Written by: Deep Tide TechFlow

Do you remember Grass, the star project from the last DePIN narrative?

On November 16, GRASS just hit a historic low of $0.26. However, a week later, the token rebounded by more than 45%, outperforming the broader market during the same period.

There is a sentiment in the community that the previous sharp fluctuations in the GRASS token price were driven by speculation around the project's first Token Holder Call, with hopes that the team would reveal stronger fundamental information during this meeting for all token holders.

Today, Grass has completed this Token Holder Call. After listening to the content, I found that it was less like the typical “fireside chat” AMA common in crypto projects and more like a financial report-style information disclosure.

Grass’s revenue data, client composition, buyback plan, and airdrop timeline were all made public for the first time.

If you missed the meeting, we have quickly summarized the data and key information revealed in the meeting video and official recap to help you determine which signals are worth paying attention to.

Meeting replay link: Click here

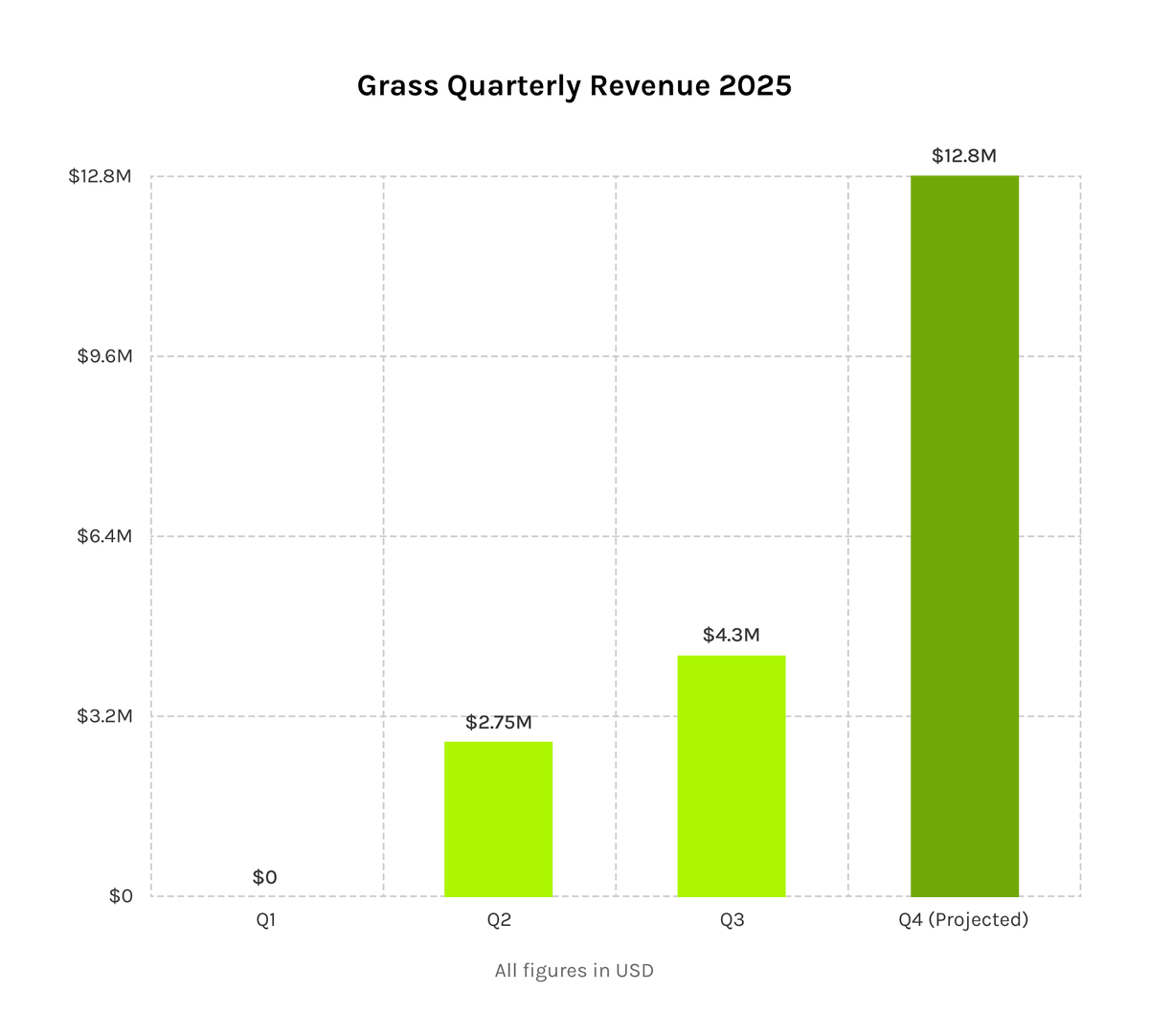

From zero to tens of millions in revenue in just three quarters?

This is the first time Grass has publicly disclosed its revenue data:

-

Q1 2025: Close to zero

-

Q2 2025: About $2.75 million

-

Q3 2025: About $4.3 million

-

Q4 2025 (forecast): About $12.8 million

The team stated that in just October and November, revenue is expected to reach $10 million. It should be noted that Q4 data is still a forecast and the actual situation remains to be verified.

How does Grass make money?

When discussing revenue, you need to understand what Grass’s business is.

