Morning Brief | Bitcoin Sharpe Ratio Drops Below 0; Google Plans to Sell TPUs Directly to Meta; Paxos Announces Acquisition of New York Crypto Wallet Startup Fordefi

Overview of major market events on November 25.

Compiled by: ChainCatcher

Key News:

- Google plans to sell TPUs directly to Meta, potentially further eroding Nvidia's market share

- James Wynn predicts bitcoin will fall to $67,000 this week, after accurately forecasting the previous drop

- DOGE: Reuters' report about its demise is fake news

- Vitalik comments on SitusAMC attack: Privacy is not optional, but a "hygiene habit"

- Analysis: Bitcoin's Sharpe ratio has fallen below 0, possibly signaling a major bottom

- Paxos announces acquisition of New York crypto wallet startup Fordefi, deal exceeds $100 million

- Hong Kong SFC finalizing regulatory regime for digital asset trading and custody services

What important events happened in the past 24 hours?

Google plans to sell TPUs directly to Meta, potentially further eroding Nvidia's market share

According to ChainCatcher, Google's parent company Alphabet (GOOG.O) is in talks with companies such as Meta (META.O) to open up the use of its self-developed Tensor AI chips, further expanding its competition with Nvidia (NVDA.O). As a result of this news, Google and its AI chip partner Broadcom saw their shares rise after hours, while Nvidia and AMD shares fell. Traditionally, Google has only deployed its self-developed TPUs in its own data centers and rented out computing power to customers. However, according to US tech media The Information on Monday night local time, Google now plans to sell TPU chips directly to customers for deployment in their own data centers.

Meta is considering purchasing Google TPUs worth billions of dollars for its data centers starting in 2027, and may begin renting TPU computing power from Google Cloud as early as 2026. Currently, Meta's AI business mainly relies on Nvidia GPUs. This represents a potentially huge emerging market for Google and Broadcom, who co-designed the Tensor chips. At the same time, it could create significant competitive pressure on Nvidia and AMD, potentially impacting their sales and pricing power. (Golden Ten Data)

James Wynn predicts bitcoin will fall to $67,000 this week, after accurately forecasting the previous drop

According to ChainCatcher, James Wynn once again posted a bearish prediction on X, stating that bitcoin may fall to $67,000 this week. Notably, on November 10, James Wynn told the community he firmly believed bitcoin would fall back to the $67,000–$92,000 range, when the price of bitcoin was $105,600.

According to ChainCatcher, DOGE (US Office of Government Efficiency) posted on X that the Reuters report about its demise is fake news. The department will resume its regular Friday updates in a few days.

The American people have authorized President Trump to modernize the federal government and reduce waste, fraud, and abuse. Just last week, the department terminated 78 wasteful contracts, saving taxpayers $335 million.

Michael Saylor: Will destroy private keys to over 17,000 BTC, treating it as a "legacy"

According to ChainCatcher, Michael Saylor said he will destroy the private keys to more than 17,000 BTC worth $1.5 billion, calling it "my legacy."

"Big Short" Michael Burry "returns," publishes column warning of AI bubble risk

According to ChainCatcher, as reported by Wallstreetcn, after rumors of fund closures and "AI short positions exaggerated by the media by a hundredfold," Michael Burry, the prototype of "The Big Short" and a well-known investor, made his promised return on November 24 local time.

He published his first column, "The Main Signs of a Bubble: Supply-Side Gluttony," to express his "short AI" view. In this article, he formally declared war on the current AI boom, with Nvidia at the center of the storm. He directly compared Nvidia to Cisco in the past.

In response to the recent mainstream market view that "tech giants are highly profitable, so there is no bubble," Burry strongly refuted this in his article. He cited data from the peak of the 1999 internet bubble, pointing out that the boom at that time was also driven by highly profitable companies, not just small websites with no revenue. Burry stated that the key problem with the current AI boom is "catastrophic oversupply and far insufficient demand." He concluded: no matter how many people try to prove this time is different, history from 1999 is repeating itself.

Vitalik comments on SitusAMC attack: Privacy is not optional, but a "hygiene habit"

According to ChainCatcher, market sources say that customer data from major US banks such as JPMorgan, Citigroup, and Morgan Stanley may have been leaked due to a cyberattack on mortgage technology provider SitusAMC.

