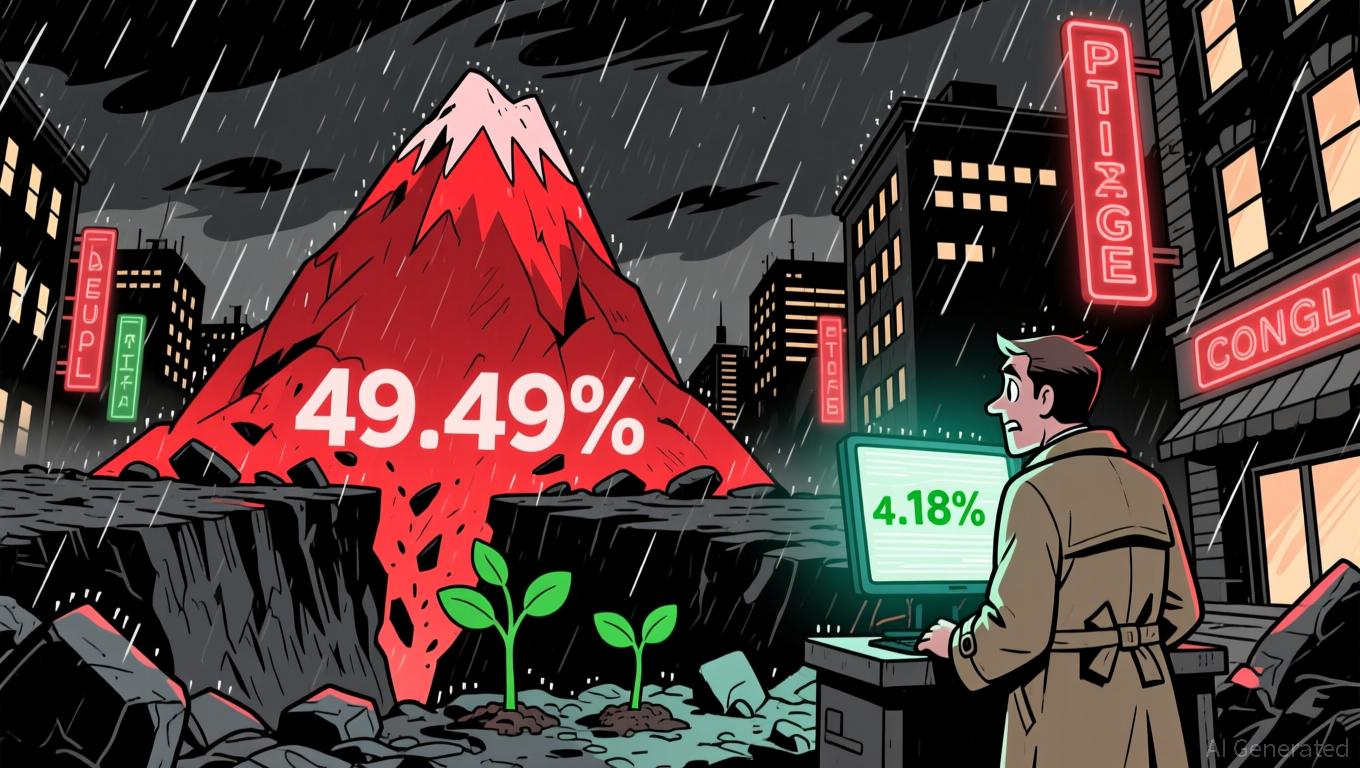

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

On November 24, 2025, YFI (yearly interest factor) saw its value climb by 1.18% in the past 24 hours, bringing its price to $4,036. Despite this brief upward movement, the overall trend remains negative: in the last seven days, YFI has fallen by 9.16%, and over the previous 30 days, it has lost 14.24%. Most notably, the asset has suffered a 49.49% decrease over the past year, highlighting a persistent bearish pattern even with the recent short-term rise.

This activity highlights the continued instability within the

The recent changes in YFI’s price mirror the broader sense of unpredictability in the market. Short-lived gains can often be attributed to shifts in liquidity, economic indicators, or speculative trades. However, since there have been no notable news or events linked to YFI, this movement likely stems from general market forces. Traders are watching closely for any signs of stabilization, but the prevailing downward trend continues to dominate.

Given the asset’s performance over the past year, investors should approach with caution, as it remains highly responsive to economic shifts and changing market sentiment. While the latest increase is encouraging, it does not necessarily signal a reversal of the broader trend. Uncertainty is still being factored into the market, and only a sustained period of growth could indicate a potential change in direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Connects Conventional Finance and Web3 Following UAE Authorization

- Animoca Brands secured in-principle approval from Abu Dhabi's FSRA to operate as a regulated fund manager in the UAE's ADGM digital asset hub. - The conditional approval enables the Web3 investor to establish a collective investment fund, aligning with its institutional-grade digital asset expansion strategy. - The move complements Animoca's $1B valuation reverse merger with Currenc Group , aiming to re-enter public markets after 2020's delisting. - ADGM's regulatory framework requires firms to meet capi

Bitcoin Updates: Bitcoin Jumps 60%—Sign of Market Evolution or Monoculture Danger?

- Bitcoin's market dominance nears 60% as altcoins lag amid regulatory pressures and shifting investor preferences toward stability. - U.S. investigations into Bitmain's mining hardware and proposed Bitcoin adoption policies highlight regulatory and institutional risks reshaping the sector. - Macroeconomic uncertainties and MSCI's crypto index exclusion plans intensify Bitcoin's appeal over altcoins, with critics warning of forced sell-offs. - While Bitcoin outperforms gold in appreciation potential, its v

Blockchain and AI Empowering SMEs to Compete Equally in International Trade

- Ant Group's Eric Jing proposed blockchain smart contracts and AI to address SME income distribution challenges at Singapore FinTech Festival 2025. - Blockchain infrastructure enables real-time, transparent revenue sharing among collaborative agents, with digital currency enhancing trustless transactions. - AI tools like Antom Copilot and EPOS360 streamline SME operations, while MAS partnerships through sandboxes advance blockchain-based trade solutions. - Projects like Guardian (tokenized money) and Path

Bitcoin Updates Today: Bitcoin Holds Firm While Investors Navigate Policy-Related Uncertainty

- Trump's 40% tariff exemption for Brazilian coffee/beef eases U.S.-Brazil trade tensions, stabilizing global commodity markets amid political clashes. - Lula's firm stance secures Brazil's agricultural exports, boosting domestic political standing while avoiding inflation spikes in U.S. food markets. - Bitcoin maintains stability at $82,000 despite Trump's tariff-driven volatility, reflecting investor confidence in decentralized assets as policy hedges. - Tariff exemptions highlight limits of U.S. economi