Grass is a distributed bandwidth network. After users install a plugin or app, Grass borrows your idle network bandwidth to crawl content from public web pages, including text, images, and videos.

Because requests come from ordinary household IPs around the world, they are less likely to be blocked by websites, which is valuable for clients who need to collect data at scale.

Who are the clients? Mainly AI companies. Training large models requires massive amounts of data, and Grass helps them obtain these materials at a lower cost. Simply put, Grass “borrows” bandwidth from users, packages it as a data collection service, and sells it to AI companies, earning the difference.

Where does the revenue come from?

It was mentioned in the meeting that 90% of revenue comes from “multimodal data”: that is, collection services for non-text content such as video, audio, and images; 98% of revenue is related to AI model training.

This shows that Grass’s current client base is highly concentrated: they are basically all AI companies, and what they buy is essentially training data.

Business focus is one aspect, but conversely, it also means that if the AI training data market changes, Grass’s revenue will be directly affected.

About the clients

Grass does not disclose its client list, reasoning that AI companies consider training data a commercial secret. Information mentioned in the meeting includes:

-

In Q4, they signed a new hyperscaler (which you can understand as a large cloud computing provider) and a leading lab in the video generation field

-

Almost all AI clients who have worked with them have made repeat purchases

However, these statements all come from the official team, and it is almost impossible for outsiders to verify the authenticity of the data.