The company confirmed on Saturday that a threat actor stole data related to several large financial institutions, including "accounting records, legal agreements," and some customer data. The scope, nature, and extent of the leak are still under investigation. Ethereum co-founder Vitalik Buterin commented: "Privacy is not a feature, but a hygiene habit." His response echoes his view throughout this year that privacy should be a basic requirement of digital systems, not an add-on.

Analysis: Bitcoin's Sharpe ratio has fallen below 0, possibly signaling a major bottom

According to ChainCatcher and CryptoQuant data, bitcoin's Sharpe ratio has fallen below 0, reaching its lowest level since the FTX crash. In addition, the chart shows that periods when the Sharpe ratio falls to or near zero often coincide with bitcoin price bottoms or major reversals.

The Sharpe ratio is an indicator that measures the relationship between investment returns and risk. A Sharpe ratio near zero usually means high price volatility but returns insufficient to compensate for the risk, which often occurs at market bottoms or during capitulation phases.

Paxos announces acquisition of New York crypto wallet startup Fordefi, deal exceeds $100 million

According to ChainCatcher and Fortune, crypto payments infrastructure company Paxos announced the acquisition of New York crypto wallet startup Fordefi, with the deal exceeding $100 million. Fordefi focuses on crypto wallet solutions designed for decentralized finance (DeFi), currently has about 40 employees, and serves around 300 clients.

Paxos CEO Charles Cascarilla said the acquisition is to meet the growing demand for DeFi access from clients. Fordefi will temporarily operate independently, but Paxos plans to eventually integrate its technology into its own infrastructure. This is Paxos' second acquisition in the past year, after acquiring Finnish stablecoin issuer Membrane Finance to comply with EU crypto regulations.

US September core PPI MoM at 0.1%, below expectations of 0.2%

According to ChainCatcher and Golden Ten Data, the US September core PPI MoM was 0.1%, below the market expectation of 0.2%, and the previous value was -0.1%.

According to ChainCatcher and Decrypt, Binance faces a new lawsuit accusing the exchange of creating a system that allowed crypto trading related to Hamas between 2017 and 2023.

The lawsuit was filed in federal court in North Dakota by over 300 US families whose members were killed or injured in Hamas attacks. Plaintiffs allege that Binance's corporate structure and compliance practices allowed users associated with terrorist organizations to transfer funds through the centralized crypto exchange. The lawsuit claims Binance lacked adequate controls, had weak customer verification, pooled assets in omnibus wallets, and had internal communication practices that limited oversight. Plaintiffs' attorneys said Binance not only intentionally provided financial services to Hamas but also actively tried to shield its Hamas clients and their funds from US regulators or law enforcement scrutiny.

Fed's Kashkari: AI does have real use cases, but not in the crypto sector

According to ChainCatcher and Golden Ten Data, Fed's Kashkari said: AI does have real use cases, but not in the crypto sector.

Hong Kong SFC finalizing regulatory regime for digital asset trading and custody services

According to ChainCatcher, Hong Kong SFC CEO Julia Leung said Hong Kong is committed to building a safe and reliable digital asset platform and is finalizing the regulatory regime for digital asset trading and custody services, which will be the last two regulatory "pieces" for establishing a robust digital asset ecosystem.

Hong Kong is increasingly adopting tokenized financial products, such as green bonds, SFC-recognized money market funds, and retail gold products. The market size of related tokenized products in Hong Kong is about $3 billion.

Trump says he will visit China in April next year

According to ChainCatcher and Golden Ten Data, Trump posted on social media that he will visit China in April next year. "Things will only get better, and our relationship with China is very strong!" he wrote. He said this call was a further communication after the "very successful" meeting between the two sides in South Korea. Since that meeting, both sides have made "significant progress" in ensuring the relevance and accuracy of bilateral agreements.

According to ChainCatcher, in response to rumors that "Jackie Chan will play CZ in the upcoming Netflix biographical documentary 'King of Crypto'," CZ denied it, saying: "That's fake. I like Jackie Chan, but he's already 71. Give him a break! I'm still working on finishing this book. The last 5% of editing always takes 95% of the time."

