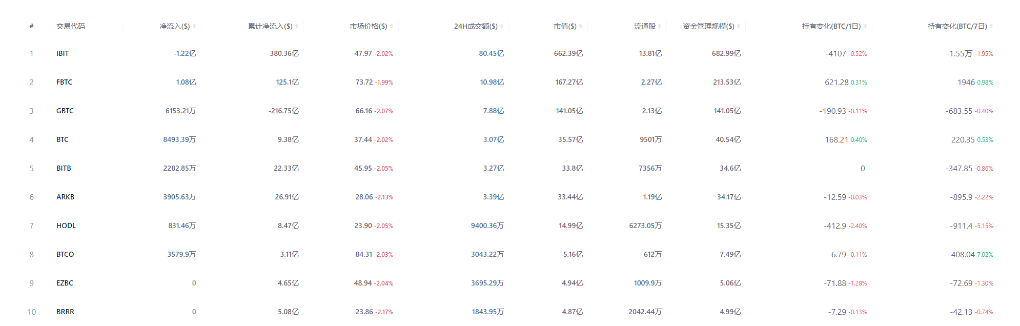

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?