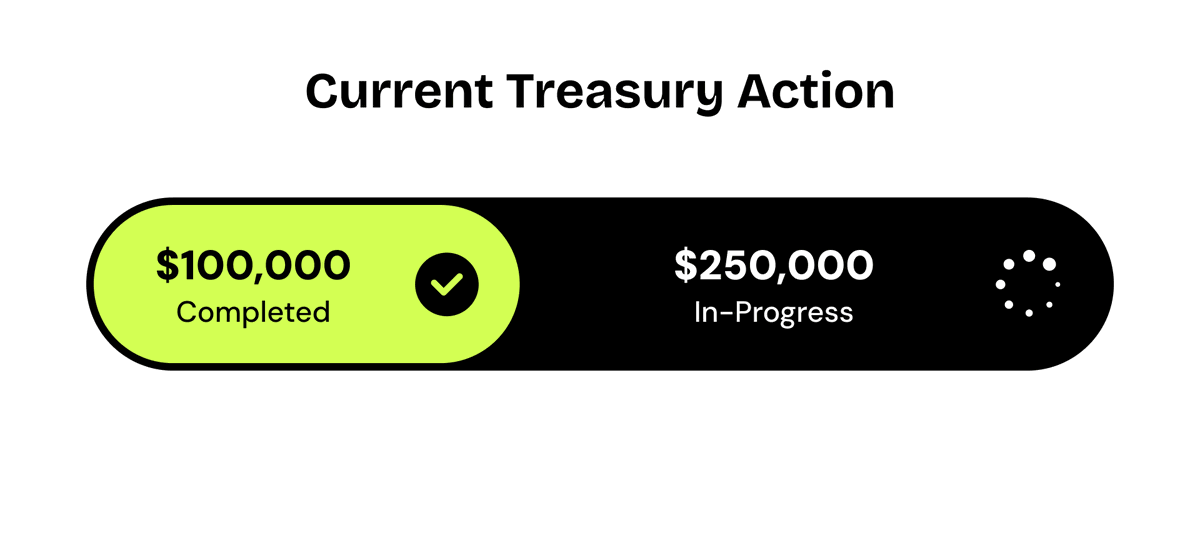

Token buyback has started, but not much

It was disclosed in the meeting that Grass has used business revenue to buy GRASS tokens from the open market, with about $100,000 in buybacks completed last week and about $250,000 underway this week.

The funds for the buyback come from revenue in the first three quarters of this year. To prevent skepticism about whether the buyback is actually happening, the team said they will later publish the wallet addresses holding these tokens.

The current total buyback amount is about $350,000. Compared to the combined revenue of about $7 million in Q2 and Q3, this means the buyback funds account for about 5%, which is not a particularly large amount and seems more like a gesture.

The team mentioned that future buybacks will shift from manual decisions to programmatic execution, but no specific rules were given.

However, it should be noted that buybacks are not a foolproof catalyst—both HYPE and PUMP have buybacks and real revenue, but token prices can still experience sharp drops at times.

The team also said two things: first, they will buy back tokens; second, most revenue will be invested in growth. How these two are balanced is currently unclear. How long the buyback can last and whether it can be scaled up ultimately depends on whether revenue continues to grow.

The second airdrop is set for the first half of next year

Grass conducted an airdrop last year, distributing GRASS tokens to early participants. This meeting confirmed the time window for the second airdrop:

The first half of 2026.

The claiming method will change

Unlike the first airdrop, Airdrop 2 will not be claimed through external wallets, but will be distributed via Grass’s soon-to-be-launched built-in wallet. This wallet is based on account abstraction technology and will be embedded in Grass’s product interface.

In other words: in the future, you won’t need to connect a third-party wallet like MetaMask to claim the airdrop; you’ll receive it directly in the Grass backend.

The rules will change

The official statement is that the new airdrop will “emphasize long-term network contribution” more. But exactly how contribution is calculated, how long counts as long-term, and how different devices and behaviors are weighted—none of these details have been announced and will only be clarified after the wallet goes live.

What does this mean for current users?

If you are currently running a Grass node, this meeting did not provide clear action guidance. The only certainty is: the rules will change, the timing is the first half of next year, and there will be a new calculation method. As for whether current points, levels, and device counts will retain their weight, it is unknown.

The current market is in a bear phase, and whether the overall crypto situation will improve in the first half of next year remains uncertain. The airdrop timeline given by GRASS is quite vague, which I believe is, to some extent, a delaying tactic to cope with the current bear market.