According to ChainCatcher, in response to Lookonchain's claim that "Pump.fun has cashed out at least 436.5 million USDC via Kraken since October 15," Pump.fun co-founder Sapijiju responded: "This is completely untrue. Pump.fun has never cashed out (i.e., the transaction between Kraken and Circle alleged by Lookonchain involving Pump.fun). In reality, this is part of Pump.fun's fund management. The USDC raised from the PUMP ICO has been transferred to different wallets to reinvest the company's operating funds into the business. Pump.fun has never had direct cooperation with Circle."

According to ChainCatcher, Musk posted that Grok 5 will challenge top human League of Legends teams in 2026, limited to human vision and reaction speed, to test AGI adaptability in complex games. Musk emphasized that Grok 5 is designed to play any game simply by reading the manual and trying it out.

Reportedly, xAI's Grok 5 is scheduled for release in early 2026, with a parameter size of 6 trillion, supporting multimodal capabilities, and a 10% chance of achieving artificial general intelligence, surpassing previous models. This challenge highlights AI's ability to autonomously play games by reading instructions and experimenting, recruiting talent to drive xAI's breakthroughs in game AGI, and demonstrating the potential from simulation to real-world applications.

Meme Hot List

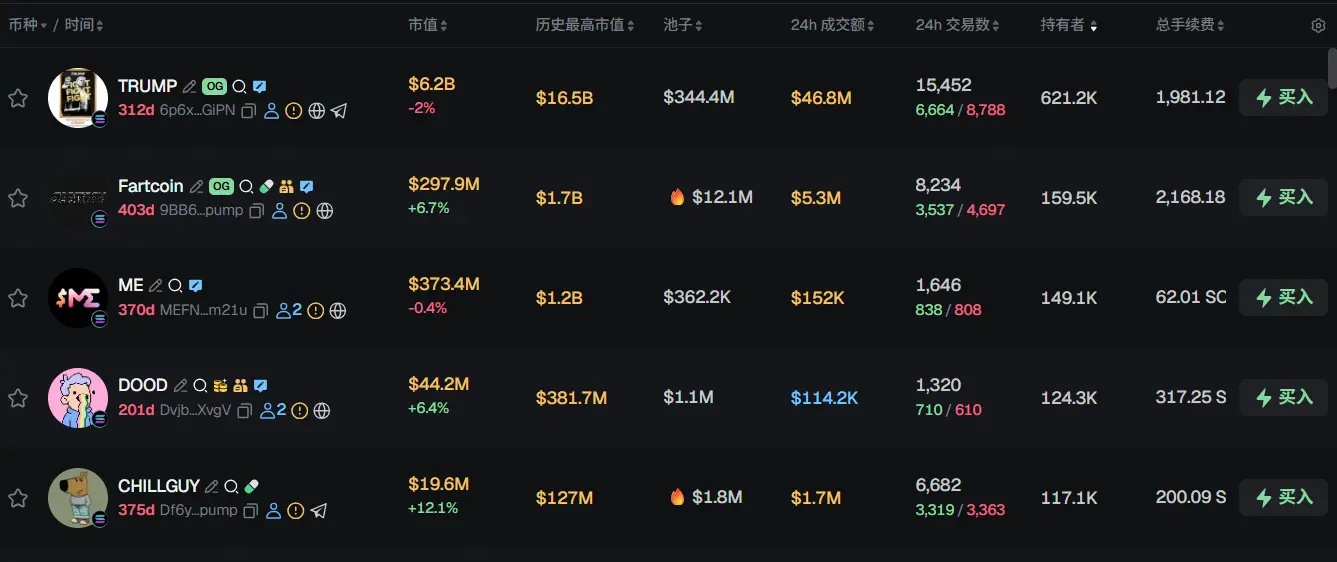

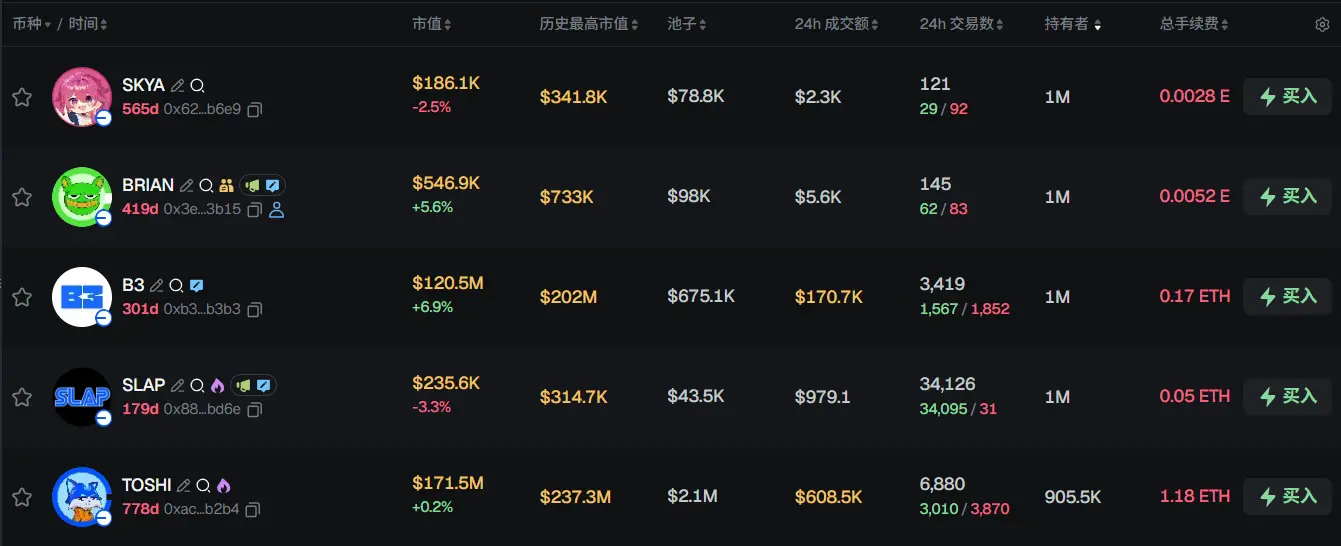

According to the Meme token tracking and analysis platform GMGN, as of November 26, 09:00 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, Fartcoin, ME, DOOD, CHILLGUY

The top five trending Base tokens in the past 24h are: SKYA, BRIAN, B3, SLAP, TOSHI

What are some must-read articles from the past 24 hours?

What is DOGE, which hasn't been dissolved, still doing?

The Reuters report that "the US Office of Government Efficiency DOGE has been dissolved" turned out to be fake news.