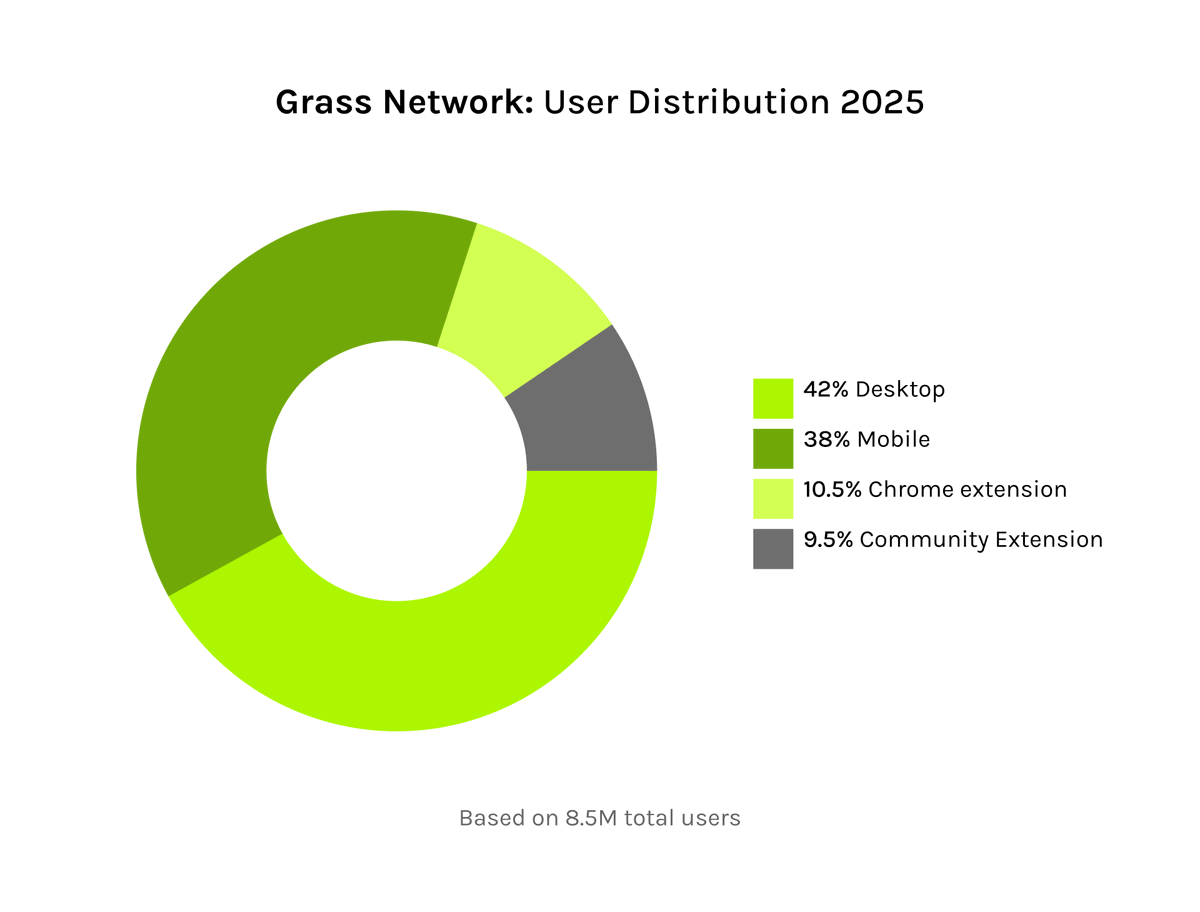

Monthly active users grew from 3 million to 8.5 million, next step is to become a real-time data source for AI

The scale of Grass’s network has grown significantly over the past year. Official data shows that monthly active participants have increased from about 3 million at the time of the first airdrop to about 8.5 million now. Mobile users account for about 38%, meaning over a third contribute bandwidth via the mobile app rather than the desktop plugin.

The team claims that the total amount of multimodal data (video, audio, images) accumulated by Grass exceeds 250 PB. 1 PB is about 1 million GB. According to the team, this volume is “enough to train a cutting-edge video generation model.”

New direction: from selling training data to providing real-time queries

Grass is developing a new product line called Live Context Retrieval (LCR).

The current business helps AI companies collect data for model training—one-off, large-scale batches. LCR is positioned differently: it provides real-time data for AI models during operation. For example, if a model needs to query the current content of a web page, Grass can instantly crawl and return it.

LCR is still in its early stages, which the team calls the “V0 version,” and is being tested with three SEO companies and one AI lab.

The team explains: training data is a big-ticket business, high in value but low in frequency, and not suitable for on-chain settlement. LCR is a high-frequency, small-amount scenario, where each query corresponds to a small payment, making it more suitable for token-based transactions.

If LCR succeeds, the GRASS token will have more utility in actual business. But for now, this is still in the planning stage, and LCR itself has not yet generated revenue.

Meanwhile, the hardware device Grasshopper, originally planned for release this year, has been delayed due to supply chain issues caused by tariffs. The specific timeline will be announced separately.

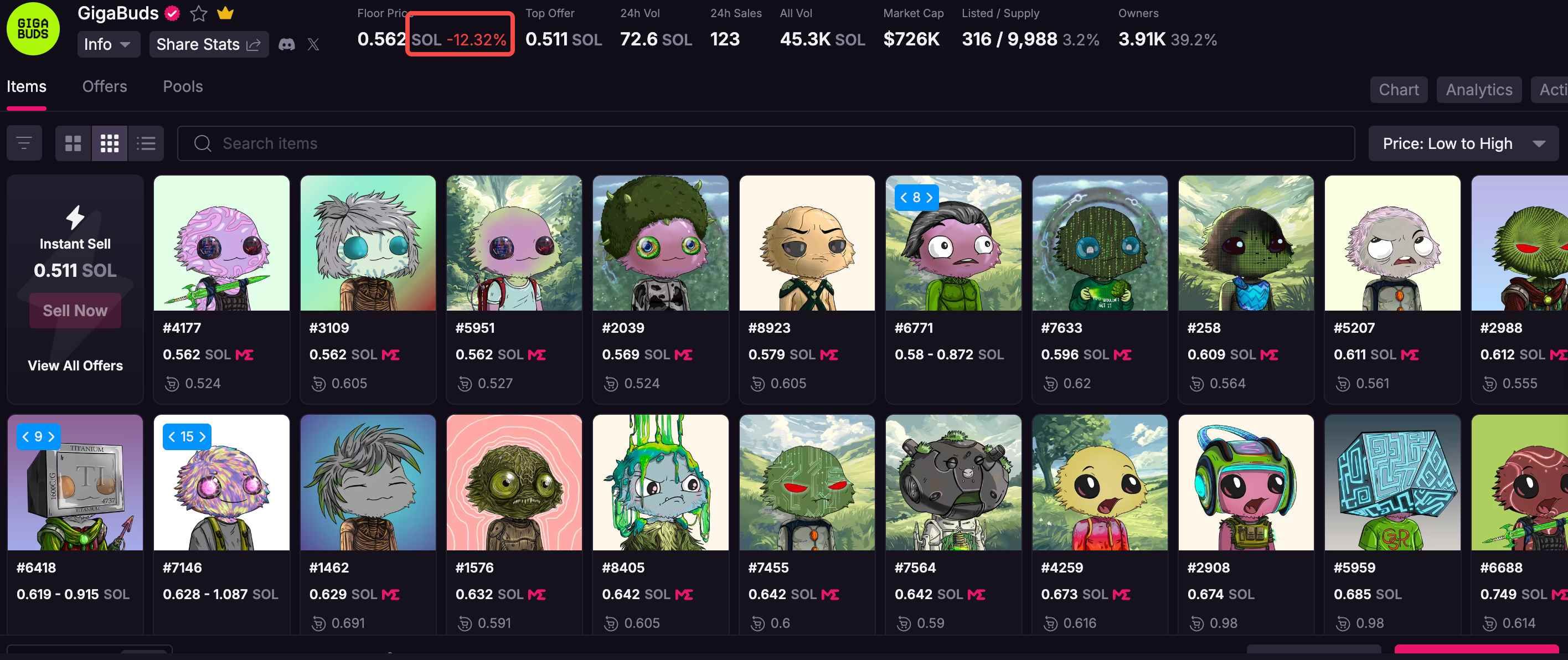

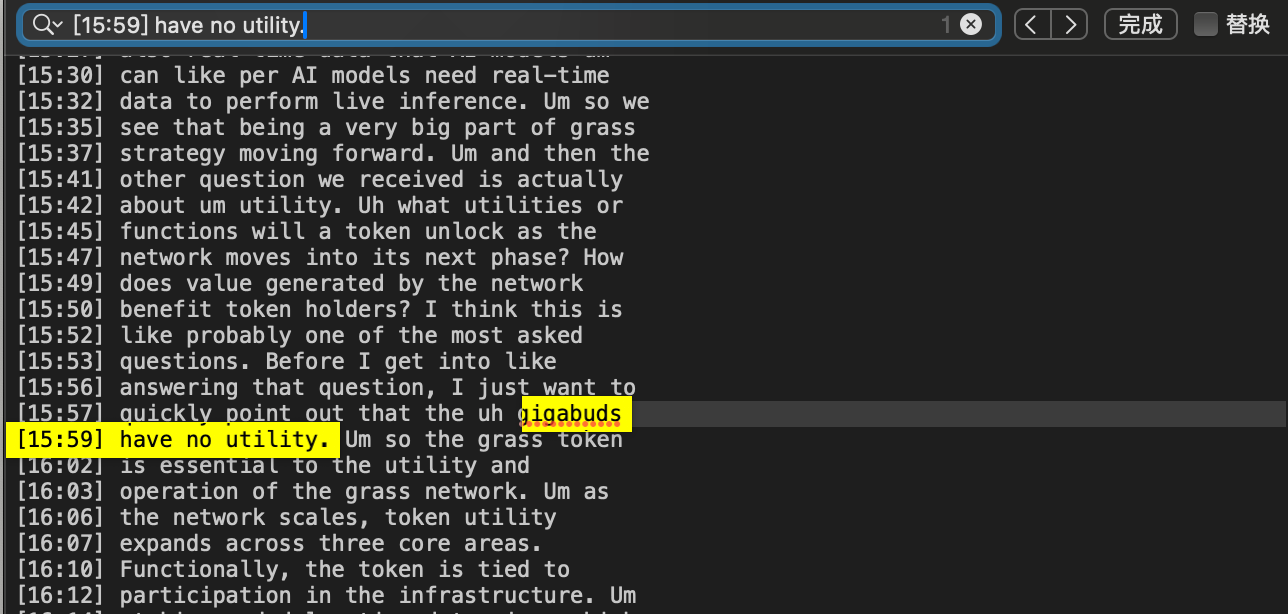

A sentence deleted from the official summary

During the part of the meeting discussing token utility, Grass CEO Andre said: “Gigabuds have no utility,” meaning Gigabuds have no functional use.

However, this sentence did not appear in the written summary released by the team after the meeting.

What are Gigabuds?

Gigabuds is an NFT series launched by Grass. Some holders may have expected it to provide added benefits in future airdrops or network rights, but the team clearly denied this expectation in the meeting.

The drop in floor price may also be a response to this statement.

As for why it was omitted from the official summary, the team did not explain. Possible reasons include avoiding negative sentiment among NFT holders or considering it non-core business information.

This sentence was indeed said in the meeting and is present in the transcript.

If you hold Gigabuds and bought them with the expectation that “they might be useful in the future,” this is a clear official statement. Whether the NFT itself still has collectible or secondary market value is another matter, but the path of functional utility has been officially closed.

Revenue goes to the foundation, the development team gets a service fee

Many crypto projects have opaque company structures, leaving users unclear about who gets the revenue, who manages the tokens, and what the relationship is between the development team and the project. In this meeting, Grass explained its structure quite clearly.

Three entities, each with its own role