According to Reuters on November 23, the person who publicly confirmed this news was a senior official in the Trump administration, Scott Kupor, director of the US Office of Personnel Management (USOPM). The news quickly caused a stir. In Reuters' description, DOGE's gradual demise now stands in stark contrast to the government's months-long publicity of its achievements: Trump and his advisers, as well as cabinet ministers, promoted it on social media in the early days, and Musk even once waved a chainsaw to promote its reduction of government positions.

However, a dramatic turn soon followed, as this seemingly explosive report quickly sparked controversy and multiple clarifications.

How to survive the bitcoin winter? Investment strategies, advice, and bottom signals

At present, the crypto market seems to be undergoing a significant "rule change." The previous market boom was exciting, but the reality is that the real challenge has just begun.

Wait.

All current signs indicate that bitcoin is in "risk-off" mode, and the echoes of the 2021 market are resurfacing: bitcoin surged before the stock market peaked, while the stock market's performance in recent months has been lackluster.

Why isn't capital flowing into bitcoin anymore?

Editor's note: If the first ten years of bitcoin solved the "right to exist," the next ten years will solve the "attribution of value."

In the early days of the crypto world, bitcoin represented rebellion and freedom, a full-scale assault on the rigid financial system. But when the rebels won the battle, a new era quietly arrived: regulation began to embrace innovation, capital migrated to more efficient tracks, stablecoins and real-world asset tokenization expanded rapidly, and bitcoin's mythical aura faded.

This article sharply points out the new turning point in the crypto industry, from bitcoin's historical mission and the collapse of network effects to the rise of stablecoins, regulation, and real-world asset tokenization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Ally Kevin Hassett Tipped To Lead The Fed

Bitcoin : Are the conditions for a future bull run already met?

Polkadot launches "KYC-free real person verification": A comprehensive analysis of Proof of Personhood!