Grass Foundation is a Cayman Islands-registered foundation with no shareholders. It has two subsidiaries:

-

Grass OpCo: Responsible for network operations, managing airdrops and staking

-

Grass DataCo: Responsible for B2B business; all client contracts are signed by this company, and revenue also goes to this company

The development team is outsourced

The team responsible for product development is called Wynd Labs. It is not a subsidiary of Grass, but a third-party service provider. Wynd Labs is paid a service fee and does not share in Grass’s revenue.

It was especially emphasized in the meeting: even if a client is brought in by Wynd Labs, the contract is signed by Grass DataCo and the revenue goes to Grass DataCo.

How much is the service fee?

The team did not disclose this. So, how much the development team actually takes home is unknown to outsiders.

To summarize:

This meeting covered revenue data, buyback progress, airdrop timeline, product direction, and company structure. For a DePIN project, this level of information density is uncommon.

What was not discussed: who the clients are, how long the buyback will last or how large it will be, the specific rules for Airdrop 2, and when new business will generate revenue. For these, the team either said they cannot disclose or that more information will be released later.

This is the first time Grass has held such a meeting, and the team said there will be more in the future. For token holders, these business developments may be more worth tracking than price fluctuations.

We also hope more crypto projects can disclose their business revenue like this; in a market where everyone is competing to be the worst, this is already quite rare.